Grayscale Report: Public Chain and Tokenization Revolution, Who is the biggest beneficiary of RWA?

Original author: Zach Pandl

Original translation: Frank, Foresight News

-

Asset tokenization refers to registering asset ownership on blockchain infrastructure. In tokenized form, assets can benefit from blockchain features, such as more efficient settlement and the ability to interact with smart contracts.

-

The modern financial system is already quite efficient to a large extent, and tokenization itself may not bring immediate efficiency gains. Instead, we believe that the main benefits may come from bringing together users, assets, and applications onto a common global platform;

-

From the perspective of the crypto market, although various assets can benefit from the tokenization trend, the most promising may be the protocol that can provide this universal global platform. Grayscale Research currently believes that the Ethereum blockchain is most likely to achieve this goal in the future.

Public blockchains can be viewed as general-purpose technologies with many potential use cases, from payments to video games to digital identity systems. The value of this technology comes in part from bringing a variety of applications to a platform with a permissionless and open architecture. When users, capital, and applications are concentrated in one place, everyone in the ecosystem can benefit from network effects.

Tokenization is one of many applications of public blockchain technology. In some cases, if existing “back-office” processes are cumbersome, moving asset management onto a blockchain infrastructure may provide immediate efficiency gains. But for many types of assets (such as listed stocks), the current digital infrastructure works reasonably well, and it’s not obvious that a public blockchain could do a better job. In these cases, the potential gains from tokenization may come from network effects: by moving the world’s assets onto a common platform, we have the potential to create a more powerful, more accessible, and less costly financial system.

From the perspective of the crypto market, although various assets can benefit from the tokenization trend, the protocols that can serve as a unified platform for tokenized assets, investors, and related applications may have the greatest potential. Currently, Grayscale Research believes that the Ethereum blockchain is most likely to achieve this goal in the future.

System Upgrade

When blockchain is more widely adopted, securities may be issued and tracked entirely on-chain. But today, ownership of the benefits of securities, as well as ownership of physical assets such as real estate, physical commodities, and collectibles, is recorded on traditional off-chain ledgers (usually electronic bookkeeping accounts). Tokenization is the process of registering asset ownership on blockchain infrastructure so that market participants can benefit from the capabilities of the blockchain. By design, the price of blockchain-based tokens should closely track the price of the underlying reference asset.

Some of the benefits of converting asset ownership into blockchain-based tokens may include:

-

Settlement efficiency: Blockchain transactions can be settled almost instantly and can be set up to exchange assets under payment conditions, reducing the risk of settlement failures;

-

Programmability: Tokenized assets can be integrated into software applications to allow for added functionality. For example, this could include conditional transfers based on off-chain information (such as regulatory approvals), or using tokens as collateral on decentralized lending platforms;

-

Accessibility: Like the internet itself, blockchain is not limited by national borders, so tokenized assets can enable investors from a wider range of countries or regions to gain access to the worlds best capital markets. Blockchain can also open up access to new asset types through fragmentation;

-

Lower costs: By increasing automation and reducing the role of middlemen, tokenized assets can reduce costs for issuers through lower underwriting fees and lower interest rates;

Researchers at the Bank for International Settlements (BIS) have defined a tokenization continuum for considering how this process affects specific markets. On one end are markets that still require a lot of manual workflows, such as real estate or bank loans. These assets may be difficult to tokenize, but the process can create meaningful efficiency gains.

On the other hand, many other markets currently use fairly efficient electronic bookkeeping systems, such as listed stocks, mutual funds and ETFs, and listed derivatives. These assets may be easier to tokenize, but the process offers more limited efficiency gains.

The best candidates for tokenization are likely to lie somewhere in the middle of the BIS continuum: markets that could benefit from slightly better electronic recordkeeping and smart contract capabilities — a list that would likely include many types of fixed-income securities, such as government bonds and structured products.

However, as discussed further below, the greatest benefits may come from moving all assets onto a unified global platform.

Tokenization Today and Tomorrow

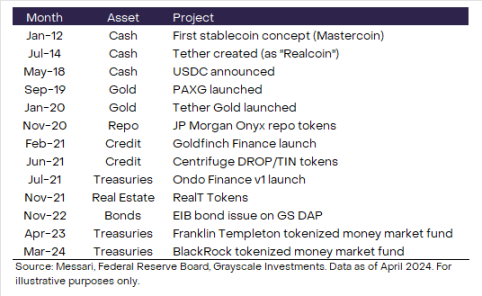

The first application of tokenization technology to find product-market fit (PMF) is stablecoins, which tokenize the simplest and most liquid of all assets: cash.

