Airdrop claims are about to open, a quick look at the valuation expectations of Mode Network (MODE)

Original | Odaily Planet Daily

Author | Azuma

During the May Day holiday, Mode Network, a Layer 2 network built on OP Stack , announced that it will launch the governance token MODE on May 7, and will officially open the first season of airdrop applications at 11:00 UTC on the same day (19:00 Beijing time). The claim homepage ( Claim.mode.network ) is now open, but the specific airdrop allocation amount cannot be seen for the time being.

Mode Network Basic Information Overview

From a positioning perspective, Mode Network is a modular Layer 2 network focused on DeFi services. The network is built on OP Stack and has built the Layer 3 network Mode Flare by integrating Celestias DA solution.

Unlike other Layer 2, the biggest feature of Mode Network is that it has a shared incentive mechanism for contract revenue built into the protocol layer. By sharing part of the profits from the sorters revenue, Dapps and users have the economic motivation to work together.

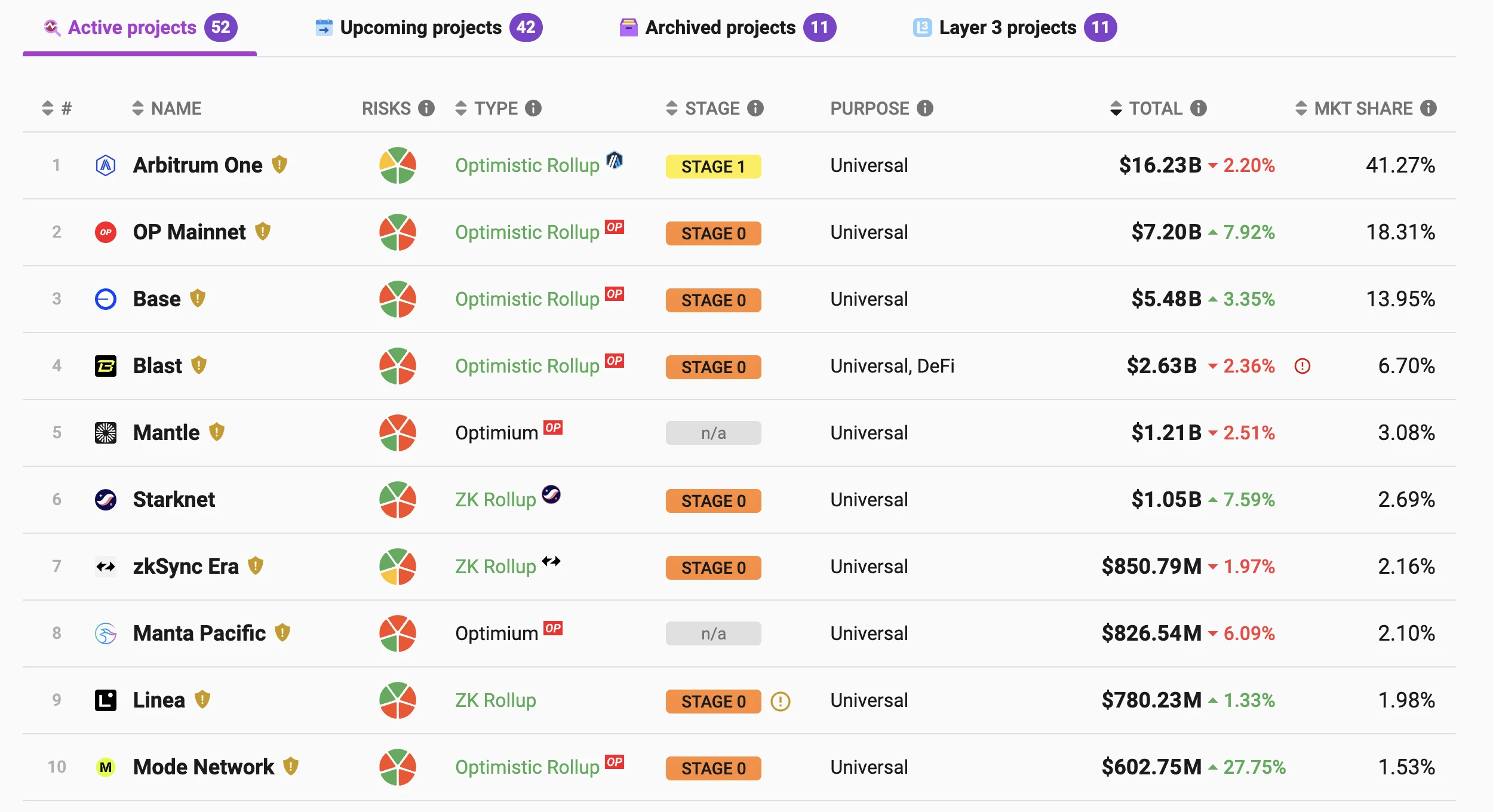

L2BEAT data shows that Mode Networks current total locked value (TVL) is approximately US$603 million, ranking 10th among all Layer 2s, and is only about US$200 million away from more well-known Layer 2s such as zkSync Era and Linea.

In terms of ecological landscape, Mode Network officials have mentioned that the network has integrated hundreds of external applications , such as The Graph, LayerZero, Pyth, Etherfi, Renzo, Safe, etc., and the network also has more than 30 native applications, including Ionic, KIM, Ironclad, etc. As its positioning, the application types on Mode Network are also mainly DeFi services.

In terms of network activity, as of the end of the first quarter airdrop, Mode Network had a total of 450,000 active addresses and a total of approximately 20 million transactions.

MODE Token Economic Model

In terms of utility, MODE will play two roles on the Mode Network. One is to serve as a governance token to determine the future development direction of the network, and the other is to serve as an incentive medium to promote the ecological development of the network.

