Bitget Research Institute: BTC ETF has seen net inflows for two consecutive days, and the AI sector continues to rise

In the past 24 hours, many new hot currencies and topics have appeared in the market, and it is very likely that they will be the next opportunity to make money.

-

Sectors with strong wealth-creating effects are: AI sector, Solana ecosystem, and ETH ecosystem;

-

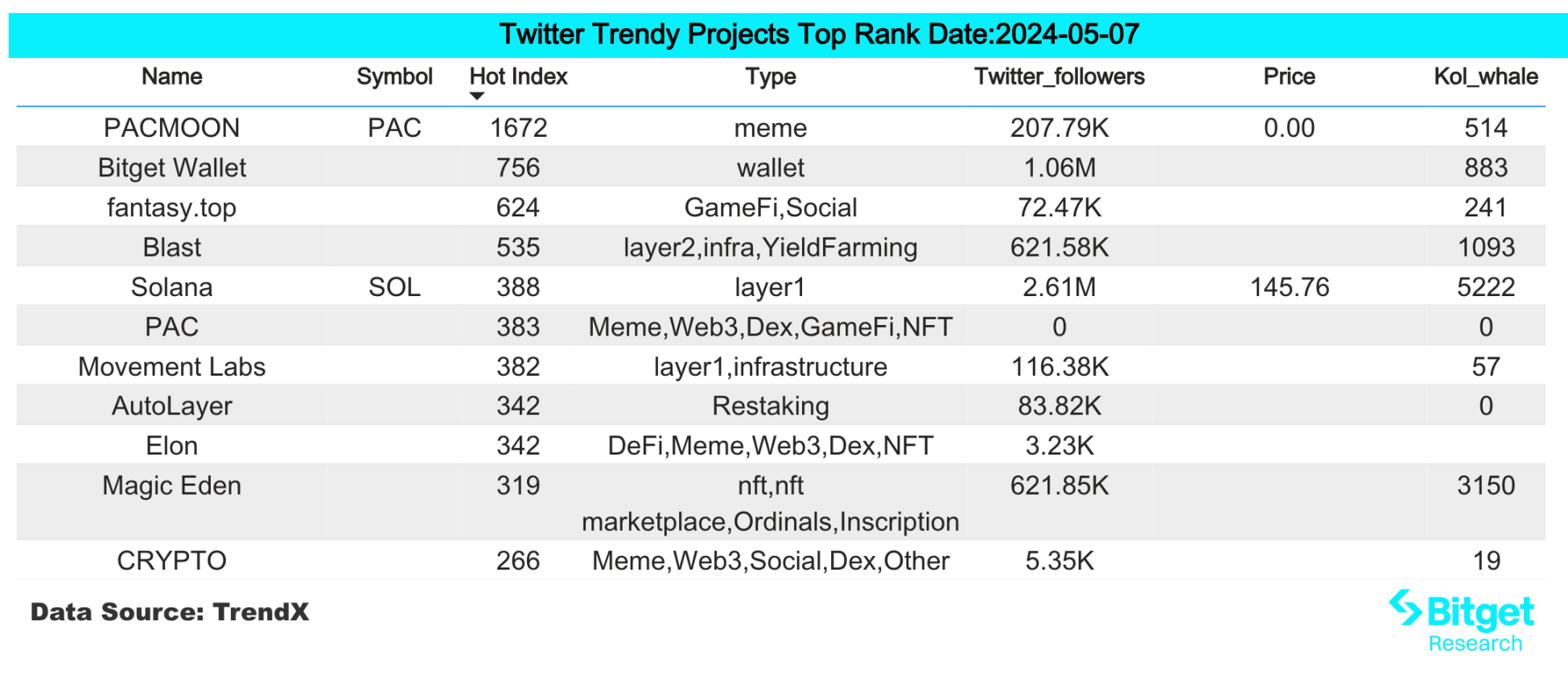

The most popular tokens and topics searched by users are: friend.tech, Bitget Wallet, RNDR, TRB, Tom Brady;

-

Potential airdrop opportunities include: Tabi, MYX Finance;

Data statistics time: May 7, 2024 4: 00 (UTC + 0)

1. Market environment

Yesterday, BTC led the overall crypto market to rebound and rise. BTC hit $65,500 and then began to fall. The current price fluctuates around $63,500. The high daily volatility caused the liquidation of long positions of $150 million and short positions of $70 million at the contract level, and the opportunity for intraday trading is relatively obvious.

