SignalPlus Macro Analysis (20240508): ETF funds have experienced net outflows for three consecutive weeks

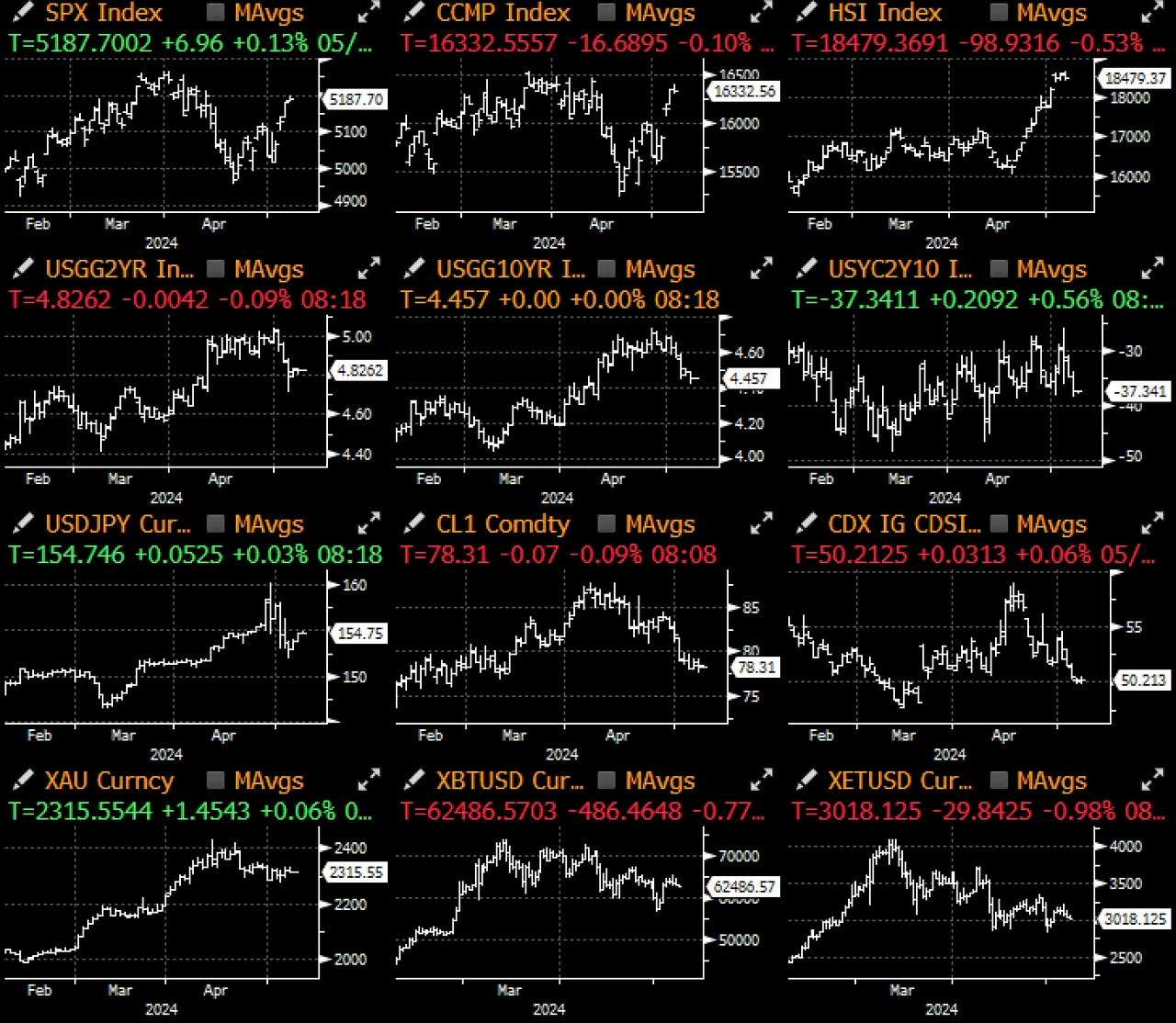

Macro assets experienced another quiet trading day, with prices remaining largely stable. Several Fed officials spoke, with divergent views. Williams of the New York Fed (centre-dovish) echoed Powells view that the Feds interest rate policy will be determined by overall data, not just CPI or employment data. In addition, he reiterated that we will eventually cut interest rates, but monetary policy is still in a very good place and the job market is achieving better balance after the release of non-farm payrolls. On the other hand, Kashkari of the Minneapolis Fed (hawkish) said that interest rates may need to remain at current levels for a long time and we may need to stay on hold for a longer period of time than expected until we know what effects monetary policy has produced. In addition, he also tried to keep the option of raising interest rates, saying I think the threshold for (the Fed) to raise interest rates is quite high, but not unlimited. When we say well, we need to do more, there is always a boundary, and that boundary is inflation stubbornly maintained at around 3%.

On the data front, the San Francisco Fed released a comment over the weekend that excess savings accumulated during the pandemic era have been exhausted, falling from a peak of $21 trillion in August 2021 to -$72 billion in March of this year. To quote the Feds comments directly: Even the exhaustion of excess savings is unlikely to cause American households to cut spending significantly as long as they can support their spending habits through continued employment or wage growth… and higher debt, while this may be the case at present, this phenomenon, combined with higher interest rates and a slowing job market, will definitely make macro observers start to pay attention to more signs of economic slowdown again.

