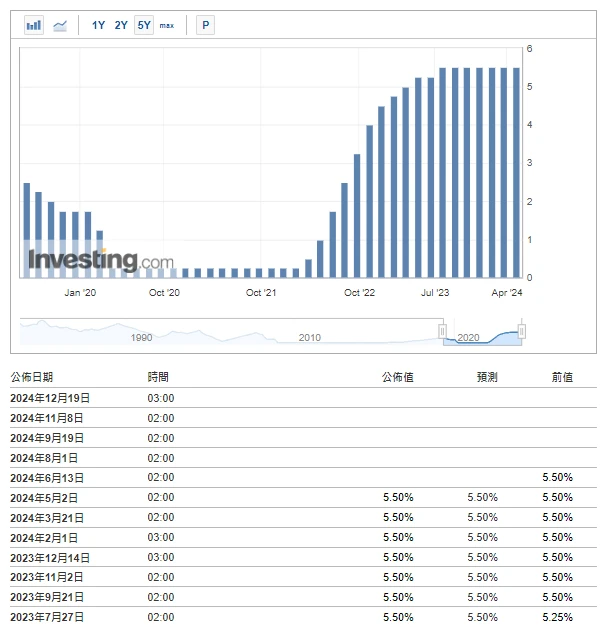

Crypto Market Sentiment Research Report (2024.04.26–05.03): The Federal Reserve rules out future rate hikes

Fed rules out future rate hikes

Data source: https://hk.investing.com/economic-calendar/interest-rate-decision-168

The Federal Reserve ended its two-day interest rate meeting on Wednesday (May 1) and maintained the target range of the federal funds rate at 5.25% to 5.5%, in line with market expectations. Federal Reserve (Fed) Chairman Powell said that the inflation data so far this year has not given Fed officials enough confidence to take interest rate cuts, which may take longer than originally expected, but ruled out the possibility of future interest rate hikes.

The market was very receptive to Powells dovish stance. U.S. Treasury yields fell, U.S. stocks rose sharply, and Bitcoins price stabilized after a short-term surge.

There are about 41 days until the next Fed meeting (June 13, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

Market technical and sentiment environment analysis

Sentiment Analysis Components

Technical indicators

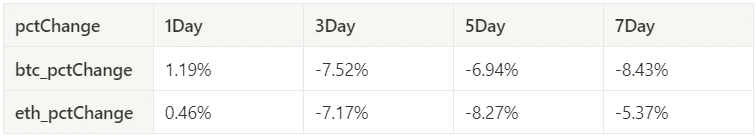

Price trend

BTC price fell -8.43% and ETH price fell -5.37% in the past week.

The above picture is the price chart of BTC in the past week.

The above picture is the price chart of ETH in the past week.

The table shows the price change rate over the past week.

