2024Q1 Crypto Industry Report: CEX spot trading volume hits a new high since Q4 2021

Original author: CoinGecko

Original translation: 1912212.eth, Foresight News

Following a strong performance in the fourth quarter of 2023, the total cryptocurrency market capitalization continued to rise by 64.5% in the first quarter of 2024, reaching a high of $2.9 trillion on March 13.

In absolute terms, this quarter鈥檚 growth (+$1.1 trillion) was almost double that of the previous quarter (+$0.61 trillion), largely due to the approval of a US spot Bitcoin ETF in early January, which pushed BTC to a record high in March.

Key Highlights

-

Bitcoin grew by +68.8% in Q1 2024, reaching an all-time high of $73,098;

-

As of April 2, the assets under management (AUM) held by U.S. spot Bitcoin ETFs exceeded $55.1 billion;

-

Ethereum re-staking on EigenLayer reached 4.3 million ETH, a quarterly increase of 36%;

-

Solana memecoins surged in Q1 2024, with the top 10 market cap increasing by $8.032 billion;

-

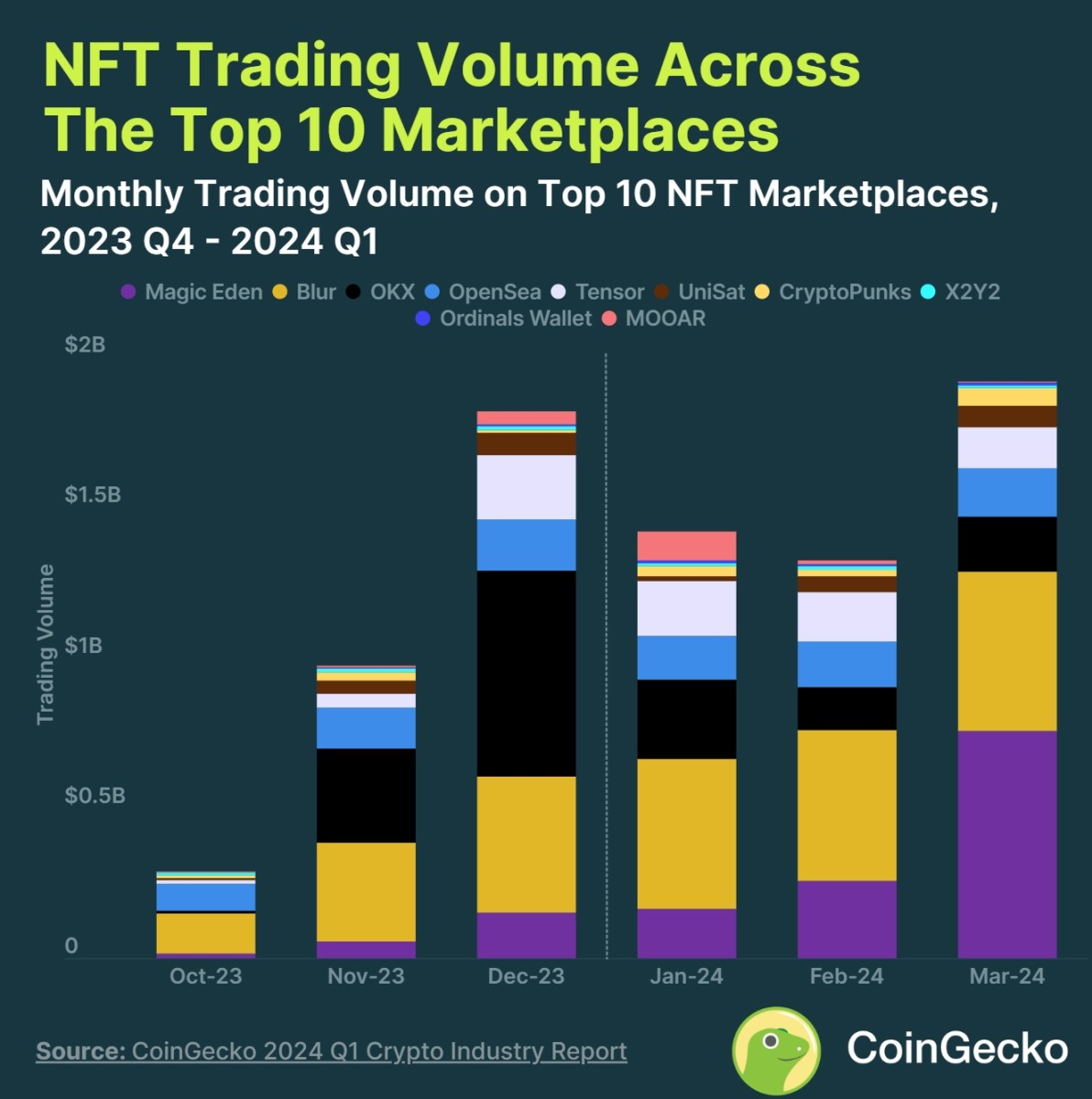

In the first quarter of 2024, NFT trading volume in the top ten markets was $4.7 billion, and Magic Eden currently leads in market share;

-

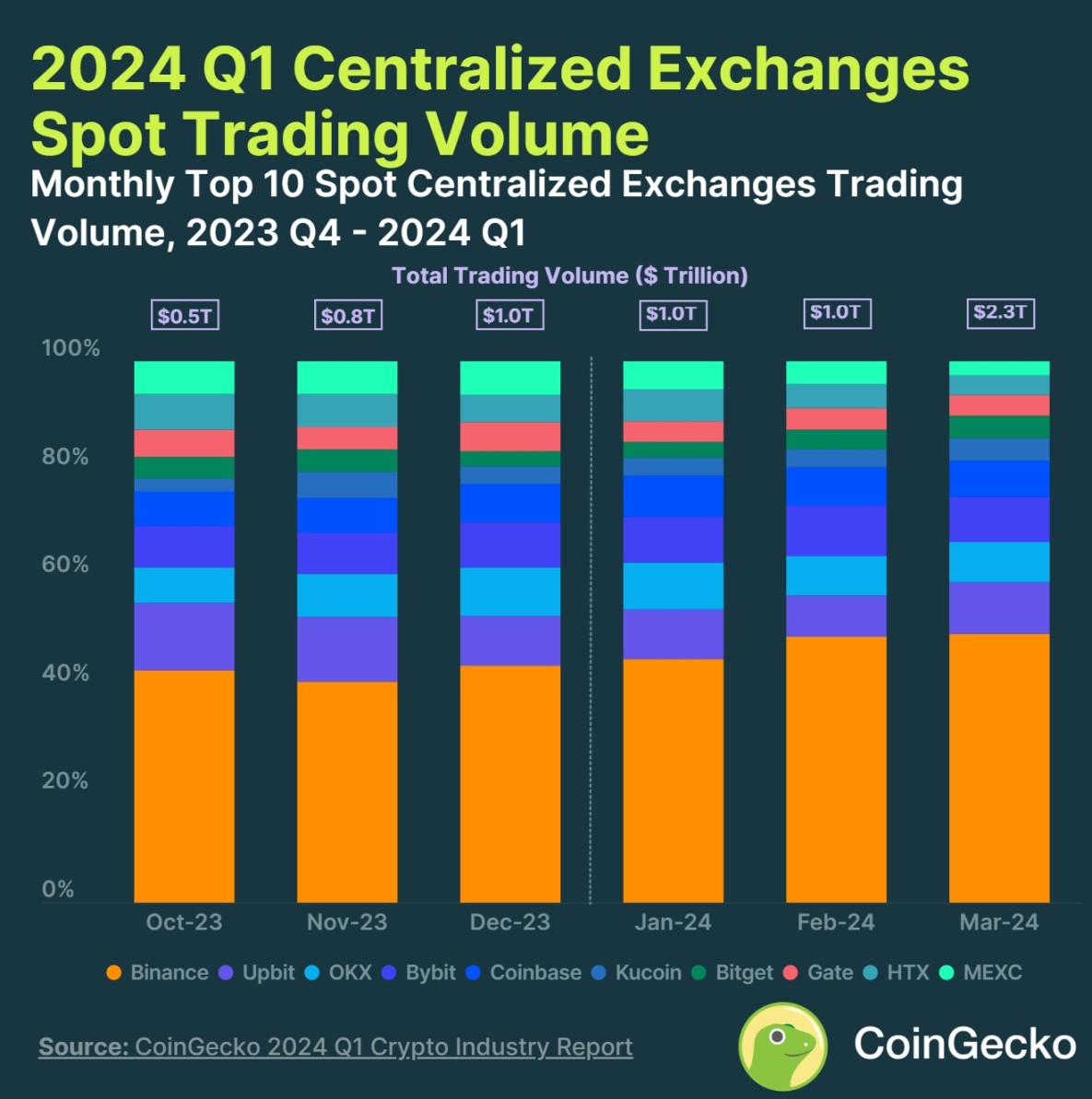

In the first quarter of 2024, CEX spot trading volume reached $4.29 trillion, the highest since the fourth quarter of 2021;

