In addition to Runes, what other transaction demands will increase miner income?

Original author | CoinShares

Compilation | Golem

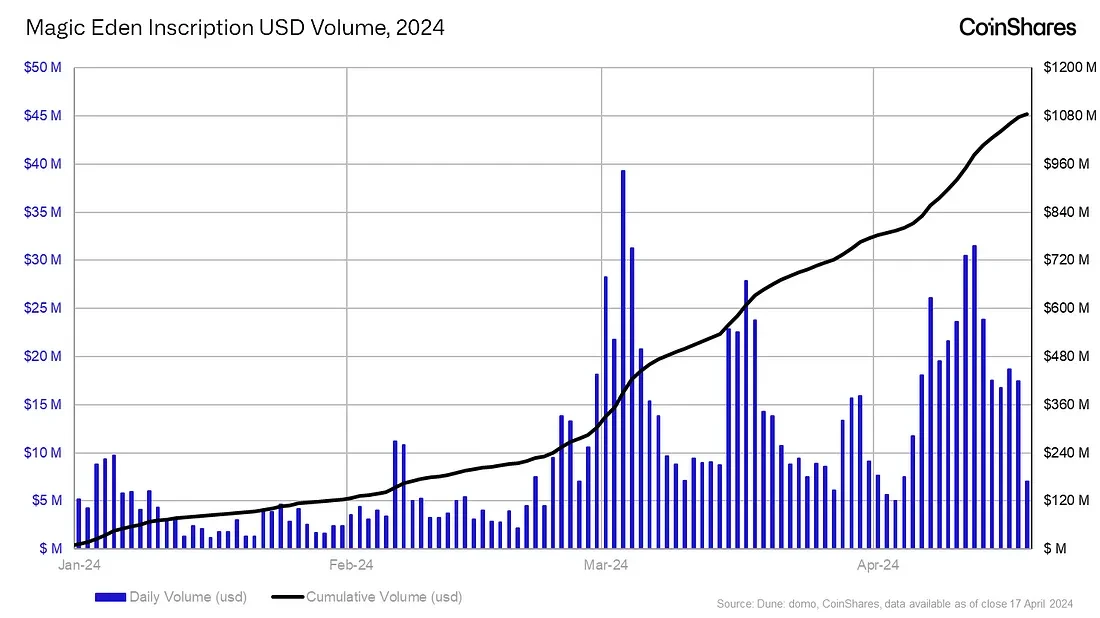

This article was written by CoinShares researcher Matthew Kimmell before the Bitcoin halving. The core idea is that Bitcoin transaction fees can offset the impact of the halving on miners. The first half of the article predicts that when Runes goes online, miners fee income will reach at least 150 btc/day (actually 1070 btc/day on the first day of launch, and it has not been less than 150 btc every day so far); the second half mainly explains the other 3 transaction requirements that can increase miners income in addition to Runes.

Since the first half of the original article is mainly about the prediction after the halving, it is outdated and will not be recompiled in this article. This article mainly extracts the second half of the original article, in which Matthew Kimmell believes that in addition to Runes, there are 3 other Bitcoin transaction requirements that can increase miners income for readers reference.

On-chain collectibles and rare satoshis

The release of the Ordinals protocol revealed a tracking system for the smallest unit of Bitcoin, Satoshi (equivalent to 0.00000001 or 10^-8 BTC), which users voluntarily agreed to. According to the Ordinals protocol, each Satoshi is assigned a sequential number. By adopting such a standard, the first Satoshi mined to the last released Satoshi will be marked and identified along a sequential number. In other words, when looking at the smallest unit of Bitcoin in this way, each Satoshi becomes an independent non-fungible unit.

Users can also choose to attach arbitrary data files to the Satoshis they own to add additional uniqueness. These files are called inscriptions, and users can mix inscriptions with any Satoshis they own while retaining the ability to transfer and store such modified Satoshis on the Bitcoin network, just like regular Bitcoins.

As a result, many satoshis are now tagged with images, text, or even complete video game files, making them uniquely distinguishable from one another and giving investors different reasons to value those satoshis.

Because of the unique numerical significance of the serial number itself or the relevant inscriptions engraved, the collection value of some cong coins has been proven in the market.

In the first case, a satoshi inscribed with an image called the Genesis Cat was auctioned for $240,000 and was hailed as a unique 1/1 artwork with cultural and political significance, and part of the Quantum Cats series, an inscription series designed to symbolize and support the restoration of previously removed features in the Bitcoin protocol. In another case, a satoshi without an inscription was sold for $165,100 because it was advertised as a satoshi with a scarce supply that could be traced back to Bitcoins first difficulty adjustment period.

These high-priced sales events provide incentives for those who are looking for valuable Satoshis on-chain. The purpose of selling Satoshis on the secondary market at prices far above the normal market is changing the propensity of some users to pay transaction fees. It is safe to say that the desire to collect a Satoshi with special significance and sell it on the market for a profit of hundreds of thousands of dollars will cause competitors to offer much higher transaction fees than normal transactions.