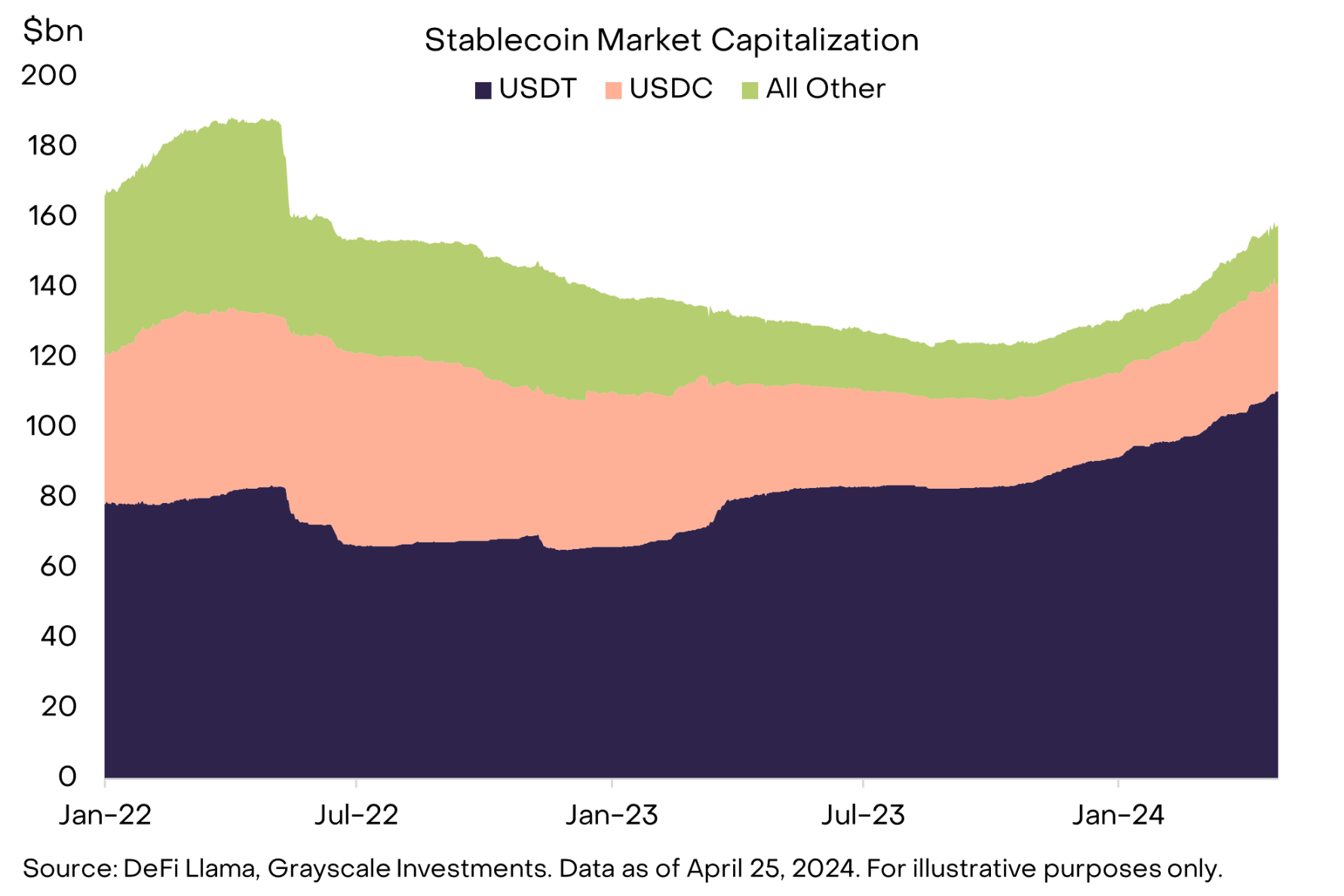

The total market capitalization of stablecoins now stands at $158 billion, with Tether (USDT) and USDC leading the pack (Chart 1). Stablecoins come in many forms, but both USDT and USDC can be considered fiat-backed stablecoins.