-

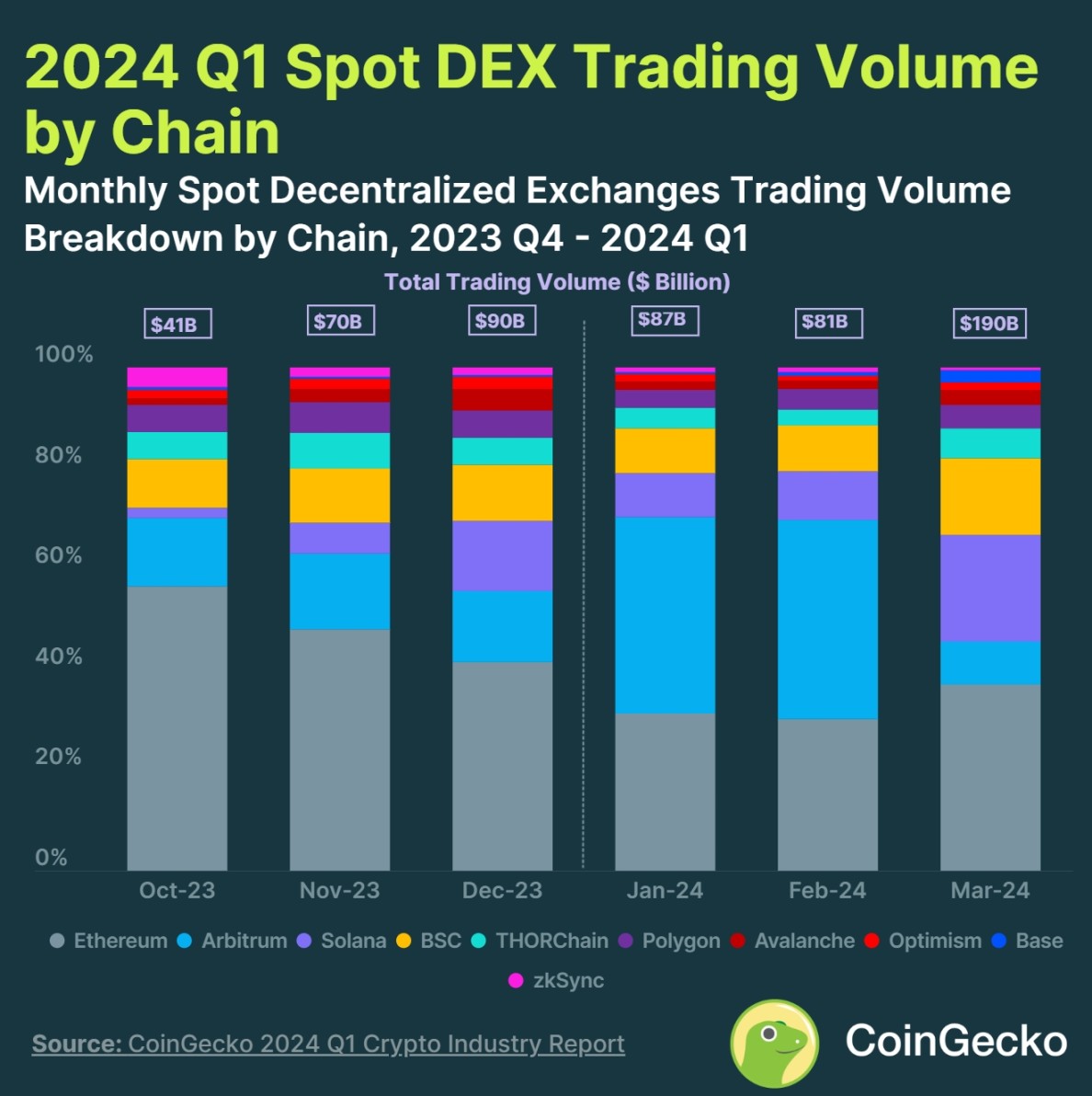

Ethereum鈥檚 share of DEX volume fell below 40% as other chains gained more attention.

