Grayscale April Market Report: As the macro storm hits, the crypto market is bullish against the trend?

Original source: Grayscale

Original translation: BitpushNews Yanan

-

Affected by the tightening macroeconomic environment, the cryptocurrency market price experienced a certain degree of correction in April. It is particularly noteworthy that due to the steady growth of the US economy and the continued high inflation level, the probability of the Federal Reserve cutting interest rates this year has significantly decreased, which undoubtedly brought certain downward pressure to the cryptocurrency market.

-

However, judging from the overall development trend of the crypto industry, the market outlook remains optimistic. The Bitcoin halving event, the increasing activity of the Ethereum ecosystem, and the possible positive progress in the US stablecoin legislation all show the industry鈥檚 inherent strong growth momentum.

-

The Grayscale research team believes that, provided that the overall macro market environment remains stable, the price of cryptocurrencies is expected to see new upside in the second half of 2024.

After seven consecutive months of gains, Bitcoin prices suffered a 15% decline in April 2024, which also led to a downward trend in the entire cryptocurrency market. Although the market ushered in a series of positive fundamental news in April – such as the Bitcoin halving and significant progress in stablecoin legislation in the United States – these positive factors failed to completely offset the market pressure brought about by the tightening macroeconomic environment.

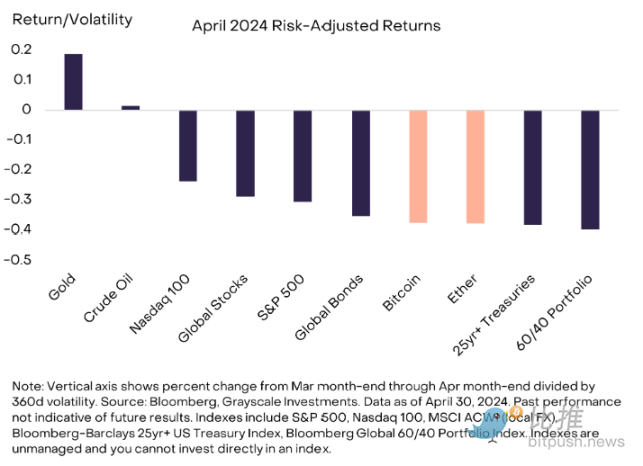

After taking risk-adjusted factors into account (i.e., taking into account the volatility of each asset), we find that the returns of Bitcoin and Ethereum are in the middle of the pack compared to traditional assets (see Figure 1). In April, gold and oil prices rose, partly due to escalating tensions in the Middle East. However, at the same time, most other major asset classes fell.

In particular, the market for long-term government bonds has performed poorly. This is mainly due to the markets expectation of higher inflation, which will lead to higher real interest rates (i.e. interest rates adjusted for inflation). In addition, global stock indices have generally declined, and volatility in stock and bond markets has also increased.

Figure 1: Macro tightening dragged down the performance of various assets in April

The core reason for this market weakness seems to be the strong performance of nominal US economic growth, which makes the prospect of the Feds interest rate cuts dim. In early April, the US Department of Labor reported that employment increased by about 300,000 in March and increased by an average of about 275,000 per month in the first quarter. Subsequent reports showed that the core consumer price index (CPI) increased by more than 4% annualized for the third consecutive month. With the release of a series of strong economic data, the public statements of Fed officials seem to suggest that the possibility of interest rate cuts is gradually decreasing.