They operate similarly to other tokenized assets: while traditional assets are held in off-chain custodians, tokenized representations can be held in blockchain wallets. This form of digital cash can then be used for payments, benefiting from blockchain’s potential for near-instant settlement, lower costs, and/or interaction with smart contracts.

Figure 1: Stablecoins have found product-market fit

After stablecoins, the next tokenized asset to gain widespread adoption is gold (Exhibit 2). The two largest projects, Tether Gold (XAUt) and PAX Gold (PAXG), have a combined market cap of about $1 billion. While there are many ways to invest in gold, these products offer some blockchain features, such as the ability to transfer risk over weekends or outside of traditional market hours. This feature has shown its utility during recent geopolitical tensions in the Middle East: XAUt and PAXG both saw significant gains during the week of April 13-14, when other markets were closed.

Figure 2: Timeline of selected tokenization projects

The latest wave of tokenization has focused on two distinct markets: U.S. Treasuries and closely related assets, and credit products.

Tokenized U.S. Treasury products are designed as cash equivalents and can be considered a stablecoin alternative with a yield. According to data provider RWA.xyz, the weighted average maturity of all existing products currently on offer is less than two years.

In other words, these products are designed to provide yield and perform cash-like functions. When cash rates were close to zero, the opportunity cost of holding stablecoins was relatively low. But now that U.S. dollar interest rates are close to 5%, investors are more motivated to look for alternatives that can generate yield, which may promote the development of tokenized Treasury products.

