Huobi Research Institute: Current status and development forecast of DePIN track, the potential profit of entering DePIN

Introduction: DePIN—Current Status and Outlook

The Decentralized Physical Infrastructure Network (DePIN) is reshaping the blockchain space through its innovative use of existing infrastructure and data-centric business model. DePIN goes beyond traditional IoT frameworks and stands out for its decentralized efficiency and cost-effectiveness.

This report explores the rapidly evolving DePIN space, particularly within the Solana network, which is known for its solid infrastructure and innovative applications. The DePIN project prioritizes real profitability over speculative finance and plays a key role in integrating technologies such as privacy enhancement, zero-knowledge proofs, and artificial intelligence. DePIN’s strategic composability with other ecosystems positions it to transform economic systems through data integrity and scalability solutions.

As the leading DePIN platform, Solana embodies the integration of high-performance blockchain technology and physical networks, promising significant economic returns and pioneering new ways to merge technology with real-world applications.

This article was written by the research team of HTX Ventures. HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation and research to identify the best and most promising teams in the world. Currently, HTX Ventures has supported more than 200 projects across multiple blockchain tracks, some of which have been listed on Huobi HTX trading.

in conclusion

-

Although DePIN is called a decentralized physical infrastructure network, its core business growth logic is not the hardware itself, but how to make more effective use of data, whether it is data storage, data transmission, data sharing, or data usage.

-

There is no need for DePIN to compare with traditional IOT, and there is no need to divide it into Web2 or Web3 when thinking about it. As long as it can use data more efficiently and distribute economically more effectively, it is a good thing.

-

The development of DePIN will combine blockchain to solve data credibility issues, and will also launch large-scale protocols along the Internet of Things to create an infinite network between people, people and machines, and machines and machines.

-

When examining DePIN projects, one should abandon speculative or financial attributes, which are more applicable to defi, meme, Brc 20, etc. When examining DePIN, one should focus on the real profitability of the project itself.

-

In the short term, what is worth paying attention to in the DePIN track is its compatibility with other ecosystems, including DePIN x Privacy, DePIN x Gaming, DePIN x ZK, and DePIN x AI. In the long run, Depins future vision includes the gig economy, the sharing economy, and data credibility.

-

The Solana network has become the blockchain of choice for DePIN project deployment, with Solana DePIN representing over $10 billion in FDV and $4 billion in market cap.

-

Solana’s advantages in DePIN development are:

-

Performance advantages plus technology upgrades

-

Strong Token Standards and Ecosystem

-

Cost advantage

-

Liquidity is concentrated, ecological composability is strong, and the community is unified

-

The developer community is active, with innovative projects and new concepts emerging one after another

What is DePIN

Messari formally proposed the concept of DePIN (Decentralized Physical Infrastructure Networks) in its research report The DePIN Sector Map released in early 2023, defining it as the use of crypto-economic protocols to deploy real-world physical infrastructure and hardware networks. In short, DePIN encourages all parties to jointly build a physical infrastructure network through blockchain-based token incentives.

Apart from the evolution of the term, projects that use cryptoeconomic protocols to deploy real-world physical infrastructure and hardware networks have actually existed for a long time. For example, the decentralized network Helium was founded in 2013, and the decentralized storage Storj was founded in 2014. These teams spontaneously explored how to build physical infrastructure networks in a decentralized manner in the fields of communications and storage. Subsequently, the Internet, artificial intelligence, energy, data collection and other fields also gradually joined in. Although the sub-sectors are different, the core logic is consistent, and eventually formed todays prosperous DePIN track.

Overall status of the DePIN track

DePIN section summary

According to Messari and Depin.Ninjia data, the DePIN ecosystem has grown to more than 650 projects in 2023, with a market value of $35 B, covering six sub-industries: computing (250), artificial intelligence (200), wireless (100), sensors (50), energy (50) and services (25). Messari predicts that the total potential market size of the DePIN sector is about $2.2 trillion, and may reach $3.5 trillion by 2028.

