The popularity of Runes is a setback in the development of encryption technology, but it is also the best embodiment of

Original author: @Web3 Mario

Introduction: Yesterday, I accidentally learned from a friend that he had obtained a considerable return on investment in the field of BTC inscriptions, which deeply aroused the authors mentality of stepping into the void. I was anxious for two consecutive days, which was really shameful. Recalling that the Ordinals technical architecture had just been released earlier, the author studied the relevant documents, but as a developer, I was quite dissatisfied with this technical path. At that time, I judged that this was simply a reversal of encryption technology, because its design concept seemed to be similar to a distant altcoin project Color Coin, that is, how to use the technical architecture of BTC to issue some independent tokens, but the difference is that Ordinals did not redevelop a chain, but chose to reuse the current BTC network that has been widely agreed upon. Compared with the proposal of on-chain virtual machines (such as EVM or other WASM), this architecture has been confirmed by the market to be somewhat crude and non-scalable. Due to the fact that BTC does not have a Turing-complete execution environment, the development of related application layers is relatively difficult, and it is also very expensive! Even after the so-called orthodox Runes technology was released, the author was quite skeptical after reading the relevant documents. He just determined some standards to make the so-called BRC-20 look less simple, and these are not worth mentioning in the on-chain virtual machine solution, because designing an ERC-20 is really something that a novice Web3 developer can accomplish… However, these judgments are so pale and ridiculous in the face of the real wealth effect. After calming down, I have some related thoughts to share with you.

The tangible fact at the root of all our thought-distinctions, however subtle, is that there is no one of them so fine as to consist in anything but a possible difference of practice. To attain perfect clearness in our thoughts of an object, then, we need only consider what conceivable effects of a practical kind the object may involve—what sensations we are to expect from it, and what reactions we must prepare.

—-William James

Anarchism post-Snowden

Many of my friends marvel at the emergence of Bitcoin, just like the golden age of ancient Greece. It seems to be an unconventional and inexplicable genius product. However, I do not agree with this view. I believe that the invention of Bitcoin is not accidental at all. It is an inevitable result of the network environment at that time.

In the previous introduction, we have reviewed the development history of the Web. In the era of classical liberal networks, the Internet protocol design principles of openness, inclusiveness, globalization and neutrality were gradually formed. However, with the emergence of a large number of Web applications, the composition of Internet users has changed greatly, from the previous subculture group of coders to a universal mainstream cultural group covering all kinds of people, with pragmatism that prioritizes high efficiency and low cost prevailing.

But this does not mean that the principle of open protocols disappears completely. Unlike political revolutions, the evolution of technology is non-violent, so the evolution of the corresponding ideology is a process of gentle integration. In fact, some developers, whom we can call the remnants of classical liberalism, have been adhering to the principle of open protocols to carry out technology research and development and related concept promotion work. We can find them very easily, such as the Free Software Foundation, the Electronic Frontier Foundation, the Wikimedia Foundation and other organizations. They have successively funded and promoted many interesting technical solutions, such as Tor, VPN, SSH, etc., and they are also the earliest batch of Bitcoin users, using Bitcoin for fundraising. Therefore, there is reason to believe that the design of Bitcoin must come from this group of people, and the initial purpose is to develop an unregulated, anonymous electronic cash system for payment for organizations.

The huge success of Bitcoin has attracted the interest of some computer experts. I believe Vitalik and Gavin Wood belong to this group of people. With the help of Bitcoins most important original technology: the POW consensus algorithm, it has become possible to build a decentralized and anonymous computer system, thereby completely changing the classic C/S Web development paradigm.

With the outbreak of the sensational Prism Incident, the credibility of technical and political authorities has been greatly reduced, which provides an excellent opportunity for the promotion of new concepts. Therefore, we can see the emergence of Web3 with the latest semantics, that is, Web3 proposed by Gavin Wood. Here I think it is necessary to quote this classic description again:

Web 3.0, or as might be termed the “post-Snowden” web, is a re-imagination of the sorts of things we already use the web for, but with a fundamentally different model for the interactions between parties. Information that we assume to be public, we publish. Information we assume to be agreed upon, we place on a consensus ledger. Information that we assume to be private, we keep secret and never reveal. Communication always takes place over encrypted channels and only with pseudonymous identities as endpoints; never with anything traceable (such as IP addresses).

The core vision of this version of Web3 is to build a decentralized, uncensored, and fully privacy-protected online world, which can be seen as a classic interpretation of anarchism in the online world, so I would like to call it anarchist Web3. It is worth noting that the significance of making such a clear distinction is that we need to figure out what principles should be used to guide our application design in order to achieve the ultimate vision, so as to complete the construction of the network, which is most in line with our demands.

Guided by such ideology, the extreme pursuit of decentralization and privacy has spawned a series of interesting Web3 projects. The successful cases in such projects are usually based on the underlying infrastructure. Recalling those exquisite cryptography and consensus algorithms, I will not give specific examples because you can find many well-known projects, but there are not many involving the application layer and protocol layer. Perhaps ENS is an exception.

