Revenue of $1.64 billion, net profit of $1.18 billion, a quick look at Coinbases 2024Q1 financial report highlights

Original daily Planet Daily

Author: Fan Jiabao

Recently, Coinbase released its first quarter 2024 financial report.

The report showed that Coinbases revenue in the first quarter was $1.64 billion, higher than the average analyst expectation of $1.34 billion; net profit was $1.18 billion, or $4.40 per share, a stunning financial reversal compared with a loss of $78.9 million, or 34 cents per share, in the same period last year. This profit performance was achieved after the company announced its first profit in two years in February this year.

Notably, the quarterly profit included a $650 million gain from the adoption of new accounting standards that resulted in the market value of crypto assets held for investment.

1. Transaction fees surge: Market recovery and Bitcoin ETF approval

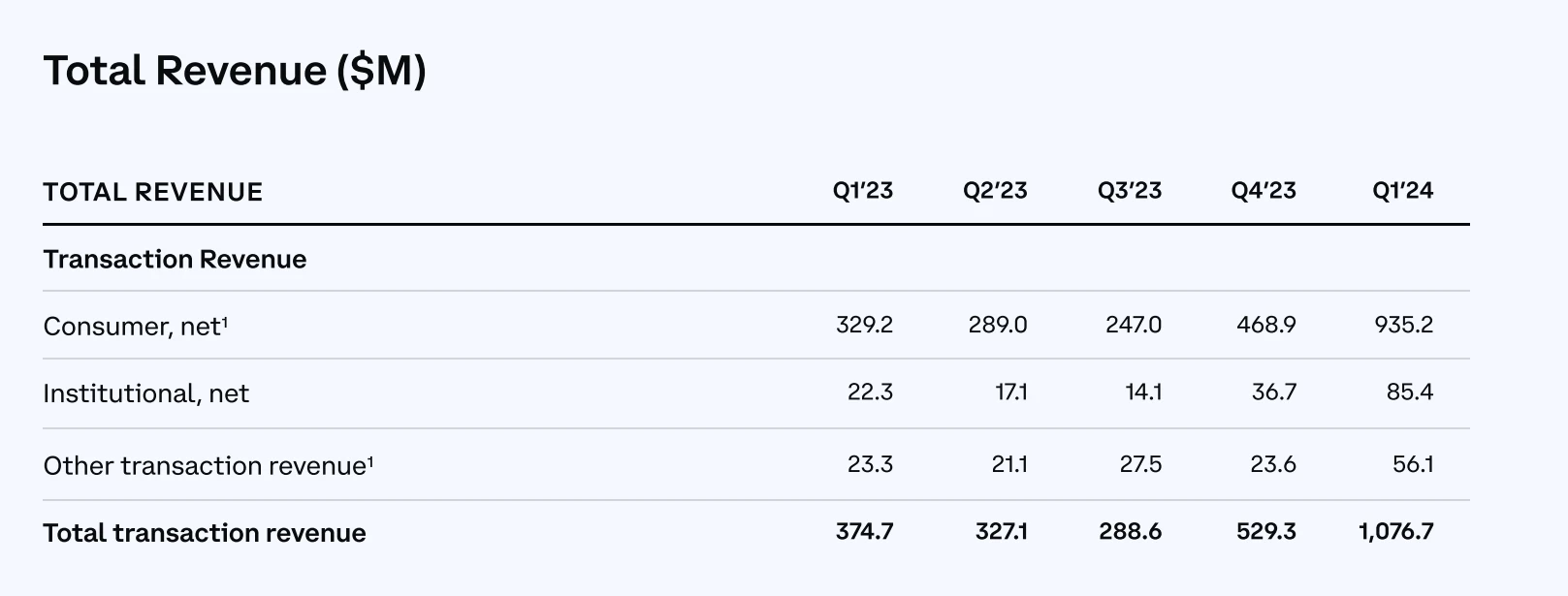

By business type, total transaction fee revenue in Q1 2024 was US$1.077 billion, a month-on-month increase of 103.42% and a year-on-year increase of 187.35%. It accounted for 65.75% of revenue and became the main source of revenue.

