An overview of the development of liquidity staking on Solana

Original author: Tom Wan, on-chain data analyst

Original translation: 1912212.eth, Foresight News

Liquidity pledge in Ethereum ecosystem has set off a wave of pledge, and even now the re-pledge agreement is in full swing. But an interesting phenomenon is that this trend does not seem to spread to other chains. The reason for this is that in addition to the huge market value of Ethereum still occupying a significant advantage, what other deep-seated factors are at work? When we turn our implementation to Solana, and the liquidity pledge agreement on Ethereum, what is the current development trend of LST on Solana? This article will reveal the whole picture for you.

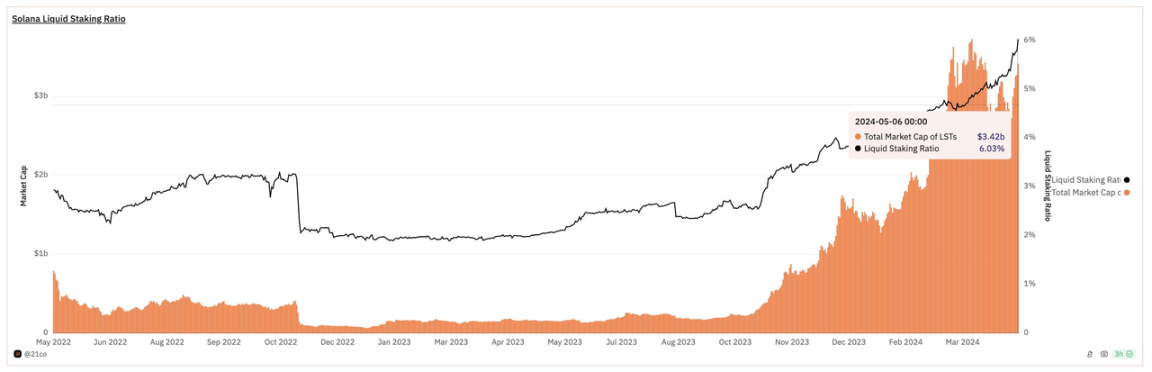

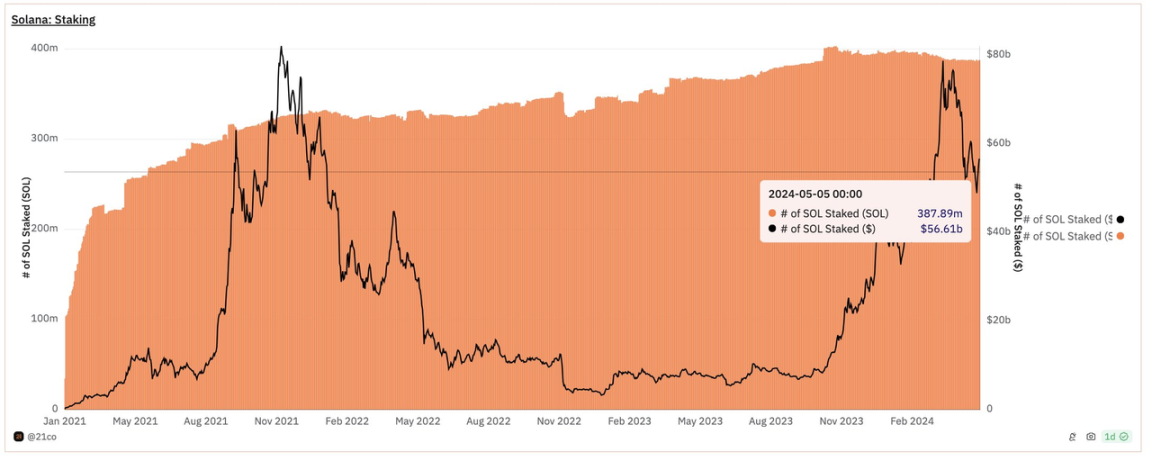

1. Although the pledge rate is over 60%, only 6% ($3.4 billion) of the pledged SOL comes from liquidity pledges

In contrast, 32% of Ethereum’s stake comes from liquid staking. In my opinion, the reason for this difference lies in the existence of “in-protocol delegation”.

Solana provides an easy way for SOL stakers to delegate their SOL, and Lido is one of the only early channels to delegate ETH to earn staking rewards.

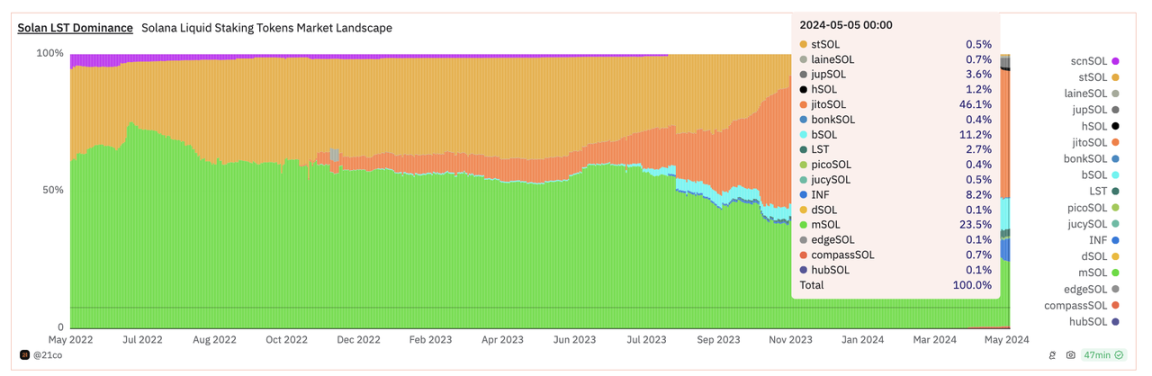

2. Solana LST (liquidity staking token) has a more balanced market share than Ethereum

On Ethereum, 68% of the market share comes from Lido. In contrast, the liquidity staking tokens on Solana are in a multi-oligopoly state.

