When will asset withdrawals be opened and the mainnet be launched? A quick overview of the latest trends of popular BTC

Original | Odaily Planet Daily

Author | Nanzhi

Merlin Chain

-

Introduction: Merlin Chain is Bitcoin Layer 2, integrating modules such as ZK-Rollup network, decentralized oracle network and fraud proof on Bitcoin chain, and is committed to empowering native assets and protocols on BTC Layer 1 through Layer 2. Two rounds of financing were completed in April and February 24, of which the April round was led by Spartan Group and Hailstone Labs, with participation from Amber Group, Presto Labs and IOBC Capital.

-

TVL: US$2.783 billion ( official website data ), US$1.018 billion ( DefiLlama data ), the TVL trend chart shown by DefiLlama is shown below.

latest progress

Open BRC-20 asset withdrawal:

Users who have not received M-Token: You can pay the gas fee to withdraw BRC-20 back to the Bitcoin mainnet, which takes 3 days. Or you can directly transfer it back to the L2 wallet without gas.

Users who have received M-Token: M-BRC 20 can be exchanged for BRC-20, and then traded on L2 or withdrawn back to the Bitcoin mainnet.

(Odaily Note: M-BRC 20 needs to be converted to BRC-20 on L2 before it can be traded on the network. The exchange does not support direct trading of m-assets such as m-rats.)

When will other assets be available for withdrawal?

The official announcement is as follows: Once most BTC and BRC-20 are unstaked and the network is stable, the process of unstacking NFTs will begin . Cross-chain testing is still ongoing.

B虏 Network

-

Introduction: B虏 Network uses the Bitcoin network as the settlement layer, uses Taproot block space to record and verify transaction proofs on the second-layer network, and builds a zk-proof second-layer network compatible with EVM. In January 24, it announced the completion of its seed round of financing, with HashKey Capital, OKX Ventures, IDG Capital, kucoin ventures, ABCDE, Waterdrip Capital, OGs FUND and Antalpha Group participating.

-

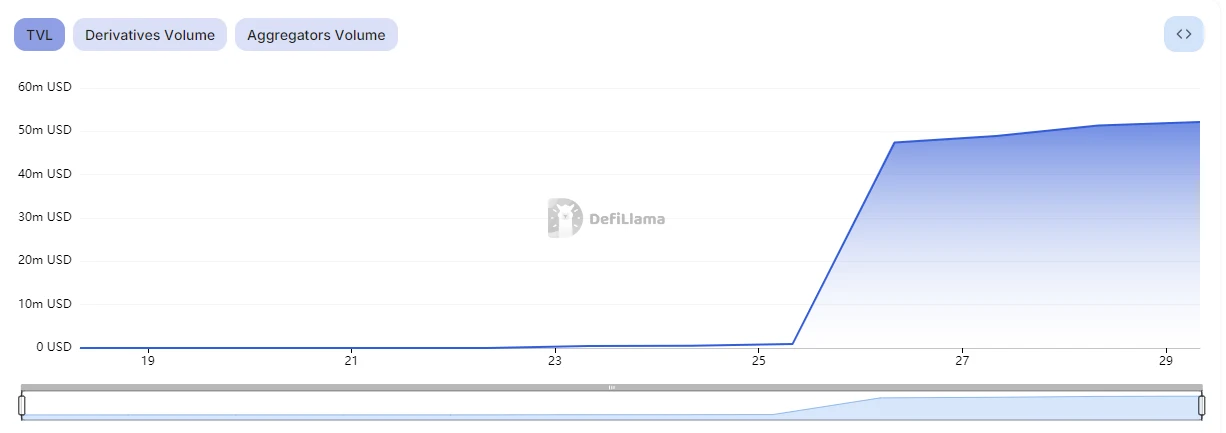

TVL: US$517 million (official website data), US$52.18 million (DefiLlama data), the TVL trend chart shown by DefiLlama is shown below.

latest progress

According to the latest official announcement, B虏 Buzz assets will cross-chain to the EVM compatible chain (which can be understood as the B虏 mainnet) on April 30. It will take several days to cross-chain to the Bitcoin mainnet, and we need to wait for the testing and auditing process to be completed.