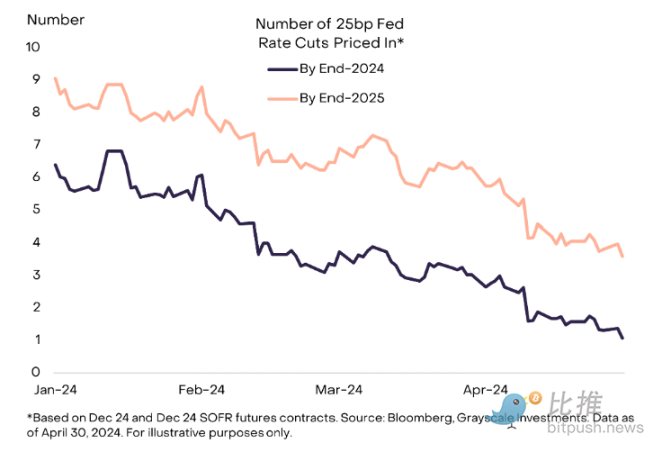

At the end of March, the market generally expected the Fed to cut interest rates three times by 25 basis points each by the end of 2024. However, by the end of April, this expectation had been significantly reduced to only one rate cut, also by 25 basis points (see Figure 2). This change reflects the markets repositioning of the Feds future monetary policy.

Since Bitcoin is seen as an alternative monetary system that competes with the U.S. dollar, the rise in real interest rates over the past month may have supported the value of the U.S. dollar to some extent. At the same time, this change in interest rates also has a direct impact on the price of Bitcoin.

Figure 2: The market currently believes that the Fed will cut interest rates relatively rarely

While the market currently believes that the number of interest rate cuts from the Federal Reserve will be relatively small (as shown in Figure 2), last months news has revealed some important macro trends that have the potential to support demand for Bitcoin for a long time.

Specifically, media reports indicate that if Trump is re-elected, his second administration may take a series of policy measures, including trying to weaken the independence of the Federal Reserve (Wall Street Journal), deliberately devaluing the dollar (Politico), and punishing countries that seek to conduct more bilateral trade in non-dollar currencies (Bloomberg). These potential policy moves undoubtedly increase the uncertainty of the dollars outlook and may have an impact on alternative currency systems such as Bitcoin.

We have discussed the importance of these macro policy issues in detail in previous reports, especially in the upcoming election, where these issues are even more important. Although the current campaign is still in its early stages, the latest related reports have highlighted the uncertainty that the election may bring to the medium-term outlook of the US dollar. This uncertainty, in turn, may affect the medium-term trend of cryptocurrencies such as Bitcoin.

Despite the more challenging macro market environment, there were still many positive factors in the cryptocurrency market in April. The most eye-catching one was undoubtedly the successful halving of Bitcoin on April 20. This halving caused the issuance rate of new coins on the Bitcoin network to drop significantly from about 900 coins per day to about 450 coins per day.

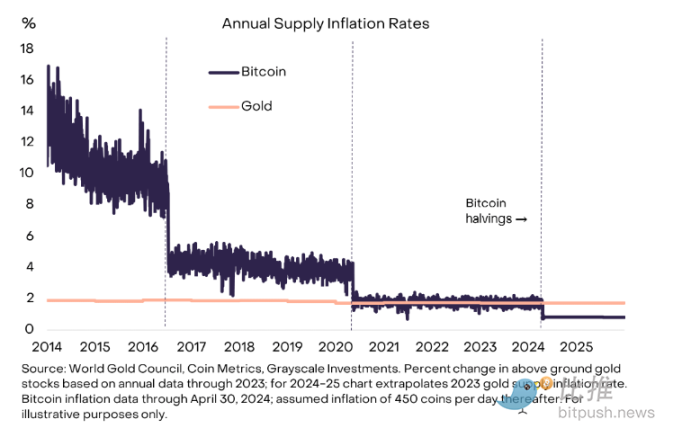

After the halving, the inflation rate of the Bitcoin network – the annualized rate of new coin issuance relative to the existing supply – dropped from about 1.7% to about 0.8%. It is worth noting that before the halving, the inflation rate of Bitcoin was roughly the same as the supply inflation rate of gold, but now the inflation rate of Bitcoin has been significantly reduced (as shown in Figure 3). If denominated in US dollars and calculated based on the current Bitcoin market price, the reduction in the daily issuance of Bitcoin actually means that its annual supply growth has been reduced by about US$10 billion.