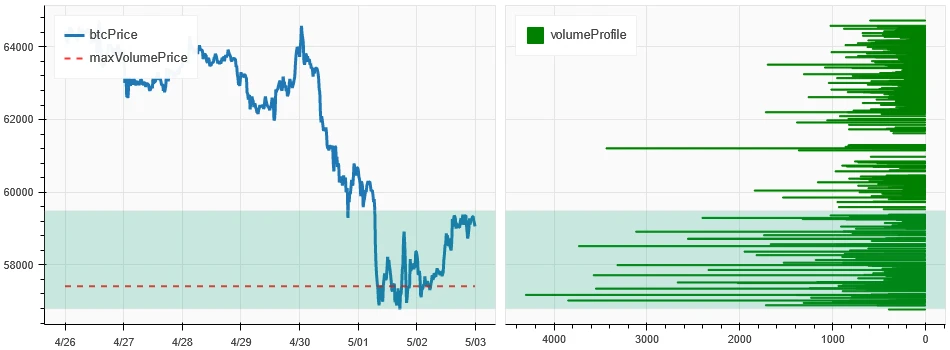

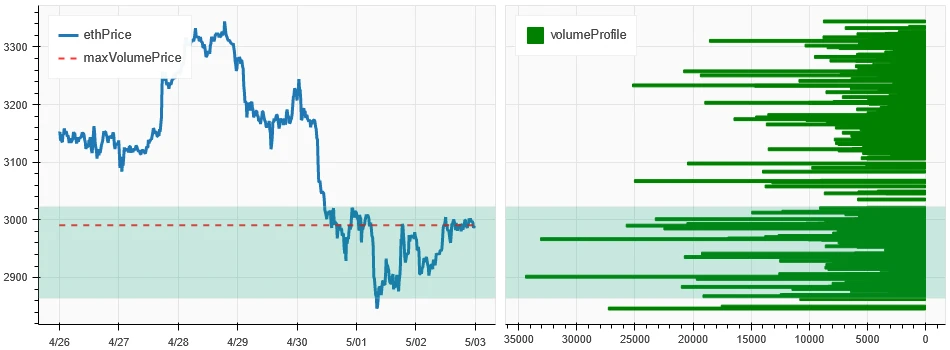

Price Volume Distribution Chart (Support and Resistance)

In the past week, the prices of BTC and ETH fell to low levels and formed a dense trading area.

The above picture shows the distribution of BTCs dense trading areas in the past week.

The above picture shows the distribution of ETHs dense trading areas in the past week.

The table shows the weekly intensive trading range of BTC and ETH in the past week.

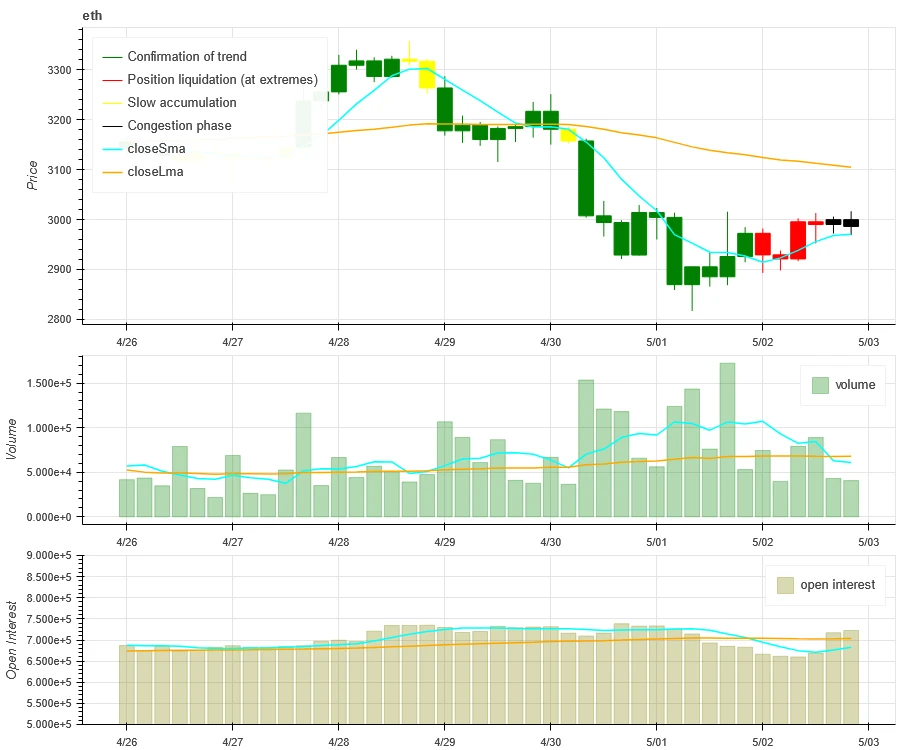

Volume and Open Interest

In the past week, the trading volume of BTC and ETH was the largest at the 5.1 interest rate meeting; the open interest of BTC and ETH both increased slightly.

The top of the above picture shows the price trend of BTC, the middle shows the trading volume, the bottom shows the open interest, the light blue is the 1-day average, and the orange is the 7-day average. The color of the K-line represents the current state, green means the price rise is supported by the trading volume, red means closing positions, yellow means slowly accumulating positions, and black means crowded state.

The top of the above picture shows the price trend of ETH, the middle is the trading volume, the bottom is the open interest, the light blue is the 1-day average, and the orange is the 7-day average. The color of the K-line represents the current state, green means the price rise is supported by the trading volume, red is closing positions, yellow is slowly accumulating positions, and black is crowded.

