Investment Project Summary

ArkStream Capital has invested in a total of 6 projects in the first quarter of 2024. We will publish project details and explain why we invested in these projects.

Project Introduction

XION is the first modular universal abstraction layer, purpose-built to enable a seamless user experience for the average user to promote consumer adoption. XIONs universal abstraction layer includes multiple protocol-level abstractions such as accounts, signatures, gas, interoperability, pricing, devices, payments, etc. By abstracting all cryptographic complexities, XION removes the main barrier to entry for new users while circumventing the challenges of fragmentation for developers. Its signature-agnostic infrastructure supports a wide range of existing crypto curves and can be easily adapted to future developments, which not only expands its market coverage but also ensures its long-term viability and interoperability across different blockchain protocols. By abstracting interoperability, XION can not only provide a seamless experience for native applications, but also provide services for applications built on connected chains.

Why invest in XION

According to different statistical calibers, the current number of crypto users is between 100 million and 200 million. ArkStream believes that in the next bull market cycle, this number will increase 10 times to 1 billion, which requires the infrastructure of the crypto world to be sufficiently user-friendly, and the abstraction layer is a feasible path to achieve Mass Adoption. ArkStream first met the XION team in 2021, when they were still building a Solana-based NFT marketplace. ArkStream participated in the first round of investment. Then the bear market came, and the NFT market did not rise as expected. The project team made a difficult decision and switched to the abstraction layer L1. In the end, they took a step closer to the ideal vision of Mass Adoption.

XIONs universal abstract solution has gained widespread market consensus as soon as it was proposed. In early February, just half a month after the launch of the test network, the number of accounts exceeded 100,000. Two months later, the number reached 1.3 million, with a total of 15 million transactions and 340+ WAU. More than 400 startup teams participated in their hackathon, and most of its more than 100 ecological projects are giants that influence the development of the crypto industry, such as Circle, Axelar, Injective, IBC, Babylon, etc. These data all show the influence of XION and indicate that they will eventually bring exponential users into Web3.

Project Introduction

UniCross is an L1 asset minting, trading, issuance and cross-chain platform on BTC L2, which supports minting, trading, cross-chain and issuance of L1 assets on different Bitcoin L2. Users can mint, trade and issue L1 multi-protocol assets such as BRC-20, Runes, BRC-420, ARC 20 on L2 through UniCross, and support cross-back to L1. Platform asset payment supports payment using multi-chain assets such as BTC, BRC-20s, ETH, etc.

Why invest in Unicross

The competition for Bitcoin Layer 2 began in Q1 2024. Before that, it was just a paper war. After the launch of Merlin mainnet, the competition has reached a white-hot stage. Through L2 Watch (https://l2.watch/), we can see that nearly 100 BTC Layer 2 are ready to go or have been launched, but the solutions are very different. Different solutions such as sidechain, Rollup, EVM compatibility, etc. have come up with their own cross-chain solutions, and finally dispersed users BTC into different custodial/non-custodial wallets, but we found that the official cross-chain solutions given by most sidechains do not include other BTC native assets. The priority of the inscription army is placed behind the BTC hoarding party, but they are the most dynamic people in this ecosystem. These native assets such as BRC-20, ARC-20, Runes, etc. that are stranded on the BTC main chain urgently need to reproduce their glory on Layer 2, especially after Runes went online, the mainnet Gas Fee that is far higher than the transaction value confirms this.

The cross-chain solution proposed by Unicross effectively solves this problem. The Unicross team, which was born out of the second largest inscription tool IDClub, has a strong market perception and iteration speed in the Bitcoin ecosystem. ArkStream is well aware of the teams product capabilities in this rapidly developing market and decided to participate in Unicross investment as soon as the Unicross project was established. It hopes that in the future BTC Layer 2 war, Unicross can capture the market with its unique position.

Project Introduction

Polyhedra Network leverages advanced zero-knowledge (ZK) technology to enhance computing power, with the goal of accelerating the adoption of Web3 by removing the limitations of traditional computing power. Polyhedras flagship product, zkBridge, is a universal ZK interoperability protocol that simplifies Web2 and Web3 integration. The protocol has helped traditional financial institutions smoothly transition real-world assets between various networks, has completed tens of millions of cross-chain transactions, and generated more than 40 million ZK proofs. In collaboration with Google Cloud, Polyhedra launched Proof Cloud, a ZK proof platform for developers, a cloud-based platform designed to simplify application development and deployment. To further enhance its technical strength, Polyhedra aims to integrate zero-knowledge proof capabilities into the Ethereum blockchain and expand its application on Bitcoin, enhancing the interoperability of major blockchain ecosystems such as Ethereum and Solana.