Figure 3: Bitcoin鈥檚 inflation rate is lower than gold

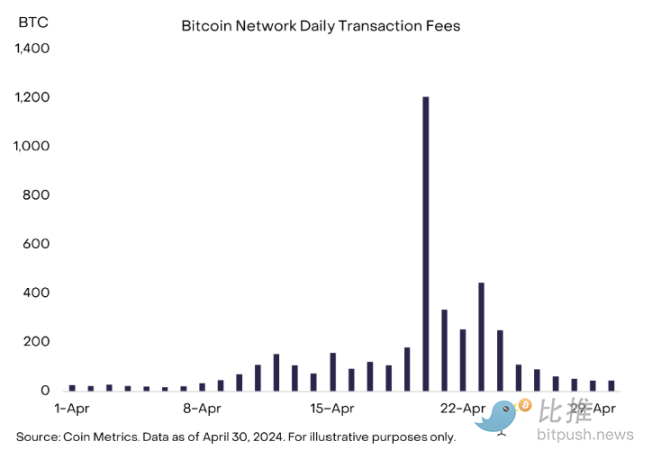

On the day of the halving, Bitcoin transaction fees saw a significant increase, mainly due to the emergence of Runes. Runes are a new alternative token standard on the Bitcoin network created by the same developer who launched Ordinals. According to data, the transaction fees collected by miners on the day of the halving reached about 1,200 BTC, a significant increase compared to the previous daily average of 70 BTC. In the following days, daily transaction fees remained between 250 and 450 BTC until the end of the month, when they began to decline (as shown in Figure 4). However, high fees make small transactions on the Bitcoin network too expensive, which may weaken Bitcoins properties as a medium of exchange (for example, the average single transaction fee on the day of the halving was $124). Although the outlook is still unclear, we initially predict that Bitcoin transaction fees will rise in the medium term to ensure miners income. At the same time, we also need to find a wider range of scaling solutions to make Bitcoin payments more cost-effective and the network more convenient to use.

Figure 4: Bitcoin transaction fees surged before and after the halving

In April, Ethereum once again underperformed Bitcoin, and the reason behind this may be that the probability of Ethereum spot ETF being approved in the U.S. has significantly decreased. According to data from decentralized prediction platform Polymarket, as of the end of May, the probability of Ethereum spot ETF obtaining U.S. regulatory approval has dropped sharply to 12%, far lower than 21% at the end of March and 75% at the beginning of January.

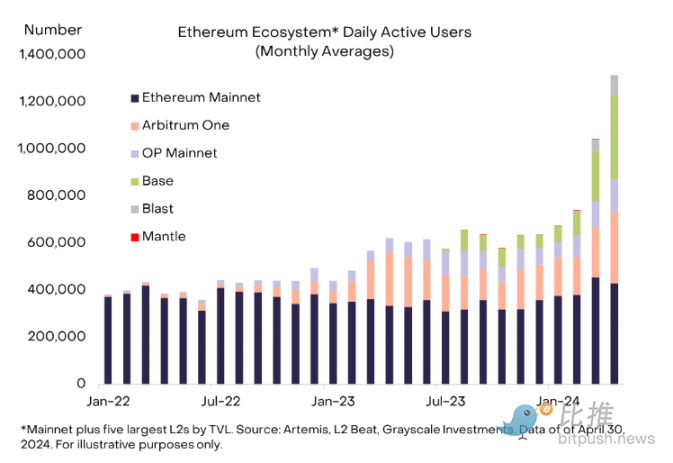

However, it is worth noting that the on-chain activities in the Ethereum ecosystem have not been affected by this, but have shown a trend of continuous growth. In particular, in April, thanks to the promotion of Base and Arbitrum, the number of daily active users in the Ethereum ecosystem has climbed to 1.3 million (see Figure 5).

Despite recent disappointing returns, we remain optimistic about Ethereum and believe that it will benefit from the growing tokenization trend.

