Bonk failed to breach a key resistance trend line, which would have resulted in the meme coin escaping further decline. However, looking at the descending wedge BONK is stuck in, it warrants another drawdown.

This sentiment is also shared by investors who place short bets on the meme coin.

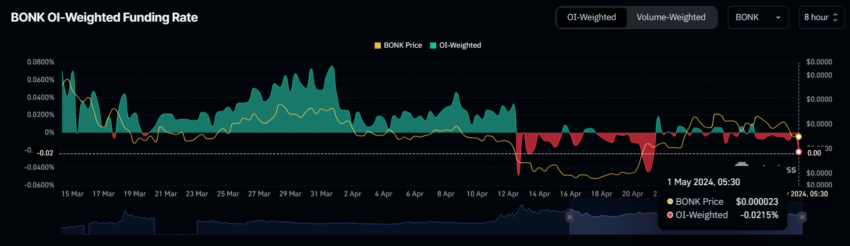

Bonk Funding Rate Dips Again

At the time of writing, Bonk’s price is above an important support line of $0.00002153. This level has been tested multiple times in the past, but this time around, the meme coin could fall below it.

A huge reason behind this possibility is the bearishness being observed among BONK holders. These investors have taken a step back, and at the same time, traders have begun placing short bets in the futures market. This is evident from the funding rate, which dipped to -0.0215%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep the contract’s price aligned with the spot market. Negative rates suggest that put contracts dominate the market, while positive rates hint at a significantly larger presence of call contracts.

In the case of BONK, it is the former that might impact the market.

The broader market cues are not particularly bullish as well; otherwise, the bearishness of the investors could have been countered. The Relative Strength Index (RSI), for instance, is presently below the 50.0 neutral line.

The RSI is a momentum oscillator that measures the speed and change of price movements. It indicates overbought or oversold conditions in an asset. By the looks of it, BONK is not in the overbought zone yet, which is synonymous with recoveries.

Read More: Bonk Airdrop Eligibility: Who Can Claim and How?

BONK Price Prediction: A Dip

BONK price moving within a descending wedge will eventually note a breakout in the upward direction. However, before that happens, another drawdown is the next step.

Indeed, BONK could see a 57% drop to test the lower trend line of the wedge, slipping below the $0.00001000 support in the process.

Read More: 11 Best Solana Meme Coins to Watch in 2024

However, this warrants the BONK’s price to fall through the support lines at $0.00002153 and $0.00001392. A bounce back from either of the two could invalidate the bearish thesis and enable Bonk to initiate recovery.