Original author: Biteye core contributor Fishery

Original editor: Biteye core contributor Crush

In the ever-changing Web3 world of narrative, there is a new way to play every few days, interactions are becoming more and more complex, with more and more steps, and the phishing scams that users face are becoming more and more dangerous.

This situation not only raises the entry barrier for new users, but also makes it challenging for experienced users to keep up with the ever-changing pace.

In this context, the concept of Intent-Centric came into being, making Web3 interactions more user-friendly and secure.

The intention-centric concept allows users to perform complex blockchain operations by defining simple intents without having to worry about the complex technical details behind them.

For example, if a user’s intent involves multiple transactions, the system automatically handles all the relevant steps, such as verification, execution of transactions, and confirmation of results, and the user only needs to submit their intent.

We can compare traditional crypto wallet interactions to DOS command lines, which are obscure and have high barriers to entry. In contrast, dappOS is a Windows system that is familiar with the users intentions.

Just as Windows revolutionized the way people interact with computers, dappOS is committed to changing the way people access and use blockchain applications.

By enabling blockchain infrastructure and applications to efficiently execute user intent in a decentralized manner, dappOS makes executing blockchain tasks as easy as clicking an icon in the Windows system.

Financing Information

DappOS, as a breakthrough Web3 intention execution network, has gained wide market recognition and favor from Web3 capital with its intention-centric design concept.

In March this year, dappOS completed its Series A financing, raising $15.3 million and reaching a valuation of $300 million. This round was led by Polychain.

Polychain is a well-known top-level Web3 USD fund. Bittensor (TAO), Celestia, Eigenlayer, Babylon and other star projects in this bull market are all led by Polychain.

This latest round of financing demonstrates the optimism of leading European and American institutions towards the “intent-centric” track, and also establishes dappOS’s leadership position in the Intent-Centric track.

In addition to Polychain, dappOS also attracted investments from several well-known institutions in its early stages.

-

In November 2022, dappOS was selected into the Binance Labs Season 5 incubation program.

-

In June 2023, dappOS received a Pre-Seed round of financing from Binance Labs, injecting initial capital into its subsequent development.

-

On July 21, 2023, dappOS further consolidated its market position and successfully completed a seed round of financing with a valuation of US$50 million. This round of financing was led by IDG Capital and Sequoia China, and attracted participation from many well-known investment institutions such as OKX Ventures, HashKey Capital, and KuCoin Ventures.

It is not difficult to see from its financing history that dappOS has stood out from a number of Intent-centric projects and won the continued favor of investors.

Through these capital injections, dappOS can not only accelerate its product development and market expansion, but also strengthen its influence in the Web3 ecological project system.

How to connect intent to traditional blockchain?

We all know that the underlying layer of blockchain is made up of cold codes. How to make blockchain execute users’ intentions safely and accurately is the core problem that intent-centric needs to solve.

As the core infrastructure of the intent-centric track, the Intent Execution Network, dappOS provides developers with Intent Task Frameworks to make intents compatible with traditional blockchains, and realizes the conversion of users specific intentions into on-chain execution results.

Currently, dappOS has four intent task frameworks: Unified Account, Intent Assets, Real-time dApp Interaction, and Intelligent Minting.

In the future, the team will launch more task frameworks to support more complex intent execution.

Unified Account

dappOSs unified account system is an intent-based account system that not only allows users to seamlessly manage and use their assets in any decentralized application (dApp) that integrates the dappOS SDK, but also operates across all major blockchains and uses all major tokens to pay fees, greatly simplifying the blockchain experience for users around the world.

In addition, the system enhances asset liquidity and interoperability between different blockchains, providing a concise and efficient fund management and transaction payment platform similar to the experience of traditional financial services while maintaining the core characteristics of blockchain such as transparency and decentralization.

Intent Assets

dappOS’s Intent Asset is an innovative asset that automatically adapts based on usage scenarios and generates interest when inactive.

For example, its stablecoin called intentUSD not only has the circulation function of regular stablecoins, but can also generate interest when idle.

This type of asset can be automatically converted into different forms of stablecoins, such as USDT or USDC, according to the different needs of users in different scenarios, greatly improving the flexibility and adaptability of the asset.

This function can be said to be the Yuebao in the Web3 field, which can generate interest for users while facilitating users to use their assets.

Real-time dApp Interaction

This framework enhances real-time interaction with decentralized applications by supporting contract calls initiated by users contract-based wallets, combined with asset bridging with arbitrary steps and dependencies.

It accommodates most dApp interaction tasks that traditionally need to be performed manually. The framework is already online and is used by popular dApps such as GMX, Benqi, and QuickSwap.

The real-time dApp interaction framework provides instant and flexible interaction capabilities for decentralized applications, which is a huge advantage for applications that require high-frequency updates and instant feedback.

Intelligent Minting

This framework effectively eliminates the need for users to entrust their private keys to third-party robots, highlights user sovereignty, and is an important advancement in security.

The launch of the smart casting framework allows users to directly control the casting process without having to rely on external agents. This approach not only improves the security of operations, but also strengthens users control over their own assets, which plays an important role in protecting user assets and improving trust.

Technology and mechanism innovation

From a technical perspective, the Intent Execution Network dappOS converts intentions of specific value into on-chain results by creating a two-sided market.

On the one hand, Service Nodes pledge collateral to provide various intent execution services.

On the other hand, it provides developers with an infrastructure to efficiently generate intent tasks to meet users needs of converting intent into on-chain results.

The Optimistic Minimum Staking (OMS) mechanism is one of the core innovations of dappOS.

The OMS mechanism requires that the intention task must have a specific value definition, which means that the user receives a predetermined compensation when the task fails.

