Can the new token economic model proposed by the EOS Foundation help it return to its peak?

Original | Odaily Planet Daily

Author | Asher

EOS was once considered one of the most promising blockchains in the Layer 1 sector. At the time of its launch, EOS was one of the top five cryptocurrencies by market capitalization. On the morning of April 25, Yves La Rose, CEO of the EOS Network Foundation (ENF), proposed new token economics on the X platform and said that he would meet with BPs later today to discuss this topic.

As soon as the news came out, according to OKX market data, EOS briefly broke through $0.95, with an increase of more than 12% in one hour, and has now fallen back to around $0.88. Next, Odaily Planet Daily will take you through a detailed interpretation of the new token economic model proposed by EOS.

A comprehensive analysis of the EOS token economic model

Reviewing the Iterative History of EOS Token Economic Model

-

2018: EOS tokens are launched with a supply of 1 billion tokens and an annualized inflation rate of 5%. 1% of the inflation is used to reward block producers, and 4% is accumulated in the eosio.saving account;

-

2020: With no framework to access and spend the assets accumulated in “eosio.saving ” , EOS block producers voted to reduce network inflation to 1% and destroyed the remaining EOS tokens accumulated in “eosio.saving ” .

-

2021: EOS block producers choose to increase network inflation to 3% to bootstrap the EOS Network Foundation. 1% of inflation continues to pay block producers, and the other 2% begins to fund the EOS Network Foundation;

-

2023: The EOS Network Foundation (ENF) begins manually funding EOS Labs as a new entity responsible for investment and growth of the ecosystem. ENF begins allocating 0.5% of the 2% network inflation funds to EOS Labs via manual transfers.

-

Early 2024: EOS block producers pass MSIG to update the system contract, which will automatically pay 0.5% inflation fees to EOS Labs and reduce ENF fees to 1.5%. The passage of this proposal marks the networks recognition of EOS Labs as an officially recognized foundation entity;

-

This proposal: The EOS Network Foundation proposes to transform EOS from an inflation token to a token with a total supply of 2.1 billion.

New proposal: curb inflation with 2.1 billion token supply and destroy 80% of the total future supply

