Cardano’s (ADA) price at the time of writing falls back after failing to breach a resistance trend line.

Combined with the bearish cues from the investors, it appears that ADA might be looking at a further decline.

Cardano Investors Back Up

Cardano’s price has slightly dropped in the last few days but is holding above a key support line. However, this did not sit well with the investors, who continued to act bearish.

ADA Whales, in particular, have continued the onslaught of selling their holdings to offset any potential losses. The addresses holding ADA worth between $10,000 to $100,000 and $100,000 to $1 million have sold over nearly $1 billion worth of their supply in the last two weeks.

Their overall holdings are now down from $6.1 billion to $5.1 billion as of date.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

However, they are not the only crucial cohort that has opted to move their holdings around. Long-term holders, known to be the backbone of a bull run, are also skeptical at the moment.

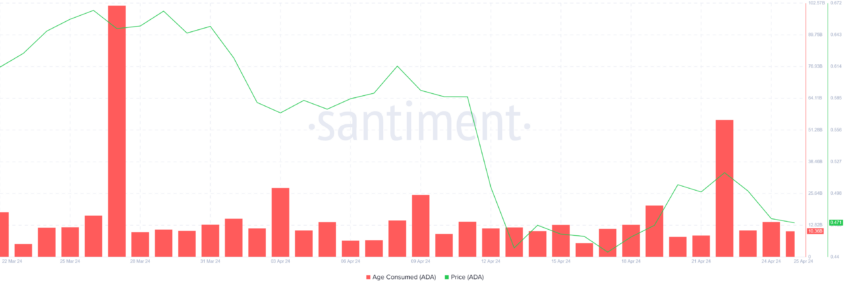

The Age Consumed metric, which measures the total age of coins spent in a transaction, noted a spike recently. This spike indicates the movement of the supply held by addresses holding an asset for more than a year.

It shows that even long-term holders are skeptical of further profits or rallies and often opt to offset their losses.

Thus, there is a fair chance that these long-term investors might anticipate further decline.

ADA Price Prediction: A Failed Breakout?

Cardano’s price has been stuck in the descending channel for the past month and a half and failed to break out this past week. Consequently, the altcoin declined to test the support at $0.47.

Based on the aforementioned factors, the altcoin could fall to $0.40, which marks ADA’s next crucial support level. This would mark a 14% drawdown.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

On the other hand, if Cardano’s price manages to bounce off the $0.46 support, it could reclaim $0.50 as support. This price has been a crucial psychological support floor, and breaching it would invalidate the bearish thesis, opening ADA up to further rally.