Transaction fee income increased significantly, primarily due to a significant increase in retail and institutional trading volumes.

Transaction revenue details (Unit: million US dollars)

Retail Trading Fees

Retail transaction fee revenue in Q1 2024 was $935 million, up 99.45% from the previous month and 184.08% from the previous year. Retail transaction volume in Q1 2024 was $56 billion, up 93.10% from the previous month and 166.67% from the previous year. Coinbases CFO pointed out in a conference call that the substantial increase in transaction fees was due to the growth of new users and the recovery of old users transaction volume, as well as the increase in per capita transaction volume among users.

Institutional transaction fees

In the first quarter of 2024, the institutional transaction fee income was US$0.85 billion, a month-on-month increase of 132.70% and a year-on-year increase of 282.96%. In the first quarter of 2024, the institutional transaction volume was US$256 billion, a month-on-month increase of 104.8% and a year-on-year increase of 106.45%.

Institutional transaction fee income benefited from the approval of Bitcoin spot ETFs and the companys product innovation. Since the SEC approved a series of new US spot Bitcoin exchange-traded funds, it has attracted a large influx of institutional investors. Many exchange-traded funds have chosen Coinbase as their custody partner, and as of the end of the first quarter, these funds have attracted more than $50 billion in funds.

Institutional platform Coinbase Prime hit a record high in trading volume and number of active customers in Q1 2024. The Prime platform provides custody, trading, financing and staking services to institutional clients. Due to the approval of the Bitcoin ETF in January 2024 and the rise in Bitcoin prices in the first quarter, customer engagement in the Prime product suite has increased significantly.

Thanks to the stimulation of ETF issuance on trading behavior, as the custody partner of exchange-traded funds, Coinbase Primes first-quarter trading volume hit a record high, up 115% year-on-year to 312 billion times. Its first-quarter revenue also soared from US$22.3 million in the same period last year to US$85.4 million. During the same period, loans surged to US$797 million.

Other trading income

Other transaction revenue in Q1 2024 was $56 million, up 137.71% from the previous quarter and 140.77% from the previous year. Other transaction revenue benefited from the increase in revenue from Base, the Layer 2 solution provided by Coinbase.