Bitcoin grew 68.8% in the first quarter of 2024, hitting an all-time high of $73,098

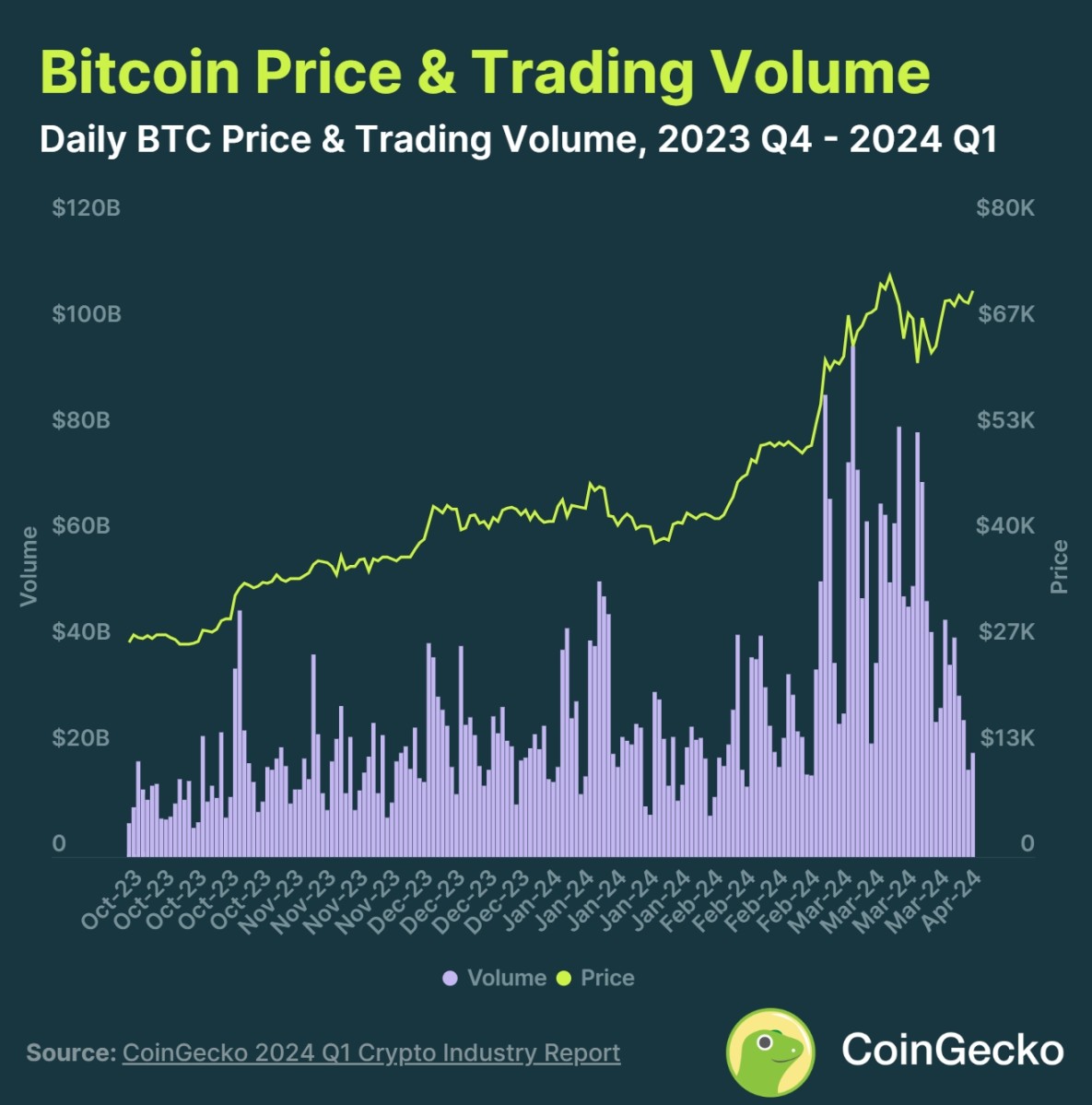

Bitcoin continued to rise in Q1 2024, gaining 68.8% during the period. Immediately after the US spot Bitcoin ETF was approved, BTC saw a 16.0% pullback to a quarterly low of $39,505. However, it then rose +85.0% to a new all-time high of $73,098. It has since retreated 18.0% to close the quarter at $71,247.

