Looking for Alpha in the bull market, how does BGB leverage the market APR?

As the US SEC approved the spot Bitcoin ETF, Bitcoin prices have hit new highs and competition among cryptocurrency platforms has become increasingly fierce.

Buyers and sellers are betting on the rising market, holdings are rising, and market fluctuations are tugging at the heartstrings of countless investors. Investors try to interpret every subtle change in the market and find a reasonable explanation for every rise and fall.

Careful investors have already discovered that this round of bull market is different from the past. There is no general rise in the market, but Bitcoin leads the whole market. Most investors who did not buy Bitcoin far underperformed the industry Beta. Platform coins have become one of the few tokens in the entire industry that can capture the industry Alpha and have a certain value.

Recently, TOKEN 2049 held a summit in Dubai, and Dubai was hit by a once-in-a-century heavy rain. Bitget provided a shelter for participants to take a short break, and held an open day in the Dubai office, inviting users to participate, communicate face to face, and directly listen to users opinions and suggestions. Bitget is the first trading platform to open its office. This move by Bitget marks it as the first trading platform to open its office space to the public, demonstrating its open spirit as an industry leader and its deep commitment to the community.

The average return rate is 138%, Golden Shovel BGB

According to TokenInsights Q1 2024 report, the platform coins GT, BNB and BGB increased by 108%, 95% and 81% respectively, all greater than the increase in BTC in Q1.

Image source: TokenInsight

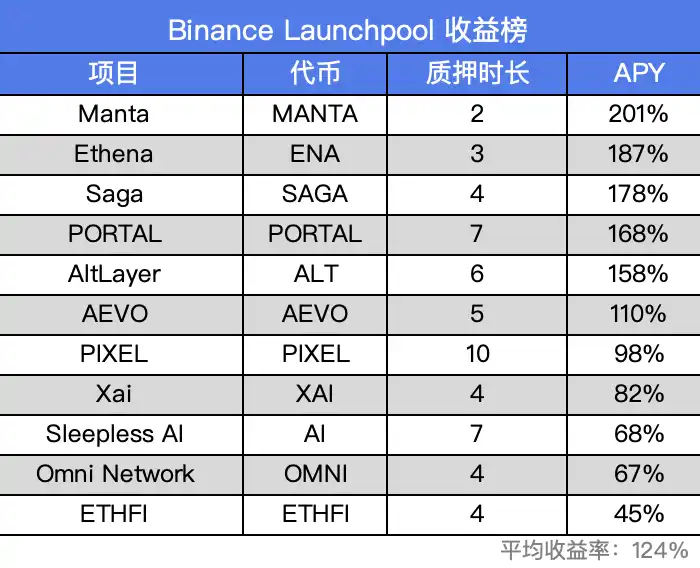

According to public data, Binance has conducted a total of 11 Launchpools since 2024, with an average annualized rate of return of 124%.

The overall average annualized rate of return of Bitget is higher than that of Binance, which is 138%. Since 2024, Bitget has launched seven Launchpool projects, including popular projects such as ZKFair ($ZKF), ZetaChain ($ZETA), and Ethena ($ENA).

Interestingly, BGB is also the first platform coin to hit a new high in this round of market. Today, BGBs market value has exceeded 1.7 billion US dollars, ranking 57th among all crypto assets and the fifth largest platform coin. If the price of BGB is adjusted to the K-line in monthly units, it will be found that BGB will hit a record high almost every 1 or 2 months.

In reality, many platforms do not want to conduct IEOs, but the high-quality projects in the market have been divided up by Binance and Bitget. Since 2024, OKX has only conducted one Jumpstart, and this project, Polyhedra Network, was jointly conducted with Bitget.

Thanks to the continuous high returns and skyrocketing prices, BGB has gradually gained the reputation of Golden Shovel in the community.

