Dissecting Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve What ETH Can’t

Original author: TechFlow

After much anticipation, Eigenlayer finally released more details of its token economy today and announced that it will allocate 15% of EIGEN tokens to users who previously participated in re-staking through linear unlocking.

Does the EIGEN token have more value? What is its specific use? What impact can it have on re-staking and even the entire Ethereum ecosystem?

The answers are all in this 40+ page token economics white paper released by Eigenlayer.

Unlike most projects that simply sketch out a few token release diagrams when introducing the token economy, Eigenlayer spent a lot of time and effort to explain the role of the EIGEN token and its relationship with the ETH token in a detailed, meticulous, and even somewhat technically geeky way.

The DeepChao research team has read through this white paper and organized the key technical points into easy-to-understand text to help you quickly understand the role and value of EIGEN.

Quick Facts

EIGEN token’s functions and problems to be solved

-

Universality and Restaking

Traditional blockchain tokens are usually only used for specific tasks, such as ETH is mainly used for Ethereum block verification. This limits the scope and flexibility of the token.

The re-staking mechanism allows users to use their already staked ETH assets for multiple tasks and services without having to unlock or transfer these assets.

-

Intersubjectively Verifiable

The white paper uses the word Intersubjectively, which is very difficult to convert into Chinese, to describe some complex network tasks: they are often difficult to verify through simple automated procedures and require subjective consensus among human observers.

EIGEN tokens act as a medium of social consensus in these tasks. In scenarios where different opinions need to be verified, EIGEN can be used as a voting tool, and token holders can influence network decisions through voting.

-

Forking Tokens and Slashing

Disagreements on certain issues or decisions may arise in the network, and a mechanism is needed to resolve these disagreements and maintain the consistency of the network.

If there is a major disagreement, the EIGEN token may undergo a fork, creating two independent token versions, each representing a different decision path. Token holders need to choose which version to support, and the unselected version may lose value.

If network participants fail to perform staking tasks correctly or behave improperly, EIGEN staked tokens may be slashed as a punishment for their bad behavior.

The relationship between EIGEN and ETH

-

Complement rather than replace: EIGEN tokens are not intended to replace ETH, but to provide a supplement based on the existence of ETH.

ETH is mainly used for staking and network security as a general purpose work token. ETH staking supports the reduction of objective faults (for example, verification nodes will be punished if they verify incorrectly)

EIGEN staking supports inter-subjective fault reduction (errors that cannot be verified on the chain, such as the price given to you by the oracle is wrong), thereby greatly expanding the range of digital tasks that the blockchain can safely provide to users.

EIGEN token: Provides a new social consensus mechanism to deal with subjective errors that ETH cannot handle

If you want to know what the EIGEN token does, you must first know what the ETH token does.

Before the concept of Eigenlayer and re-staking, ETH can be seen as a work token with a specific purpose. In laymans terms:

ETH tokens are used to maintain the security of the network and generate new blocks, perform tasks related to the maintenance of the Ethereum blockchain, and cannot be used for anything else.

In this case, ETH is characterized by:

-

Has a very specific work purpose;

-

It has extremely strong objectivity. For example, if there is a double signature error on the Ethereum chain or an error in the Rollup aggregation, you can judge it through pre-written objective rules on the chain, and then fine the validator a certain amount of ETH.

With Eigenlayer, ETH is actually transformed into a general purpose work token. In laymans terms:

You can use ETH to pledge for various tasks, such as new consensus mechanisms, Rollups, bridges or MEV management solutions, etc. It is no longer limited to the pledge of Ethereums own chain. This is also an important function of Eigenlayer.

However, in this case, although the usage scenario has changed, ETH still has the following characteristics:

-

“Objective” limitations still exist, as slashing and forfeiture actions can only be applied to objectively verifiable tasks on the Ethereum chain.

But you have to know that not all errors in the crypto world can be attributed to the chain, and not all disputes can be resolved by the consensus algorithm on the chain.

Sometimes, these non-objective, difficult to verify, and controversial errors and problems significantly affect the security of the blockchain itself.

For example, the oracle quotes 1 BTC = 1 USD. This data is wrong from the source, and you cannot identify it with any objective contract code or consensus algorithm on the chain; and if something goes wrong, it will be useless to confiscate the validator’s ETH. To put it bluntly:

You cannot use an objective solution on the chain to sanction a subjective error off the chain.

What is the price of an asset, is a data source available, is an AI interface program running correctly… These issues cannot be agreed upon and resolved on-chain. Instead, they require more of a social consensus to arrive at answers through subjective discussion and judgment.

Eigenlayer calls this class of problems intersubjectively attributable faults: a set of faults for which there is broad consensus among all reasonably active observers of the system.

Therefore, the EIGEN token has its place – providing a new social consensus mechanism in addition to ETH to maintain network integrity and security. It specifically solves this kind of subjective failure.

Specific approach: EIGEN staking, token fork

ETH is still a work token for general purposes, but EIGEN will be a general inter-subjective work token to complement each other.