According to CMC data, there are 60 DePIN projects that have issued coins, with a market value of 1.33 billion US dollars. The top 100 DePIN projects in terms of market value are FIL, RNDR, HNT, THETA, BTT, AKT and AR. The top projects in other tracks include IOTX, ANKR, and AI-related projects such as TAO. Judging from the top 10 projects in the DePIN field, most of them belong to the fields of AI, Storage and Computing. DePIN currently occupies a very small share of the entire Crypto market, which is lower than Meme, Defi, NFT and other sectors. Compared with the traditional Internet of Things industry, there are 21 projects with a market value of over 100 million, and only 4 projects with a market value of over 1 billion.

If we extrapolate based on this data, then in the short and medium term, the potential profit expectation of entering DePIN is about 243 times, while the medium and long term profit expectation is more than 400 times.

Depin project segment breakdown

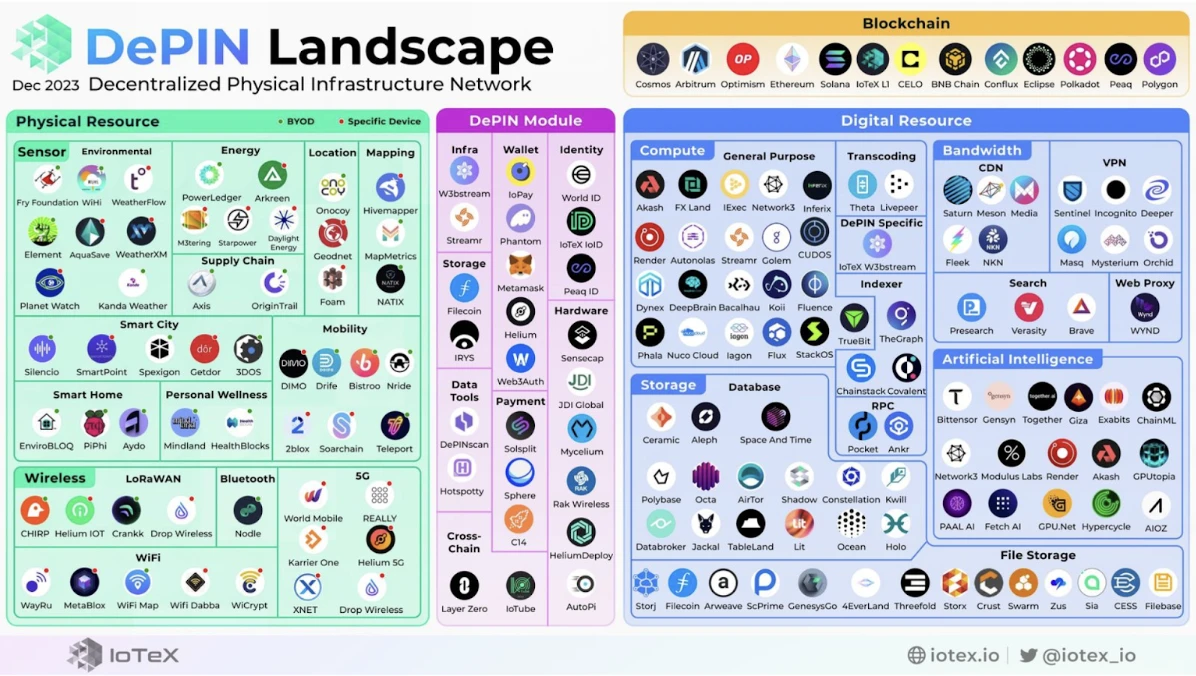

The reference here is the IOTEX plate disassembly method, which is divided into two parts: software and hardware.

The hardware part consists of two major sections: sensors and wireless networks; the software part consists of four sections: computing, storage, network distribution, and artificial intelligence.

Although the DePIN project is called a decentralized physical infrastructure network, all of its core business logic revolves around how to extract value from data.

-

Sensors – responsible for data collection

-

Wireless network and network distribution – responsible for data transmission

-

Computing section – responsible for data calculation

-

Storage section – responsible for data storage

-

Artificial Intelligence – Responsible for Data Application

Therefore, the DePIN project itself starts with hardware, but the real development lies in how to make good use of data, which is exactly the same as the development model of the traditional Internet economy.

When evaluating the prospects of a Depin project, we must think from the perspective of data. Whoever uses the data well and whoever masters the data has a good project.

We need to put aside the speculative part of Crypto and return to the practical value part.

