Analysis of Ethena鈥檚 mining yield in the second quarter, 400%+APY is not a dream?

Original author: Donovan Choy, former Bankless analyst

Compiled by: Odaily Planet Daily Azuma

Editors Note: Earlier this month, USDe developer Ethena Labs announced the launch of the second season of the Sats event. The new event will cooperate with Ethena to use BTC as a supporting asset. It is expected to last until September 2 (5 months) or until the supply of USDe grows to US$5 billion, whichever comes first.

As the most popular stablecoin project in the market, Ethena Labs popularity has reached its peak with the TGE of ENA. Currently, the full circulation valuation (FDV) of ENA exceeds 13 billion US dollars. For users who are interested in participating in the project, in addition to directly purchasing ENA in the secondary market, the most efficient way is to earn subsequent ENA rewards through the second season event Sats.

This article is a detailed analysis by former Bankless analyst Donovan Choy on the operation and potential yields of the three mining strategies of low, medium and high in Stas activities, compiled by Odaily Planet Daily.

Ethena鈥檚 first season event, Shards, lasted for six weeks, and top miners such as Defi Maestro reaped eight-figure profits through the first season event.

If you missed the first season, it鈥檚 still time to participate in the second season Sats event. Although the (Pendle) pool is approaching full, you still have a chance to participate.

Below, we will analyze three different Ethena mining strategies and their potential returns.

Before we start the data analysis, let鈥檚 first take a brief look at the basic concepts involved in the above strategies.

-

First, Ethena is the issuing protocol for USDe, a synthetic USD stablecoin with its own yield. When you buy USDe during the Season 2 event, your address will automatically accumulate points (sats), which will determine your ENA rewards in the Season 2 event – ENA is Ethenas governance token, and its FDV is as high as $14.3 billion at the time of writing this article.

-

Secondly, Pendle is a yield-splitting protocol that can split a token with its own yield (such as USDe) into a principal token (PT) and a yield token (YT). PT allows users to maintain independent principal exposure, while YT allows users to maintain independent yield exposure. Since YT does not include the principal, the value of YT will gradually tend to zero on the expiration date. For the strategies to be mentioned in this article, we will also focus on YT.

In the case of this article, since the current annualized rate of return of USDe is 17%, when you purchase USDe YT tokens on Pendle, the YT tokens only carry the value of the 17% rate of return and the points reward provided by the underlying protocol (Ethena).

-

Third, Mantle and Arbitrum are both Layer 2 networks, and Pendle has been deployed on these networks in addition to Ethereum.

With these basic concepts in mind, let鈥檚 take a look at the three main mining strategies in Season 2:

-

Low risk: Hold USDe on Ethereum (earn 5x sats per day), or lock it for at least 7 days (earn 20x sats per day);

-

Medium risk: Buy USDe YT at Pendle;

-

High Risk: Lock up ENA to get a yield bonus, and buy USDe YT on Pendle with an equal amount of funds.

Estimated total amount of stas for the second season activities

To calculate the specific potential rate of return, we need to first answer a key question – how many sats will be distributed by the end of the second season? Based on this crucial answer, we can quantify the airdrop returns and determine which strategies can achieve the best return at the corresponding risk level.

Note: We do not count the points issued to USDe and ENA in CEX wallets.