Why invest in Polyhedra

Since the birth of the first altcoin in the crypto industry, how to conduct cross-chain exchange has been a problem that developers have been committed to solving. At first, developers tended to use atomic swaps to solve this problem with a more centralized solution. The emergence of Polkadot and Cosmos is committed to forming a unified set of standards so that all public chains can be built according to their standards, so that assets that meet the standards can be exchanged across chains without barriers. However, it is difficult to form a unified standard in the decentralized world. In the end, the market chose a more centralized cross-chain bridge to temporarily solve this problem until the emergence of the cross-chain interoperability protocol. Wormhole, LayerZero and Polyhedra have formed a three-legged situation in the past two years, launching three representative cross-chain bridge products, Portal, Stargate, and zkBridge, respectively, and building their own cross-chain interoperability protocols based on this.

Compared with the other two companies, Polyhedra has targeted the vacant market of Bitcoin ecology this year. Through zkBridge and zero-knowledge proof technology, Bitcoin can now securely transmit its current and historical data to more than 20 networks, including Bitcoin Layer 2, Ethereum and Ethereum Layer 2, and is also compatible with innovative protocols such as Ordinals, BRC-20 and Atomicals. This enables smart contracts on other blockchain networks such as Ethereum and Bitcoin Layer 2 to access Bitcoin data and protocols without trust and implement various computing logics, with security guaranteed by zero-knowledge proofs. In addition, Polyhedra has worked with EigenLayer to design and implement Bitcoin AVS, a system that allows other blockchain networks to securely write data and transfer assets to Bitcoin. At present, the core players in the Bitcoin ecology have cooperated with Polyhedra, including but not limited to OKX Wallet, Unisat Wallet, Babylon, Merlin Chain, BitLayer, Bsquared, BEVM, Particle Network, etc., many of which are also ArkStreams Portfolios. ArkStream believes that the investment in Polyhedra is an important part of its Bitcoin ecosystem layout, which will help ArkStream further seize core resources in the Bitcoin ecosystem in the future and help more portfolios grow.

Project Introduction

BEVM is a decentralized and EVM-compatible Bitcoin second-layer network that uses BTC as Gas. BEVM is based on the technology brought by the Taproot upgrade, such as the Schnorr signature algorithm, which allows BTC to cross-chain from the Bitcoin mainnet to the second layer in a decentralized manner. Since BEVM is compatible with EVM, it allows all DApps that can run in the Ethereum ecosystem to run on BTC Layer 2.

Why invest in BEVM

In 2017, BTCs SegWit upgrade enabled Bitcoin blocks to accommodate larger data, and the 2021 Taproot upgrade not only allowed the expanded space to contain more complex data, but also introduced the Schnorr signature algorithm, making decentralized Bitcoin multi-signature a reality. This in turn makes decentralized Bitcoin cross-chain operations possible, and ultimately, decentralized BTC Layer 2 a reality. BEVM is the best example of decentralized BTC Layer 2. SegWit and Taproot upgrades have revitalized Bitcoin again, evolving Bitcoin from the 1.0 era to the Bitcoin 2.0 era, allowing us to see a richer Bitcoin ecosystem. The outbreak of Token launch protocols such as Ordinals on Bitcoin in 2023 is the result of Bitcoins SegWit and Taproot upgrades. This shows the Bitcoin community that it is possible to issue assets based on Bitcoin. Issuing assets is only the first step; a richer and more diverse application ecosystem needs to be established on the second layer of BTC. Therefore, BEVM came into being.

Over the past six years, the BEVM team has been committed to exploring the development of BTC Layer 2. In 2018, the teams first product, ChainX, achieved cross-chain of more than 100,000 BTC. In 2023, the explosion of the Bitcoin ecosystem showed their team the arrival of a new era of the Bitcoin ecosystem, and they began to develop a new product, BEVM. There are roughly two types of Bitcoin Layer 2 solutions. One is represented by Merlin, which integrates the solutions of all parties. In the early stage, the approach is more market-oriented and is not constrained by whether the cross-chain solution is decentralized enough; the other is BEVM, which emphasizes the nativeness and decentralization of BTC and has been built over the past few years. Both solutions have their own advantages. ArkStream hopes that the concept of Bitcoin ecological development can be expanded to every corner of the crypto world, so it has bet on the most promising teams in various categories of solutions. ArkStream expects BEVM to attract more people from the native Bitcoin community to join the development of Layer 2.

Project Introduction

Merlin Starter is the first Launchpad platform on Merlin Chain, which mainly incubates Merlin native projects and provides promising projects and asset support for the Merlin Chain ecosystem. Merlin Starter provides projects with a combination of single-pool and multi-pool IDO formats, including oversubscription, lottery, first-come-first-served, etc.