DePIN Investors

As mentioned earlier, there have always been investment institutions and entrepreneurs in the DePIN track, but the market environment in early 2023 was not suitable, and the new paradigm of DePIN was still being explored, so few new DePIN projects were launched. By the end of 2023, whether it was the improvement of the market environment or the exploration and accumulation of entrepreneurs, many projects gradually took shape from the initial concept, and then began to be launched in the market. The subsequent actions were captured by the market. At this time, DePIN quickly occupied an important position in the market with weak technological innovation.

For example, VCs such as Multicoin, Borderless, A16Z, and HTX Ventures have invested heavily in DePIN, and the projects they invest in are all highly applied and weakly speculative. Of course, compared to their own portfolios, DePIN projects only account for a small part.

The following figure supplements the financing situation of the top DePIN projects.

Top DePINs by Capital Raised

Solana DePIN Ecosystem Research

Solana Network has become the preferred blockchain for DePIN project deployment

-

Solana DePIN represents over $10 billion in FDV and $4 billion in market cap.

According to CMC, the top 500 Solana DePIN projects by market value include Render Network (RNDR), Helium Network (HNT), and Helium Mobile (MOBILE); the remaining DePINs include Helium IOT (IOT), Hivemapper (HONEY), etc. Recently, the hottest projects in this field include Solana-related HNT series such as MOBILE and IOT, plus getgrass, a bandwidth network market project that may soon issue a coin.

-

The DePIN track and the Solana network are the result of mutual selection.

The irreplaceable nature of Mass Adaption, especially DePIN and Web2 applications. Solana successfully supported the demand for STEPN, and this is also a project that really made Web3 stand out.

Solana’s cNFTs provide more cost-effective authorization certificates for DePIN/PoPW nodes, which is a common practice.

The migration of RNDR and Helium projects has given the projects themselves stronger capabilities. For example, this transition has brought new capabilities to Render, including real-time streaming, dynamic NFTs, and state compression, which significantly improved the performance and scalability of the network, while opening up richer and more diverse application scenarios for users.

Projects like DePIN are different from high-value DeFi applications. They are closer to traditional IoT (Internet of Things) concepts such as edge computing, and they value stability and low prices. Solana naturally has an advantage in synchronization speed. Taking the currently popular Helium as an example, the number of IoTs has reached more than 300,000, and there are more than 3,000 5G devices. Only Solana can meet the deployment of a large amount of hardware.

-

DePIN brings high value to the Solana ecosystem

Projects like Helium have significantly increased the number of active wallets. Helium alone reports over 60,000 active wallets per month engaging in activities such as claiming rewards, staking, delegating, or burning tokens, while over 30,000 other wallets use other SPL programs, highlighting the impact Helium has on the Solana ecosystem.

From a regulatory perspective, DePIN demonstrates Solana’s real-world application in the eyes of regulators and policymakers, enhancing its legitimacy and brand recognition.

Solana network advantages are more obvious

-

Performance advantages plus technology upgrades

Including high throughput, the official claims that Solana can process about 65,000 transactions per second, and 2500-3000 in daily operation. Other performance includes fast transaction confirmation, scalability, and block size. After the future Firedancer upgrade, the theoretical TPS can reach 1 million+, and the daily TPS is estimated to reach 100,000+, which is also the main factor for Visa and DePIN to choose Solana.

-

Strong Token Standards and Ecosystem

A vibrant ecosystem with well-tested DEXs and established standards such as cNFTs (compressed NFTs), pNFTs (programmable NFTs), Token Extensions, etc., provides DePIN projects with the essential components to develop and launch their on-chain products.

-

Cost advantage

Even after the Cancun upgrade, Solana is still a Layer 1 with a lower gas fee. In the head L2, the DA layer has switched to Ethereum mainnet Blob, including ZK Rollups ZkSync and Starknet, and Optimism and Base of the Optimistic Rollup. The gas fees of the four L2s have dropped by an order of magnitude, but they have not switched to Celestia, and the fees have not been reduced to the lowest.

-

Liquidity is concentrated, ecological composability is strong, and the community is unified

Ethereum and its Layer 2 are highly ideological and compete for liquidity. This is particularly prominent in this round of bull market. There is little difference in technology and ecology, and the wealth creation effect is not significant. General L2 is no match for competing chains such as Solana.

Driven by the recent strong momentum of meme coins, the Solana defi ecosystem has also exploded, with TVL reaching $3.3 billion. This also means that there will be stronger income products and speculative products on Solana, and with the addition of RWA, AI, and DePIN projects, the composability of defi products will be stronger.