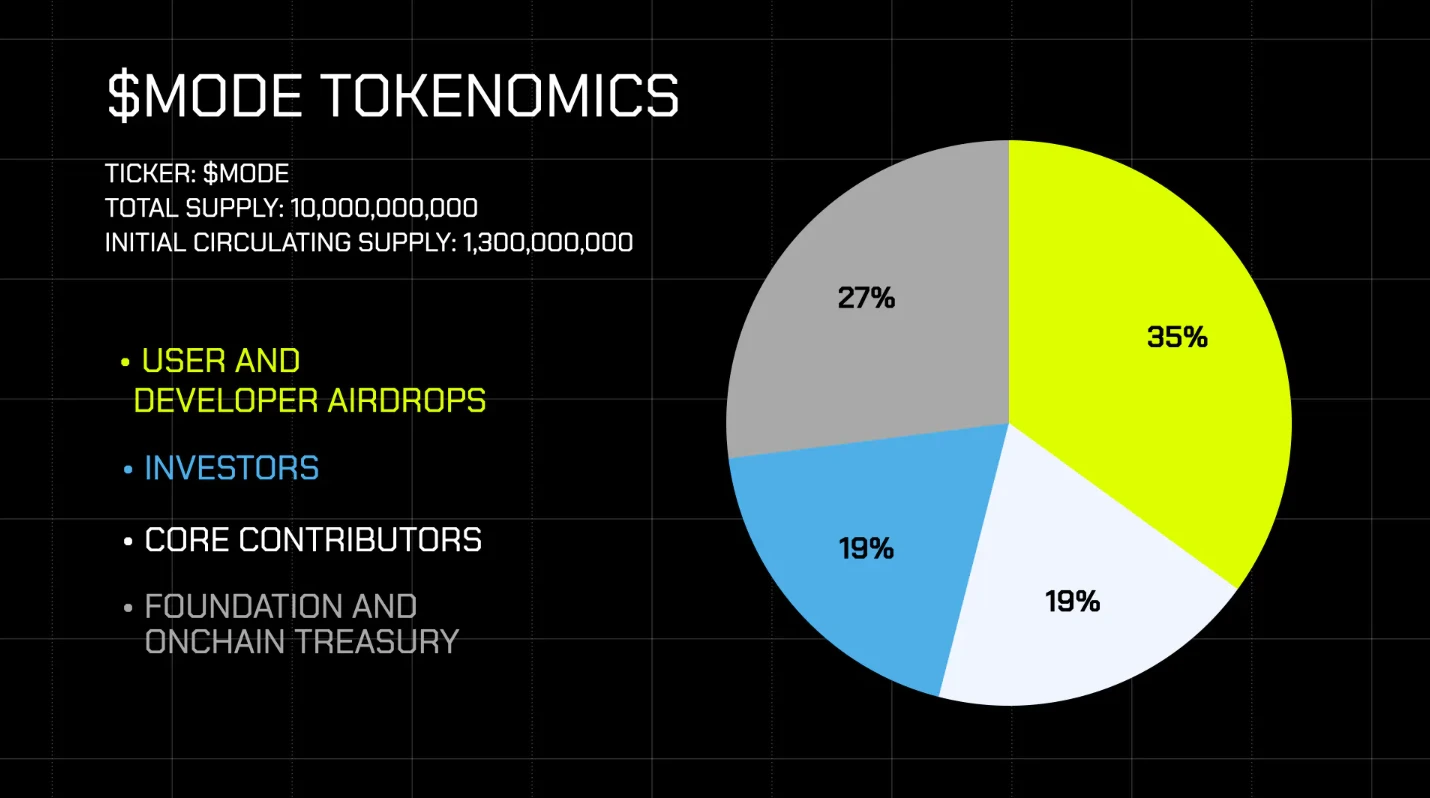

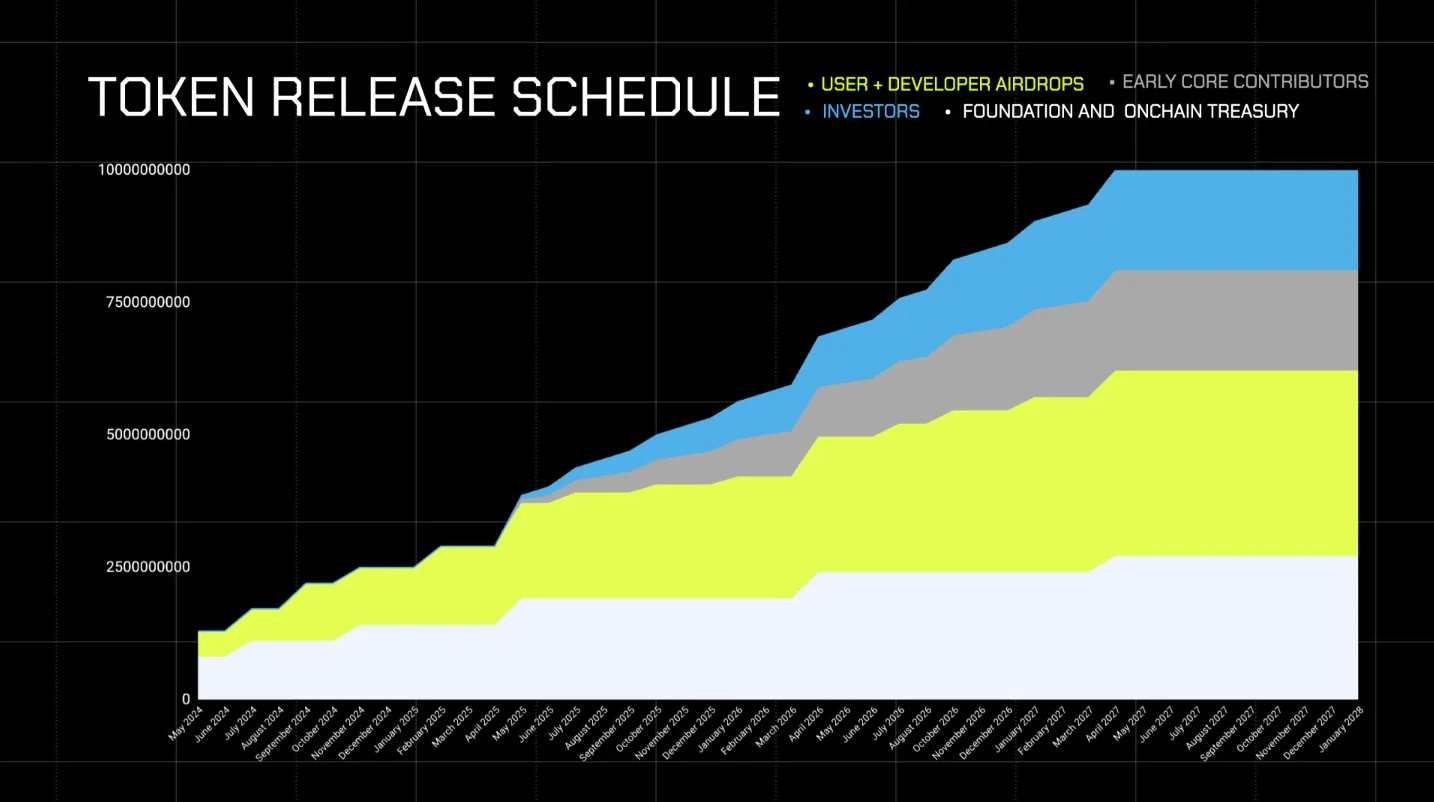

The total supply of MODE is 10 billion, of which the initial circulation supply will be 1.3 billion. The circulation share comes partly from the first quarter airdrop rewards and partly from the foundation and the on-chain treasury. In terms of the distribution mechanism, the distribution details of MODE are as follows:

-

35% of MODE will be used for airdrops to users and developers , with 5.5% allocated in the first quarter and 5% in the second quarter. The remaining tokens will be gradually distributed in future airdrop rounds.

-

19% of MODE will be allocated to investors . These tokens will be locked for 12 months and then released linearly over 24 months.

-

19% of MODE will be allocated to early contributors . This portion of tokens will also be locked for 12 months and then released linearly within 24 months.

-

27% of MODE will belong to the foundation and the on-chain treasury to be used for ecological development incentives.