Solana’s top 3 liquid staking tokens account for 80% of the market share.

3. History of Liquidity Staking on Solana

The early market was divided between Lido’s stSOL (33%), Marinade’s mSOL (60%), and Sanctum’s scnSOL (7%), with Solana’s LST having a total market value of less than $1 billion.

This lack of adoption can be attributed to marketing and integration. At the time, there weren’t many high-quality DeFi protocols targeting LST, and the narrative wasn’t focused on liquidity staking.

When FTX crashed, the liquid stake ratio dropped from 3.2% to 2%.

4. LST Leader

Jito launched jitoSOL in November 2022. It took them about a year to reverse and surpass stSOL and mSOL to become the most dominant LST on Solana with a 46% market share.

Second place: mSOL (23.5%)

Third place: bSOL (11.2%)

Fourth place: INF (8.2%)

Fifth place: jupSOL (3.6%)

5. Jito’s success

In summary, the most important factors for the success of liquidity staking tokens are liquidity, DeFi integration/partnerships, and expansion support for multiple chains.

6. Liquidity staking is an untapped potential for Solana DeFi, which could increase its TVL to $1.5 billion to $1.7 billion

Liquidity staking tokens drive the growth of the Ethereum DeFi ecosystem. For example, 40% of AAVE v3s TVL comes from wstETH. It can be used as collateral to generate yield and unlock more potential for DeFi, such as Pendle, Eigenlayer, Ethena, etc.

Here are my expectations for Solana’s liquid staking ratio in 1-2 years (based on current valuation):

-

Base case: 10%, an additional $1.5 billion in liquidity in DeFi;

-

Bullish case: 15%, additional $5 billion in liquidity in DeFi;

-

Long-term bull case: 30%, similar liquid-to-collateral ratio to Ethereum. Adding an additional $13.5 billion in liquidity to DeFi.

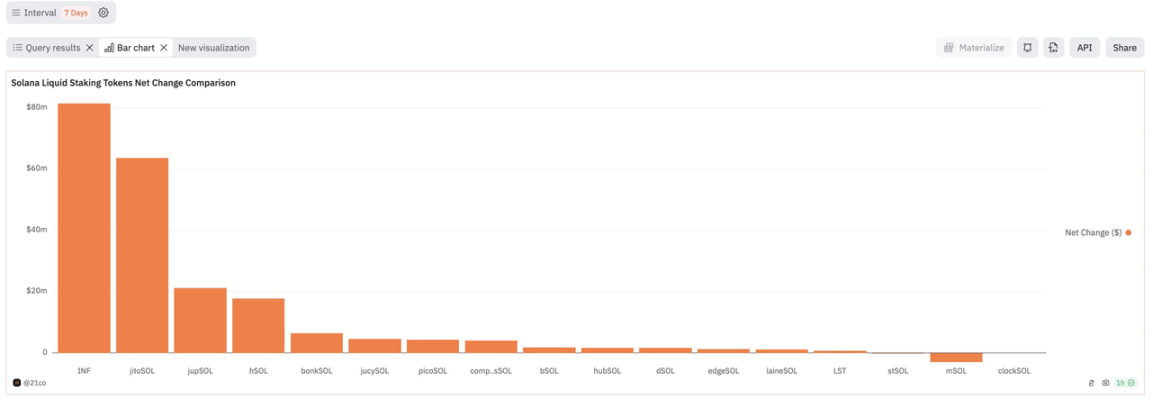

7. Many excellent DeFi teams are working together to introduce more staked SOL into DeFi

Drift Protocol, Jupiter, Marginifi, BONK, Helius labs, Sanctumso, and SolanaCompass have all launched liquidity staking tokens.

As a DeFi user, it’s always better to have competition and innovation in the market. This is why I am optimistic about the future of Solana DeFi.

This article is sourced from the internet: An overview of the development of liquidity staking on Solana

Related: A look at the 34 winning projects at Solana Renaissance

Original author: Peng SUN, Foresight News On the evening of May 6, venture fund Colosseum announced the results of the 9th Solana Foundation Hackathon Solana Renaissance. This Solana Renaissance attracted much attention, with more than 8,300 participants from over 95 countries and regions participating. Only 34 of the 1,071 participating projects broke through the siege, with a winning rate of only 3.17%. Whats more surprising is that Ore, which crashed the Solana network as soon as it went online, won the championship. As soon as the news came out, ORE nearly doubled to above $330. Perhaps it was because of Ores small step that promoted the healthy and stable development of the Solana network? In addition, the winning projects of this Solana Renaissance are also distributed in many fields such…