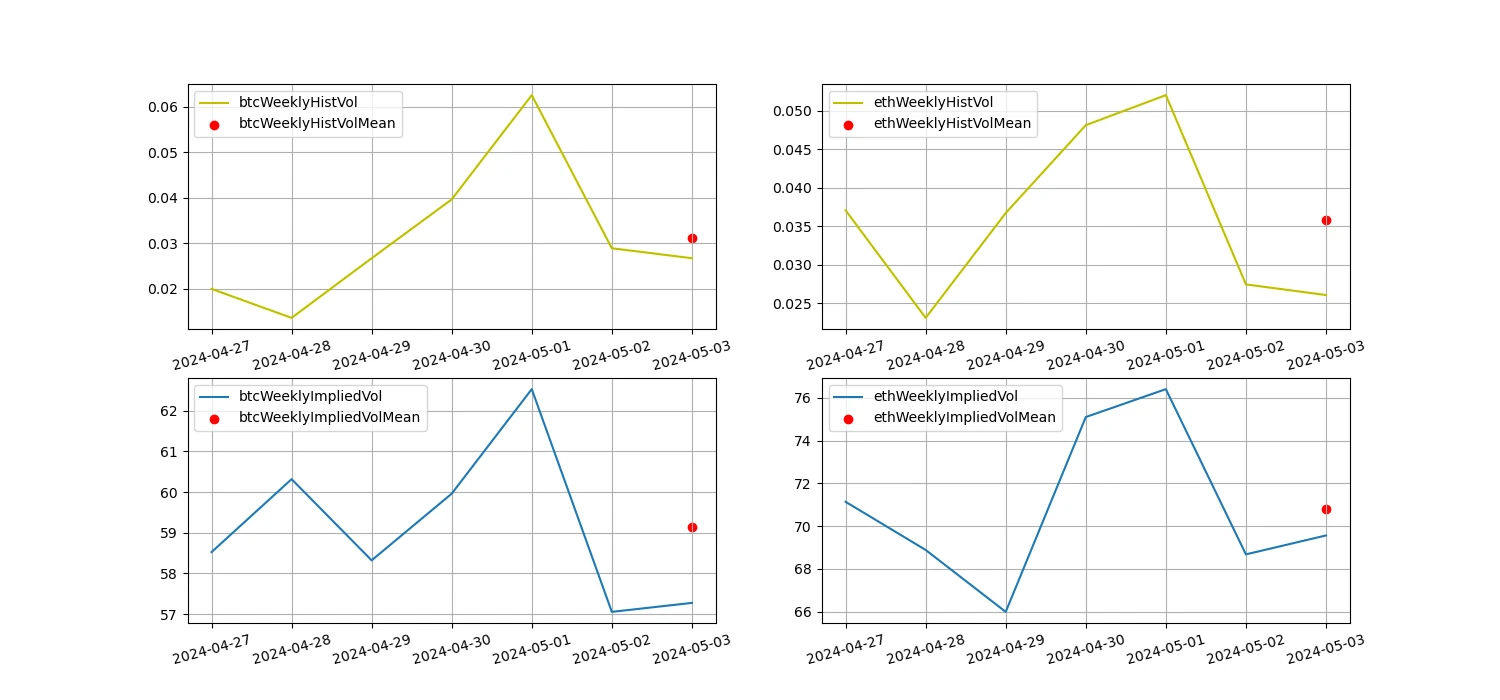

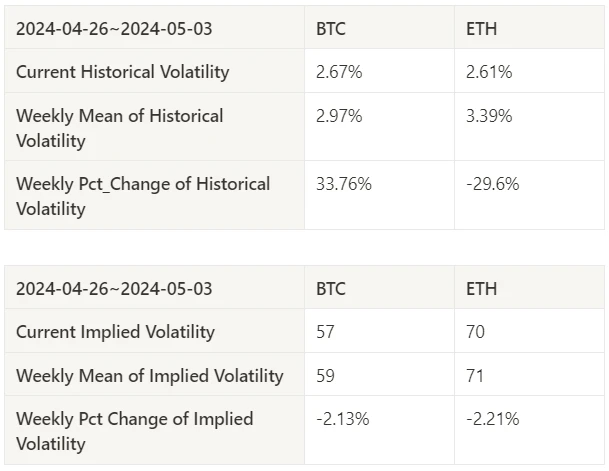

Historical Volatility vs. Implied Volatility

In the past week, the historical volatility of BTC and ETH was the highest after the drop of 4.30; the implied volatility of BTC and ETH decreased.

The yellow line is the historical volatility, the blue line is the implied volatility, and the red dot is its 7-day average.

Event-driven

In terms of events, the Federal Reserves interest rate meeting ruled out the possibility of further interest rate hikes, and Bitcoin rose and fell during the meeting.

