Polygon (MATIC) has been moving sideways for days and is awaiting a trigger to help the altcoin escape its consolidation.

But by the looks of it, MATIC investors could end up waiting longer, given that major resistance is blocking recovery.

Polygon Is Noting Bearish Cues

MATIC’s price has been testing the upper and lower limits of the consolidation range it has been stuck in for a while now. The broader market cues are not necessarily helpful to the altcoin, since the Relative Strength Index is in the bearish zone.

The RSI is a momentum oscillator used to measure the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market.

While the Polygon native token is not oversold at the moment, it is noting considerable bearishness, sitting below the neutral line of 50.0.

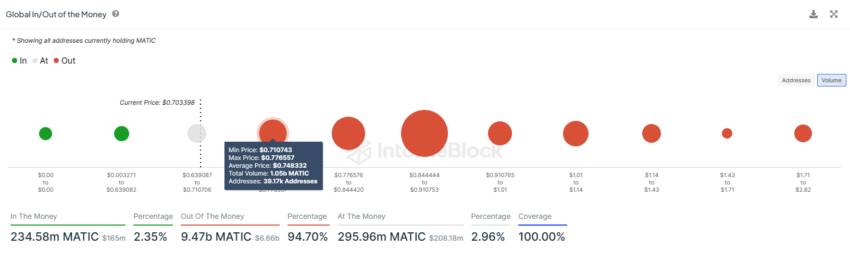

However, even if MATIC does witness bullish cues, it could find some resistance at the hands of investors. According to the Global In/Out of the Money (GIOM) indicator, about 1.05 billion MATIC worth $735 million, bought between $0.71 and $0.77, is awaiting profits.

Given that the consolidation’s upper limit is at $0.74, MATIC would still need to chart further rise to make this supply profitable.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

Failure to do so could keep the altcoin consolidated, which is the likely outcome.

MATIC Price Prediction: Decline on the Cards

MATIC’s price trading at $0.70 failed, breaching through the resistance of $0.74 for the fourth time in the last three weeks. The altcoin might most probably note another drawdown, given it is facing considerable resistance, as mentioned above.

This could result in MATIC noting consolidation in the coming days and a decline to the support of $0.64. However, if the bearishness rises, MATIC’s price could fall through this support and hit the low of $0.60.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

On the other hand, if the winds turn bullish, MATIC’s price could escape consolidation. This would provide MATIC with the boost to attempt to secure $0.80 as support.

Consequently, it would also turn the 1.05 billion MATIC supply profitable. The result would be an invalidation of the bearish thesis and a potential further rise in price.