Interpreting Botanix: BTC L2 for decentralized network asset management (with interactive tutorial)

Original | Odaily Planet Daily

Author | Nanzhi

Yesterday, Botanix Labs announced that it had raised a total of $11.5 million in funding, with participation from Polychain Capital, Placeholder Capital, etc. The funding will be used to build the decentralized EVM equivalent BTC L2 Botanix.

Spiderchain combines the ease of use of EVM with the security of Bitcoin. Since the testnet was launched in November 2023, there have been more than 200,000 active addresses. Odaily will analyze Botanixs feature mechanism and testnet interaction process in this article.

Botanix

According to the official definition, Botanix is a decentralized Turing-complete L2 EVM built on Bitcoin, consisting of two core components: the Ethereum Virtual Machine (EVM) and Spiderchain.

EVM uses the PoS mechanism, which aims to use EVM to provide ease of use and versatility, while using the PoW mechanism of the Bitcoin network to provide security. User equity (Staking) is equivalent to the number of bitcoins staked by the user in a multi-signature wallet.

Spiderchain is the core mechanism of Botanix. Spiderchain is a set of dynamic, constantly changing, decentralized multi-signature wallets that protect the security of Bitcoin assets on Botanix. Spiderchain pioneered the decentralized multi-signature wallet, which is protected by a random subset of participants to achieve a highly decentralized protection mechanism. The official definition may be too difficult to understand, so we will only use the following section to analyze it.

Spiderchain

There is no official definition of BTC L2. One solution is to build an EVM network (that is, Layer 2 of the Bitcoin network). Users deposit assets into the official multi-signature wallet and then map them to the EVM network. Except for the cross-chain between L1 and L2, subsequent user operations are only related to the EVM network and no longer consume Bitcoin network resources. Transferring assets out of this type of L2 is equivalent to destroying assets from the EVM network, and then the multi-signature wallet releases the assets to the user. At this time, the security of assets in the multi-signature wallet is the primary concern of users. Previously, several major L2 assets were actually controlled by the official, and the risk of running away has become a major concern and pain point.

Spiderchain aims to solve the centralization problem of asset multi-signature wallets. The name Spiderchain comes from the concept of multi-signature wallets, in which each leg of the spider represents a different participant, and each block will randomly select a group of participating nodes and multi-signature wallets to manage assets.

Spiderchain calls these nodes Orchestrators. Every time the Bitcoin mainnet produces a block, a new multi-signature wallet is synchronously generated to manage the stored Bitcoin assets. The selection of nodes to manage is handled by VRF (verifiable random function). Each group consists of about 100 nodes. The randomness and continuous variability avoid the risk of single point loss of control and the risk of malicious attacks from the project partys super authority.

In addition, Spiderchains nodes also have the feature of permissionless joining. Anyone can invest assets to become an Orchestrator node to provide a sufficient number of nodes. According to official disclosure, it currently supports 10,000 to 100,000 full nodes, thereby realizing the decentralized feature.

Therefore, it is not difficult to understand if we look back at the official definition: Spiderchain is a set of dynamic, constantly changing, decentralized multi-signature wallets .

In addition to the above features, Spiderchains operating logic is similar to that of regular nodes. Users can freely join the creation of nodes, but if malicious operations or other bad behaviors occur, the assets staked by the nodes will be slashed. Security follows the PoS security model. As long as the number of malicious nodes is less than other Orchestrator nodes, mathematical security is guaranteed.

Financing Details

Rootdata data shows that Botanix has completed two rounds of financing:

The seed round was completed on May 7, 24, with a financing amount of US$8.5 million, with participation from Polychain Capital, Placeholder Capital, Valor Equity Partners, and a series of angel investors including Andrew Kang, Fiskantes, Dan Held, The Crypto Dog, Domo, etc.

The Pre-seed round was completed in June 2023, with a financing amount of US$3 million, with participation from UTXO Management, Edessa Capital, XBTO Humla Ventures and others.

Testnet Interaction

-

Enter the official Faucet and click to add the test network in the wallet

-

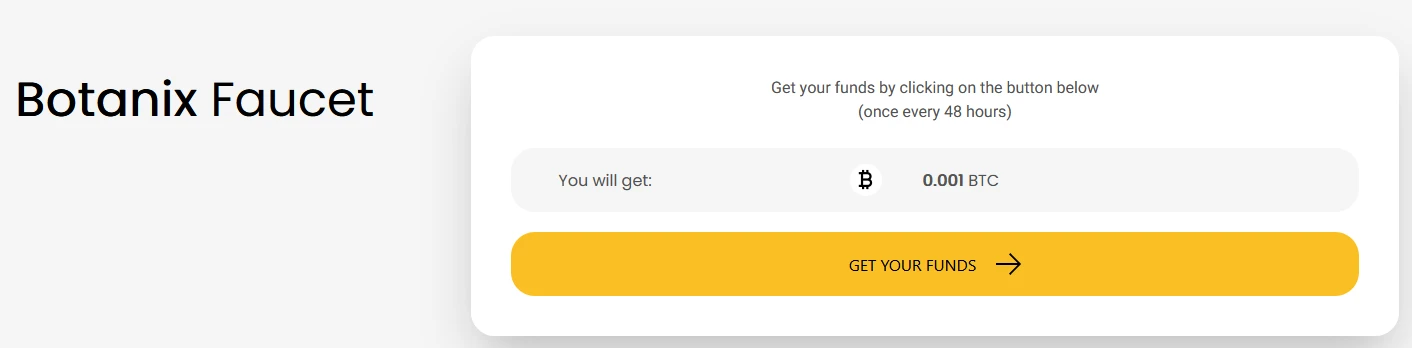

Click to receive the network test token. If you cannot receive it at this site, you can go to other sites to receive it:

https://dripdripdrip.xyz/botanix-testnet

-

Currently, Botanix has launched two applications, AvocadoSwap and Bitzy . The latter requires an Access Code to use. Users can follow the official X account and send a private message to obtain it.

But it is worth noting that Botanix has not promised the rights and interests of testnet participants, and readers need to decide whether it is worth batch interaction.

in conclusion

Botanixs Spiderchain solution is an important step towards decentralization in the EVM direction of BTC L2, and the amount of financing is also relatively high among all BTC L2. According to official disclosure, the mainnet will be launched soon, and readers can keep paying attention to it for a long time.

This article is sourced from the internet: Interpreting Botanix: BTC L2 for decentralized network asset management (with interactive tutorial)

Related: Ripple’s XRP Faces Risk of Steeper Price Correction

In Brief XRP price is attempting a break out of the symmetrical triangle pattern, which suggests a 27% increase is possible. Ripple traders appear to be skeptical about a rally in XRP, which is evident in their bearish bets, favoring a price decline. The Relative Strength Index (RSI) can confirm an invalidation of the bearishness should it breach the neutral line. Ripple (XRP) price recovery rally largely depends on the broader crypto market and the investors’ behavior. However, neither party favors a price rise, which could cause considerable damage to XRP holders. Ripple Investors Take a Step Back XRP price attempts to move upward, but by the looks of it, this effort will be thwarted. This is because Ripple is noting bearishness at the hands of its investors, particularly traders. Bearish bets against XRP have increased in the futures…