Bitcoin’s (BTC) price has been making mild moves despite the halving that occurred towards the end of April. Thus, institutional investors have moved to accumulate altcoins in the meanwhile to capitalize on the potential bull run that the crypto market could witness once BTC rises.

BeInCrypto has analyzed three tokens that have been noted to be of the most interest to these large wallet holders.

Cardano (ADA) Whales Add More ADA to Their Holdings

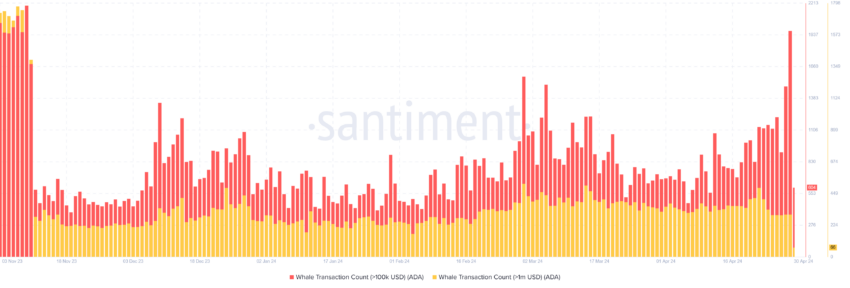

Cardano has been noting increasing accumulation at the hands of the whales since November 2023. This buying streak noted a sudden uptick in the last few days as transactions worth more than $100,000, typically associated with crypto whale transactions, shot up.

While this has not translated to a bullish outcome for price action, Cardano’s price could certainly benefit from the increased interest from whales. Although these large wallet holders make up less than 10% of the circulating supply, their contribution to the daily volume is paramount.

Thus, crypto whales leaning towards ADA could prove to be a boon for the altcoin.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

Toncoin (TON) Joins the Top Crypto Assets

Toncoin recently entered the top ten list and surpassed the likes of Shiba Inu and Cardano to become the ninth-biggest cryptocurrency in the world. The reason behind this rally was the disclosure in March that Telegram was looking into a potential initial public offering (IPO).

As a result, whales jumped in to capitalize on any possible rally by accumulating TON. This can be noted in the surge in transactions valued at more than $100,000 and transactions worth more than $1 million.

In the past two months, Toncoin’s price observed a 238% rally from $2.14 to $7.24 at its highest point. The altcoin, however, has since declined to trade at $5.35 as the market has been cooling down since the recent rally.

Read More: What Are Telegram Bot Coins?

Arbitrum (ARB) Whales Aim at Profits

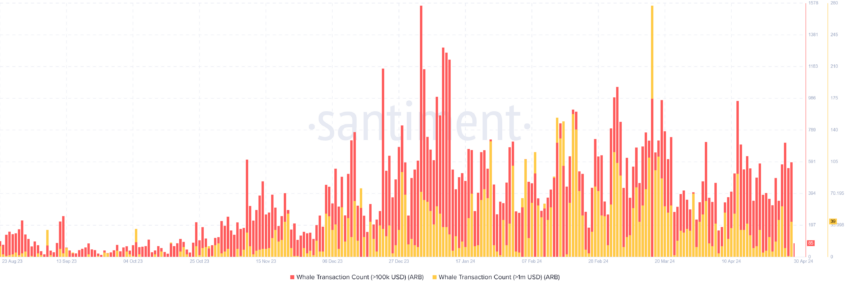

Despite Arbitrum’s price observing corrections for nearly two months now, the large wallet holders have been loading up on ARB. While this could be an attempt at preventing further decline in price, crypto whales seem to be looking at the right opportunity to sell.

The anticipation of a rally following BTC halving was one of the biggest driving factors of crypto whale accumulation. However, crypto whales might also look forward to booking profits due to the upcoming token unlock on May 16. Over 3.5% of the circulating supply worth around $100 million will be poured into the market.

This event will likely impact the market negatively. Thus, crypto whales might attempt to sell before the token unlocks to maximize their profits.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

In the last few weeks, the transactions worth more than $100,000 and $1 million have been consistently high. This accumulation could prevent a drop in Arbitrum’s price below $1.00.