Given that the halving is a completely predictable and scarce event in Bitcoin鈥檚 history, there is bound to be competition in collecting the rare Satoshis and etching the runes for the first block. The first Satoshis mined after the halving are expected to be so valuable that the Foundry USA mining pool even plans to share its revenue with miners for winning the right to mine the block. This may be short-lived, but this intense competition will definitely cause fees to soar.

Private transaction requirements

Another atypical demand could be a transaction accelerator. Marathon launched a product called Slipstream in late February, which opened a way for users to bypass the Bitcoin memory pool (the packaging waiting area for transactions) by directly communicating and paying transactions to the MARA mining pool. Although the product does not provide much advantage in earning fees compared to other mining pools, there are still several successful examples.

While not widespread, accelerators like Slipstream have the potential to increase fees in an indirect way if there is enough demand. If a transaction is submitted directly to a mining pool, it is not known to any other Bitcoin user in advance. As a result, other users may find that their transactions within the block fee range actually need to wait because the low-fee transactions submitted directly to the mining pool are included in the block secretly, but this does not reflect the true fee situation. This can confuse consumers about how much fee should be attached to accelerate their transactions. As more transactions flow to these accelerators, multiple fee markets will emerge, some public as part of the Bitcoin protocol and others private.

In a state where transactions need to be confirmed quickly, this chaos in the private fee market could lead to users overpaying compared to actual fee expectations in the public market, but it is worth noting that we have not seen this happen on a large scale.

Miner Extractable Value (MEV)

MEV is another emerging dimension of Bitcoin block space demand. MEV refers to situations where a miner (or mining pool) has the opportunity to earn additional profit by manipulating the order of transactions within a block. Previously, MEV was a potential feature of Bitcoin that was limited due to Bitcoins strict functional limitations and simple transaction model. However, due to changes in the Bitcoin software and the nature of how users conduct Bitcoin transactions, MEV has become more pronounced. Here are 3 possible sources of MEV revenue:

1. On-chain collectibles: Because some inscriptions and satoshis have high value, and the market technology is still relatively inefficient, it is possible to obtain additional income by buying, sniping and reselling mispriced assets, and even miners are willing to sacrifice fee income to grab higher-value satoshis.

2. Tokenized assets: Runes, BRC-20, RBG, Taproot assets, and other possible token assets open the door for miners to participate in front-running and arbitrage transactions to obtain additional rewards.

3. Bitcoin plug-in: As more and more external platforms or Bitcoin L2 use Bitcoin as settlement, miners may be able to exploit loopholes in early designs and additional incentives for them (such as merged mining) to obtain higher income.

This halving means a further reduction in block rewards and a relative increase in the importance of transaction fees for miners. This may provide additional motivation for miners to seek transaction-related benefits and find diversified means of income. Therefore, we believe that MEV will at least be tried.

Summarize

The diversification of Bitcoin transaction demand could be a lifeline for mining economics. As halving events reduce block rewards, these new uses of Bitcoin block space could significantly increase transaction fees. This is critical for miners because these fees can offset the loss of block rewards and maintain their profitability.

As mentioned previously, transaction fees in the near term will be significantly increased by competition from new market sectors, such as issuing assets and finding unique collectibles. These applications will not only bring additional transaction fees, but may also encourage the emergence of more strategic transaction processing methods.

Ultimately, the shift of miners to a more complex economic model that relies more on transaction fees highlights the importance of understanding and exploiting new Bitcoin transactions to remain competitive.

Looking ahead, I expect transaction fees to far exceed 50% of mining revenue in some blocks. Looking back at the two-month period at the end of 2023, a period dominated by the inscription market, average transaction fees accounted for 30% of mining revenue after the halving. If this average value (193 BTC/day) is maintained, it will make up 43% of the impact of the halving on miners revenue.

However, the sustainability of these transactions driven by non-Bitcoin demand remains an unresolved mystery – are they leading long-term changes in the Bitcoin trading market, or are they just a temporary symptom of the bull run?

This article is sourced from the internet: In addition to Runes, what other transaction demands will increase miner income?

Related: This Is Why Shiba Inu (SHIB) Is Posed for a 16% Rally

In Brief Shiba Inu price is expected to bounce back to mark a new year-to-date high owing to bullish cues. Whale addresses have accumulated over $330 million worth of assets in the past month. Active addresses by profit show resilience from selling as profit-bearing investors are taking a backseat. Shiba Inu (SHIB) witnessed a good start to the month of March as it charted new 2024 highs, but this did not last long. Following corrections and recovery, the meme coin is now at a crucial price, which will likely rally for this reason. Shiba Inu Whales Don’t Quit Shiba Inu’s price corrected by over 30% at the beginning of the month, but this did not discourage the large wallet holders who kept on adding SHIB to their wallets. In the…