Figure 5: Ethereum ecosystem continues to grow

There have been several exciting pieces of good news in the stablecoin space this month. On April 17, Senators Lummis and Gillibrand jointly introduced a bipartisan bill to establish a clear legislative framework for stablecoins. The proposal is extensive, requiring stablecoin issuers to hold a one-to-one reserve to ensure the value of stablecoins, and also proposing corresponding consumer protection measures, such as introducing the assistance of the Federal Deposit Insurance Corporation (FDIC) in the event of a failure. More strikingly, the proposal explicitly proposes a complete ban on algorithmic stablecoins.

As the legislation progressed, payment giant Stripe also announced a major move. The company will allow its customers to use USDC stablecoins for payments on networks such as Ethereum, Solana, and Polygon. For these rapidly developing projects, Stripes decision is undoubtedly a positive signal.

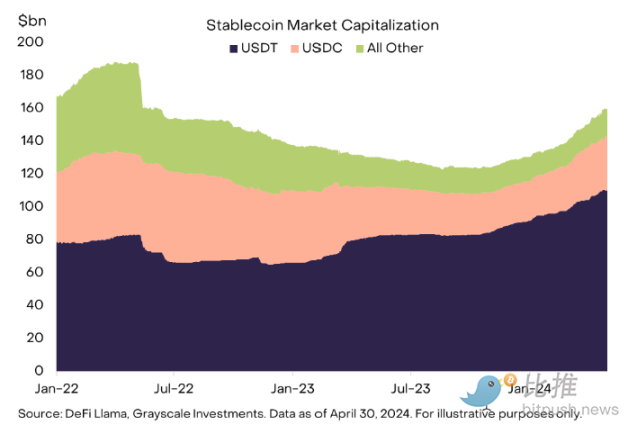

In 2024, the stablecoin market has seen significant growth, with its total market value rapidly climbing from $130 billion in January to $160 billion now in just five months, an increase of 23%.

It is worth mentioning that since the beginning of 2023, Tether (USDT) has firmly held the top spot in the stablecoin market with its outstanding performance. According to the data in Figure 6, Tether currently accounts for 69% of the total market value of stablecoins, which is an overwhelming advantage. However, although Tether further expanded its market leading position in 2023, other stablecoins are also actively exerting their strength, presenting a diversified competitive landscape.

USDC, issued by Circle, a US company, has shown strong growth momentum in 2024. According to statistics, its market value has increased by 36% so far, significantly higher than Tethers 20% growth performance in the same period.

Figure 6: Stablecoin market value continues to grow

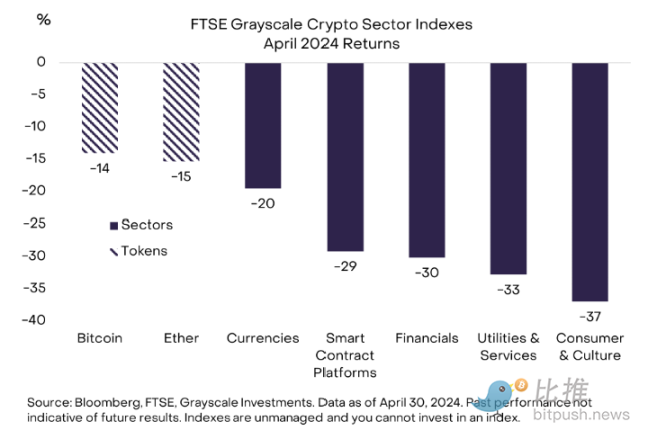

Both Bitcoin and Ethereum outperformed the FTSE Grayscale Cryptocurrency Industry Index in April. The index covers 243 tokens (or altcoins) in five crypto segments (Figure 7). The best performing crypto segment in April was the currency sector (mainly due to the relatively stable price of Bitcoin), while the worst performing were the consumer and cultural sectors. The weakness in this sector also reflects the decline and adjustment trend of Meme Coin after its strong rise in March.

