What are people FUDing about after the launch of Runes Protocol?

Original author: Portal_Kay

X/Tweet: @portal_kay

Last Saturday, when the Runes protocol was launched, I saw a lot of posts about FUD runes. In fact, FUD is nothing, it just means that the popularity of runes is too high, so it naturally attracts a lot of attention. It’s just that the dimensions of most FUD are a bit nonsensical, so I still want to explain it.

Generally speaking, the content of FUD runes can be divided into two categories:

1. FUD regarding the Runes protocol;

2. FUD about the value of Rune assets.

FUD about Runes Protocol

1. Does Rune make asset issuance more and more centralized?

After the protocol went online on the morning of April 20, the most discussed were the first 10 runes. But after everyone read through them, they found that it seemed impossible to start. Either the project party pre-mined 100%, or the project party reserved a large part of the money for rat trading. Isnt this a return to the era of centralized issuance?

My opinion on this issue is: [It is not more centralized, but the choices are richer].

Of the first 10 runes, only the rune 0 hard-coded by Casey himself is completely fair and unreserved, while the others have varying degrees of reservation. This is not a problem with the Runes protocol, but the choice of the deployers themselves.

After the BTC ecosystem experienced BRC-20 and various BRC-XXX protocols, Casey actually learned from the experience and lessons of various protocols (especially BRC-20), and gradually optimized the Runes protocol to the final launch. Runes originally planned two issuance methods: Fixed Cap and Fair Launch. In a later upgrade, it was added that the deployer can retain the Premine quota based on the Fair Launch.

Therefore, the Runes protocol can support more diverse asset issuance scenarios:

1. Issue Meme coin, 100% Fair Mint, all depends on community consensus;

2. The project party issues project governance tokens and distributes them to investors, ecosystem and other stakeholders according to the planning of token economics;

3. The reward tokens of a certain project will be 100% pre-mined and airdropped to community users;

4. For projects jointly built by the project owner and the community, the project owner reserves a portion for operational needs, and the rest is provided by the community Fair Mint.

5. …

In fact, I think the issuance of assets driven by project parties will be an inevitable trend in the development of the ecosystem. It is actually a very low probability for truly ownerless tokens to be able to operate continuously. How many tokens can you name that rely entirely on the community to naturally build consensus? In a more common situation, isn’t it that there is a project party that is working hard to build the project, which ultimately allows the project to have a sustainable narrative and the value of the assets to gradually increase?

2. Other FUDs about Rune Token

The characters are so long, who can remember them?

When I first learned about the Runes protocol, I also thought this setting was not good. But on the one hand, the length of the name is not an essential problem, you will get used to it after a little familiarity; on the other hand, long characters can also have their own unique gameplay. If you don’t believe it, just look at ORDINALS•ARE•DEAD, which even Leonidas tweeted.

Runes must be sold one by one, so what’s the difference between them and NFTs?

In fact, the Runes protocol itself supports very convenient operations on assets, but the protocol has just been released, and various trading platforms have not had time to provide research and development support. Casey also tweeted to explain the differences between Rune transactions and BRC-20 token transactions. From the tweet, it can be seen that Runes can support any number of transfer transactions, and it is not necessary to place an order for a whole sheet.

