Original|Odaily Planet Daily

Author: Wenser

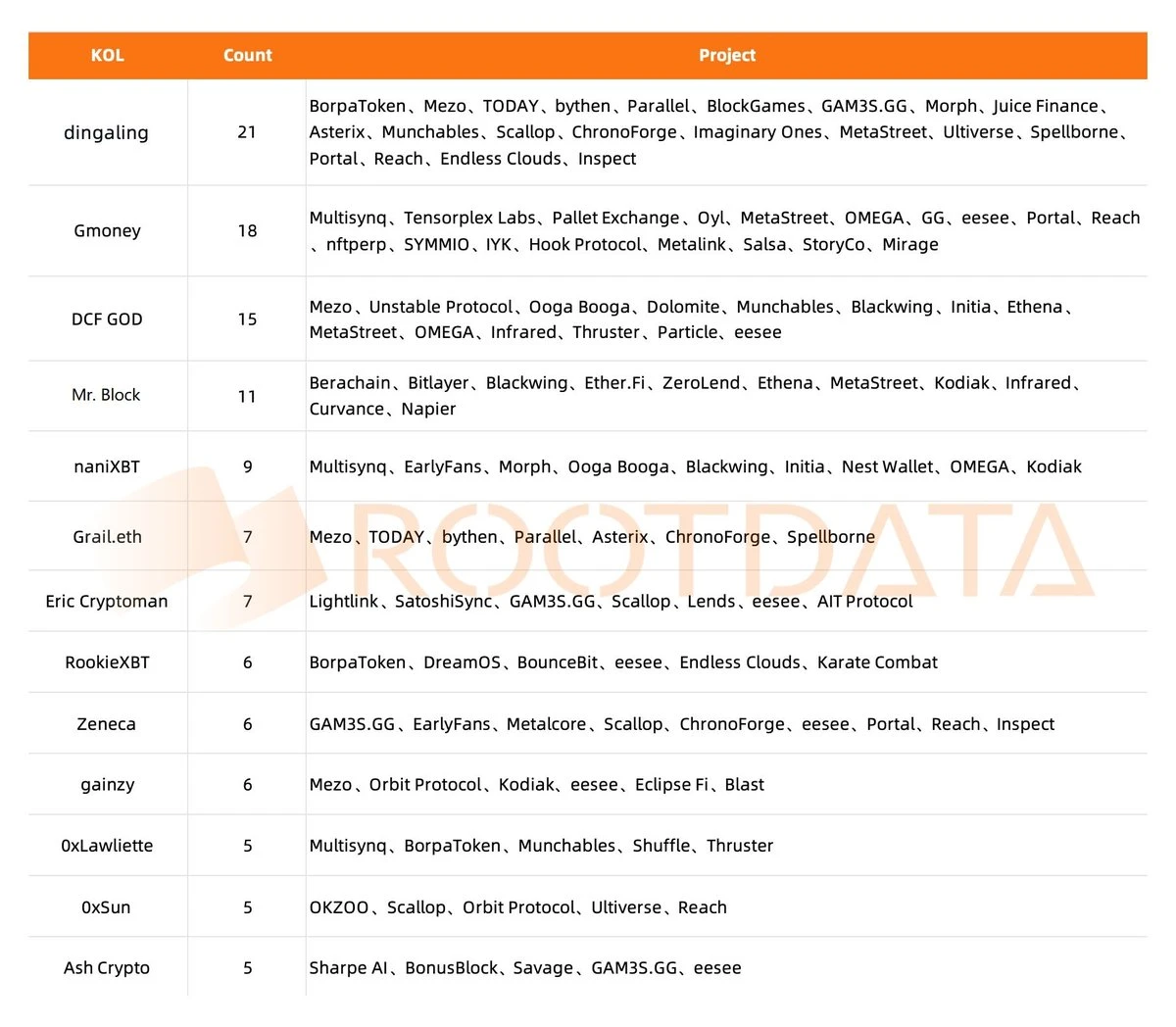

In April 2024, Web3 asset data platform RootData released statistics on KOLs participation in project financing in the past six months . Dingaling ranked first with 21 project financings, GmoneyNFT and DCF GOD ranked second and third. Today, Odaily Planet Daily will work with you to disassemble KOLs investment strategies from this table and find new Alpha.