It is worth mentioning that Mode Network has officially explained the operating mechanism of the foundation and the on-chain treasury. The foundation tokens are mainly responsible for funding ecological projects, and the use of on-chain treasury tokens needs to be decided through community governance, and then connected to major applications in the form of incentives. This also means that in the early stage of MODE TGE, there may be less than 550 million first-quarter airdrop shares (part of the airdrops will also be locked, which will be explained in detail below) out of the 1.3 billion circulating shares in an absolutely tradable state.

A Brief Analysis of the Airdrop Mechanism

Like many current projects, Mode Network also uses a points mechanism to measure community contributions. Users can accumulate points by bridging assets to the network and using various applications. The amount of points will affect the final airdrop share.

On May 5, Mode Network ended the first season of airdrops, and users who had used the network and accumulated points ( needed to reach a certain unannounced minimum threshold ) before that had the opportunity to obtain projects. However, Mode Network also mentioned that the snapshot will be taken before May 7, and if users withdraw funds before then, their airdrop shares may change.

In addition, in order to limit potential selling pressure from large investors, Mode Network will set certain airdrop lock-up restrictions for the top 2,000 addresses in terms of points – 50% can be claimed when the airdrop starts, and another 50% can be claimed after 90 days. During this period, users must keep their assets on Mode Network, otherwise they will be fined in proportion, and the fined tokens will flow to the second season airdrop event.

According to the airdrop rules, the claim window for the first season of MODE airdrop will last for 30 days, and unclaimed tokens will be distributed to developers and users as future rewards.

After the first season of activities, Mode Network immediately launched the second season of airdrop activities. The second season of activities will last from May 5 to September 6, and a total of 5% of the token share will be allocated. Users of the first season of activities will receive a certain amount of points acceleration in the second season of activities.

