Interpretation of the Indian crypto market: Investment activity is relatively sluggish, and tax reform is the most criti

Original article by Ryan Yoon Yoon Lee, Tiger Research

Original translation: Felix, PANews

Key points:

-

India’s blockchain market continues to grow: India has a young population, a strong technical talent pool, and supportive government policies. Web3 technology is widely adopted, ranking first in the 2023 Global Cryptocurrency Adoption Index.

-

Tax Reforms and Regulatory Changes: In the first quarter of 2024, India’s tax and regulatory environment saw significant changes for the Web3 and blockchain industries, including excessive TDS (tax deducted at source) and capital gains tax rate adjustments, as well as increased regulation of cryptocurrency exchanges.

-

Investment and ecosystem development: Despite the uncertainty in the regulatory environment, Indias Web3 ecosystem continues to attract investment and grow. Although there was a clear lack of new investment in the blockchain industry in the first quarter, some projects are still being built.

1. Current status of the Indian blockchain market

As highlighted in the previous report, “ India’s Web3 Market Overview ”, India is quickly becoming a significant player in the global blockchain market. Several key factors driving this growth are: 1) a young demographic, 2) an abundance of technical talent, and 3) government policies that are conducive to technological innovation. In addition, India’s population of over 1.4 billion provides an ideal environment for widespread adoption of Web3 services. According to Chainalysis’ 2023 Global Cryptocurrency Adoption Index, India ranks first in the world, up three places from fourth place last year, reflecting the growth of India’s Web3 market.

The Web3 ecosystem in India is thriving. It is supported by more than 1,000 active startups, especially in the important Web3 hub of Bangalore. Although the investment amount has declined in 2023, the investment frequency has remained stable, indicating that the market continues to grow. In addition, the Indian government is gradually adopting Web3 technology, experimenting with the digital rupee through the CBDC project, and advancing the construction of a national blockchain framework. This change in attitude from initial prohibition to support highlights the recognition of the potential of blockchain and the commitment to cultivating a healthy technology ecosystem.

2. Changes in the first quarter of 2024

2.1 Expected changes in the taxation system

Players in the Indian blockchain market have urged the government to reduce the 1% TDS (tax deducted at source) on cryptocurrency transactions and 30% capital gains tax on profits in the upcoming Budget 2024-25.

Source: CoinDCX

TDS is particularly burdensome for investors as it imposes a 1% tax on the currency at the time of realisation. For example, if you sell Bitcoin worth Rs 1,000, you will be taxed Rs 9.8, or 1% of Rs 998, excluding transaction fees (Rs 2, assuming 0.2%).

According to a report by the Esya Center, trading volumes in India have plummeted 90% since the tax was announced in 2022. In response, industry groups and players including the Blockchain Industry Association and the Bharat Web3 Association have called on the government to reduce TDS to 0.01% and allow crypto trading losses to be offset against profits, similar to the stock market.

The Indian blockchain industry was disappointed with the interim budget announced in February, which maintained the 30% tax on cryptocurrency profits and the 1% tax deducted at source (TDS). Considering that these decisions were made before the general election, no major changes in the taxation structure were expected at the time. After the general elections in April/May, tax reforms are expected. The industry remains hopeful of adjustments that could include regulatory clarity, the abolition of the 1% TDS, and a reduction in the overall tax rate.