As for trading volume, it climbed to an average of $34.1 billion per day in the first quarter of 2024. This is an increase of 89.8% from $18 billion in the fourth quarter of 2023.

Bitcoin ETFs Manage Assets Over $55.1 Billion

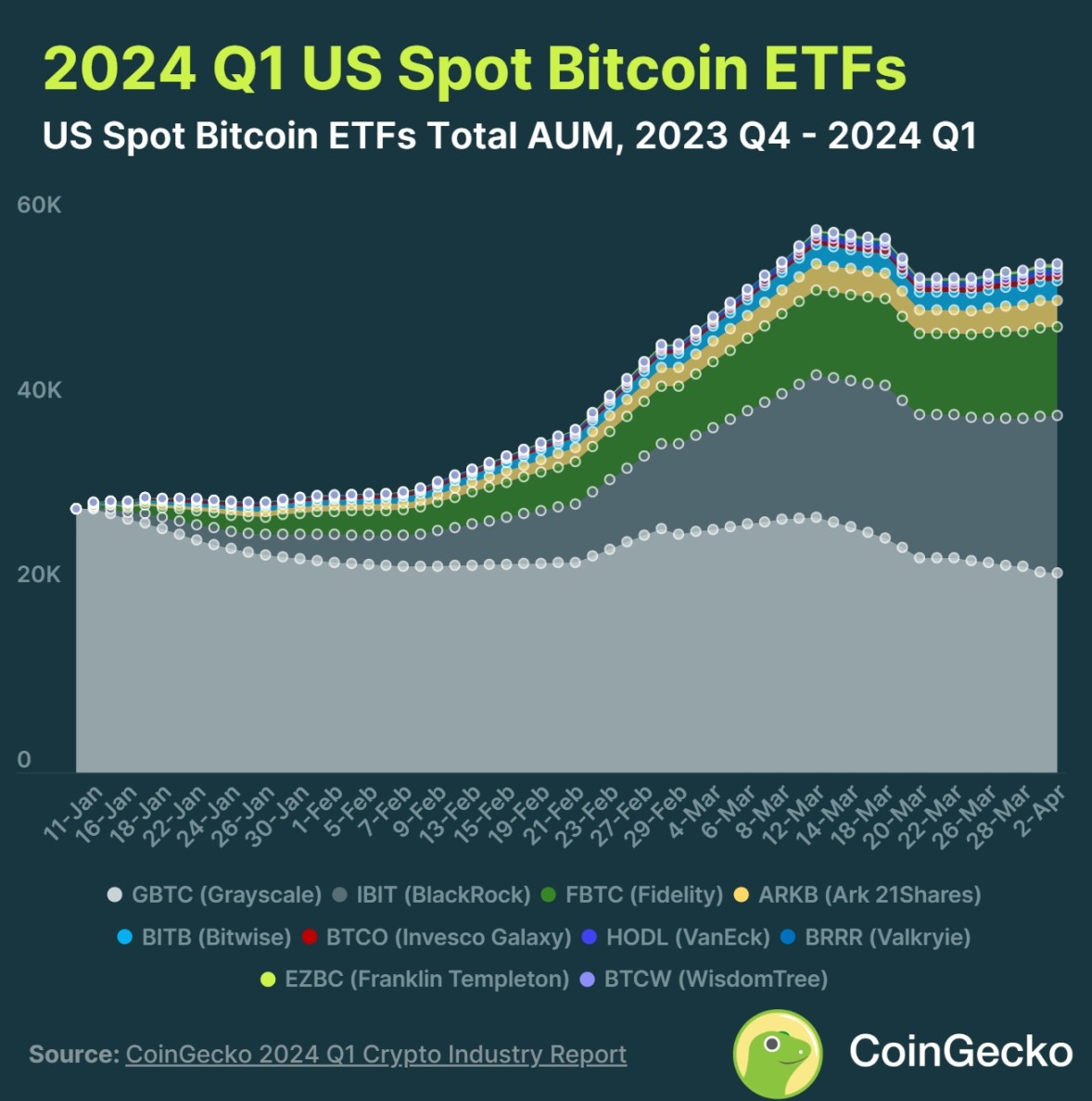

As of April 2, 2024, US spot Bitcoin ETFs hold more than $55.1 billion. This happened after the US SEC approved spot BTC ETF trading on January 10.