Why invest in Merlin Starter

Asset issuance is always the core of the crypto industry, whether it is Ethereums smart contracts or emerging protocols such as Ordinals on Bitcoin. Looking at the development of the crypto world, from one-click mining, to one-click coin issuance, to one-click chain issuance, and one-click inscription, the first stop to attract users is always assets. The rise of each emerging ecology is accompanied by the issuance and distribution of assets. ArkStream believes that after the launch of Merlin Chains large amount of TVL on its mainnet, more reservoirs are needed to undertake it. In addition to the three major traditional DeFi components of lending, exchanges, and Yield Farming, Launchpad and IDO platforms are indispensable. MerlinStarter stands out in the ecosystem and has taken the lead in occupying this bridgehead. Through the issuance of benchmark projects and great attention from ecological funds, it has further attracted high-quality projects to be issued on it.

Project Introduction

Nubit is a scalable, efficient, Bitcoin-native data availability (DA) layer that is deeply involved in the Bitcoin ecosystem and actively expands Bitcoin modularity. Nubits DA layer services can effectively expand Bitcoins data capacity, support and provide modular services such as Ordinals, decentralized indexers, Layer 2 solutions, and price oracles, thereby supporting the expansion and efficiency of the Bitcoin ecosystem.

Why invest in Nubit

In the past two years, many Bitcoin Layer 2 projects based on the Rollup architecture have begun to shine. However, given the non-Turing complete scripting language characteristics of Bitcoin, for most Rollup-type Layer 2 solutions, although academic papers such as BitVM attempt to inherit Bitcoins security by simulating gate circuits of on-chain fraud evidence, choosing a professional local data availability solution is more in line with the markets development pace. ArkStream believes that Celestia, the proposer of the modular blockchain architecture and the data availability layer (DA), provides a good reference idea that can also be applied to the Bitcoin ecosystem.

As one of the few DA projects in the Bitcoin ecosystem, Nubit occupies a pivotal position in the entire ecosystem with its unique technical architecture and product solutions. Nubit is led by a professor from the Department of Computer Science at UCSB. The core team is composed of top researchers in the blockchain and security fields in academia. It has Chainlinks outstanding scientists, former Facebook Diem Blockchain CTO, Dahlia Malkhi, a top scholar in the blockchain consensus field, and BRC 20 founder domo as consultants, with a strong academic and technical development background. It is worth mentioning that Nubit and domo have joined hands to jointly develop industry standards, and the Modular Indexer they developed has been integrated with major wallet dAPPs.

Nubit is also committed to leading the Bitcoin Season 2 narrative with top projects in the Bitcoin ecosystem, and has already collaborated with many well-known projects, such as the highly respected EVM-compatible Layer 2 projects Merlin Chain, Bitlayer, etc., Bitcoin Staking PoS chain BounceBit, Babylon, a leading project focusing on Bitcoin Staking and Restaking, and Yala Finance, a liquidity protocol that implements native Yield, etc. These well-known cooperative projects and Nubit are jointly promoting the steady development of the Bitcoin ecosystem, and through in-depth cooperation with these high-quality projects, Nubit can not only further improve and perfect its technical solutions, but more importantly, consolidate and enhance its influence and competitiveness in the entire Bitcoin ecosystem.

ArkStream Capitals investment in Nubit is not only a recognition of its outstanding technical capabilities and broad market prospects, but also reflects a firm belief in the future development direction of the entire Bitcoin ecosystem and the broader technology field. As a pioneer and supporter of the industry, we not only see the potential value of Nubit, but also see the infinite possibilities and opportunities it brings.

Company News/Member News

Position Change

Chung TszChung, promoted to Investment Partner

Educational background: Bachelor鈥檚 degree from the University of Hong Kong; Master鈥檚 degree from the Norwegian School of Economics; MBA from Lagos Business School, Nigeria

Before entering the Crypto industry, Chung worked at the African Export-Import Bank as the only Chinese member, and later worked in risk management at Allianz Germany. Chung has been with ArkStream Capital for 3 years, mainly responsible for project investment, and currently lives in Chongqing. During his tenure, he followed up and invested in many high-quality white horse projects, including SEI, IO.NET, LINERA, etc.

Chung is good at establishing partnerships. During the months-long investment process of a single project, he regularly communicates with the team about the progress, effectively helping the project grow, and has received unanimous praise from multiple project teams. Many ArkStream portfolios have also actively invited Chung to represent ArkStream as a team consultant, regularly providing advice on development directions and connecting with cooperative resources. Some project team members even flew to Chongqing to meet with Chung.

Chung has established a rich overseas first-tier capital network and has worked closely with international emerging crypto VCs such as Symbolic Capital and MH Ventures. From 0 to 1, he helped ArkStream expand many overseas resources and made outstanding contributions to ArkStreams global development.

New Members

Wang Zhaoqian Ren, EIR / Investment Director

He received his masters degree from Bournemouth University in the UK and his bachelors degree from the University of Southampton in the UK, majoring in cognitive neurology. He worked at the Institute of Cognitive Science at the University of Southampton in the UK, and his main research areas are human learning and eye movements.