2.2 Blocking global crypto exchanges

Source: Cointelegraph

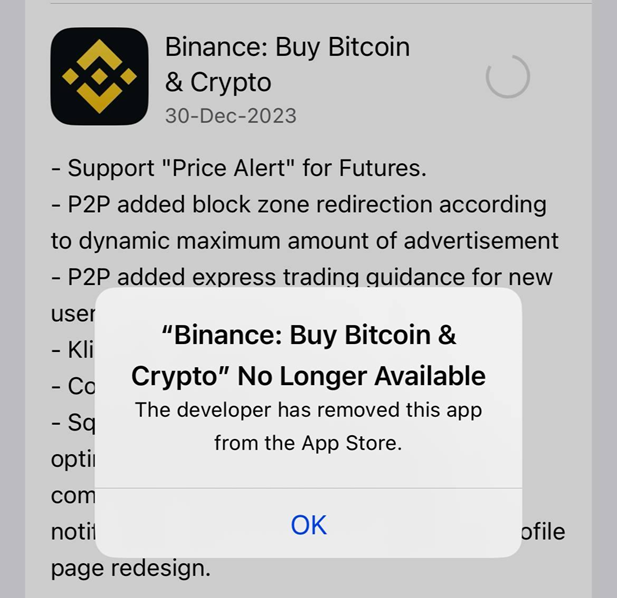

In December 2023, India’s Planning Commission issued notices to nine crypto exchanges for violating money laundering laws. Further regulatory action took place in January 2024, when the Financial Intelligence Unit (FIU) asked major global crypto exchanges including Binance, Kraken, and OKX to remove their apps from Indian app stores. These requests were quickly responded to, with both the Apple App Store and Google Play Store removing the apps. OKX also announced in March that it would cease operations in India by April 30, highlighting the significant challenges facing crypto exchanges under the current regulatory framework.

The regulatory landscape for crypto exchanges in India began to change significantly last year when Coinbase stopped accepting new customers in India. Coinbase CEO Brian Armstrong attributed the decision to informal pressure from the Reserve Bank of India.

Fortunately, in March of the same year, the exchange KuCoin announced that it had become the first global exchange to be approved by the Financial Intelligence Unit (FIU), marking a major shift in regulation. This approval allowed KuCoin to begin acquiring users within the established regulatory framework. This change in the first quarter revealed a shift in regulatory intensity in India.

2.3 Investment ecosystem development

Despite the uncertainty in the regulatory environment, the Web3 ecosystem in India continues to grow. Recently, the Core Foundation launched a $5 million innovation fund to promote the development of the Web3 ecosystem in India. Solana and CoinDCX also launched a $3.2 million developer support program. These large-scale support plans show the confidence of these projects in the Indian market.

2.4 New Funds

Source: AFK Gaming

Stan is an Indian blockchain esports company that completed its Pre-Series A funding round in January, raising $2.7 million from CoinDCX and other investors. Stan is building a blockchain gaming community and announced the launch of a marketplace in addition to releasing its own official NFTs.

There is a notable lack of new investment in the blockchain industry in the first quarter of 2024. The slump in investment activity could be influenced by two main factors: a surge in global interest and capital flows in AI technology, and ongoing regulatory uncertainty in India.

2.5 Other Changes

Despite efforts to support Web3 and the blockchain ecosystem, companies are moving their operations to regions such as Dubai and Abu Dhabi. This shift is largely driven by escaping India’s regulatory ambiguity and strict tax policies. Dubai, in particular, is attracting crypto businesses with its incentives such as exemptions from income and corporate taxes.

Indian crypto exchange Mudrex also offers a U.S. spot Bitcoin ETF to Indian investors and supports four spot ETFs from BlackRock, Fidelity, Franklin Templeton, and Vanguard.

Finally, CoinDCX merged with the defunct Koinex, solving the asset withdrawal problem for Koinex users and gaining some users. CoinDCX is the first crypto exchange in India to become a unicorn, currently valued at $2.15 billion, and its influence is expected to expand further after the merger.

3. Conclusion

The most critical issue facing the Indian blockchain market right now is the need for comprehensive tax reform. While the influx of investors seems to only push up prices rather than foster significant market development, it is possible that investors can contribute to a healthier market environment and provide substantial support for groundbreaking projects.

Furthermore, the policy direction set by the new government after the elections will be crucial in reshaping the future of the Indian blockchain market. The outcome of these elections and the subsequent policy decisions could prove to be a critical turning point in determining whether the market can overcome its current challenges and reach its full potential.

This article is sourced from the internet: Interpretation of the Indian crypto market: Investment activity is relatively sluggish, and tax reform is the most critical

Related: Toncoin (TON) Price Climbs 37%: Here’s Why Profitable Holders Could Stop the Uptrend

In Brief TON Daily Trading Volume reached new all-time highs, surpassing $314 million. TON EMA lines are still drawing a bullish trend and possible price increases despite the recent surge. The percentage of profitable holders is now at 95%, the biggest value since 2021, which could imply a selling pressure ahead. TON’s daily trading volume has surged to new all-time highs, surpassing a staggering $314 million. Despite this recent increase, TON’s EMA lines indicate a bullish trend and potential for further price gains. However, a potential cause for concern is the high percentage of profitable holders, currently at 95% – the highest level since 2021. Historically, this suggests that selling pressure may be on the horizon. Is this a buying opportunity or a sign to wait? TON Daily Trading Volume…