Ethena (ENA) is gaining notable attention, stirring discussions among traders and analysts with its potential price trajectory aimed at flipping the $1 mark.

The cryptocurrency maintains relevance without the hype surrounding AI or meme tokens, which are currently the key trending sectors at the moment. Based on recent sentiment and market trends, ENA shows signs of a bullish breakout.

Ethena Mentions on Social Platforms on the Rise

Over the past month, key influential accounts within the crypto community have steadily mentioned ENA, indicating rising interest. Analysis reveals that 32 significant X users discussed ENA in the last 30 days, with a reinvigorated focus from 12 of them in just the past week.

Remarkably, three unique key opinion leaders (KOLs) have again highlighted ENA in the last 12 hours, adding to the short-term bullish sentiment.

Despite this uptick in mentions and social buzz, long-term sentiment stability remains uncertain. Only 20% of the monthly mentions have occurred in the last week, suggesting that while the immediate outlook may be positive, sustained momentum could require further growth in engagement and discussion.

Ethena Bagholders Await Favorable Selling Conditions as Price Stalls

As Ethena (ENA) inches towards the significant $1 price point, recent market dynamics hint at a potential upward trajectory. Currently trading at approximately $0.90, the token has seen notable activity in its trading volume and investor sentiment.

Read More: What Is Ethena Protocol and its USDe Synthetic Dollar?

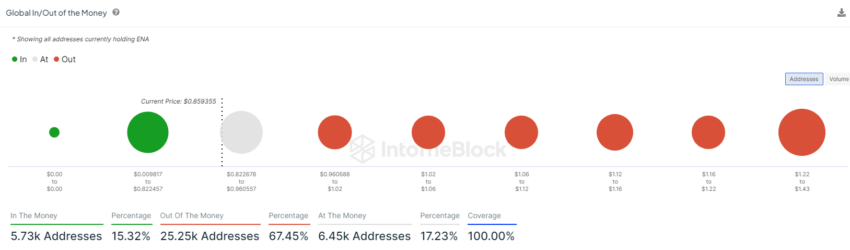

The most recent data indicates a strong holding pattern among investors, with a substantial 67.45% of ENA holders “Out of the Money,” meaning their holding price is higher than the current market price. This will likely cause a slow-down in selling at current levels and force the majority of holders to continue holding until their positions flip In the Money.”

Moreover, ENA’s network metrics reveal a healthy and growing ecosystem despite a slowing market. Despite fluctuations, the total number of ENA holders has maintained relatively steady growth. currently sitting above 36,000 holders for the past month.

The network’s growth, illustrated by the number of new addresses being created daily, continues to decline as the price has followed a similar pattern. However, it is worth noting holders are still holding firm, as previously illustrated.

ENA Price Prediction: Push Above $1 Next

Technical analysis of the ENA price chart shows a consolidation phase with the price stabilizing above key Fibonacci support levels. The Relative Strength Index (RSI), currently at 55, points to a balanced market condition, neither overbought nor oversold.

This stability, combined with sustained holder growth, presents a case for potential price appreciation after an extended consolidation period. Currently, ENA sits in the middle of the 0.737 and 0.5 fib levels – representing a strong consolidation area for ENA.

A push toward $1 is likely, and should it flip this psychological resistance area, the price will likely test $1.12 next.

Given these factors, the $1 price level is not just a psychological barrier but a feasible short-term target. As the market conditions align with increased user engagement and solid technical support levels, ENA could see its value appreciate to or beyond this threshold soon.

Read More: How To Use Ethena Finance To Stake USDe

Additionally, if market sentiment remains bearish, momentum could shift in favor of the bears, pushing the price back to the key fib support level at $0.735. Which would invalidate the bullish price target.