Two major Bitcoin (BTC) whales have stirred the cryptocurrency market with their recent transactions. One whale moved a significant amount of BTC after a decade-long dormancy, while another executed a large WBTC sale for millions in stablecoins.

These transactions highlight shifting strategies among significant players and hint at potential market implications.

Bitcoin Whales Are Re-Evaluating Portfolios

Two significant Bitcoin transactions have stirred the cryptocurrency market. The first involved crypto whale 15WZNLACuvcDrrBL2btDErJggnaMQtHh5G, who, after a 10.3-year hiatus, moved a massive 687.33 BTC, valued at approximately $43.94 million to a new wallet.

This transaction, traced through the blockchain under the ID 605c67609ba71c3e707fc73af52a94a982cbd039315ea7beb85e99de59be7402, marked a significant movement from an old wallet address, 15WZNLACuvcDrrBL2btDErJggnaMQtHh5G, to a new one at bc1qky2rlawjxfschh2q3t7kp8665g9jnpfqqzqzuu.

The historical significance of this crypto whale’s BTC, acquired in January 2014 when Bitcoin’s price was $917, reflects the cryptocurrency market’s dramatic growth and enduring volatility.

According to blockchain analytics firm Spot On Chain, this movement could indicate strategic asset reallocation. It could also signal preparation for a potential sale, sparking discussions and speculations among market analysts and enthusiasts.

Read more: Bitcoin Price Prediction 2024/2025/2030

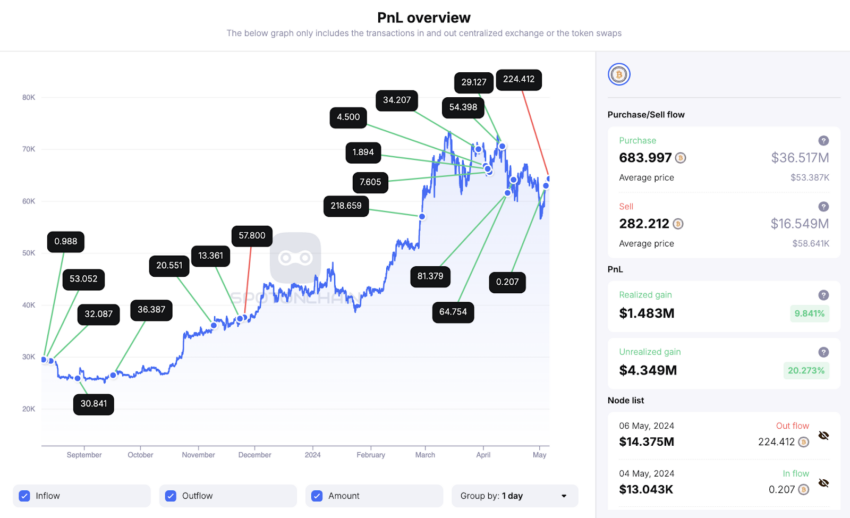

Simultaneously, another prominent player, 0x4860d039cbc7cffb0267f86e63f4b4442b71505e, executed a sizable transaction. The crypto whale sold 224.412 Wrapped Bitcoin (WBTC) for a combined $14.38 million in DAI and USDT. The transaction occurred amid a recovering market where Bitcoin’s price recently surpassed $64,000.

Even so, this crypto whale has been actively trading. It has earned over $4.5 million from various transactions, including a significant buy of 684 WBTC at an average price of $53,387 from exchanges such as Binance and Bybit.

These movements are not just isolated financial transactions; they reflect deeper trends and strategies within the cryptocurrency market.