Officially recommended cross-chain bridges include: Mesonfi, Owlto_finance , Orbiter_finance, OmniBTC , Chaineye_tools , etc.

latest events

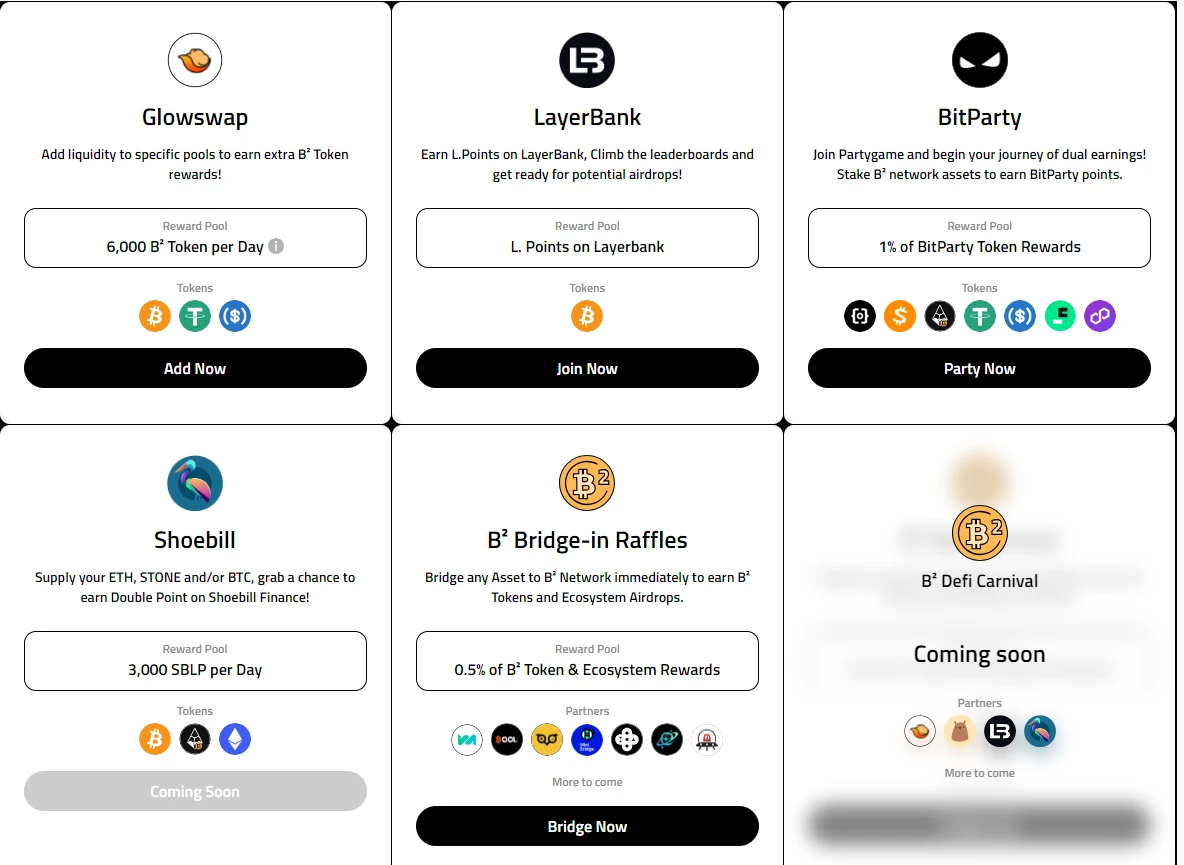

According to the official roadmap, B虏 has six phases. The first round of Buzz Deposit (i.e. staking mining) has been completed, and the second phase, Bridge-in, has been launched. In this phase, 0.5% of B虏 tokens will be provided to users who cross into assets . The next two phases are DeFi Carnival and Runes Fest.