Hyper-financialized liberal capitalism

Since MasterCoin designed the ICO crowdfunding method in 2013, the crowdfunding financing model with cryptocurrency as the underlying asset has gradually become popular. With the improvement of protocol layers such as ERC 20, the threshold for issuance and participation has been greatly reduced. In 2017, the development of ICO reached its peak.

Lets review that period of history. Coins (or tokens) as the subject matter have also evolved into different types, the most representative of which are utility certificates and ownership certificates. The former is similar to an admission ticket. Only with this certificate can you have the right to use the target project. In fact, in the early days of ICO development, most of the tokens issued by projects belong to this type, including Mastercoin, NextCoin, and even Ethereum (the early design of Ethereum did not include POS planning).

I believe that the emergence and rapid development of ownership certificates are inseparable from two opportunities. The first is that a geek named Sunny King proposed Proof of Stake (POS) in 2012 and developed Peercoin. I think the greatest contribution of this concept is that it was the first to propose a paradigm design that uses tokens to carry the ownership of a certain exclusive network (although here, tokens carry more of a dividend right). Then the paradigm design around network ownership became a hot topic, and in 2018, EOSs ICO reached its peak of development. However, the excessive development bubble and the explosion of applications that have been delayed have caused development to stagnate.

The second opportunity for the development of ownership certificates can be traced back to the issuance of Comp by Compound, which completely opened the era of ultra-financialized free capitalism Web3. For a long time before this, the focus of the development of ownership certificates was on the allocation of ownership of the underlying network, and the application layer did not seem to respond. In fact, some well-known Dapp projects were born very early. At that time, administrator governance + payment system was basically the mainstream model. Until the emergence of Comp, the Dapp development model of community co-governance + mining incentives around the key uses of Dapps through the ownership of token-carrying applications has gradually gained wide recognition and developed rapidly. Due to the rich financial returns, smooth exit mechanisms and the characteristics of a free market environment, investors of all sizes have brought huge amounts of funds into Web3. Similar to the changes in the classical liberal network, the industry has once again ushered in changes with the changes in the composition of major users. The meaning of Web3 has also undergone a great change. Let us recall the definition given by Chris Dixon:

Web3 is the internet owned by the builders and users, orchestrated with tokens. In web3, ownership and control is decentralized. Users and builders can own pieces of internet services by owning tokens, both non-fungible (NFTs) and fungible.

At this point, the difference is very obvious. Web3 has gradually shifted from the original pursuit of de-authorization and personal privacy to the redistribution of network resources by carrying network ownership through digital assets. Under this vision, the private ownership of digital assets and an absolutely free market are the ultimate goals, while de-authorization and personal privacy have degenerated into means to ensure the above two goals. This is an important change, which is basically equivalent to the political pursuit of free capitalism (in fact, in political philosophy, free capitalism is basically equivalent to a specific and concrete anarchism).

Under the guidance of such ideology, the innovation of the value categories and ownership distribution methods carried by digital assets has become the main evolutionary direction. Basically, before the recent intense wave of deleveraging, the main innovations in the Web3 industry were concentrated here. We need to be very clear about the difference between the two, because this will bring two completely different evaluation criteria. Some Web3 projects are very good in the eyes of anarchist Web3 supporters, but they seem meaningless to free capitalist Web3 supporters. Of course, there are also completely opposite situations. In the final analysis, it is because of ideological differences.

Innovation around digital assets will continue

After clarifying the difference between these two propositions, I hope to explore what the core driving force behind the next wave of rapid development of Web3 may be. Personally, I am more in favor of some views of pragmatism. In my opinion, the significance of judging a certain idea or concept lies in the effect of this idea on peoples behavior and the value it produces. The top-down thinking based on metaphysics is usually not conducive to the development of society. From this perspective, I also agree with socialism.