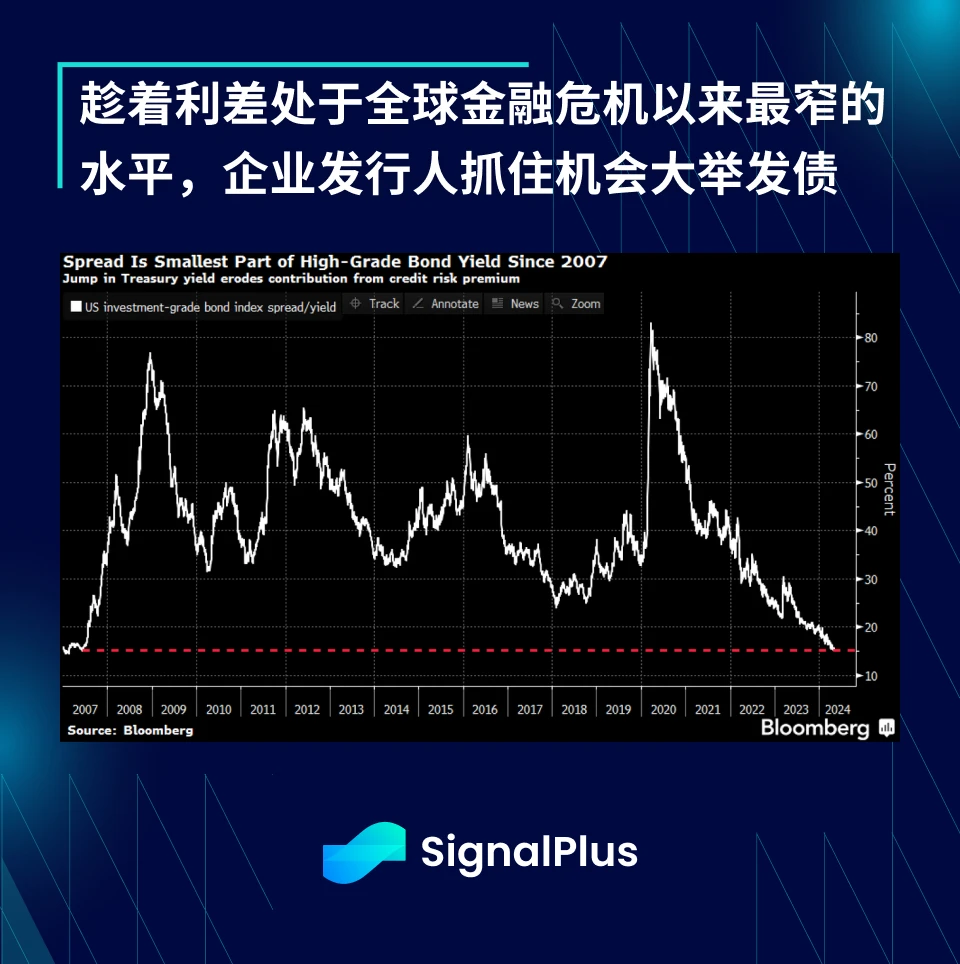

There is not much to watch in terms of asset prices, but companies are taking advantage of the current low activity to launch another round of bond issuance, with as many as 14 companies announcing bond issuances on Tuesday, and more than $34 billion of new bonds priced in the past two days alone, far exceeding previous expectations. And although corporate bond spreads are at their narrowest level since 2007, demand is still quite strong, with oversubscription of more than 4.4 times.

In terms of fund flows, despite the current high valuations, inflows into equities and fixed income have remained steady this year, with no signs of stopping. In terms of cryptocurrencies, ETFs have seen outflows for three consecutive weeks, with Greyscale seeing another massive outflow of $459 million (IBIT data has not yet been updated), causing BTC prices to fall 2-3% in late New York trading.

On the positive side, according to the FTX reorganization plan, 98% of FTX creditors will receive at least 118% of the claim amount within 60 days of the plan taking effect, other creditors will receive 100% of the claim amount, and there are billions of dollars in compensation to make up for the time value of the investment. After disposing of all assets, FTX expects to have up to $16.3 billion in cash remaining for distribution, far higher than the total amount of $11 billion owed to creditors. Ironically, this may become the largest single liquidity off-ramp event in the history of cryptocurrency. Will creditors reinvest these recovered funds into cryptocurrency, or will they return to traditional assets? Interesting times.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240508): ETF funds have experienced net outflows for three consecutive weeks

Related: Aptos (APT) Price Eyes All-Time High: Here’s How It Aims to Get There

In Brief Aptos price is trading at $60, only 20% away from establishing a fresh all-time high above $19.92. Long liquidations in the past week have amounted to more than $9 million, which are now coming to an end. Average Directional Index suggests the active bullish trend is picking up pace. Aptos (APT) price is treading against the broader market cues to consistently post gains on the daily chart. The altcoin now stands less than 20% away from charting fresh all-time highs, provided APT does not lose this crucial support level. Aptos Price Finds Support From the Market Aptos price, trading at $16 at the time of writing, is continuing the bullish trend that began towards the end of February. Despite the prolonged rise in APT by over 80%, the…