Through Launchpool, Bitget has added new usage scenarios for BGB, driving demand growth. At the same time, it has also locked liquidity to a certain extent, making the scarcity of tradable BGB in the market more scarce, which is beneficial to the long-term development of the currency price. In addition to Launchpool, Bitget has recently launched a new mining platform PoolX, which is positioned as a lighter Launchpool with a higher frequency and faster pace. The yield of BGB and USDT remains at 20% – 30%, which is a good return rate regardless of bull or bear markets.

Not only that, holders of BGB can also enjoy a variety of rights and interests on Bitget, such as 20% off spot transaction fees, no withdrawal fees for staking BGB, etc. According to the BGB white paper, the introduction of a repurchase and destruction mechanism will be considered in the future to further enhance the value and scarcity of BGB.

Explore high-quality assets and deeply deploy spot

In this round of market conditions, more platforms choose to launch a large number of projects without caring about the quality of the projects.

Of course, data shows that Bitget has launched quite a few projects, with a total of 186 new assets launched in Q1 2024, ranking third among all platforms. However, after communicating with the Bitget coin research team, it was found that Bitgets coin listing strategy is not to blindly pile up the number of new assets.

Image source: Bitget

Bitget has clear quantitative standards when evaluating new assets. It does not rely mainly on business and channel project recommendations, but is driven by top-down research to proactively explore high-quality assets. In an interview, Bitget Research Institute revealed three key decisions about listing coins: value-driven, efficiency-oriented, and comprehensive radiation. Bringing wealth effects to platform users and focusing on user interests is the beginning of Bitgets development.

In order to create more opportunities to make money, Bitget has listed currencies that are expected to rise in the short term or have good fundamentals and are expected to rise in the medium and long term. For example, ORDI, the leader of the BRC 20 track, TIA, the leader of modular blockchain, and GAS, the fuel token of the public chain Neo. Thanks to its early launch, Bitget has become the dominant market for these tokens, second only to Binance and OKX.

For early popular currencies, Bitget will strive to go online as soon as possible to seize the precious time window for users. For example, Bitget has launched UNIBOT, a Bot track asset, as early as July 2023. For old projects that have skyrocketed again due to major positive news, Bitget has an interesting strategy. They may not go online immediately, because it may cause users to chase high and suffer short-term losses. On the contrary, Bitget will choose the right time to go online. Community user Alice said that Bitget did not have the coin GAS at first, but shortly after GAS suddenly became positive in October last year, Alice noticed that Bitget officially announced the launch of GAS. At first, she did not pay attention to it. As a result, GAS skyrocketed 10 times in the next two weeks, which made the users who got on board at that time reaped a lot of benefits.

For trading platforms, how to strike a balance between the quantity and quality of online projects is a difficult test to answer.

Bitget COO Vugar Usi said in an AMA that the spot business will be the key strategic direction of Bitget in 2024. It will continue to enrich the currency types, actively look for potential projects, introduce different spot areas, etc. As of now, there are more than 750 available tokens and more than 820 spot trading pairs on Bitget.