(Odaily Note: As of the time of posting, B虏 does not support asset outflows. Please pay attention to liquidity issues.)

In addition, B虏 has also carried out two-phase special activities with a series of projects. The only official token involved is the liquidity task of Glowswap, and the remaining activities will reward the projects own tokens.

Build on Bitcoin

-

Introduction: BOB (Build On Bitcoin) is an EVM rollup stack with native Bitcoin support. Developers build decentralized applications on top of Ordinals, Lightning, and Nostr. In March 24, BOB announced the completion of a $10 million seed round of financing, led by Castle Island Ventures, with participation from Mechanism Ventures, Bankless Ventures, CMS Ventures, UTXO Management, and some angel investors; BOB later announced that Coinbase Ventures joined its $10 million seed round of financing.

-

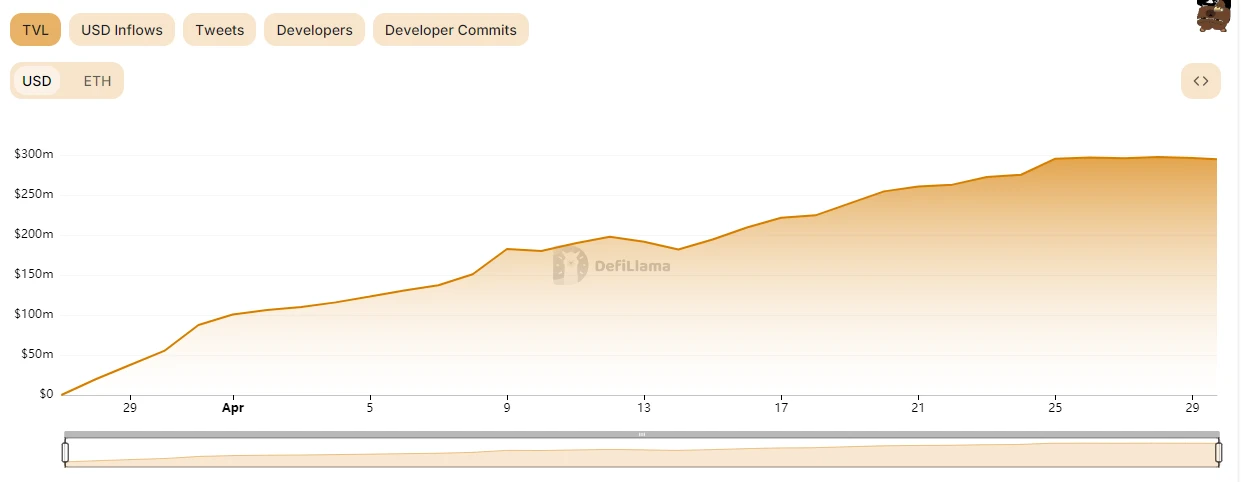

TVL: US$294 million ( the official website data and DefiLlama data are consistent). The TVL trend chart shown by DefiLlama is shown below.

latest progress

According to the official announcement, the mainnet launch has been postponed to May 1 (originally scheduled for April 24) to accommodate additional testing and auditing. User locked assets will receive additional benefits during the extended week and will be available at the start of Season 2 on May 1. User assets are safe and its non-custodial BOB Fusion contract has been strictly audited. In the unlikely event of further delays, user assets will be automatically unlocked on May 15 at the latest .

BounceBit

-

Introduction: BounceBit is a Bitcoin staking chain based on the PoS mechanism. The BounceBit network ensures network security by staking Bitcoin and BounceBit tokens. BounceBit introduces a hybrid DeFi and CeFi income mechanism, allowing BTC to passively earn interest.