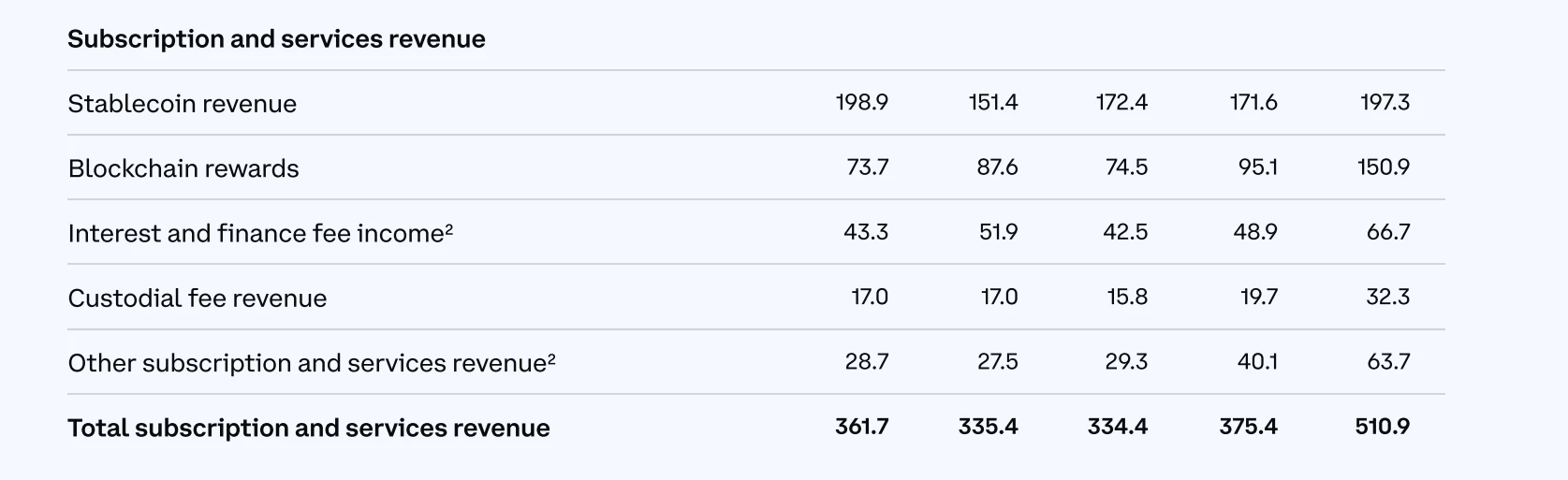

Subscription and services revenue grew strongly

Subscription and service revenue reached US$511 million this quarter, a month-on-month increase of 36.09% and a year-on-year increase of 41.25%, accounting for 31.20% of revenue, mainly driven by the growth of blockchain reward revenue, hosting fee revenue and other subscription service revenue.

Subscription and Services Revenue Breakdown (US$ Millions)

Stablecoin income

Stablecoin revenue in Q1 2024 was $197 million, up 14.98% from the previous month and down 0.8% from the previous year. Stablecoin revenue benefited from the increase in USDC market value. The value of USDC on the platform was $5.5 billion, about twice that of the end of Q4 2023.

It is worth noting that in the first quarter, USDC had the highest market capitalization growth rate among all USD stablecoins.

Reward income

The blockchain reward income in Q1 2024 was US$151 million, a year-on-year increase of 104.75% and a month-on-month increase of 58.68%. The blockchain reward income mainly benefited from the sharp rise in crypto assets, especially the price of Ethereum on March 31, which rose by about 60% compared with December 31 last year.

Custody fee income

Custody fee income in Q1 2024 was $32 million, up 63.96% from the previous month and 90.00% from the previous year. Custody fees benefited from the rise in crypto asset prices and the increase in custody business for Bitcoin spot ETFs. Of the 11 Bitcoin spot ETFs approved by the SEC in January 2024, Coinbase served as the custodian of 8 of them. At the end of Q1 2024, the companys custody assets were approximately $171 billion.

Interest and financing income

In Q1 2024, Prime financing income was reclassified from other subscription service income to interest and financing income. Interest and financing income was US$67 million, a month-on-month increase of 36.40% and a year-on-year increase of 54.04%.

Other subscription service revenue

In Q1 2024, Prime financing income was reclassified from other subscription service income to interest and financing income. Interest and financing income was US$67 million, a month-on-month increase of 36.40% and a year-on-year increase of 54.04%.

New growth poles support continued expansion of performance

The passage of the Stablecoin Act will provide Coinbase with stablecoin revenue for the foreseeable future.