-

The developer community is active, with innovative projects and new concepts emerging one after another

Through hackathons and various incentives, Solana has cultivated an active developer community, which has provided impetus for the development of its ecosystem. Subsequently, top projects such as Magic Eden, Stepn, and jito emerged. Even during the bear market, Solana still maintained its developer ecosystem and community activities. Through continuous incentives and hackathons, Solana continued to improve its infrastructure and stimulate the development of more innovative applications, further promoting the prosperity of the ecosystem.

-

The wealth-creating effect is the best marketing tool

Sagas huge airdrop leads to a new way of playing with crypto phones and drives the unification of the Solana ecosystem community, including Solend, Helius, Chads and Solcial, which have announced airdrops, benefits and gifts for owners of Saga 2. BOME, a meme coin in the recent bull market, has also achieved the miracle of listing on Binance in 3 days.

Ecological development

The Solana DePIN project is summarized in the following table:

Solana DePIN Ecosystem Summary:

Leading projects: RNDR, Helium

-

RNDR, a decentralized rendering platform.

-

Helium Network is a wireless network project. It has been developing since 2014 and has raised more than $350M in financing. Investors include a16z, Deutsche Telekom, Google, Tiger Global and other well-known funds in and outside the industry. Helium migrated to the Solana blockchain in April this year. HNT is currently ranked 64th on CMC.

Second-tier projects: Helium series (MOBILE and IOT), io.net , Nosana

-

MOBILE and IOT are projects within the Helium ecosystem.

-

IOT: This is the protocol token of the Helium IoT network, mined by LoRaWAN Hotspots through data transfer revenue and proof of coverage.

-

MOBILE: This is the protocol token of the Helium 5G network, rewarded to those who provide 5G wireless coverage and Helium network verification. MOBILE is currently ranked 166 on CMC.

-

io.net , by integrating GPU networks from data centers, crypto miners, and established projects like Render, uses computing power for machine learning applications, positioning itself as a GPU aggregator. It has not yet issued a coin, and currently has 426k Twitter followers. The total amount of Series A financing reached US$30 million, led by Hack VC, and participated by Multicoin Capital, 6th Man Ventures, M 13, Delphi Digital, Solana Labs, Aptos Labs, etc. At present, the number of GUP miners has reached more than 50,000.

-

Nosana, a marketplace connecting user-provided GPU networks with consumers aiming to develop AI products.

Potential projects: ALEPH, HONEY, Shadow

-

ALEPH, storage solution, cross-chain database.

-

Hivemapper (HONEY) was launched in November 2022. It is a decentralized global map network that rewards contributors who collect a large amount of 4K street images using dashcams through the Drive-to-Earn model. In April 22, it completed a $18 million financing, led by Multicoin Capital, and participated by industry figures such as Solana founder, former Apple Maps executive, and Helium CEO. Currently CMC ranks 513.

-

Shadow, a competitor to Filecoin, uses high-performance traditional and mobile computing to reduce the cost of enterprise-level data center storage – calling this technology DAGGER.

DePIN future development forecast

-

The DePIN track has high infrastructure requirements and needs to meet high throughput requirements, so the DePIN project will choose to be built on the higher-performance Layer 1, or even on Layer 2 or Layer 3.

-

More project possibilities, such as clean energy infrastructure and virtual power plants: Project Daylight and Etheos

-

DePIN projects are transitioning to large platforms, such as Helium and Render, so that smaller DePIN projects can leverage them for development

-

DePIN dedicated chain, we have seen two EVM/substrate chains specifically for DePIN, such as Peaq and IoTex. In addition, one of the blue-chip DePIN projects, Dimo, is also using Polygon CDK to build their chain, showing the demand for application chains.

-

DePIN is composable with other ecosystems. This is particularly evident on Solana, such as the wealth-creating effect of Bonks airdrop on Saga. In the future, there will be more combinations of Depin and defi to increase returns and speculation, and the combination of Depin and RWA to provide solutions for project financing or provide data in the real world.

For example,

-DePIN x ZK,

As technology continues to develop, technologies such as ZK TLS can effectively prove the authenticity of Web2 or Web3 data and open up the path from Web2 data to Web3. DePIN combined with ZK technology will spawn a large number of Web3 projects that can launch vampire attacks on Web2 projects. We should keep an eye on this.