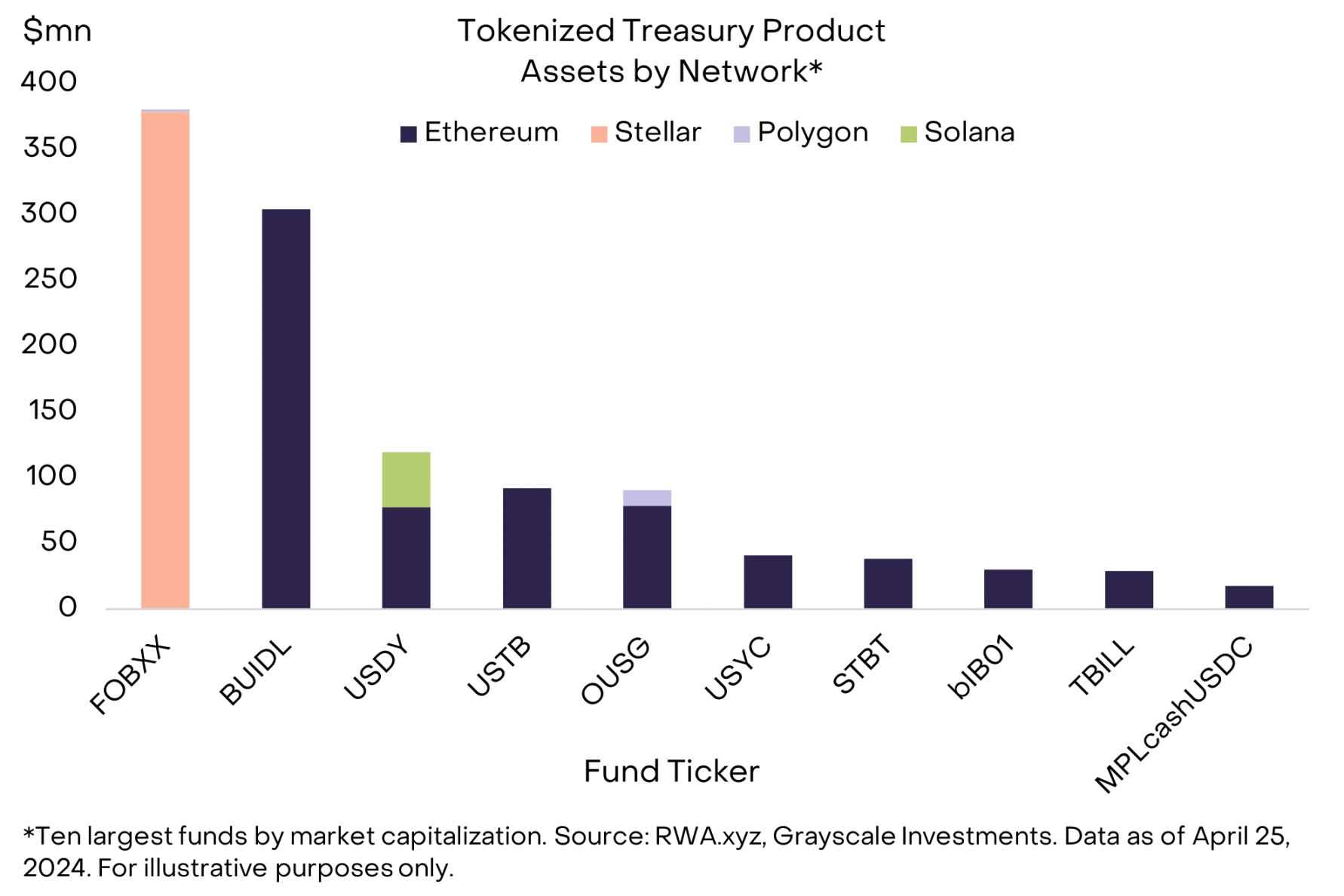

Currently, the size of circulating tokenized Treasury funds, led by Franklin On-Chain U.S. Government Money Fund (FOBXX) and BlackRock USD Institutional Digital Liquidity Fund (BUIDL), has exceeded $1 billion (Figure 3). Many existing products have been launched on the Ethereum network and appear to be targeted at crypto-native institutions, such as cryptocurrency trading funds and DAOs (decentralized autonomous organizations).

However, the largest fund, FOBXX, took a different approach: it was launched on the Stellar chain and is available to retail investors through a mobile app. All in all, about 60% of tokenized Treasury fund AUM is on Ethereum, 30% on the Stellar chain, and the rest on other blockchains.

Chart 3: About 60% of tokenized treasury products are on Ethereum

Individual companies have also launched tokenized credit products. This is a diverse category that includes direct lending to a single counterparty, pools of structured credit products (e.g., ABS, CLOs), and lending to intermediaries in specific industries (e.g., real estate financing, emerging markets). While these products can be risky and complex, and are currently designed only for institutional investors, their goal is simple – to channel capital from lenders to borrowers through blockchain infrastructure. According to RWA.xyz, there are currently $612 million in active loans in this category, with an average yield of about 10% (Exhibit 4).

Figure 4: Tokenized credit products cover different borrower groups

There are many other potential applications for tokenization technology, but few have made it past the experimental stage. For example, tokenized real estate platform RealT offers investors outside the United States a way to fractionalize and own properties; the protocol currently has $103 million in total value locked. There is also hope that tokenized private equity will provide the alternative investment industry with access to a wider range of investors, and it remains to be seen whether these new issuance channels will contribute significantly to the industrys AUM.

Various fixed income securities have been issued directly on-chain, by both public sector issuers (e.g. the European Investment Bank) and private sector issuers (e.g. Siemens). While tokenized equities have been attempted before, we suspect that these projects will require greater regulatory clarity before they can make further progress.

If adoption continues, tokenization has the potential to drive a significant amount of blockchain activity and fee revenue, as the potential market size is huge — in the U.S. alone, U.S. Treasuries represent a $26 trillion market, and total domestic non-financial sector lending is $36 trillion. The current size of on-chain tokenized assets represents a negligible fraction of these totals. However, in order for these products to grow beyond today’s crypto-native institutions, they will need to connect more effectively with existing pools of capital. This may require building connections to brokerage or bank accounts, or by providing investors with sufficiently compelling reasons to move their assets on-chain.

The revolution will not happen in private chains

A common misconception is that tokenization may not benefit crypto assets because the activity will occur on private permissioned blockchains rather than public permissionless blockchains like Ethereum. While banks have indeed experimented with using private blockchain infrastructure (e.g., JPMorgan Onyx, HSBC Orion, and Goldman Sachs DAP), this is at least partly a reflection of current regulation that prevents depository institutions from interacting with public chains. Asset managers that are not subject to these restrictions have been operating on public chains or a hybrid of public and private chains.

In fact, almost all successful tokenized applications to date (such as stablecoins, tokenized treasuries, and tokenized credit products) have been launched on public blockchain infrastructure.

The reason is simple: users are here.

We expect that moving certain assets onto blockchain infrastructure will bring efficiency gains, but the greater promise of tokenization lies in seamlessly connecting assets and investors (or borrowers and lenders) across the world and building richer experiences through interoperable applications.