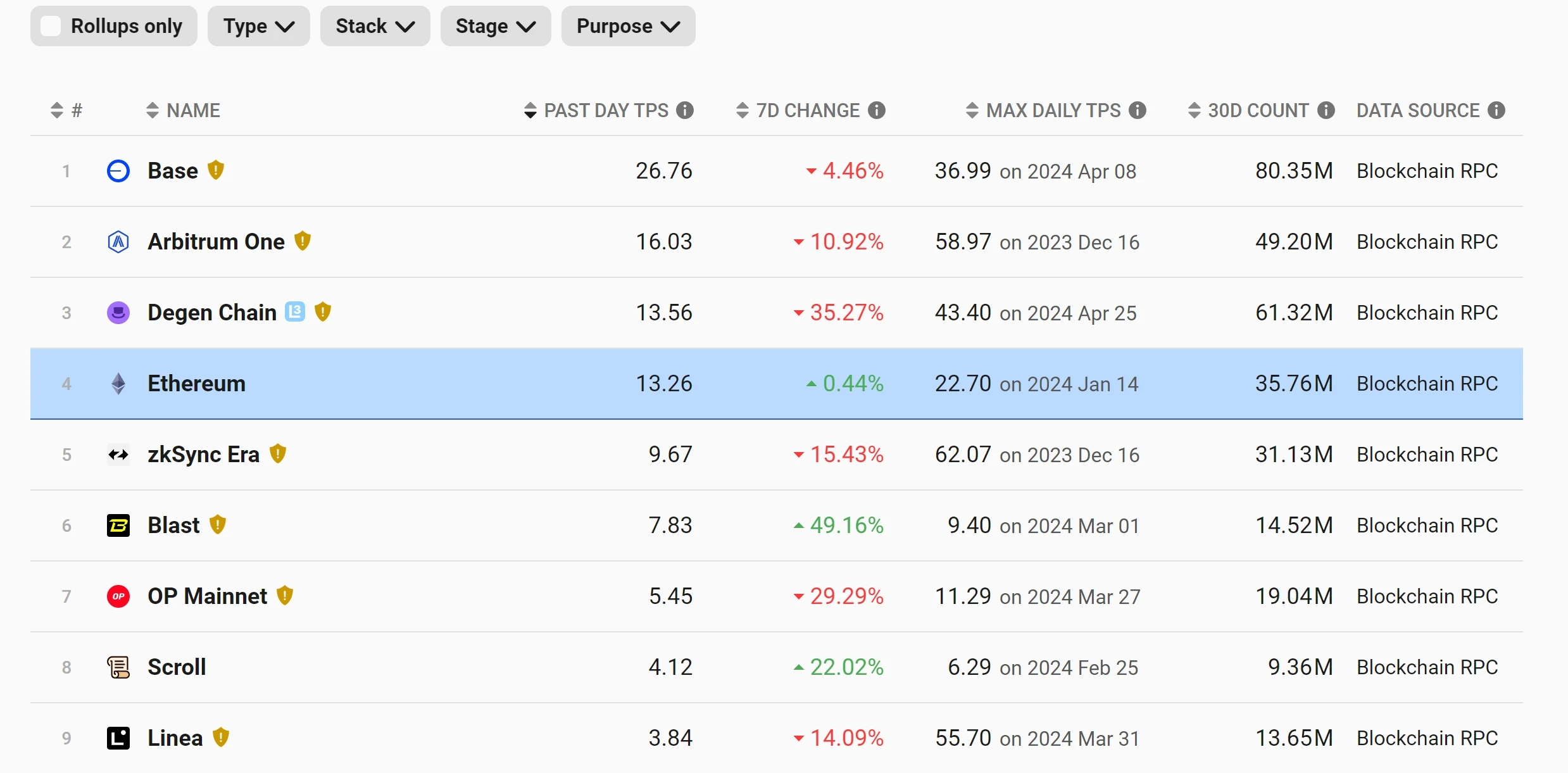

Furthermore, the Base chain, as Coinbases killer weapon to bet on L2, performed well in the past quarter. Due to the active trading of a large number of new and old Meme tokens, transactions on Base have far exceeded other L2 second-layer chains in the past few months.

Comparison of Layer 2 Network Transaction Overview

In addition, according to estimates by Wall Street analysts, Coinbases new business derivatives revenue will reach hundreds of millions of dollars in the next two years. In the long run, the expansion of Coinbases main platform into the derivatives field increases its upside.

Finally, the continued growth of Coinbase International and Coinbases acquisition of compliance licenses for crypto assets in more countries will also drive the continued expansion of its business scale.

This article is sourced from the internet: Revenue of $1.64 billion, net profit of $1.18 billion, a quick look at Coinbases 2024Q1 financial report highlights

GameCene, a Web3 game publishing platform, has announced the successful completion of its seed funding round, raising $1.4 million. This funding will fuel GameCene’s growth, accelerate the development of its platform, expand its diverse game library, and further streamline the management and monetization of user assets. GameCene: A Catalyst for the Web3 Gaming Revolution GameCene’s mission is to bridge the gap between Web2 developers and players, enabling them to seamlessly transition into the world of Web3 gaming. The platform offers a novel gaming ecosystem for players, providing unique entertainment experiences and empowering the effective monetization of in-game assets through Web3 technology. Omni-chain Game SDK: Empowering Game Developers GameCene’s Omni-chain Game SDK empowers millions of developers to effortlessly build and distribute blockchain games. The SDK provides a comprehensive suite of tools…