Arthur Hayes: Bitcoin will fluctuate between $60,000 and $70,000 until August

Original author: Arthur Hayes

Original translation: GaryMa Wu talks about blockchain

Note: This article is an excerpt from the original article, and some details or information may be deleted. We recommend that readers refer to the original article while reading this article to obtain more comprehensive information.

Since mid-April, some degens have been screaming “May Crisis” as they see the continued decline in the crypto market.

The price action is in line with my expectations. US tax season, concerns about future Fed policy, the Bitcoin halving event, and slowing growth in US Bitcoin ETF asset management (AUM) have combined to produce a much needed market cleanup in the first two weeks. Speculators or short-term investors, they may choose to temporarily exit the market and wait and see what happens next. And us hardcore guys will continue to hodl, if possible, and accumulate more of our favorite crypto reserve assets such as Bitcoin and Ethereum, as well as high beta altcoins like Solana, Dog Wif Hat, and I have to say Dogecoin.

This is not a fully polished global macroeconomics, politics, and crypto article. Instead, I want to highlight why the U.S. Treasury, Fed, and Republic First Bank bailouts provide or increase access to fiat liquidity now and in the near future. I will quickly go through some tables that support my bullish view.

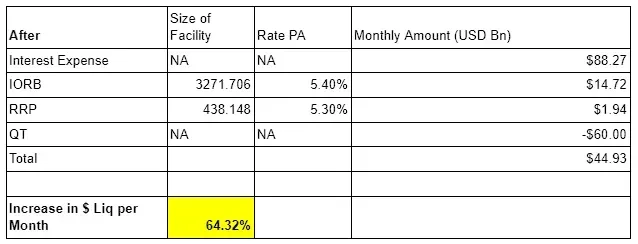

Quantitative Tightening (QT) Cuts = QE

When regular investors equate Quantitative Easing (QE) with money printing and inflation, it spells trouble for the elite. So they need to change the terminology and the method of delivering the financial system (cancer) its dose of monetary heroin. Reducing the pace of asset shrinkage under the Fed’s Quantitative Tightening (QT) program sounds harmless. But make no mistake – by reducing the pace of QT from $95 billion per month to $60 billion, the Fed is actually increasing dollar liquidity by $35 billion per month. When you combine interest on reserve balances, reverse repurchase agreement (RRP) payments, and interest payments on U.S. Treasury bonds, the reduction in QT increases the amount of stimulus provided to global asset markets each month.

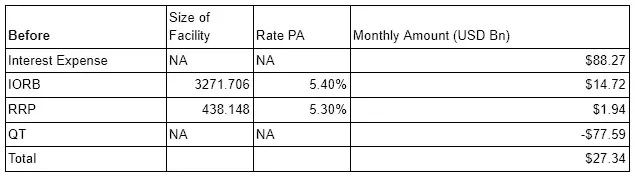

The Fed announced this week that it will cut QT at its May 2024 meeting. Using a handy chart, let’s take a look at USD liquidity before and after the meeting.

Note that the QT term is the actual average monthly reduction in 2024 based on the Feds weekly reported balance sheet. As you can see, the Fed missed its target of $95 billion per month. This raises the question if the target was $60 billion per month, would the Fed also miss that target. Missing the target pace is positive for USD liquidity.

“High” interest rates require the Fed and the U.S. Treasury to pay interest to the wealthy, which, combined with the slowdown in QT, is even more stimulative.

This is the purpose of Powell of the Federal Reserve, but what about his good partner Yellen?

U.S. Treasury Quarterly Funding Announcement (QRA)

Because the United States is in fiscal dominance, Yellens statement is more important than that of any other monetary official. Every quarter, the U.S. Treasury releases the QRA to guide the market on the amount and type of debt that must be issued to finance the government. Before the Q2 2024 QRA, I have some questions:

1. Will Yellen borrow more or less than last quarter, and why?

2. What is the maturity profile of the debt issued?

3. What will the target Treasury General Account (TGA) balance be?

Question 1 :

In the April-June 2024 quarter, the Treasury expects to borrow $243 billion of privately held net market debt, assuming a $750 billion cash balance at the end of June. The borrowing estimate is $41 billion higher than published in January 2024, primarily due to lower cash receipts, partially offset by a higher cash balance at the beginning of the quarter.

If you hold Treasuries, this is bad news. Supply will increase, and despite a strong U.S. economy and stock market, tax revenues will be subpar. This will accelerate the bond market and send long-term interest rates sharply higher. Yellen’s response to this will likely be some form of yield curve control, and this is when Bitcoin will really start to climb toward $1 million.

Question 2:

Based on current fiscal projections, Treasury expects to increase the size of its 4-week, 6-week, and 8-week bill auctions in the coming days to ensure that our weekly cash needs are met around the end of May. Treasury then expects to modestly reduce the size of its short-term bill auctions in early to mid-June, ahead of the June 15 non-withholding and corporate tax payment dates. Then, throughout July, Treasury expects to return the size of its short-term bill auctions to or near the February and March levels.

Yellen needs to increase the issuance of short-term bills because the market cannot afford her to react at the long end of the interest rate curve. Another benefit of increasing bills is that it will clean up reverse repurchase agreements (RRPs), thereby injecting dollar liquidity into the system.