https://x.com/RootDataLabs/status/1779848819364245812

Popular tracks: Games, BTC L2, Social

According to the above table information and Rootdata official website information , many KOLs main investment targets are concentrated in popular tracks such as games, social networking, and BTC L2 network . Among them, the following projects have received more recognition and investment from KOLs:

-

EESee has 7 KOLs investing in it. It is a decentralized aggregation trading and lottery platform in the Blast ecosystem. It mainly serves buyers and sellers by providing additional liquidity and trading markets for digital assets, tokens and RWAs, and uses special token cash-back to offset the negative effect of users failing to win the lottery. Winners receive lottery pool rewards, while losers receive points, which are linked to future rewards. The current price of the ESE token is $0.08, with a 24-hour trading volume of $1.82 million.

-

Mezo has 4 KOLs as investors. It is one of the latest Bitcoin L2 networks and was created by the developer Thesis team. It has previously completed a $21 million Series A round led by Pantera Capital and participated by Multicoin, Hack VC, Draper Associates, etc. Mezo uses the idle Bitcoin of holders through the Proof of HODL points plan. The longer the storage time, the more HODL score multiplier the user has. No coins have been issued yet.

-

GAM 3 S.GG has 4 KOLs investing in it, and it is a Web3 game content platform. According to its official profile, it has launched 400+ games, and its mission is to get gamers into web3 through game discovery, content, live broadcasts, community events, and more. The GAM 3 S.GG super application eliminates barriers to entry for novices by simplifying the user experience, providing early access opportunities, and curating content to highlight popular web3 games. The token G 3 is currently priced at $0.177, with a total market value of $170 million.

-

Scallop has 4 KOLs investing in it, and it is the lending market of Sui ecosystem. It is committed to building a dynamic money market, providing high-interest lending, low-cost lending, AMM and asset management tools on a unified platform, and providing SDK for professional traders. The current price of the token SCA is $0.61, and the circulating market value is $18.54 million.

-

MetaStreet has 4 KOLs investing in it, and is a liquidity expansion protocol for the Blast ecosystem NFT credit market. Its main product is a capital vault that provides secondary market liquidity for NFT-backed notes, where participants can deposit funds to earn income from a diversified portfolio of NFT-backed notes. Investors also include Dragonfly, DCG, OpenSea, Nascent and other star capitals, and it has previously completed a $25 million financing. No tokens have been issued yet.

-

Reach has a total of 4 KOL investments. It is a SocialFi collaboration platform designed for creators and contributors within the Web3 community. Reach enables anyone who wants to promote their content to leverage an engaged, verified, and audited user base, and get paid for their contribution to network effects. Developed as a Discord Bot, it allows creators to easily set up tasks to promote their content. Tasks can be customized based on the target audience, including following, likes, reposts, and tweet comments on the X.com platform. Certain tasks also have rewards (ETH), which are selected and funded by the creator, while other tasks have leaderboard points rewards that can be used to purchase tasks. The token REACH is currently priced at $0.045, with a total market value of $4.888 million.

In addition, the Defi track is also the focus of many KOLs, and products such as Kodiak, Orbit Protocol, and Particle have also received a lot of attention.

KOL characteristics: Most are NFT players

It is worth mentioning that in the KOL list counted this time, NFT players account for a relatively high proportion. 、 Gmoney 、 Mr. Block , Grail.eth , Zeneca , 0x Sun and others, their avatars or IDs are all NFT-related elements, and they are also well-known KOLs in the NFT market.

Coincidentally, the Memecoin craze also started from NFT players and gradually spread to different groups in the crypto market. In my opinion, there are three main reasons why NFT players are active in the investment market:

-

The community has a greater influence. The communities where KOLs in the NFT track are located are generally more cohesive and have greater influence in the community. Therefore, they have stronger content marketing value and are recognized by investment projects;

-

Better cultural aesthetics. Different from KOLs in other fields, KOLs in the NFT field do not only judge project quality based on team background, capital support, and project resources, but also pay more attention to a project’s cultural background, project aesthetics, and operating methods. Therefore, they are more inclined to invest in teams and projects with certain aesthetic abilities. Shoddy projects are unlikely to win their favor.