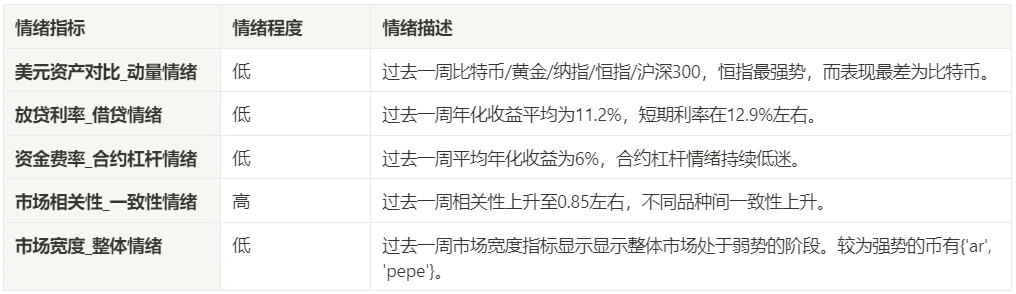

Sentiment Indicators

Momentum Sentiment

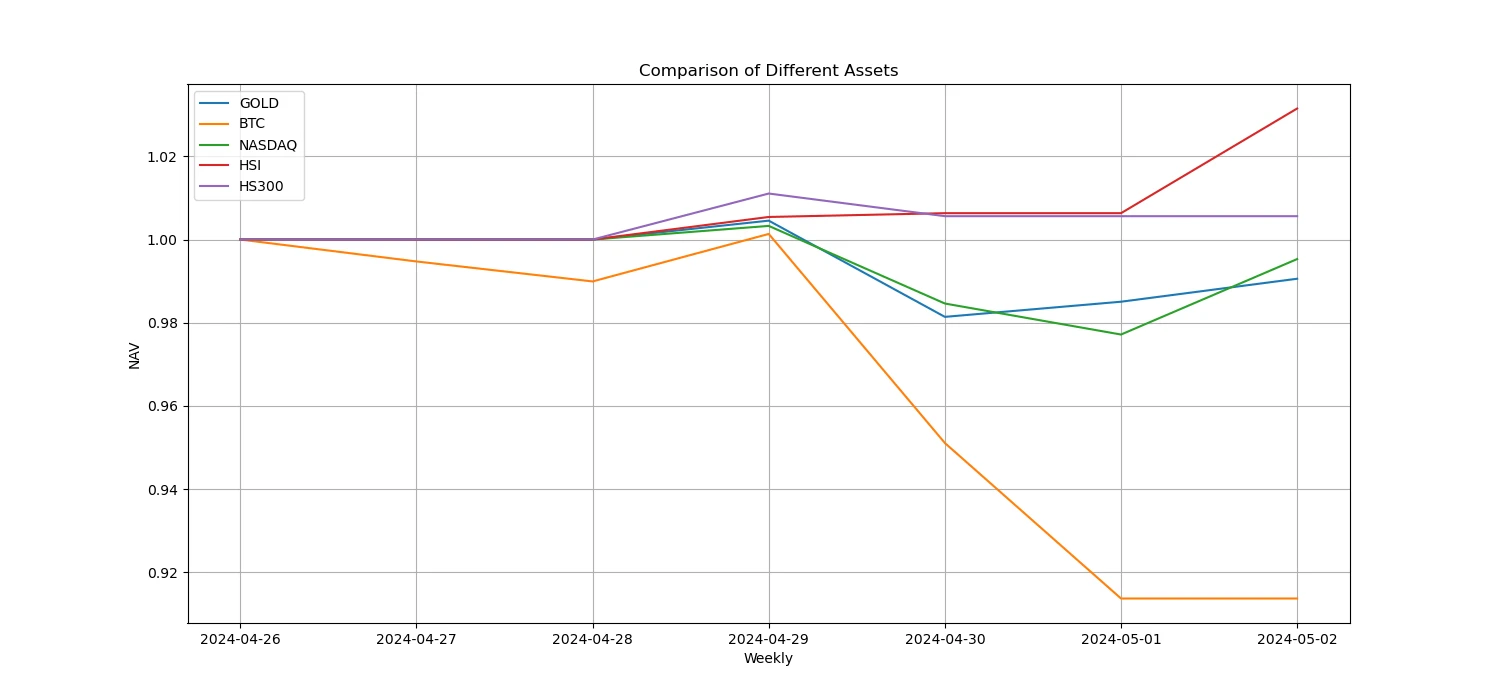

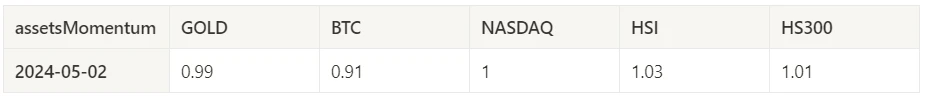

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/CSI 300, Hang Seng Index was the strongest, while Bitcoin performed the worst.