BlackRock鈥檚 IBIT ETF has accumulated over $17 billion in BTC and has cemented itself as the second-largest BTC ETF. In the first quarter of 2024, it also had the most trading volume among its competitors.

Meanwhile, Grayscale鈥檚 converted GBTC ETF had $21.7 billion in AUM as of April 2. The company experienced $6.9 billion in net outflows due to profit-taking by early investors and its high fees compared to competitors. Still, it was the largest BTC ETF in the first quarter.

The number of Ethereum re-staked on EigenLayer reached 4.3 million, a quarterly increase of 36%

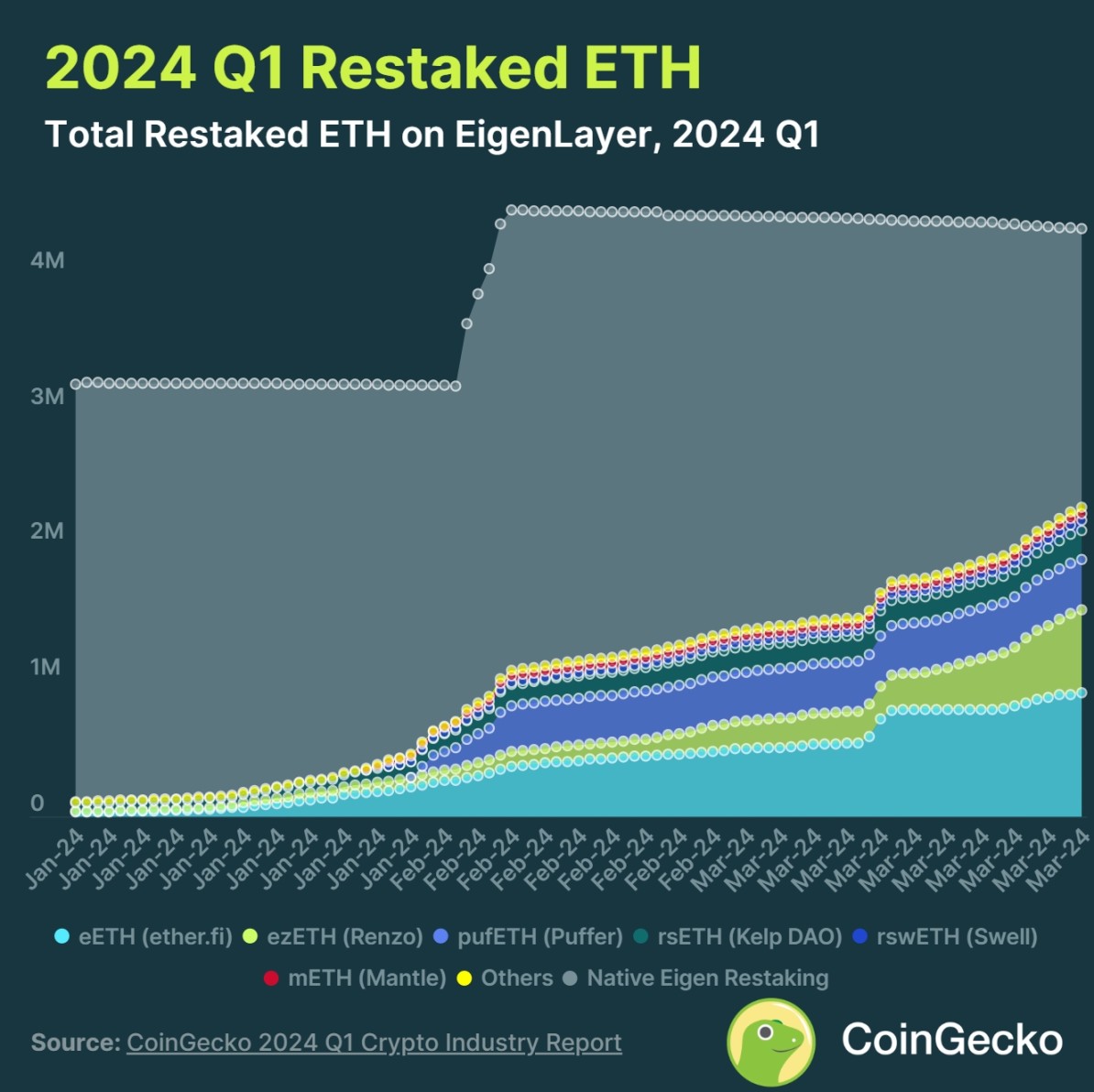

Ethereum re-staking activity on EigenLayer began to pick up in Q1 2024, with the total amount of re-staked ETH increasing by 36% to 4.3 million.

Most of the re-staked ETH (52.6%) is held by the Liquid Re-stacking Protocol (LRT), totaling 2.28 million ETH. EtherFi has a 21.0% market share. It grew 2,616% throughout the quarter and held 910,000 ETH as of the end of March.