-

The NFT market is cold and seeking new breakthroughs. Affected by liquidity issues, the NFT market has been performing poorly in recent years. Therefore, in comparison, KOLs in the NFT track are more motivated to seek new growth points and breakthroughs. This is also one of the reasons why many NFT players have flocked to the primary and secondary markets in large numbers. Of course, to some extent, this is also a forced choice.

Commonality of the targets: emerging ecosystem + mature model

In addition, through the analysis of KOL investment projects, we can also see that in addition to Ethereum re-staking tracks such as Ethena and Ether.fi, the investment targets they choose are mostly concentrated in emerging ecosystems that have mature models that can be used as references, such as:

-

Blast: As an L2 network backed by Blur, the master of the points system, Blast has gradually grown into an application network with an increasingly rich ecosystem through its points system, gold points rewards, Big Bang events and other step-by-step operational activities. Whether it is games, social networking, Defi, or NFTFi, Blasts points are the best selling point of the product, thus attracting many teams and investors including KOLs to rush in.

-

Berachain: As an L1 public chain that has previously completed a $100 million Series B financing and is valued at at least $1 billion, Berachains ecosystem is also gradually developing, especially its positioning as a community-driven blockchain network and its strong Meme attributes, which has also made many KOLs become pioneers and evangelists of this ecosystem.

-

Sui Network: As a blockchain network powered by the Move language, Suis high throughput, low latency and asset-oriented programming model have also been recognized by many project parties. According to recent data from the Artemis platform , the average daily transaction volume on the Sui chain briefly surpassed the Solana network, reaching 41 million times. In the long run, casual games are a major advantage track for Sui. The previous Sui Basecamp event in Paris also showed the market the highly active status of this ecosystem, thus providing a good soil for the implementation of mature models.

Summary: KOL rounds are the norm, so take it easy

Previously, KOL rounds of financing became a hot topic of discussion in the crypto industry. Many people have a negative attitude towards this, believing that KOL rounds of financing will lead to KOLs abusing their influence, prompting ordinary users to FOMO and follow suit. Some people believe that KOL rounds of financing are a manifestation of the change of market forces, and to a certain extent replace the important role of institutional investment in the past. Of course, some people are dismissive of this, believing that KOL rounds of financing have many disadvantages, and that many times the amount KOLs get may not necessarily get high returns. After all, there are still high-risk factors such as project rugs, security risks, and market sentiment cooling, which can easily lead to KOLs becoming free labor or even paying money and working hard, but in the end getting nothing.

Regarding this issue, overseas KOLs have a more peaceful attitude. Endless Clouds founder Loopify and well-known overseas KOL OSF have both made relevant remarks. From being penniless to gradually accumulating certain resources in the crypto industry through their own efforts and content output, they have become the choice of many projects. Although it looks like chicken soup, it is indeed the case.

So, instead of complaining, you should accept it and find your own Alpha. Maybe you will be the next one to become famous in the crypto world.

This article is sourced from the internet: Dismantle the top KOL investment list and find new Alpha

Related: Polygon (MATIC) Price on the Rise: Investors Fuel Swift Comeback

In Brief MATIC price is making its way back after bouncing off the support at $0.65 to reach $0.81. Investors are putting aside profit-taking and focusing on making their supply profitable instead. The funding rate is recovering as well, suggesting traders are making bullish bets against MATIC. Polygon (MATIC) is among the few altcoins observing quick recovery supported by its investors. The altcoin could soon be on the path to reclaiming the profits lost during the early April correction. Polygon Investors Are Optimistic MATIC price is climbing on the daily chart, and Polygon investors note the potential for this recovery. They are acting accordingly, with the network noting minimal selling in the last few days. This sentiment is being extended at the time of writing as well. Upon categorizing active…