Figure 7: All five crypto segments were weak in April

In most cases, the markets pullback clearly reflects a broad decline in market sentiment. However, after a deeper analysis, we found that some specific thematic trends are still worth paying close attention to. For example, after risk adjustment, the return on investment of some decentralized exchange (DEX) tokens is still low. Another notable example is World Coin (WLD), whose price experienced a drop of up to 45% in April. Although the WLD team announced that it is building an Ethereum-based L2 network and actively exploring cooperation opportunities with OpenAI, these positive news have failed to effectively boost the coin price. More worryingly, the WLD team also plans to further increase the supply of tokens through a new private sale, a move that may put further downward pressure on prices.

There is also good news for other projects: Toncoin (TON) has performed well recently, successfully surpassing Cardano (ADA) and becoming the seventh largest asset in the cryptocurrency field. The project further announced that it will be deeply integrated with the instant messaging tool Telegram and launched a series of community and developer incentives, which undoubtedly added more appeal to it.

In addition, in the past 30 days, the markets attention has also been attracted by SocialFi, a decentralized social media application. Particularly worth mentioning is the FriendTech platform, which innovatively provides creators with an opportunity to generate income from online communities. On FriendTech, users can trade keys connected to Twitter accounts to access exclusive chat rooms. According to data from the analysis company Kaito, the popularity of FriendTech peaked in September 2023.

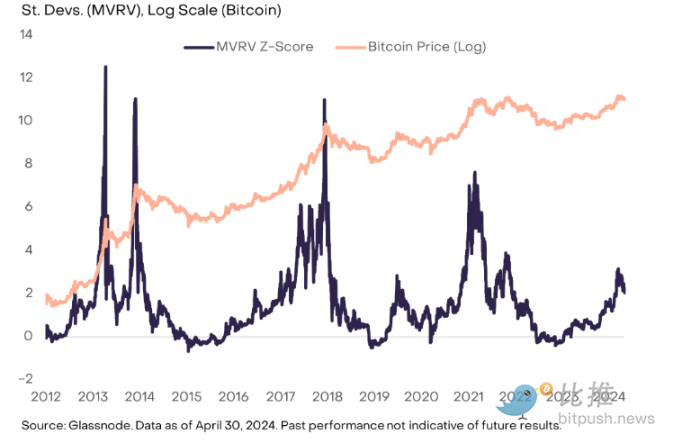

At the end of March, we judged that Bitcoin was entering the fifth inning of the current bull cycle. To borrow a baseball metaphor, we may now have entered the seventh inning: Bitcoin valuations have retreated, and the pace of inflows from Bitcoin spot ETFs has slowed. At the same time, indicators that reflect the positioning of speculative traders, such as perpetual futures funding rates, have also declined. Given the expected shift in the Feds monetary policy, the current temporary pause in the rally seems reasonable – after all, rising real interest rates are a fundamental headwind for Bitcoin.

However, from a broad macroeconomic perspective, the outlook appears to remain positive: the U.S. economy is on track for a soft landing, Fed officials are signaling future rate cuts, and the November election results seem unlikely to trigger tighter fiscal policy. In addition, metrics used to measure Bitcoin valuations, such as the MVRV ratio, are currently well below the peak of previous cyclical highs (see Figure 8). As long as the macroeconomic outlook remains broadly stable, we believe that Bitcoin prices and the total market value of cryptocurrencies are expected to continue to rise this year.

Figure 8: Bitcoin valuations show lower than previous peaks

This article is sourced from the internet: Grayscale April Market Report: As the macro storm hits, the crypto market is bullish against the trend?

Related: In addition to Runes, what other transaction demands will increase miner income?

Original author | CoinShares Compilation | Golem This article was written by CoinShares researcher Matthew Kimmell before the Bitcoin halving. The core idea is that Bitcoin transaction fees can offset the impact of the halving on miners. The first half of the article predicts that when Runes goes online, miners fee income will reach at least 150 btc/day (actually 1070 btc/day on the first day of launch, and it has not been less than 150 btc every day so far); the second half mainly explains the other 3 transaction requirements that can increase miners income in addition to Runes. Since the first half of the original article is mainly about the prediction after the halving, it is outdated and will not be recompiled in this article. This article mainly extracts…