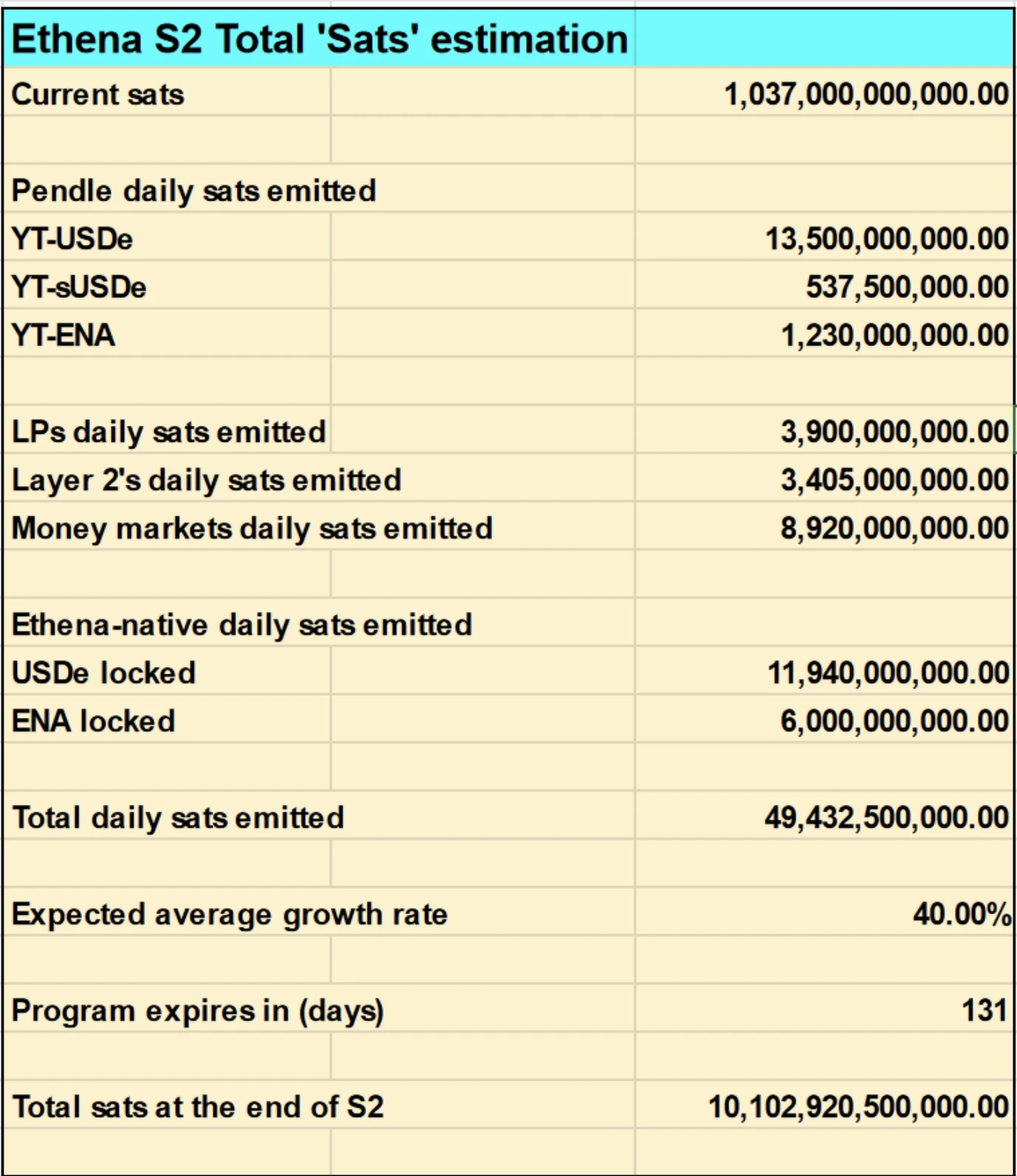

We conservatively estimate the overall growth rate of sats to be 40%, which means that by the end of the second season (September 2, 2024), a total of 10.1 trillion sats will be issued. It is worth mentioning that if the USDe supply reaches $5 billion ahead of schedule, the second season will also end, but we believe that based on the current supply of $2.4 billion and the growth rate, this is unlikely to happen ahead of schedule.

Note: Data is taken from DeFiLlama.