This not only improves the efficiency of task execution, but also ensures the safety of users funds. If a task fails, the network will cut the collateral of the relevant service providers to ensure that each task is either successfully executed or the user is compensated.

In addition, service providers only need to stake a minimum collateral slightly higher than the total value of the intended tasks in progress. This setting reduces their burden while improving capital efficiency, allowing them to provide verifiable value-specific services, and users can also enjoy a fast service experience.

Free Market Governance is another major innovation of dappOS, which enables marketization of intentions, fair competition, and unleashing potential.

Under this governance model, service providers pledge collateral in an open market to provide execution services, creating a competitive environment, reducing costs and improving service quality.

This governance approach ensures the openness and transparency of the network, and its ability to adapt to user needs, optimizing the efficiency and responsiveness of the network by dynamically allocating resources and tasks.

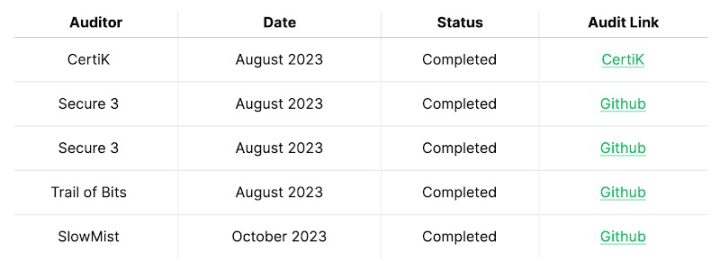

Audit and Security

As a new technology, security is the primary concern of users. DappOS attaches great importance to security, conducts a comprehensive audit process, and designs a structured exit mechanism to maintain the security and reliability of the network and minimize the probability of risks.

dappOS v2 has passed the security audits of top security companies such as Trail of Bits, Certik, Slowmist and Secure 3, and the corresponding audit reports have been made public on dappOS. The audit reports not only demonstrate its security framework, but also create confidence for large capital inflows.

Delayed exit mechanism To further enhance security, dappOS implements a structured exit delay mechanism for service providers and validators in its intention execution network.

All service providers and validators in the network must adhere to the 14-day withdrawal delay. This delay is critical because it takes time to confirm the service providers tasks and responsibilities.

For service providers, this ensures that any specific value tasks they participate in have been fully resolved and are not controversial. Similarly, for validators, the delay ensures that any governance actions or challenge participation have been fully processed and concluded, preventing governance attacks. This mechanism greatly increases the threshold for subjective malicious behavior.

The above security measures reflect dappOSs determination to create a safe, reliable and transparent ecosystem. Through strict auditing and delayed withdrawal mechanisms, dappOS proactively avoids potential security issues, protects users from vulnerabilities, and creates conditions for large funds to enter, ultimately achieving a positive cycle of the ecosystem.

Interaction and participation

The Execution Validator of dappOS uses the PoS mechanism. In the future, project parties will inevitably issue tokens to maintain project security, so dappOS is very worth interacting with.

Many leading projects have integrated dappOS V2, such as GMX. dappOS and GMX have also issued 100,000 ARB to interactive users.

KiloEx has recently integrated dappOS V2. One week after the integration, the daily transaction volume broke a new high, reaching 238 million US dollars. The DAU on the Manta chain increased by more than 3000%, and the transaction volume increased by 217%. The two parties will also jointly issue joint airdrops for interactive users.

In addition to interaction, another important way to participate in dappOS is to become an Execution Validator and contribute to the security of the network.

The role of the validator is to maintain the security and stability of the network by ensuring that service providers complete their tasks accurately and without error.

However, compared to interaction, participating in the execution of validators not only requires users to have certain technical capabilities, but also requires them to spend enough time on maintenance.

If you are interested in becoming an executive validator, you can contact the project team via email.

Summarize

Currently, the intent-centric track is still in the early stages of development. Its main purpose is to liberate the current complex interaction logic of Web3, simplify it, and make it easier for new Web3 users to get started.

If successful, intent-centric infrastructure will also bring about an increase in Web3 traffic and become an indispensable part of the process of new users entering Web3. In the future, it can bring very considerable capital flow and market activity. The narrative is very grand.

If you want to be the first to participate in such a potential track with a grand narrative, you must aim at leading projects with high-quality backgrounds, support from top capital, and the ability to set industry standards.

Judging from dappOS’s luxurious investment lineup and its high-quality cooperation projects, it has most of the conditions to become the leader in the Intent-Centric track.

dappOSs intent-centric infrastructure not only accelerates the popularity of dApps, but also makes blockchain applications easier to be widely accepted and used.

Through the many technological innovations in dappOS v2, complex blockchain functions become within reach, and ordinary users can also enjoy the benefits brought by Web3 technology. This is exactly the vision of dappOS as the Windows in the Web3 field.

DappOS has now become an inevitable target for all projects in the Intent-Centric track, and whether the overall Intent-Centric market can break the circle as expected remains to be seen.

This article is sourced from the internet: dappOS: Building Windows for the Web3 Era

Related: AEVO to Release 827.6 Million Tokens After Successful Airdrop: Price Impact

In Brief The Total Value Locked (TVL) within AEVO is currently positioned at over $14 million. Although it’s reaching 8 digits, this is 44% less than it was in January. Although the number of deposits is growing in the past weeks, the number of withdrawals is growing faster. 837 million AEVO tokens will flood the market in May, which could lead to strong price corrections. Aevo is a decentralized options platform that utilizes an off-chain order book for matching orders while the actual trades are executed and settled on-chain through smart contracts. It received investments from big players like Paradigm, Dragonfly Capital, Coinbase Ventures, and more. Also, AEVO airdrop recently drove a lot of attention to its ecosystem. The AEVO token was recently listed on Binance, and a significant token…