The above picture shows the trend of different assets in the past week.

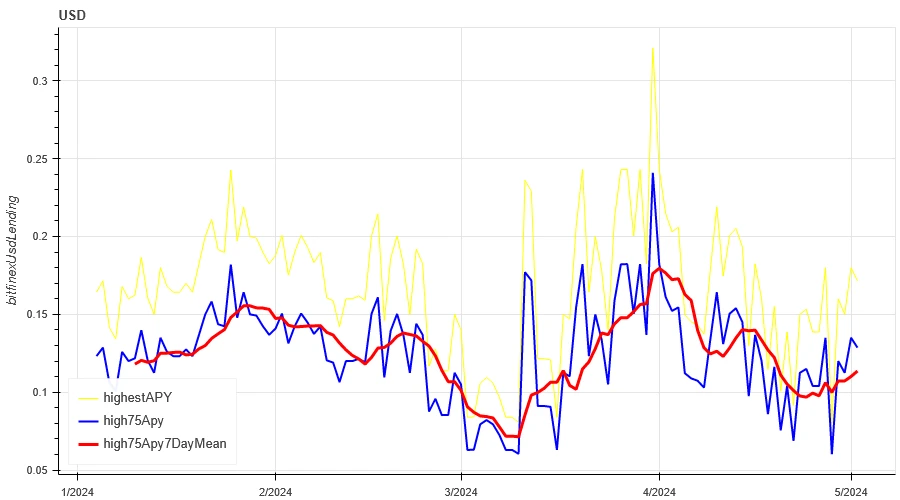

Lending Rate_Lending Sentiment

Over the past week, the average annualized return on USD lending was 11.2%, and short-term interest rates were around 12.9%.

The yellow line is the highest price of USD interest rate, the blue line is 75% of the highest price, and the red line is the 7-day average of 75% of the highest price.

The table shows the average returns of USD interest rates for different holding days in the past

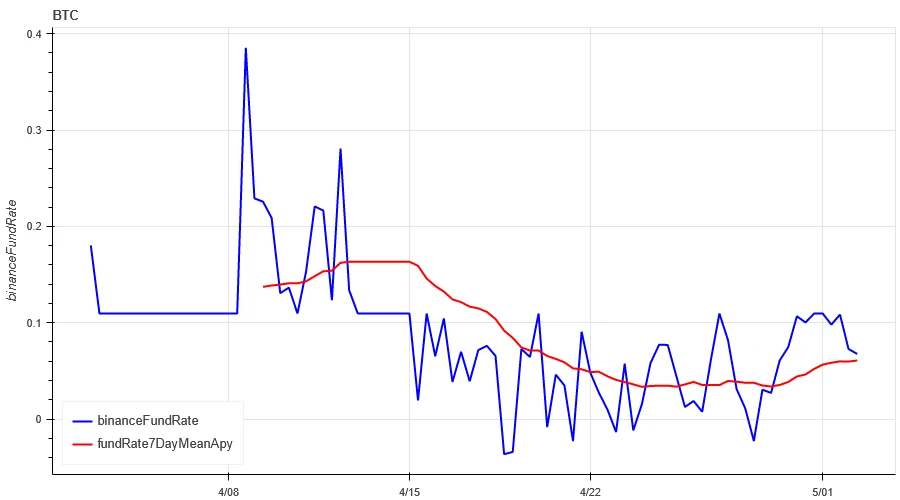

Funding Rate_Contract Leverage Sentiment

The average annualized return on BTC fees in the past week was 6%, and contract leverage sentiment continued to be sluggish.

The blue line is the funding rate of BTC on Binance, and the red line is its 7-day average

The table shows the average return of BTC fees for different holding days in the past.

Market Correlation_Consensus Sentiment

The correlation among the 129 coins selected in the past week rose to around 0.85, and the consistency between different varieties continued to rise.