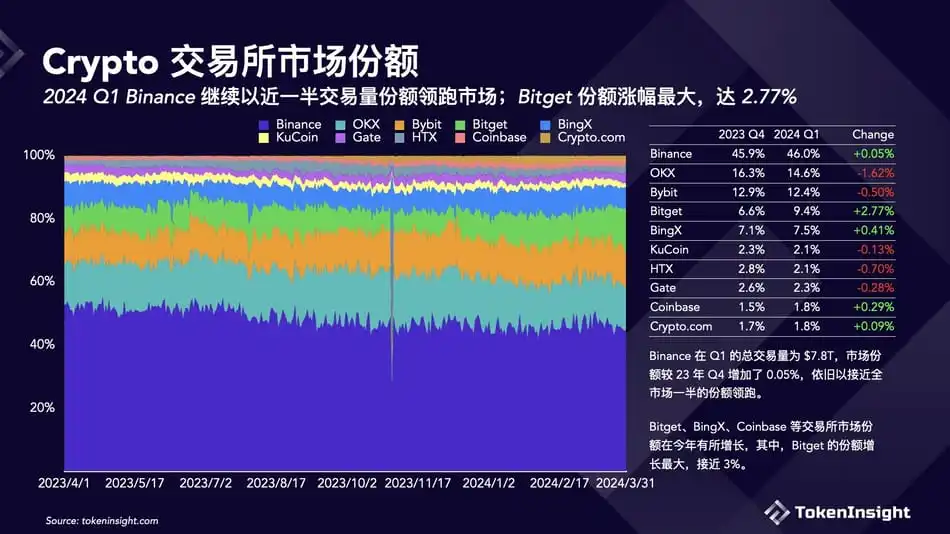

Judging from the data, Bitgets spot strategy has achieved good results and successfully achieved a balance between the two. TokenInsight data shows that in Q1 2024, Bitgets market share increased the most, close to 3%. According to the 2023 CEX Market Report recently released by 0x Scope, Bitgets current comprehensive market share has jumped to fourth place, and spot growth is rapid. At the same time, the growth of spot business has also helped Bitgets performance in the traditional battlefield of contracts. Coinglass data shows that Bitgets BTC and ETH contract positions continue to rise, ranking second and third among contract exchanges respectively.

Image source: TokenInsight

User first, building a top platform

It is no coincidence that Bitget has grown into the fourth largest trading platform in just six years. Among Bitget’s four corporate values, the first one is “user first”, which means that its business decisions are based on user needs rather than the actions of competitors.