The US dollar index returned to above 105, the US capital market rose overall, and the Nasdaq rose 1.19%, providing emotional support for the crypto market. BTC ETF received an inflow of 217 million US dollars yesterday, and GBTC had a net inflow of funds for two consecutive trading days. The selling pressure from BTC ETF was announced to be temporarily over. Pay attention to the support level of BTC at 62,500 US dollars in the future. If there is strong support, you can consider buying BTC on dips.

2. Wealth-making sector

1) Sector changes: AI sector (NEAR, AR, RNDR)

main reason:

The AI track is a sector that is relatively resilient and has rebounded quickly in this round of market decline. It is also a track that VCs are collectively optimistic about and betting on. For example, NEAR, AR, and RNDR are all leaders in the sub-sectors of the AI track;

Rising situation: NEAR rose 10% in the past 7 days, RNDR rose 34% in the past 7 days, and AR rose 15% in the past 7 days;

Factors affecting the market outlook:

-

Impact on traditional technology companies: Technology companies continue to deploy AI projects. Recently, there is news that Microsoft is training a new artificial intelligence model MAI-1 internally, and is allocating more talent, funds, and materials to the AI field. Since AI projects in the crypto market are in the same track, their valuations have room to rise;

-

Focus on AI narrative: The application of AI not only needs to pay attention to whether the narrative level has a high ceiling, but also needs to pay attention to the actual demand and user volume of the product. At present, there are already many AI applications that can be implemented in the encryption field, and investors should pay more attention to the demand level of the application.

2) Sector changes: Solana ecosystem (SOL, KMNO, JTO)

The main reasons are: 1. Solanas native token SOL has been rising recently, outperforming BTC and ETH, and the ecosystem is in a state of net capital inflow; 2. FTXs second round of locked SOL auction has ended, and the SOL auction price is between US$95-110;

Rising situation: SOL rose 14% in the past 7 days, KMNO rose 75% in the past 7 days, and JTO rose 23% in the past 7 days;

Factors affecting the market outlook:

-

Contract data: Check the contract data on the tv.coinglass website to understand the movement of the main funds. First, check the increase in net long positions on the contract; then check whether there is a net increase in long positions, an increase in OI, and an increase in trading volume. If so, it means that the main force continues to buy and can continue to hold;

-

Projects actions: Solana has recently been promoting the concept of Restaking, referring to Eigenlayer to perform objective subjectivity authentication at the consensus layer, which will boost the entire ecosystem.

3) The sector that needs to be focused on in the future: ETH ecosystem

Main reason: The ETH ecosystem is in a relatively undervalued state, but with the implementation of ETF information and the advancement of the SECs prosecution of related DeFi, the ETH ecosystem will be more compliant and have room for layout;

Specific currency list:

-

UNI: The first DeFi Swap project on blockchain applications, recently received the Wells Notice from the SEC, Uniswap will make a self-certification in the near future to form trading opportunities;

-

LDO: The leading LSD project in the ETH ecosystem, with a TVL of 28.7 billion US dollars and a valuation of less than 2 billion US dollars, is relatively undervalued;

3. User Hot Searches

1) Popular Dapps

friend.tech:

friend.tech said that new features such as Keydrops, Memeclubs and Pinned Rooms will be launched soon. Dune data shows that since friend.tech released V2 on May 4, the number of clubs has reached 107,513.

2) Twitter

Bitget Wallet:

Bitget Wallet announced yesterday that it has launched GetDrop, a special welfare zone where Bitget Wallet’s ecological cooperation project partners will issue exclusive airdrops to the community, BWB Points, and future token holders. The first “MEME Party” of GetDrop will be launched on May 7.