MODE Valuation Expectations

Although MODE has not yet been TGE, some pre-market trading markets have already opened OTC trading of MODE in advance, which may serve as a data reference after MODE is open for application tonight.

Whale Markets data shows that the current OTC transaction price of MODE on the platform is US$0.11, corresponding to an initial market capitalization (MC) of US$143 million and a corresponding full circulation valuation (FDV) of US$1.1 billion.

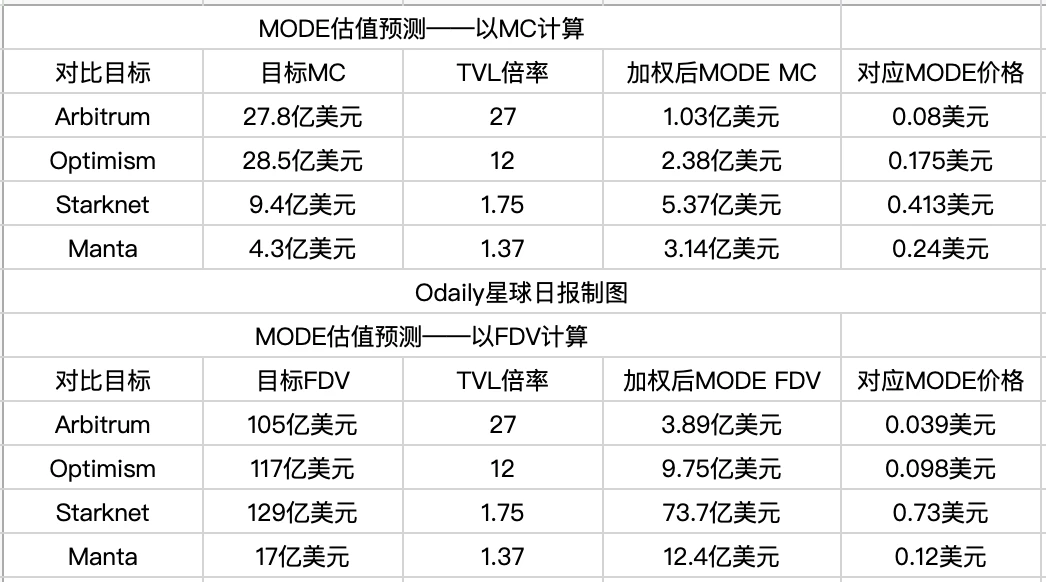

Previously, since the valuation model of Layer 2 itself is relatively clear, we can also perform valuation by weighted calculation of TVL and combining the MC and FDV status of existing Layer 2 projects.

As shown in the above figure, after removing some extreme outliers, we can see that the price estimate for MODE roughly falls in the range of 0.098 – 0.24 USD, which is relatively more concentrated in the lower half.

Of course, the above price is only a static estimate based on the competitive situation of the track in which Mode Network is located. Considering that the major Layer 2 networks have certain differences in structural design, style emphasis, and circulation status, the price performance of MODE still needs to wait until the opening before there will be a definite answer.

This article is sourced from the internet: Airdrop claims are about to open, a quick look at the valuation expectations of Mode Network (MODE)

Related: Ethereum (ETH) Price Analysis: Brace for a Possible Drop to $3,000

In Brief Ethereum Daily Active Addresses are still on the rise despite the recent corrections. NUPL data indicates that ETH has recently moved into the ‘Belief – Denial’ zone, potentially signaling upcoming corrections. EMA lines are drawing a potential consolidation or correction phase ahead. Despite recent corrections in the Ethereum (ETH) price, Ethereum’s Daily Active Addresses continue to rise, suggesting sustained interest and engagement within the network. This contradiction between price movement and network activity raises questions about the immediate future of ETH price. The move of ETH into the ‘Belief — Denial’ zone, as indicated by NUPL data, combined with EMA lines suggesting a potential phase of consolidation or further correction, poses a pivotal question: Will ETH price stabilize in a consolidation phase, or are we on the cusp…