Solana Memecoins Surge in Q1 2024, Top 10 Market Cap Increases by $8.32 Billion

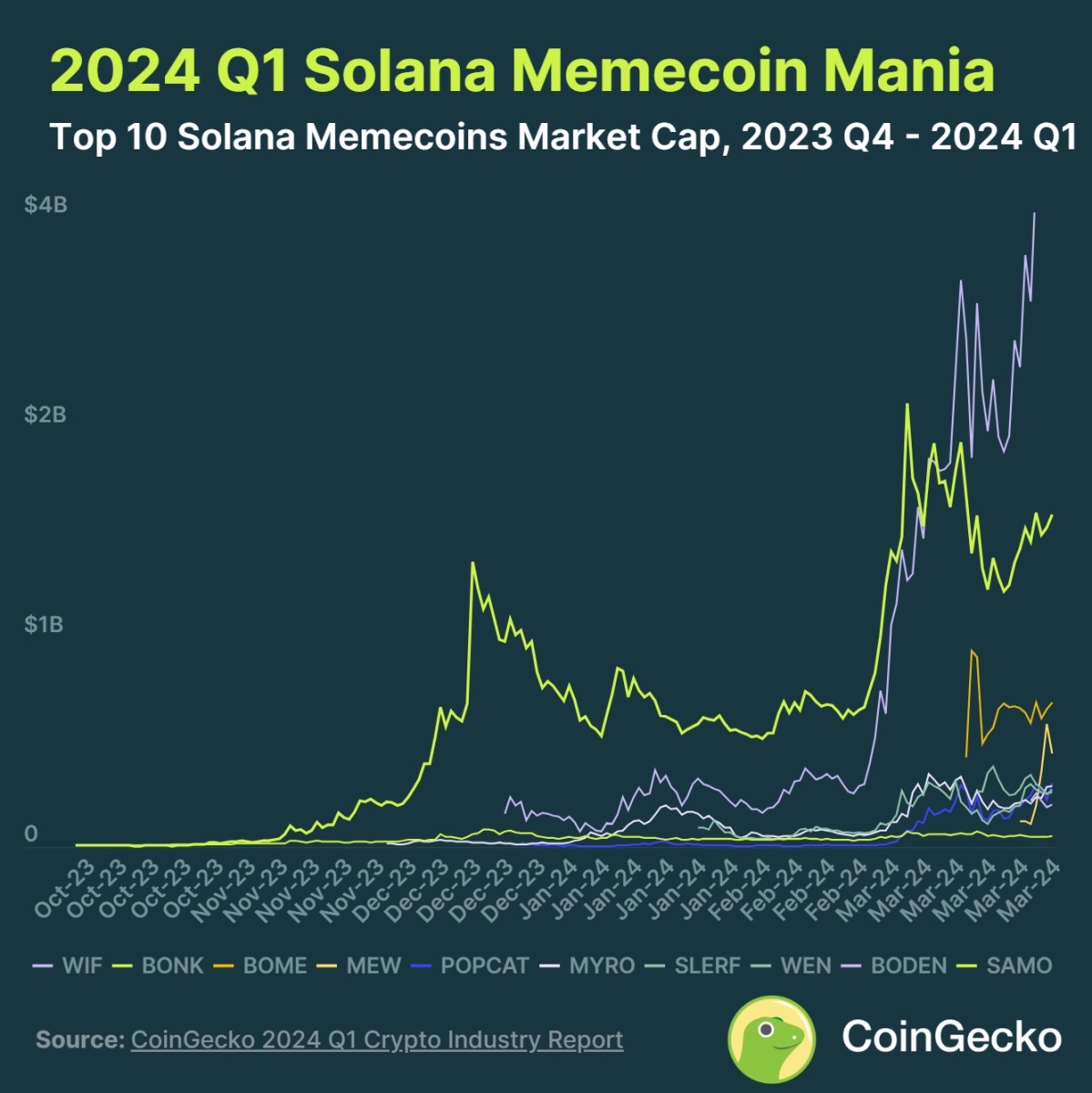

The top 10 Solana (SOL) memecoin grew by 801.5%, or $8.32 billion, in the first quarter of 2024. Their combined market cap was $9.36 billion at the end of the quarter.

Of the top 10 Solana memecoins, only Bonk and Samoyedcoin exist until Q4 2023. BONK was Solana鈥檚 top memecoin since its launch in December 2022, but was surpassed by Dogwifhat (WIF) in early March. WIF launched in November 2023. Meanwhile, Book Of Memes launched on March 14 and reached a market cap of $1 billion within two days.

The top 10 NFT markets generated $4.7 billion in trading volume in the first quarter of 2024

In the first quarter of 2024, the top ten NFT markets had a trading volume of $4.7 billion. Blur remained the leading NFT trading market platform in the first quarter, with a trading volume of more than $1.5 billion. Its market share was 27.6% during the same period, up from 24.9% in the fourth quarter of 2023. At the same time, Magic Eden successfully surpassed Blur in terms of trading volume in March, with a trading volume of more than $760 million, thanks to the launch of the Diamond Rewards Program and cooperation with Yuga Labs.

CEX spot trading volume reached $4.29 trillion in the first quarter of 2024, the highest since the fourth quarter of 2021

In the first quarter of 2024, the top 10 CEX spot trading volume reached 4.29 trillion US dollars. This means a quarter-on-quarter increase of 95.3%. This is the highest quarterly trading volume record for the top ten spot CEXs since December 2021.

As of March 2024, Binance remains the largest CEX with a market share of 50% and has slowly regained its dominance throughout the quarter. The exchange has seen a significant increase in new listings and project launches during the same period. Meanwhile, MEXC, known for offering a variety of small-cap tokens, has seen its market share shrink as traders focus on major tokens such as BTC, ETH, and SOL.