In the above figure, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

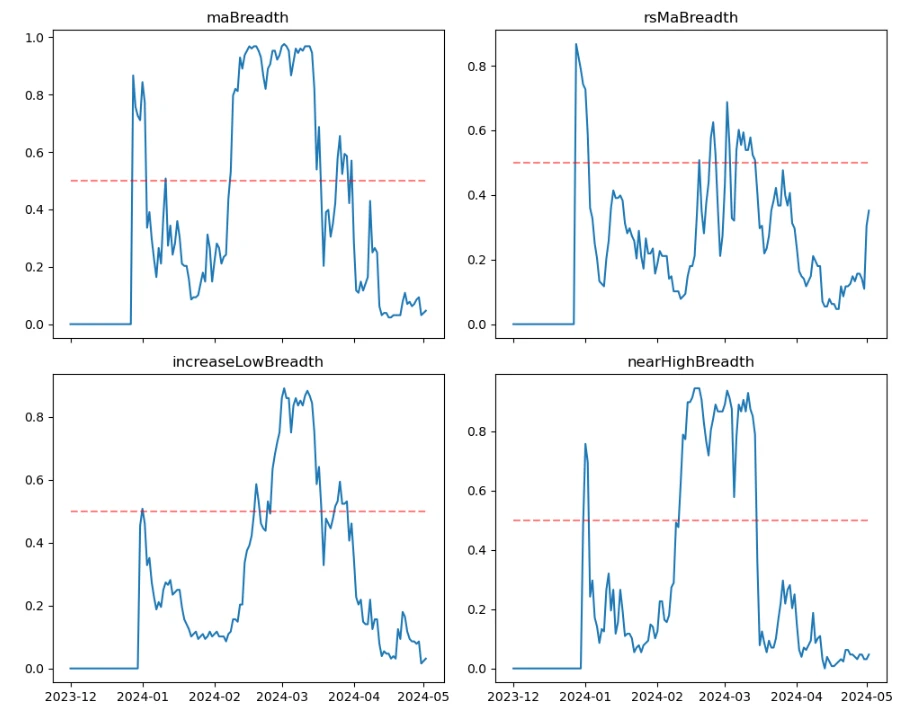

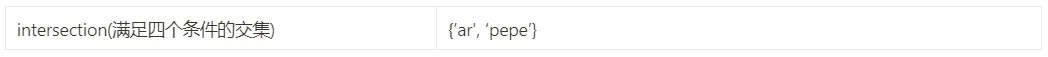

Market Breadth_Overall Sentiment

Among the 129 coins selected in the past week, 4.7% of the coins were priced above the 30-day moving average, 35% of the coins were priced above the 30-day moving average relative to BTC, 3.1% of the coins were more than 20% away from the lowest price in the past 30 days, and 4.7% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that the overall market was in a weak stage.

The above picture is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] 30-day proportion of each width indicator

Summarize

In the past weeks market, the prices of Bitcoin (BTC) and Ethereum (ETH) both fell at 4.30. The historical volatility was the largest when it fell at 4.30, the trading volume was the largest when the Federal Reserve held interest rate meetings, and the open interest increased slightly. The implied volatility of BTC and ETH has dropped compared to the beginning of the week. In addition, the funding rate remains low, indicating that the contract trading sentiment continues to be sluggish. The overall market is still in a weak stage in terms of market breadth indicators. In terms of events, the Federal Reserves interest rate meeting ruled out the possibility of further interest rate hikes, and Bitcoin rose and fell during the meeting.

Twitter: @DerivativesCN

Website: https://dcbot.ai/

Medium: https://medium.com/@DerivativesCN

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.04.26–05.03): The Federal Reserve rules out future rate hikes

Related: A review of Aptos Grant DAO鈥檚 fifth round of funding and community incentive plan

The fifth round of funding for Aptos Grant DAO has been successfully concluded. This round of funding received applications from 403 BUIDL teams around the world, of which 7 teams stood out and received a total of 3,200 APT funding, including 1,200 APT fixed BUIDLer funding and 2,000 APT from the community quadratic matching fund pool. This round of community quadratic voting lasted for one week, during which a total of 874 community members participated in the voting and contributed an additional 182.3 APT community donations. After Anti-Sybil Attack detection, the final funding matching results are displayed on the Grant details page . This grant launched the Community Incentive Fund, providing 60 million GUI and three popular Aptos NFTs as community voting incentives. After anti-sybil attack detection, a total of…