Ren is the first entrepreneur to join ArkStream. He was formerly the vice president of Northern Light Venture Capital, a first-tier US dollar fund, and the vice president of Qingsong Fund/A 8 Group (00800.HK). Wang Zhaoqian is an academic investor who adheres to scientific research methodology. He is good at early and growth stage investments in Web3, AI and TMT. He is committed to bridging Web2 Web3, with a cumulative investment of more than 200 million US dollars. Representative cases include JT (01519.HK), Zongmu Technology, Fabu Technology, Dianjiang Technology, etc. He was named Forbes U 30 VC Investor and the Best New Investor of Lieyun.com.

research report

Arkstream Capital: Nine Alpha Prediction for 2024

Arkstream Capital: How to Fortify the Security Defense of Merlin Chains $3 Billion TVL

Arkstream Capital: Why We Invest in IO.Net

Host and attend events

offline activity

Streams with Degens, Hong Kong

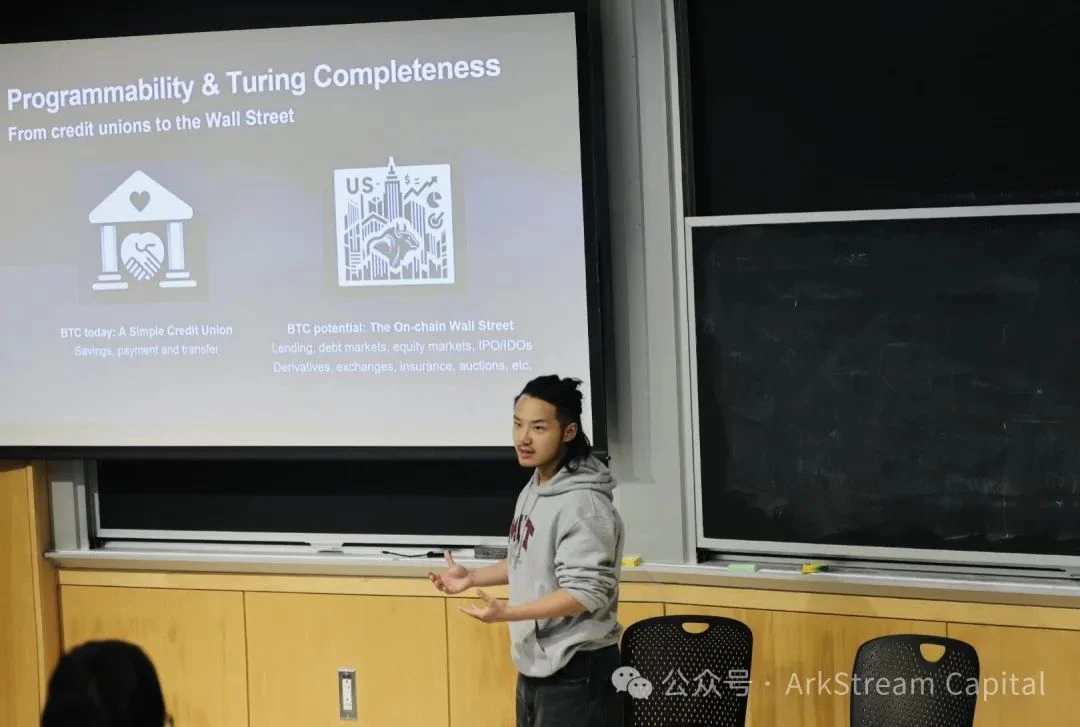

MIT Harvard Blockchain Course, Boston

Online Activities/Twitter Space

[When the Wind Rises Again] Episode 3: MEME, a crypto-native political movement

[When the Wind Rises Again] Episode 2: Merging AI and DePIN in Web3s Tapestry

[When the Wind Rises Again] Episode 1: Exploration and Breakthrough of Bitcoin Layer-2

CMCLive: How fastest growing Layer 2 shapes the space

This article is sourced from the internet: ArkStream Capital: 2024 Q1 Investments and Updates

Related: Algorand (ALGO) Could Fall to $0.20 After Breaking This Support Level

In Brief Algorand price is maintaining the $0.23 level as a support floor attempting to climb back up to $0.25. ALGO, however, is losing the interest of new investors, resulting in a decline in new address formation. Amidst mixed signals, ALGO is still above the Ichimoku Cloud, suggesting a bullish outcome is still likely. Over the last two days, the price of Algorand (ALGO) has declined on the daily chart, retracing back to just above a critical support level. Although a recovery seems possible, the current lack of market bullishness could pose a significant obstacle. The Challenge of Attracting New Investors In recent days, a noticeable dip in the price of Algorand has stirred either fear or concern among active and potential investors. This sentiment is reflected in the slowed…