If the validator stakes ETH, some objective failures may occur, and the staked ETH may be slashed and confiscated;

Similarly, you can stake EIGEN. When some subjective failures (which cannot be directly judged on the chain and require subjective judgment and processing) occur, the staked EIGEN can be cut and confiscated.

Lets take a specific scenario and see how EIGEN works.

Suppose there is a decentralized reputation system based on Eigenlayer, where users can rate service providers on the platform. Each service provider will stake EIGEN tokens to indicate their reputation.

Before this system starts, there are 2 necessary stages:

-

Setup phase: Coordination rules between system stakeholders are encoded to give rules for how subjective disputes should be resolved;

-

Implementation phase: The pre-agreed rules are enforced in an unspoken manner, preferably locally.

In this system, users can self-enforce the conditions they have agreed to in advance.

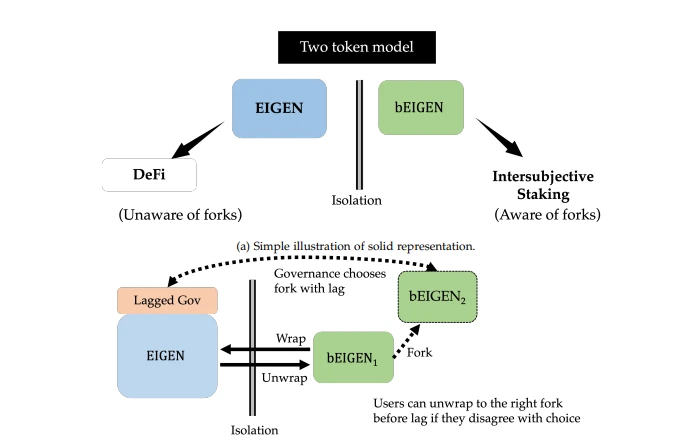

Then, if the service provider is deemed to have provided false services or misled users, the platform’s community consensus mechanism may trigger a challenge, resulting in a token fork event, which will then become two versions of the EIGEN token – EIGEN and bEIGEN.

Now, users and AVS are free to decide which to respect and value. If there is a widespread belief that the slashed stakeholder has behaved inappropriately, then users and AVS will only value the forked token, not the original token;

Then, the original EIGEN tokens of malicious pledgers will be cut and confiscated through this fork.

So this is equivalent to a social consensus arbitration system to resolve disputes that cannot be objectively handled on the ETH chain.

It is also worth mentioning that for users and other stakeholders, you don’t have to worry about the impact of this “fork” at all.

Generally speaking, after a token forks, you must make a choice about it in general, which also affects the use of your token in other places.

But EIGEN creates an isolation barrier between CeFi/DeFi use cases and EIGEN staking use cases. Even if bEIGEN is affected by an inter-subject fork dispute, any EIGEN holder who uses it for non-staking applications does not have to worry because it can redeem the fork of bEIGEN at any time in the future.

Through this fork isolation mechanism, Eigenlayer not only improves the efficiency and fairness of handling disputes, but also protects the interests of users who are not involved in the disputes, thereby ensuring the overall stability of the network and the security of user assets while providing powerful functions.

Summarize

It can be seen that EIGENs inter-subject pledge and dispute resolution mechanism supplements the subjective disputes and failures that ETH as an on-chain pledge mechanism cannot handle, unlocks a large number of previously impossible AVS on Ethereum, and has strong crypto-economic security.

This could open the door to innovation in: oracles, data availability layers, databases, AI systems, gaming virtual machines, intent and order matching and MEV engines, prediction markets, and more.

However, judging from the roadmap given in its white paper, the current use cases of EIGEN are still in a very preliminary startup stage, more like the concept has been fully developed but is far from being actually implemented.

As users can officially receive EIGEN tokens after May 10, let us wait and see whether the use value envisioned by EIGEN can effectively carry the changes in the token market price.

This article is sourced from the internet: Dissecting Eigenlayer Token Economics: A New Social Consensus Mechanism to Solve What ETH Can’t

Related: Bitcoin’s Q1 Surge: ETFs Spark Boom, but Euphoria Signals Caution Ahead

In Brief Bitcoin sees 69% Q1 rise, sparked by new ETFs and halving anticipation. Warning signs as euphoria peaks; history suggests market pullbacks. LTHs’ MVRV ratio signals nearing peak; profit-taking likely soon. As Q2 2024 unfurls, Bitcoin continues to dominate headlines, boasting a staggering 69% price increase in the first quarter alone. This surge, primarily fueled by the debut of spot Bitcoin Exchange-Traded Funds (ETFs) and the anticipation for Bitcoin halving, underlines a transformative phase for the crypto market. However, Bitcoin’s rally has caused an increase in euphoria, signaling potential market caution. Generally, there are pullbacks or market reversals after the euphoric stage. What Are Warning Signs From Bitcoin’s Q1 2024 Performance According to the “Q2 2024, Guide to Crypto Markets” report by Coinbase Institutional and Glassnode, there are some…