For example, Space and Time is a verifiable computing layer that can extend zero-knowledge proofs on decentralized data warehouses to provide trustless data processing for smart contracts, LLMs, and enterprises. Space and Time connects indexed blockchain data from the chain with off-chain data sets, and uses Proof of SQL to ensure tamper-proof large-scale computing and prove that query results have not been manipulated.

Proof of SQL is a new ZK-proof developed by Space and Time that allows data warehouses to generate SNARK cryptographic proofs of SQL query execution, proving that the query calculation was completed accurately and that both the query and the data are verifiably tamper-proof.

Developers can use projects to connect indexed on-chain data and off-chain data, use SQL to transform data to perform low-latency cache queries and large-scale analytical jobs, transform and shape data into patterns specific to your business, publish queries to APIs and build dashboards. At the same time, zero-knowledge technology can ensure that tamper-proof query results are sent to smart contracts or published directly on the chain in a trustless manner.

Currently, Space and Time has established indexes for Ethereum, Polygon, Sui, Sei and Avalanche, and is constantly supporting more chains. It has also been connected to Chainlink.

-DePIN x AI,

The development of decentralized physical infrastructure networks could fundamentally change how data is used, such as decentralized machine learning, with Bittensor being an example.

Bittensor is an open source protocol that powers a decentralized, blockchain-based machine learning network. Machine learning models are trained collaboratively in TAO and are rewarded based on the value of the information they provide to the collective. TAO also allows external access, allowing users to extract information from the network while adjusting network activity to their own needs.

-DePIN x Privacy,

It has been emphasized before that although DePIN is a decentralized physical network, its core is centered around the use of data. If in a large-scale decentralized network, protecting the privacy of data will inevitably become a very important issue. Therefore, if DePIN is destined to develop, privacy protection is absolutely unavoidable. Therefore, we must pay attention to the direction of combining DePIN with privacy.

-DePIN x Gaming

The combination of DePIN and games can be understood from several aspects.

Large-scale decentralized hardware networks are likely to bring better gaming experiences to some extent.

The concept of wearable reality devices + games + metaverse may become popular again

Through DePIN hardware facilities, it is possible to change the incentive mechanism and gaming experience of the game itself

References

https://www.panewslab.com/zh_hk/articledetails/8vy12wz3Ft.html

https://mp.weixin.qq.com/s/DE28WI5hE7OE5s2D-TFLxw

https://foresightnews.pro/article/detail/53218

https://depin.ninja/leader-board

https://depinhub.io/rankings/investors

About HTX Ventures

This article was written by the research team of HTX Ventures. HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation and research to identify the best and most promising teams in the world. As a pioneer in the blockchain industry for ten years, HTX Ventures promotes the development of cutting-edge technologies and emerging business models in the industry, and provides full support for cooperative projects, including financing, resources and strategic consulting, to build a long-term blockchain ecosystem. At present, HTX Ventures has supported more than 200 projects across multiple blockchain tracks, some of which have been listed on Huobi HTX trading. At the same time, HTX Ventures is one of the most active fund-of-funds (FOF) investors, working with global top blockchain funds such as Bankless, IVC, Shima, Animoca, etc. to jointly build a blockchain ecosystem.

This article is sourced from the internet: Huobi Research Institute: Current status and development forecast of DePIN track, the potential profit of entering DePIN in the medium and long term is expected to exceed 400 times

Related: Altcoin Season Begins in 45 Days, Prominent Analyst Reveals

In Brief Altcoin season may start in about 45 days, following Bitcoin’s surge, with potential for high returns. Investors advised to diversify and be patient for significant gains, especially in early altcoin season stages. Key cryptos to watch include Polyhedra Network, Wolf Wif Ballz, Portal, Boson Protocol, and VoluMint. As the horizon brightens with the anticipation of another altcoin season, investors are on the lookout for the next big cryptocurrency. With a diverse range of tokens gaining traction, the market is ripe with opportunities for those willing to dive into the depths of blockchain technology and its myriad applications. 45 Days Until Altcoin Season According to renowned analyst Rekt Fencer, altcoin season might be around the corner. This optimistic outlook suggests it is now the time to select the right…