Ethereum鈥檚 share of DEX volume falls below 40%, as other chains gain more attention

In the first quarter of 2024, Ethereum鈥檚 share of DEX trading volume fell below 40%. In February 2024, the market share hit an all-time low of just 30%. However, despite the decline in market share, March 2024 still saw a record $70 billion in trading volume, driven by a surge in trading activity across the market.

On Arbitrum, DEX trading volume boomed in January and February 2024, driven by the STIP incentive program. Its trading volume even exceeded Ethereum during the same period. However, as soon as the incentives ended in March, trading volume plummeted, with a market share of 8% at the end of the month.

Other chains such as Solana and Base also experienced active seasons, with memecoin contributing a huge amount of transaction volume.

This article is sourced from the internet: 2024Q1 Crypto Industry Report: CEX spot trading volume hits a new high since Q4 2021

Related: Dogecoin (DOGE) Could See a Massive Price Surge

In Brief A crypto analyst identifies a buy signal on Dogecoin, suggesting an upcoming price surge. Dogecoin shows strong recent performance, with a modest 1.14% rise from its weekly open. Current trends hint that Dogecoin’s recent peak price may climb higher, offering big gains. Cryptocurrency enthusiasts are poised for potential gains as Dogecoin (DOGE), the popular meme-inspired token, flashes signs of an imminent price surge. Prominent crypto analyst Ali Martinez has pointed to a critical development in Dogecoin’s trading patterns that investors should watch closely. Dogecoin’s (DOGE) Next Big Price Jump Martinez highlights that the Tom DeMark (TD) Sequential, a respected technical indicator among traders, has issued a buy signal on Dogecoin’s daily chart. This indicator, known for predicting trend reversals, suggests that DOGE’s current downtrend may be tapering off,…