SignalPlus Macro Analysis (20240507): SPX futures and BTC trends show striking similarities

The market had a quiet trading day yesterday, and the market continued to maintain momentum this week after the dovish developments last week (Fed policy is more inclined to a weak job market, slow JOLTS/non-farm data, weaker economic data and the market faces a large fixed income short position) boosted risk sentiment. Due to the lack of front-line economic data before the CPI data release on May 15 (a week later), and the companies reporting earnings only account for about 7% of the SPX market value, and there are no heavyweight Fed officials such as Powell and Waller waiting to speak, the market is more likely to be technically driven in the near term.

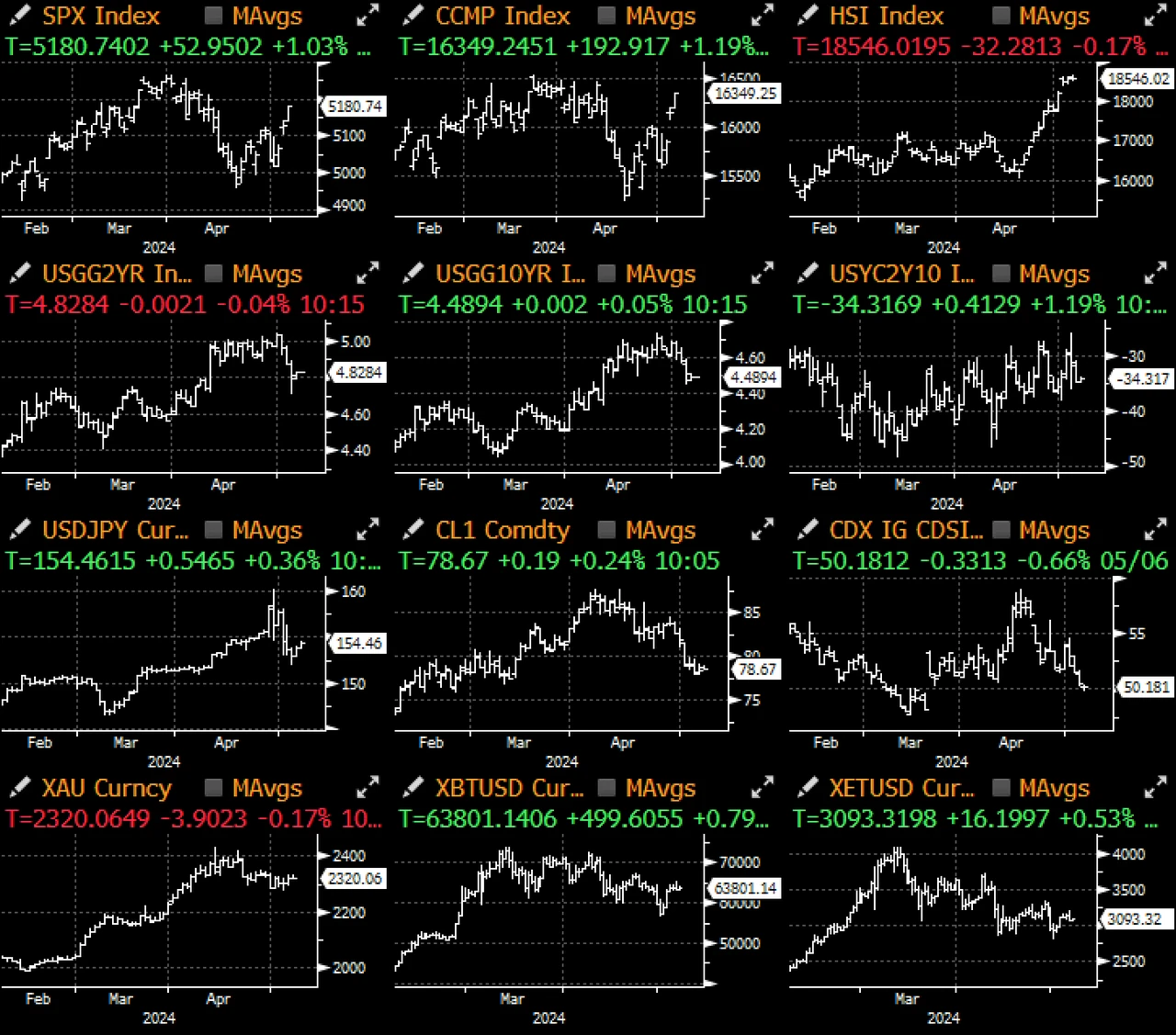

Speaking of momentum, bond yields have retreated sharply after testing overhead resistance, falling 20-30bps over the past week. In equities, SPX futures have reclaimed their 50-day moving average, with recent all-time highs once again in sight, though short-term technicals do look a bit overbought. Cross-asset volatility has also declined, with equity volatility retreating to cycle lows, followed by interest rates and FX volatility, especially USD/CNH and USD/JPY, which have retreated to recent ranges. Our view remains unchanged, and the market is likely to slowly move higher in the short term until the market finally decides that bad (economic) news is clearly bad news for future earnings and growth.

On the crypto front, not much news other than more SEC litigation action, this time targeting Robinhood鈥檚 crypto division. BTC prices continue to reflect the ups and downs of stock market sentiment, with SPX futures and BTC showing striking similarities over the past month. We expect crypto prices to keep pace with stocks in the absence of new catalysts (where is the halving discussion?), but crypto prices are still more inclined to the upside given the massive leveraged long liquidations in April. Good luck trading everyone.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240507): SPX futures and BTC trends show striking similarities

Related: Is Render (RNDR) Getting Ready for a New Price Rally?

In Brief RNDR Supply on Exchanges has decreased consistently for the last few days, indicating accumulation. The mean coin age is growing again, suggesting holders are more confident in RNDR. EMA Lines are showing strong support close to the current price and could soon draw a bullish trend. The Render (RNDR) price is in focus as its supply on exchanges has consistently decreased, signaling accumulation by investors. This is coupled with an increase in the mean coin age, indicating a stronger confidence in holding RNDR. Moreover, EMA lines are aligning to offer strong support close to their current value, hinting at the potential for a bullish trend to develop shortly. Together, these factors suggest a positive shift in the market sentiment towards RNDR. Render Mean Coin Age Is Increasing Again…