Low-risk strategy: hold and lock USDe

Now let鈥檚 calculate the potential return of just holding and locking USDe, which is the lowest risk strategy in this article. Here are our two assumptions: 5% of the total supply of ENA will be distributed in the second quarter (assuming the same as the first quarter); the FDV of ENA during the second quarter airdrop is $20 billion, and the data at the time of writing this article is $14.4 billion;

As shown in the table below, if you lock in 20,000 USDe at 20x efficiency today (130 days left in the second quarter), you will make a profit of $5,186. This means a return on investment (ROI) of 25.93%, which translates to an annualized rate of return (APY) of 72.45%.

Unlike the subsequent strategies, this strategy does not involve a Pendle and you get to keep all of your capital.

Medium-risk strategy: Pendle YT

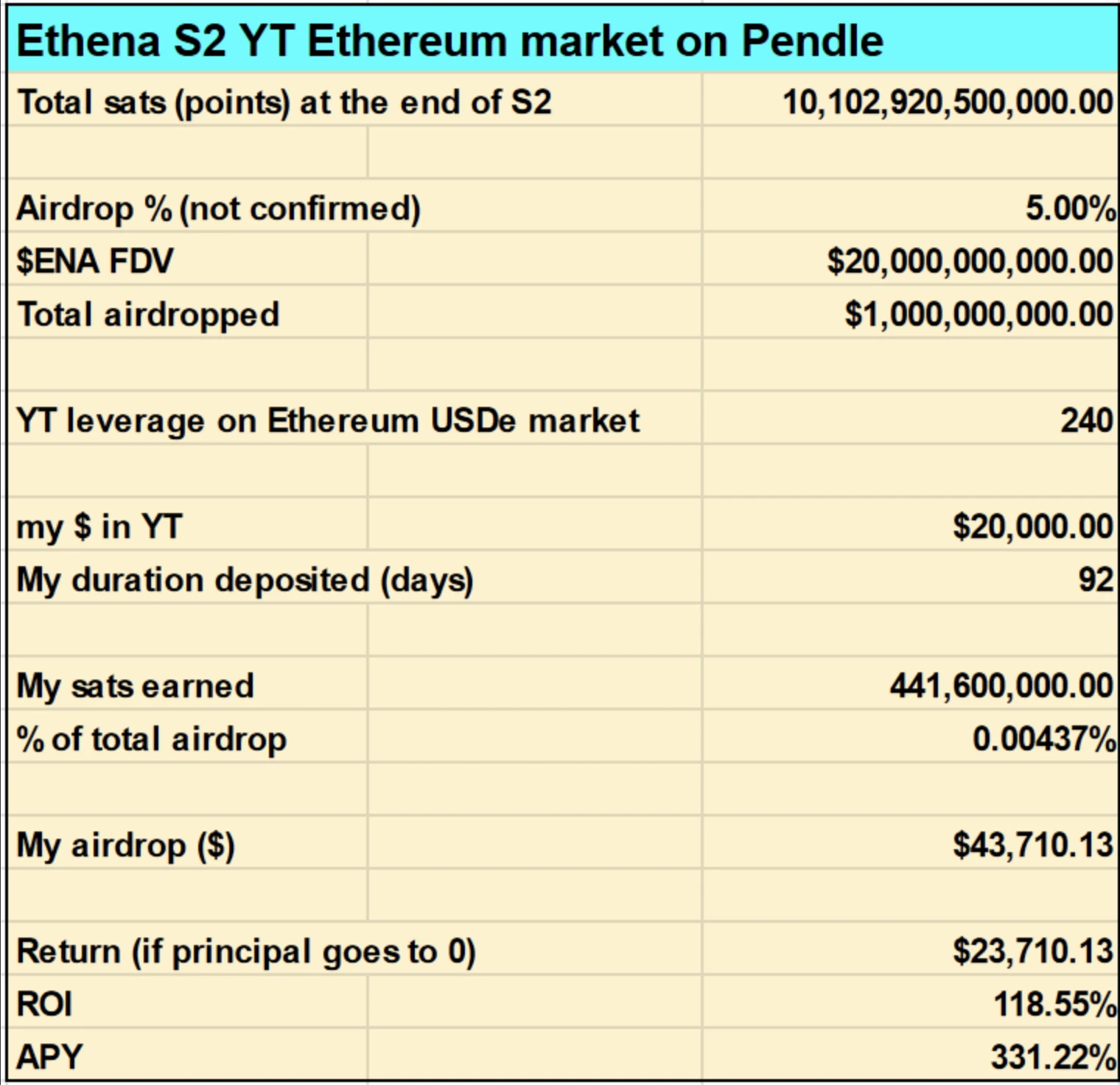

Now let鈥檚 look at a medium risk strategy to earn sats using Pendle鈥檚 USDe YT on the Ethereum mainnet.

With the same $20,000 in funds (but the difference is that the term will be 92 days because the Pendle pool will expire), the expected ENA income will be approximately $43,710, and the net income after deducting the principal will reach approximately $23,710 (the value of YT will be zero at maturity, so you will lose $20,000 in principal), which is about 4 times that of the first strategy.

Under this strategy, the ROI is expected to reach 118.55% and the APY is expected to reach 331.22%.

It should be noted that the calculations in the table below are based on the current leverage ratio of the Pendle market. YTs real-time leverage ratio will be affected by market demand and expiration date.

If you do not choose the Ethereum mainnet, but operate on the Pendle pool on Arbitrum, the expected ROI and APY are slightly lower, to 114.96% and 321.18% respectively. The reason for this difference is actually because the real-time leverage rate of YT on the Ethereum mainnet and Arbitrum is different.

You can also perform similar operations in a Pendle pool on Mantle or Zircuit, but expect some changes in the data.

High-risk strategy: lock ENA and then buy YT

Finally, let鈥檚 look at the highest risk, highest potential return strategy, which splits the principal 50:50, with half used to lock in ENA and the other half used to purchase Pendle鈥檚 USDe YT.