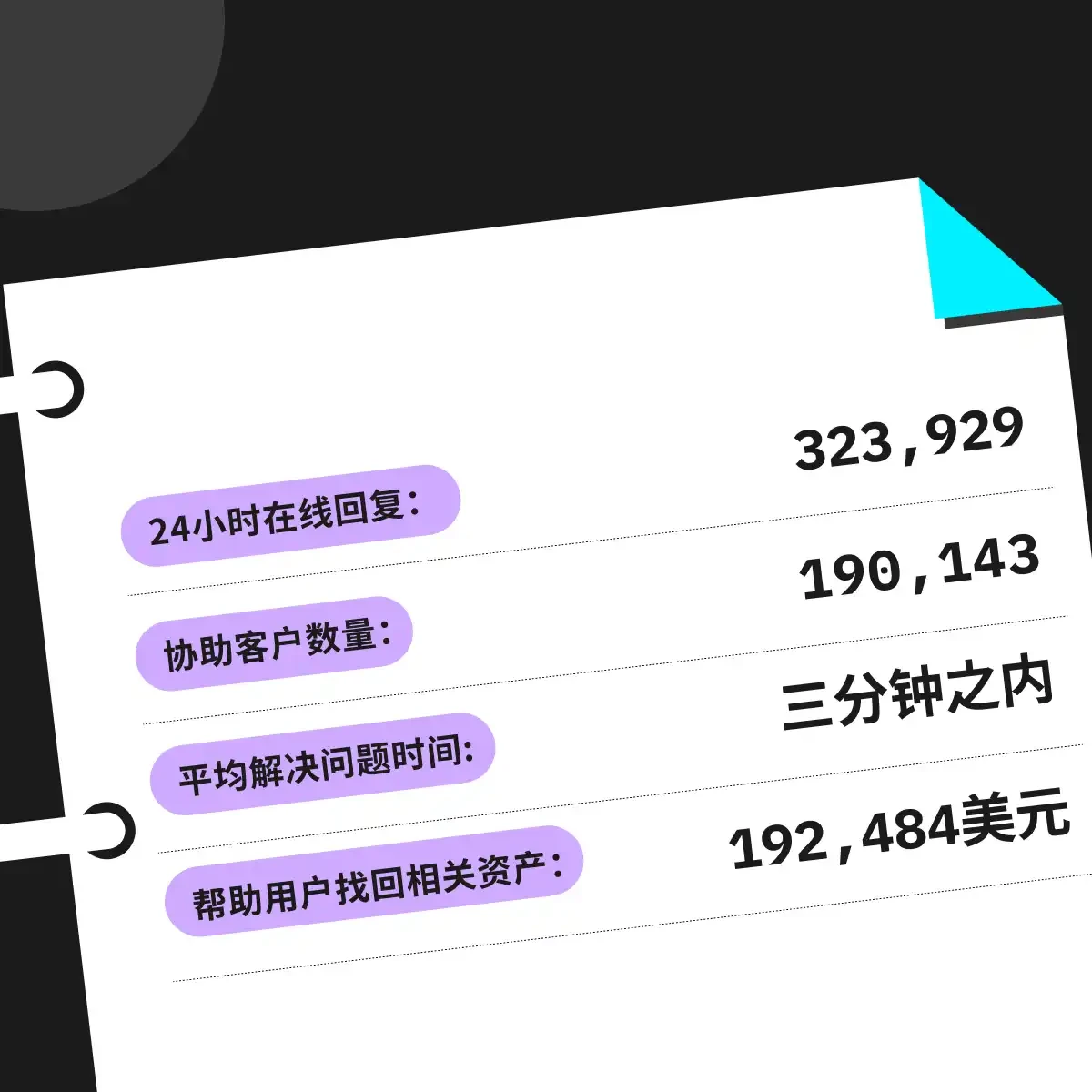

Bitgets quarterly report shows that it has worked with and provided support to more than 190,000 customers, with an average response time of less than 3 minutes. In addition, it has helped customers recover more than $190,000.

Source: Public information compilation

When asked how Bitget became the worlds top platform, Vugar Usi believes that as the crypto industry matures, competition among trading platforms will not only be limited to the platform or the transaction itself, but competition at the level of the entire crypto ecosystem.

In fact, Bitget has already built a diversified crypto ecosystem through its industry-wide layout. It has acquired the decentralized wallet Bitget Wallet, supported VC institutions such as Foresight Ventures, and invested in emerging public chains such as Morph, covering multiple upstream and downstream links of the crypto industry chain.

Another example of Bitgets current status is its exclusive cooperation with football superstar Messi. On the eve of the 2022 World Cup, shortly after Binance announced the signing of Champions League King Cristiano Ronaldo, Bitget reached a cooperation with another GOAT Messi in the football field. As the two most influential football stars in the world, Cristiano Ronaldo and Messi compete with each other in the World Cup. Signing Messi, who is as famous as Cristiano Ronaldo, also reflects Bitgets determination to challenge the industry leader.

In addition to leveraging Messis unparalleled global influence to promote the crypto industry, Bitget was able to reach a cooperation with Messi because its development history coincides with Messis growth experience. From being ignored and unpopular in the past, Bitget has been working silently and making progress day by day in places where the spotlight cannot reach, and one day, it has won the attention of the world and the industry.

Image source: Bitget

Bitgets six-year development history has also witnessed the rise and fall of many crypto platforms. Bitget has adhered to the concept of long-termism, brought rich returns to users, and made important contributions to the development of the crypto industry. This is the story of Bitget, and it is also a microcosm of the growth of every serious crypto company.

This article is sourced from the internet: Looking for Alpha in the bull market, how does BGB leverage the market APR?

Related: Here Is Why PEPE Price Could Continue Breaking New All-Time Highs

In Brief PEPE gained more than 25,000 holders in just 2 weeks and this growth rate is not slowing down. Its price achieved new all-time levels. 86% of holders are now in profit. PEPE, the third biggest memecoin in the market cap, behind just DOGE and SHIB, grew by almost 800% in the last month. The frog coin is now almost topping the $3B market cap. Despite all this growth, can this trend continue? On-chain and Technical Analysis shows us that PEPE price could soon reach new all-time highs. PEPE Gained More Than 25,000 Holders The recent spike in PEPE holder base by over 25,000 within two weeks speaks volumes about the growing trust in the currency. This influx of new investors serves as a solid foundation for sustained upward…