Public blockchains have many applications beyond tokenization, making them natural hubs for user assets and activity over time. As such, they will likely continue to be the primary destination for asset issuers and developers building open finance applications. We believe that private permissioned blockchains operated by companies or national governments are unlikely to credibly provide the global, neutral platform needed to host the world’s tokenized assets.

Transactions, Fees, and Value Added

Blockchain transactions typically generate fees, which can flow to token holders directly (e.g., dividends) or indirectly through a reduction in token supply (e.g., buybacks). Therefore, asset tokenization can add value to blockchain-based tokens if it generates transaction activity and fees. However, the mechanism by which this occurs will depend on the type of protocol and the token properties (Exhibit 5).

Figure 5: Assets from across the crypto industry could benefit from tokenization

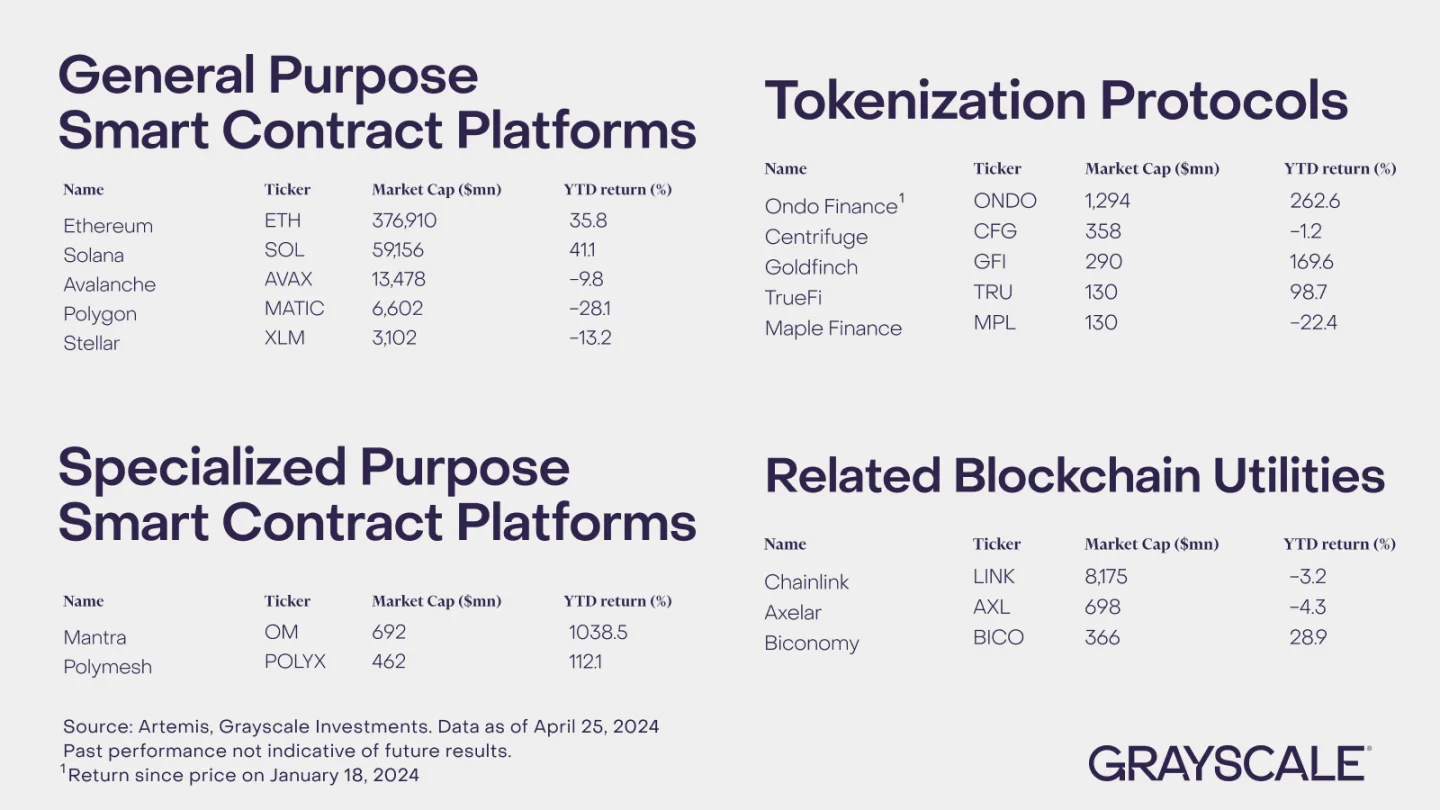

Some of the components of our smart contract platform crypto space should see the most immediate impact. L1 blockchains in this segment (and perhaps eventually some components of their L2 ecosystems) can serve as general-purpose global platforms for tokenized assets. The native tokens of these protocols are often used to pay transaction fees (“gas”), and may receive staking rewards or benefit from a reduction in token supply.