Why is it so complicated? This is because Ethena will provide additional yield incentives to users who lock ENA representing 50% of the total value of their USDe holdings. By holding YT-ENA and YT-USDe in the same wallet, this will increase your total rewards in both pools by 50%.

This may also be the strategy adopted by the most savvy YT traders, who may have made full use of the airdrop rewards they received in Season 1 in order to obtain higher sats accumulation efficiency in Season 2.

As shown in the table below, this strategy (deployed on Arbitrum) offers the highest returns – 162.56% expected ROI and 454.17% expected APY, but in turn comes with higher risk due to locking in ENA.

Note: The USDe pool is on Arbitrum and the ENA pool is on the Ethereum mainnet.

Finally, if you choose to use the Pendle YT strategy, you need to pay attention to the real-time leverage. When the market is selling YT (which is more likely to happen near the expiration date), the leverage will increase, and vice versa. Although the real-time leverage will continue to change based on the situation of the YT market, once you buy YT, the leverage for your own position will not change and will last for the entire holding period.

This article is sourced from the internet: Analysis of Ethena鈥檚 mining yield in the second quarter, 400%+APY is not a dream?

Related: Can Jupiter (JUP) Overtake ThorChain After Its 18% Rally?

In Brief Jupiter price exploded in the last 24 hours, bringing the altcoin closer to $1.80. The altcoin is not only the second biggest DEX by volume but is also close to overtaking ThorChain (RUNE) in terms of market cap. Bears that have been pining for correction are failing, with over $2.8 million liquidated in the past three days. Jupiter’s (JUP) price was impressive these last couple of days after the platform established its presence in the Decentralized Exchange (DEX) market. The question now is if the cryptocurrency can continue this bull run and surpass some of its other competitors. Jupiter Makes a Dent Jupiter launched its native token, JUP, back at the end of January. However, the cryptocurrency blew up only last month. The altcoin shot up from $0.47…