Casey tweets: Differences between Rune trading and BRC-20 token trading

FUD about the value of Rune assets

1. I spent 2000 gas to buy runes. It’s a huge loss, right?

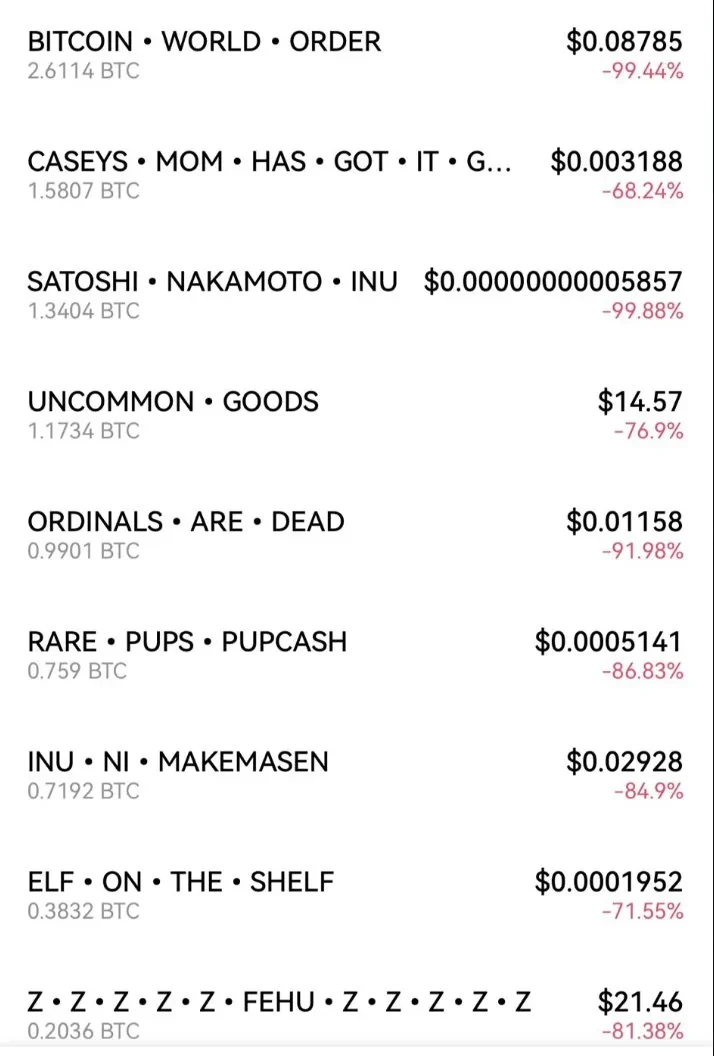

On the first day of the protocol launch, there was a screenshot of the OKX rune market that was widely forwarded. The KOL who posted it also added a few sarcastic words like Is this the rune you want? 2000 gas and you only get this? However, the statistical method of this screenshot is actually wrong. OK should have made a mistake in the starting price of these newly listed runes, so the calculation of the increase and decrease range was wrong.

So did all those who participated in the IPO of Rune on April 20 lose money? Here are a few targets that were deployed and launched on the first day and had good returns (Note: Unisat transaction price is a relatively compromise price). Of course, this does not mean that you can make money by blindly investing in all Rune projects after they are released. In the end, you still need to do solid investment research to find good targets.

In fact, this kind of FUD is mainly due to two reasons:

1. The poster mainly holds BRC-20 or EVM ecological assets. When he sees that Rune becomes popular, a lot of traffic and funds are attracted to it, so he instinctively starts to reject it. This kind of person is like the buttocks decide the head, because he has a large position in other assets, so he will naturally worry that Rune will siphon funds from other sectors. This kind of FUD can basically be ignored, because his interests are there, and this cannot be solved by reasoning.

2. Human nature naturally rejects new things. Runes Protocol is a new thing for many people. If you havent read some information before, you must be unfamiliar with it. People naturally reject unfamiliar things, which is understandable. However, as a crypto player, rejection of new things often means missing out on opportunities to make money.

What on earth are you all FUDing about?

After sorting out the above FUD content, I suddenly felt that these might be just superficial. So what are people FUDing about in essence? I guess what people are really FUDing about might be: the excessive issuance of assets without any new narrative!

In fact, after experiencing the BTC asset wave driven by BRC-20 in the past year, people are no longer willing to fomo for the issuance of assets that are nothing new. After all, a large number of Ordinals images have returned to zero, and the various BRC-20 inscriptions that were hyped up at the time have also disappeared quietly, and there are also a variety of BRC-XXX protocol assets that few people can remember. Everyone finally realized that air is still air, and basically everything will return to zero in the end.

The current BTC ecosystem is in such an awkward period. Asset protocols with strong consensus have come out, but the landing applications have not yet been born. The asset protocol is ultimately just a medium for carrying value. Only when the assets flow in landing applications such as DeFi and GameFi, can they be considered to have certain practical value.

But all signs indicate that this awkward period will soon be over. Various applications are also in the early stages of their birth, and now is like the dawn before the BTC ecosystem explodes… Please give the BTC ecosystem a little more patience.

Disclaimer: This article is for reference only and should not be used as legal, tax, investment, financial or any other advice, and does not represent the position of RunesCC.

This article is sourced from the internet: What are people FUDing about after the launch of Runes Protocol?

Related: Injective (INJ) Holders Stuck at Break-Even: Waiting for Push to $44 Next?

In Brief 83% of INJ active holders are on break-even, suggesting they will wait for the price to rise again. The number of INJ active addresses started to grow again after falling from the middle to the end of March. EMA Lines show a strong pattern for consolidation. The Injective (INJ) price dynamics reveal that 83% of active holders are at break-even, hinting they’re awaiting a price rebound. Concurrently, INJ’s active addresses have recently increased after a late March dip. Additionally, the EMA lines suggest a solid consolidation pattern following a 14.62% correction last month. This combination of factors signals a potential upward trajectory for INJ as the market stabilizes and investors remain hopeful. These Holders Can Prevent Selling Pressure The INJ price has recently shown signs of recovery, growing…