Bitcoin’s (BTC) price is anticipating a rally, which would help the cryptocurrency recover its recent losses. The institutions are the key to this, but retail investors are also gaining prominence in the market.

This would give BTC the necessary boost to break out of the current downtrend.

Bitcoin Demand Sees a Surge

Bitcoin’s price largely depends on the institutions for the present bull run, and the market is seeing the effects of the same. Last Friday marked the first instance of the Grayscale Bitcoin Trust (GBTC) recording inflows amounting to $63 million.

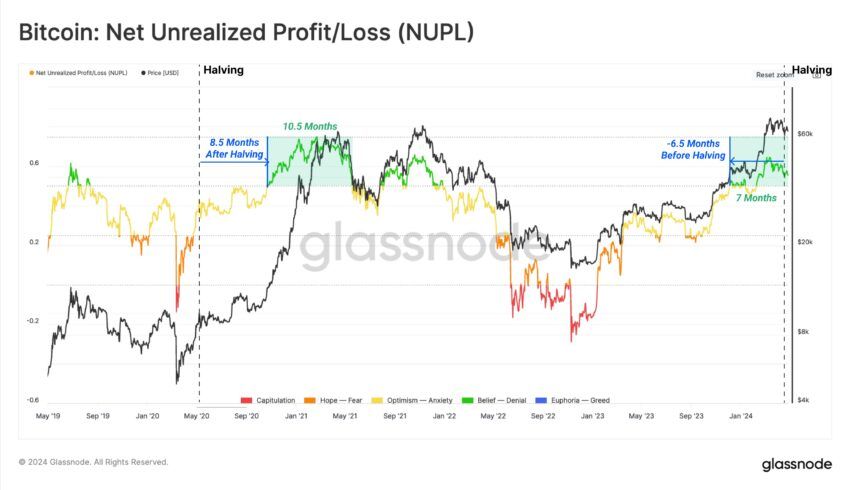

The launch of spot Bitcoin Exchange Traded Funds (ETFs) has been a massive boost to the bull run. This is evident in the Net Unrealized Profit/Loss indicator, which is presently above 0.5, indicating Euphoria in the market.

Since halving is bullish, demand tends to surge following the reward slashing. During the last bull cycle in 2020-2021, this Euphoria was achieved eight months after the halving. On the other hand, this time around, the same occurred nearly six months before the halving.

Thus, with ETFs consistently driving the demand, the recovery could fast-track, too.

However, this demand is not limited to institutions alone, as retail investors will likely jump on the bandwagon. This is because the Reserve Risk indicator is currently in the positive green zone.

This indicator is a measure of the overall confidence that investors exhibit. Combined with the low price, BTC presents an attractive risk-reward ratio to invest. Consequently, if BTC holders see the potential for profits, they will move to accumulate, in effect pushing recovery.

Read More: Bitcoin Halving History: Everything You Need To Know

BTC Price Prediction: Breakout Anticipated

Bitcoin’s price trading at $64,140 at the time of writing tests the upper limit of the flag the cryptocurrency has been stuck in since March. This bullish continuation pattern exhibits the potential of a 45% rally, placing the target at $92,505.

However, more realistically, the target is breaching the current all-time high of $73,000. This would take place once $65,000 is secured as a support floor and BTC breaks out of the pattern.

Read More: What Happened at the Last Bitcoin Halving? Predictions for 2024

On the other hand, if the breach fails, Bitcoin’s price could fall back down to $61,000. Losing this support would result in BTC testing the flag’s lower trend line, potentially hitting $56,600 to invalidate the bullish thesis.