-

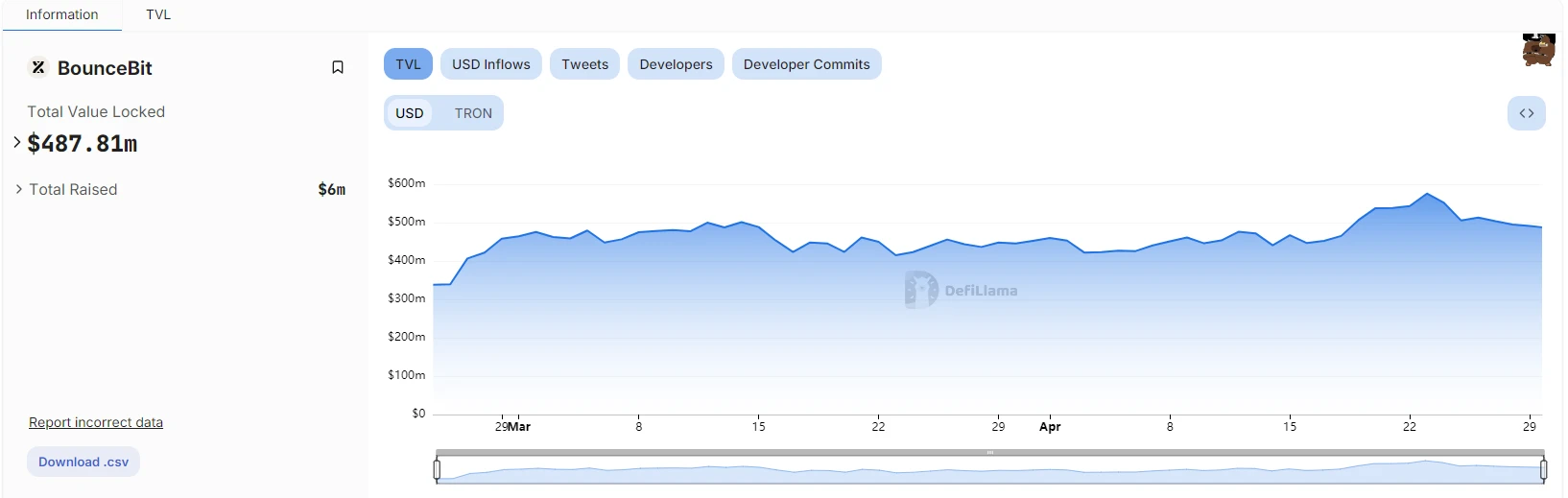

TVL: US$1 billion ( official website data ), US$487 million ( DefiLlama data ), the TVL trend chart shown by DefiLlama is shown below.

latest progress

BounceBit network tokens have been launched in Binance Megadrop. Users can obtain airdrop rewards by applying for BNB regular products on the Binance Megadrop platform or completing BounceBit Quest through the Binance Web3 wallet. 8% of the total tokens will be used for this event.

The event started on April 26, and the token will be available for trading on Binance on May 13. So far, $1 billion has flowed into BounceBit. For details on how to participate in the event and token data, please see More than 57,000 users participated in two days, a detailed explanation of Binance Megadrops first project BounceBit .

When will the mainnet be launched?

According to the official roadmap, the current phase is the MEGADROP phase, and the next phase is the MAINNET ACTIVATION phase , which includes the cross-chain bridge , BB token airdrop, AUCTION, MUBI and DAII open withdrawal . However, the specific date has not yet been disclosed.

This article is sourced from the internet: When will asset withdrawals be opened and the mainnet be launched? A quick overview of the latest trends of popular BTC L2

Related: AEVO to Release 827.6 Million Tokens After Successful Airdrop: Price Impact

In Brief The Total Value Locked (TVL) within AEVO is currently positioned at over $14 million. Although it’s reaching 8 digits, this is 44% less than it was in January. Although the number of deposits is growing in the past weeks, the number of withdrawals is growing faster. 837 million AEVO tokens will flood the market in May, which could lead to strong price corrections. Aevo is a decentralized options platform that utilizes an off-chain order book for matching orders while the actual trades are executed and settled on-chain through smart contracts. It received investments from big players like Paradigm, Dragonfly Capital, Coinbase Ventures, and more. Also, AEVO airdrop recently drove a lot of attention to its ecosystem. The AEVO token was recently listed on Binance, and a significant token…