There is intense competition in the smart contract platform crypto space, but the Ethereum ecosystem still dominates other blockchains in terms of users, assets (total value locked), and decentralized applications. In addition, we believe that Ethereum can be considered very decentralized and neutral to network participants, which may be a necessary condition for any global tokenized asset platform.

Therefore, we believe that Ethereum is currently best positioned among smart contract blockchains to benefit from the tokenization trend. Other smart contract platforms that may benefit from the tokenization trend include Avalanche (a platform used by financial institutions for various proof-of-concept projects), Polygon and Stellar, as well as L1 blockchains designed for tokenization, such as Mantra and Polymesh.

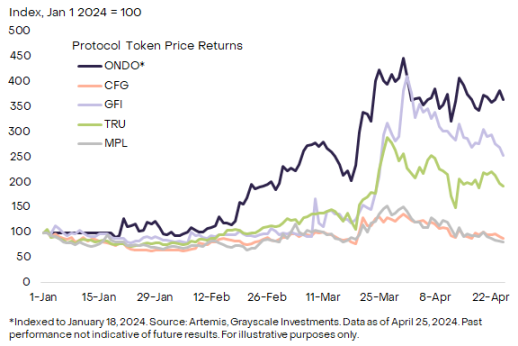

The next group of beneficiaries include the tokenized protocols themselves, which provide platforms for bringing traditional assets into on-chain software applications (Exhibit 6). Many of these providers do not have governance tokens (e.g., Securitize, Superstate), but some do.

For example, Ondo Finance, which issues tokenized treasury products, and Centrifuge, a tokenized credit product platform and part of the financial crypto space, are examples. Before considering these tokens, investors should consider the nature of the governance rights they confer and whether they confer rights to any protocol income.

Chart 6: Year-to-date returns for selected tokenized protocols

Finally, the increase in blockchain activity due to tokenization may support many other components in the crypto ecosystem. For example, Chainlink hopes that its Cross-Chain Interoperability Protocol (CCIP) will provide core infrastructure for messaging data across blockchains (both private and public). Similarly, the Biconomy protocol provides certain technical processes that can help traditional financial institutions interact with blockchain technology (for example, a paymaster service that allows users to pay for gas using tokens other than the blockchains native token).

Both Chainlink and Biconomy are part of our Utilities and Services crypto space.

Tokenization Vision

In summary, many digital commerce use cases are moving away from closed platforms hosted by centralized middlemen to open and decentralized platforms based on public blockchain infrastructure, and tokenization is just one of many blockchain adoption trends.

But given the size and scope of global capital markets, it could be an important trend, and if public chains can bring together borrowers and lenders (or asset issuers and investors) and disintermediate existing fintech, then increased network activity should bring value to public chain tokens.

This article is sourced from the internet: Grayscale Report: Public Chain and Tokenization Revolution, Who is the biggest beneficiary of RWA?

Related: 2024Q1 Crypto Industry Report: CEX spot trading volume hits a new high since Q4 2021

Original author: CoinGecko Original translation: 1912212.eth, Foresight News Following a strong performance in the fourth quarter of 2023, the total cryptocurrency market capitalization continued to rise by 64.5% in the first quarter of 2024, reaching a high of $2.9 trillion on March 13. In absolute terms, this quarter鈥檚 growth (+$1.1 trillion) was almost double that of the previous quarter (+$0.61 trillion), largely due to the approval of a US spot Bitcoin ETF in early January, which pushed BTC to a record high in March. Key Highlights Bitcoin grew by +68.8% in Q1 2024, reaching an all-time high of $73,098; As of April 2, the assets under management (AUM) held by U.S. spot Bitcoin ETFs exceeded $55.1 billion; Ethereum re-staking on EigenLayer reached 4.3 million ETH, a quarterly increase of 36%;…