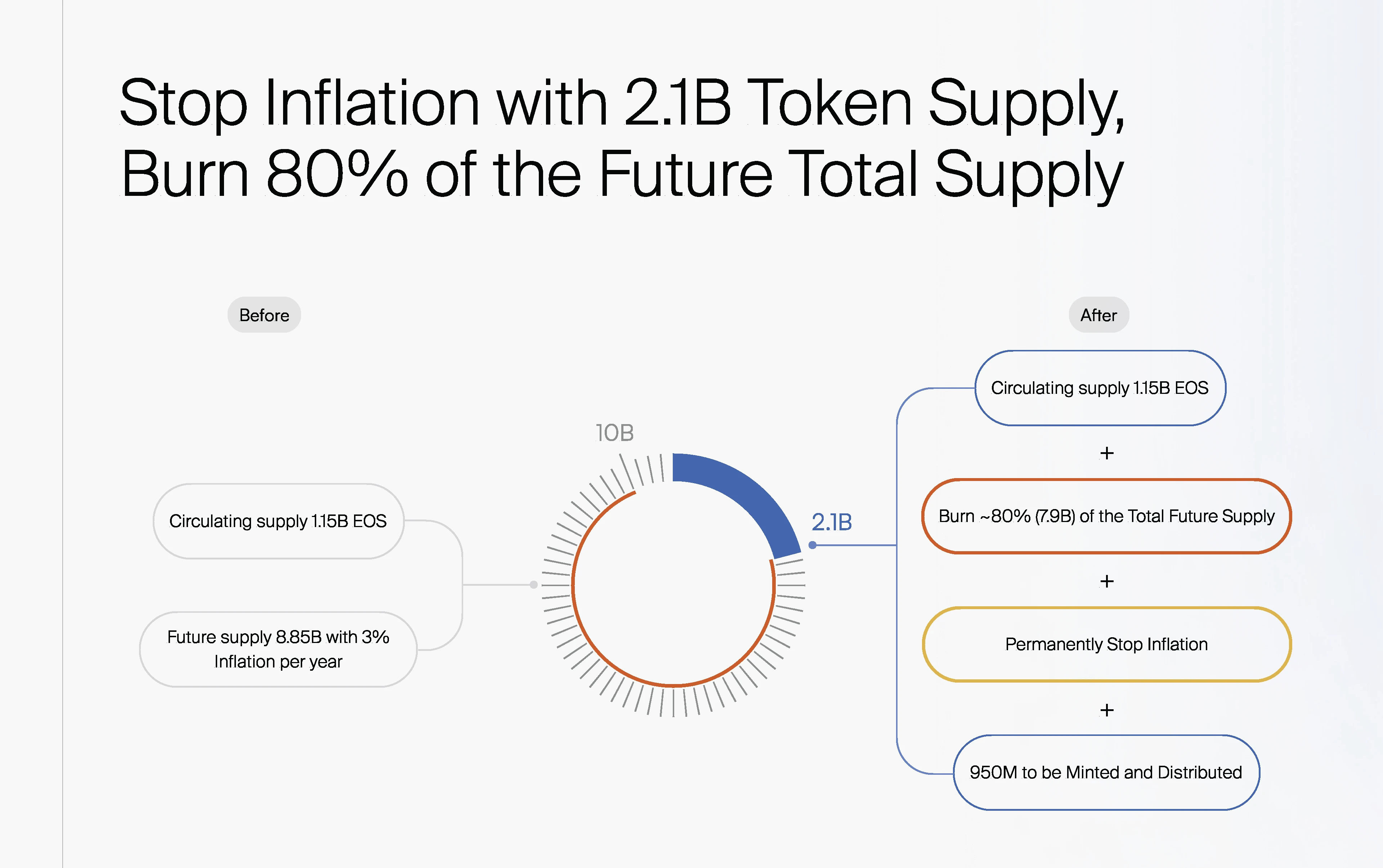

According to the latest proposal, EOS will transform from inflationary tokens to a fixed number of tokens with a total supply of 2.1 billion. The following figure shows the comparison of token supply before and after the proposal:

-

Before the proposal (before token destruction): It consists of two parts: one is the circulation of 1.15 billion EOS tokens, and the other is the total future inflation of 8.85 billion EOS tokens, with an annual inflation rate of 3%;

-

After the proposal (after token destruction): 80% of the future inflation supply (7.8 billion EOS tokens) will be burned. The final actual token composition is divided into two parts, one is 1.15 billion circulating tokens, and the other is 950 million will be minted and distributed.