3) Google Search Region

From a global perspective:

RNDR: Yesterday, all AI tokens including RNDR rose across the board. RNDR saw abnormal transfers on the chain. Apples Worldwide Developers Conference will start on June 10, and RNDR may usher in speculation. Previously, the price of RNDR had huge fluctuations before and after the Apple Vision Pro conference.

TRB: TRB, a token controlled by the market maker, has risen sharply in the past two days, up 72% in the past 7 days. In Q4 2023, TRB had two huge short-term pump and dumps, and the contract liquidation volume was extremely high. Traders need to pay attention to the risk of sharp rise and fall of strongly controlled tokens.

From the hot searches in each region:

Yesterday, the hot searches in various regions showed great differences, with no general regional rules. The hot words and tokens globally were Grass, TRB, RNDR, and JUP.

However, the hot word Tom Brady was on the hot search in Europe, America, Asia and other regions. Tom Brady was angry about cryptocurrency-related jokes on Netflix Roast. Previously, he had suffered heavy losses in cryptocurrency investments.

4. Potential Airdrop Opportunities

Tabi (zero-cost interaction on the testnet)

TabiChain is a gaming blockchain built on Cosmos with EVM compatibility. Tabi Chain connects the Cosmos and ETH ecosystems through cross-chain functionality for smooth communication. The asset layer centralizes the liquidity of chains and shards for seamless game-blockchain interaction. Formerly the cross-chain NFT marketplace Treasureland.

In 2023, the project completed a US$10 million angel round of financing, with investors including Animoca Brands, Binance Labs, Draper Dragon, HashKey Capital, Infinity Crypto Ventures, Youbi Capital, etc.

How to do it specifically: (1) Go to the projects official website to claim the testnets test coins (https://faucet.testnet.tabichain.com/); (2) Complete the Voyage mission. The first phase has ended and the second phase is in progress. You can join the projects Discord to find an invitation code; (3) Complete the social media mission on Galxe; (4) According to the information officially disclosed by the project, it can be seen that in the future, nodes similar to XAI may be sold. This part may be the focus of airdrops. If you are optimistic about the project, you can purchase and configure nodes. This part requires DYOR.

MYX Finance

MYX Finance is a decentralized derivatives exchange based on the MPM model, incubated by D 11 Labs. It adopts smart rates and risk hedging mechanisms to ensure protocol stability and provide sustainable high returns.

In November 2023, MYX announced the completion of a $5 million seed round of financing at a valuation of $50 million. This round of financing was led by HongShan (formerly Sequoia China), with participation from Consensys, Hack VC, OKX Ventures, Foresight Ventures, Redpoint China, HashKey Capital, GSR Markets, Alti 5, Leland Ventures, Cypher Capital, Bing Ventures, Lecca Ventures and others.

How to operate: There is not much difference between the user operation level and the general derivatives DEX. The operations that users can perform are trading, providing LP, etc. Currently, the project integrates Linea and Arbitrum, which can appropriately increase the activity on the Linea chain in order to obtain Linea airdrops in the future.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603809243

【Disclaimer】The market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.

This article is sourced from the internet: Bitget Research Institute: BTC ETF has seen net inflows for two consecutive days, and the AI sector continues to rise

Related: Is the Solana (SOL) Price Consolidating Before Pushing to New Highs?

In Brief The number of unique users on Solana peaked on March 17, but has been declining since then. Its daily number of Dex Trades is still at high levels, showing persistent activity on the chain. RSI is at healthy levels, but EMA lines could trigger a bearish signal soon. Solana (SOL) saw its user base peak on March 17, with numbers dwindling since then. Despite this, the SOL price remains in focus as trading activity stays high, indicating persistent interest. This suggests that while the user count has fallen, engagement remains strong. Technical indicators like the Relative Strength Index (RSI) show health, but there’s a cautionary note as EMA lines hint at a possible bearish trend. This mix of high trading activity and uncertain technical signals raises the question…