SignalPlus Volatility Column (20240426): Macro data exceeded expectations

Yesterday (25 APR), the US GDP in the first quarter was significantly lower than expected, while the PCE price index rebounded sharply to 3.7%, indicating that the PCE inflation index to be announced tonight is likely to be higher than the markets previous forecast. Weak economic output and rising prices have hit risk sentiment, and the three major indexes have fallen. The two-year US Treasury yield, which is sensitive to interest rate policy, once jumped to 5.016%, and gradually fell back below 5.0% during the day. Feds Goolsbee said that after a series of higher-than-expected inflation data, the Fed must re-adjust and must wait and see.

Source: TradingView

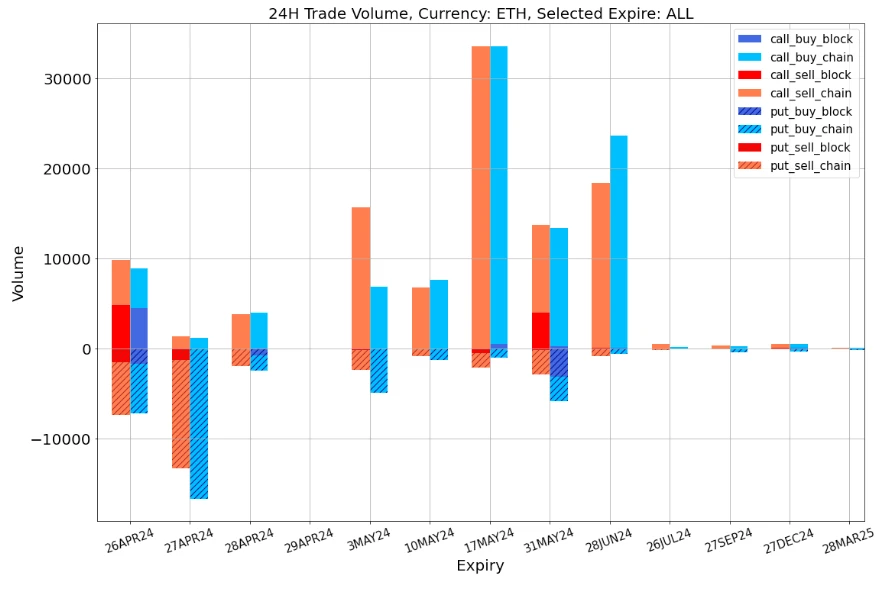

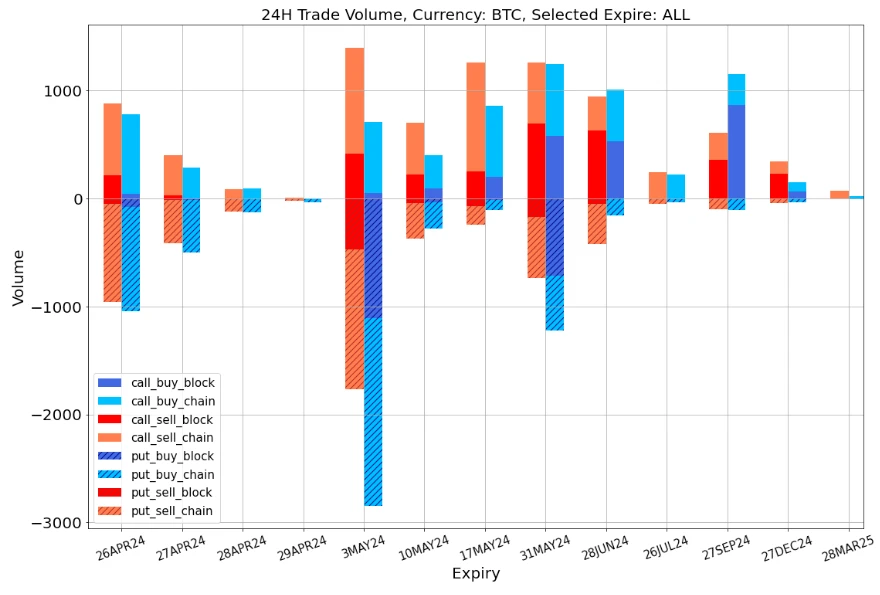

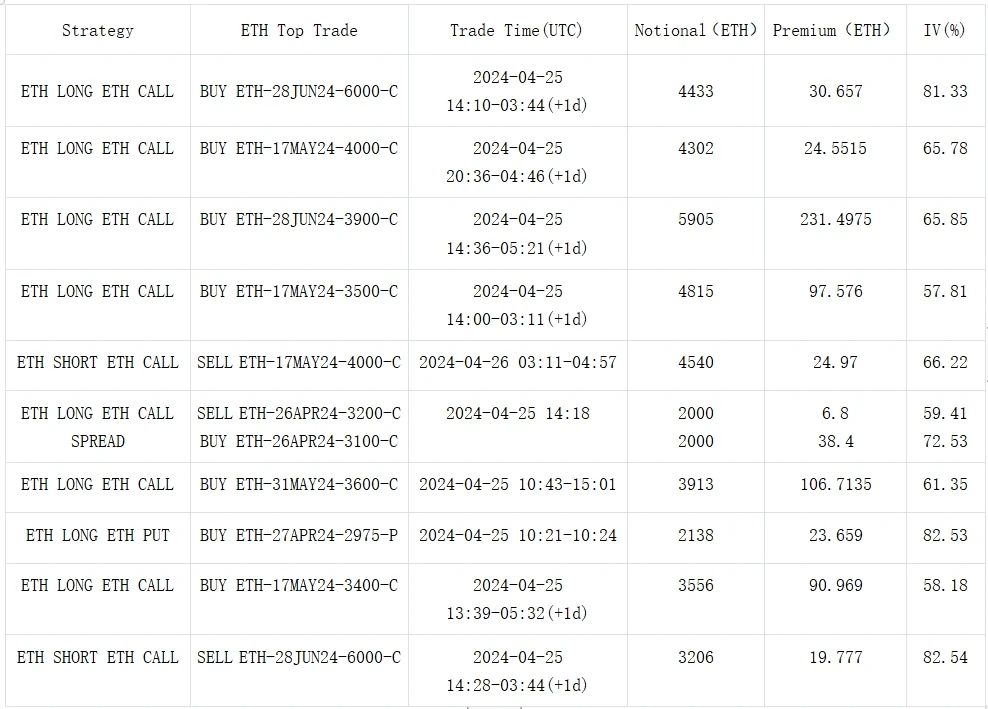

In terms of digital currency, the correlation between BTC and US stocks has been strengthened recently. The price of the currency once dropped below 63,000 at the opening stage of the US market, attracting a large number of buy orders for BTC at 59,000-P and 60,000-P in the next week. In terms of bulk, the distribution of BTC transactions has shifted to the forward period, and the buying and selling of OTM CallSpread and several sets of triangular spread strategies have shown a game of upside space; ETH is mostly bought in call options, and is distributed at the strike price near 17 MAY 24 and 28 JUN 24 0.25 Delta.

Source: Deribit (as of 26 APR 16:00 UTC+8)

Source: SignalPlus

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240426): Macro data exceeded expectations

Related: Dogecoin (DOGE) at Risk: Factors Leading to a Potential Correction

In Brief Dogecoin price continues to remain stuck in a rising wedge, suggesting the potential of a 40% decline. On one hand, whales have been exhibiting caution for the past two weeks, dumping nearly $55 million worth of DOGE. On the other hand, a 6% increase in holdings of short-term holders threatens a price drop. Dogecoin (DOGE) price is witnessing increasingly bearish behavior from investors combined with pessimistic market cues. Furthermore, the meme coin is stuck in a bearish pattern and will likely witness a significant decline if validated. Dogecoin Investors’ Bullishness Fading? Dogecoin’s price is primed for a decline, and with the lack of support from DOGE holders, this correction could arrive quicker than expected. Whale addresses are noting a pullback as they are offloading their investments. The addresses…