Image source: EOS CEO tweet

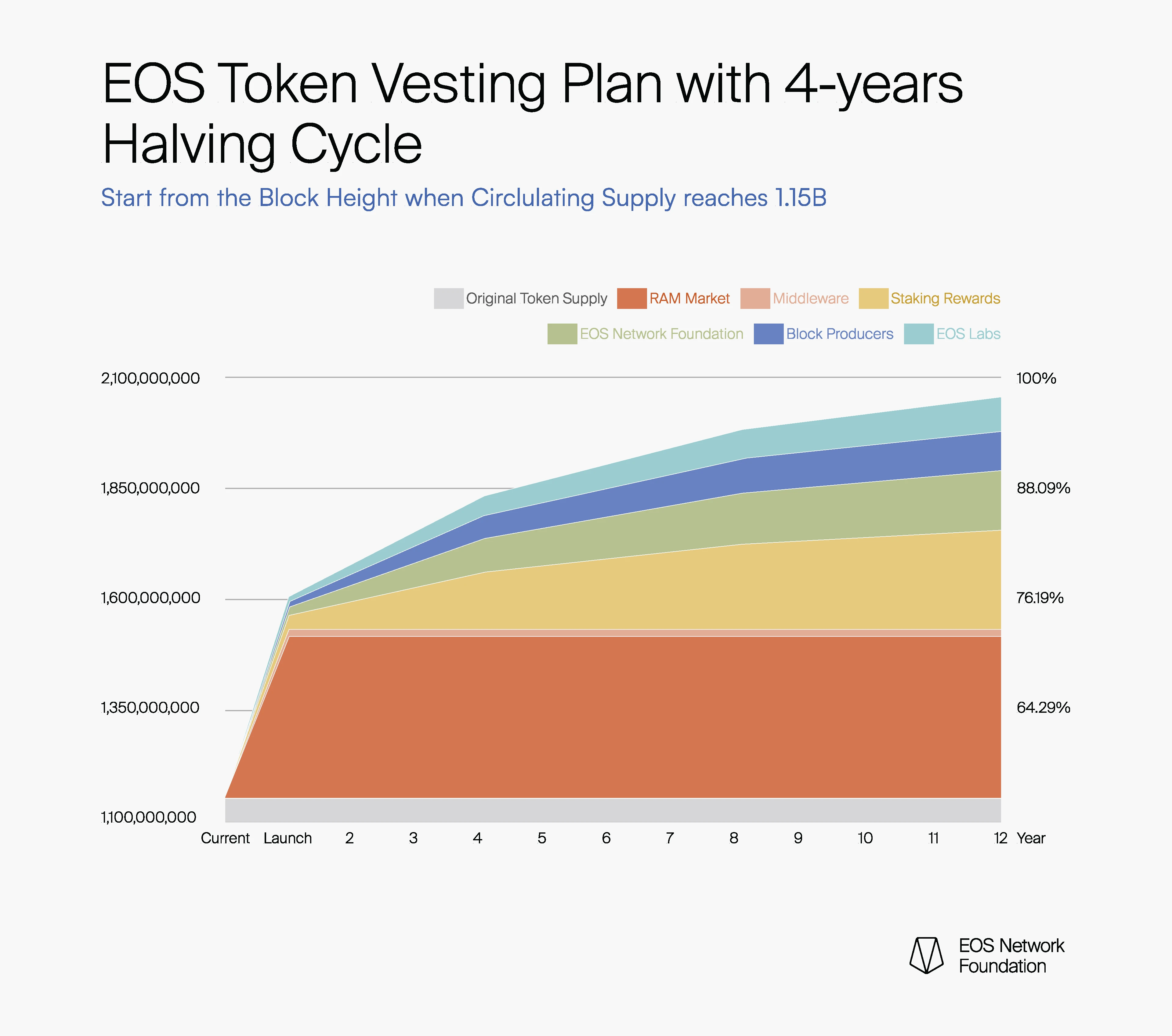

Specifically, if the new proposal is implemented, the actual token distribution will be as follows:

-

Original Token Supply: 1,150,000,000 EOS, representing 54.8% of the total supply . The current number of tokens that existed prior to this proposal will remain unchanged, totaling approximately 1.15 billion EOS tokens , with a commitment that no other changes will be made to this initial supply;

-

RAM Market: 350,000,000 EOS, accounting for 16.7% of the total supply . A total of 350 million EOS will be used to develop and grow the RAM market and its crypto community. Specifically, one part is RAM market making and liquidity provision. 315 million EOS will be allocated for market making and liquidity provision for centralized exchanges and DeFi across multiple blockchains. The other part is programmatic RAM procurement. 35 million EOS tokens will be used to programmatically purchase RAM from the system Bancor pool within the TBD time frame. RAM purchased through this mechanism will be used to support or fund EOS ecosystem initiatives;

-

Staking rewards: 250,000,000 EOS, accounting for 11.9% of the total supply . A total of 250 million EOS tokens will be used for staking rewards, with the reward release rate controlled by EOS block producers. The proposal suggests using a logarithmic curve to distribute rewards;

-

EOS Network Foundation: 150,000,000 EOS, representing 7.1% of the total supply. The EOS Network Foundation will distribute 150 million EOS tokens, equivalent to 8.5 years of current 1.5% network inflation;

-

Block Producers: 100,000,000 EOS, 4.8% of the total supply. In order to make block production and network infrastructure more sustainable in the long term, all network fees generated by PowerUC, RAM transaction fees, and name auctions will be evenly distributed to the top 21 block producers;

-

EOS Labs: 85,000,000 EOS, 4% of the total supply. The token will be used to invest in ecosystem growth, liquidity provision for ecosystem projects, and partnerships;

-

Middleware: 15,000,000 EOS, representing 0.7% of the total supply. 15 million EOS tokens will be used exclusively as public product funding for middleware development to improve the usability of the EOS network.

EOS Release Table under the New Token Economic Model

This article is sourced from the internet: Can the new token economic model proposed by the EOS Foundation help it return to its peak?

Related: jam: New hope for the creator economy in the Base ecosystem?

Original|Odaily Planet Daily Author: Wenser On April 21, according to official news , the jam.so creator economy app launched by Farcaster and LensProtocol ecological project jam had a transaction volume of over 10 million US dollars within 72 hours of its launch, with a total of over 47,000 transactions. According to Dune data , the current transaction volume of jam.so has exceeded 270 million DEGEN. As another new seed of Farcaster and DEGEN ecosystem SocialFi, jam has currently received a donation of 1 million DEGEN tokens , which will be used for ecological development in the future. Today, Odaily Planet Daily will share with you about this small and beautiful creator economy application. jam.so: A blockchain version of Instagram that allows creators to earn their first dollar? As a creator…