Question 3:

In the July-September 2024 quarter, the Treasury expects to borrow $847 billion in privately held net market debt, assuming a cash balance of $850 billion at the end of September.

The TGA balance target is $850 billion. The current balance is $941 billion, which is equivalent to a reduction of about $90 billion in the next three months.

The impact of this QRA is a slight positive for USD liquidity. Its not as sensational as a November 2023 announcement that sends bonds, stocks, and crypto prices soaring. But it will slowly help our investments grow in value over time.

First Republic Bank

Did you hear about this tiny, rotten-metal bank? I had never heard of it before it failed. The failure of another too-big-to-fail (TBTF) bank is not noteworthy. What is important is the response of the monetary officials who control the United States.

The U.S. government insures deposits in any bank in the U.S. up to $250,000 (through the FDIC). When a bank fails, uninsured depositors should lose everything. However, in an election year, this is politically unacceptable, especially if those in power have been assuring the public that the banking system is healthy.

Here is an excerpt from the FDIC:

As of January 31, 2024, Republic Bank had total assets of approximately $60 billion and total deposits of approximately $40 billion. The FDIC estimates that the Deposit Insurance Fund (DIF) costs associated with Republic Banks failure will be $667 million. The FDIC has determined that Fulton Banks acquisition of Republic Bank is the least expensive solution to the DIF, an insurance fund created by Congress in 1933 and administered by the FDIC to protect deposits at banks nationwide, compared to other alternatives.

Explaining what happened in vernacular requires reading between the lines.

Fulton agreed to acquire Republic First and ensure that all depositors were fully insured, provided that the FDIC provided some cash. FDIC insurance gave Fulton $667 million so that all Republic First depositors would be fully insured. Why should insurance funds be used for all deposits when some deposits were not insured?

The reason is that if all deposits are not covered, then the banks will collapse. Any large depositor will immediately move their funds to a TBTF bank, which has a full government guarantee on all deposits. Subsequently, thousands of banks across the country will fail. This is not a good look in a democratic republic where elections are held every two years. Once the public knows that the bank failures are entirely due to the policies of the Federal Reserve and the U.S. Treasury, some overpaid idiot will have to find a real job.

Rather than suffer a setback at the election, the person in charge has now essentially guaranteed all deposits in the U.S. banking system. This is actually an implicit increase of $6.7 trillion, because that is the amount of unprotected deposits reported by the Federal Reserve Bank of St. Louis.

This leads to money printing because the FDIC does not have $6.7 trillion in its insurance fund. Maybe they need to ask CZ for advice because the money is not safe. Once the fund is depleted, the FDIC will borrow money from the Fed, which will print money to pay back the loan.

As with the other implicit money printing policies discussed in this article, there has been no massive liquidity injection today. But we can now be fairly confident that trillions of dollars of potential liabilities have been added to the Fed’s balance sheet, which will be financed by money printing.

Buy in May and hold on to your money

Slowly adding billions of dollars of liquidity each month will dampen negative price swings going forward. While I don’t expect cryptocurrencies to immediately fully realize the inflationary nature of recent U.S. monetary policy announcements, I do expect prices to bottom, oscillate, and begin to slowly rise.

As summer arrives in the northern hemisphere, some crypto investors will feel the market is active and they may feel that they have pre-acquired wealth, so they will spend time in some popular places and enjoy life. I certainly won’t always stare at the Bitcoin market. I can go dancing. The recent sharp sell-off provides a great opportunity for me to unlock my USDe and spend synthetic dollars on high-beta shitcoins.

I’m going to buy Solana and the related Dogecoin for momentum trading. For a longer-term altcoin position, I’m going to increase my allocation to Pendle and look for other “discounted” coins. I’m going to use the rest of May to increase my position. Then it’s just a matter of holding onto the coins and waiting for the market to realize the inflationary nature of the recent US monetary policy announcements.

For those who need my predictions, here are the highlights:

1. Did Bitcoin hit a local low of around $58,600 earlier this week? Yes.

2. What is your price prediction? A big surge to over $60,000, then prices fluctuate between $60,000 and $70,000 until August.

3. Are the recent Fed and Treasury policy announcements a form of implicit money printing? Yes.

This article is sourced from the internet: Arthur Hayes: Bitcoin will fluctuate between $60,000 and $70,000 until August

Related: Internet Computer (ICP) Price Hits 23-Month High – Can it Breach $18 Next?

In Brief Internet Computer price hit a 23-month high, crossing $17 today following a 54% rally this week. The network crossed a crucial milestone, validating 3 billion blocks at a rate of 44.87 blocks per second. This rally will likely sustain pushing ICP to $18 since investors are still optimistic. The Internet Computer (ICP) price had a successful run over the past week, breaking through a crucial barrier. But will this growth continue down the line if investors’ bullishness is lost? Internet Computer Reaches New Milestone The Internet Computer price rallied over the last few days as the network inched close to a new achievement. This milestone was reached during the intra-day trading hours on Monday as Internet Computer validated 3 billion blocks. Internet Computer reaches 3 Billion Blocks. Source:…