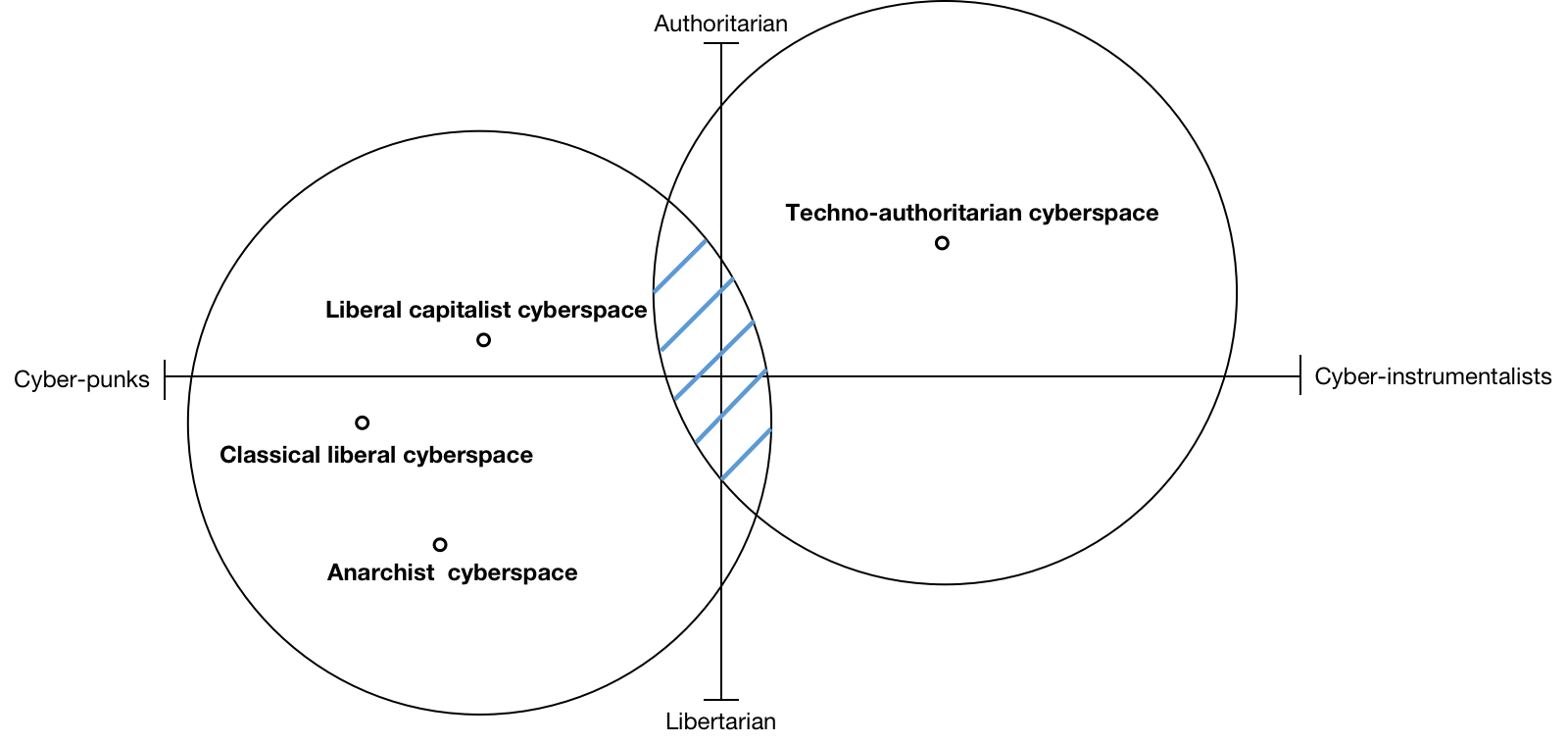

Under the guidance of such a concept, I think the development of the network world will most likely follow an eclectic, low-friction path. Remember the network ideology map we mentioned in the previous article? Generally speaking, we can classify the classical liberal network, anarchist Web3 and free capitalist Web3 into the same area, which is the relative part of the technical authoritarian network, and the future network world ideology will burst out with greater energy in the blue shaded part. The core of driving this development lies in whether there will be new and more universal value propositions to be discovered. From some of the existing achievements, I think digital assets basically have such capabilities, or innovation around digital assets will continue to be the core driving force of Web3.

First of all, I need to state that I do not disagree with the value of work related to decentralization and privacy protection. On the contrary, I think the relevant results are usually enlightening. However, based on the current actual situation, these two goals are usually based on the evolution of cryptographic technology and are subject to the development of related technologies. Some products supported by this concept are mostly unsatisfactory in performance, or compared with some mature computer network technologies, these products still have a lot of room for improvement. Moreover, as a basic discipline, cryptography has the characteristics of large investment and long output cycle, which is inconsistent with the current development status of Web3 companies, and I don’t think this situation will change in the short term.

However, the situation will be different when it comes to discussions about digital assets. So far, I am still impressed by the ingenuity of the design of digital asset ownership (or encrypted assets) in the Web3 world. The most direct impact includes three aspects:

-

A method of confirming ownership that relies solely on technical guarantees;

-

A method for realizing digital assets in a physical form that ensures the owners exclusive control over the digital assets;

-

A method for transferring digital assets based on the Internet;

It is no exaggeration to say that any previous technical solutions and specific products for the realization of digital assets are not as perfect as the Web3 solution, which also brings more practical value to the digital assets in Web3, that is, high liquidity and low-cost trust guidance, injecting new vitality into the development of the network world. Therefore, I believe that the core driving force of the next wave of rapid development of Web3 will continue to be innovation around digital assets, and in simple terms, innovation may be carried out in the following aspects:

* Paradigm innovation: Similar to FT and NFT, the introduction of each new paradigm of digital assets has injected unprecedented development momentum into Web3, because the introduction of new paradigms gives people specific boundaries of innovation and is instructive. On the surface, Fungible and Non-Fungible, this pair of opposite categories is enough to cover all types, but what I want to express is that this is wrong. Imagine gender. We have taken gender binary for granted for a long time, and then look at what we have achieved now. In fact, I think it is interesting to propose some Token paradigms with different characteristics under specific conditions, and Fungible is just one of the dimensions. There will be more dimensions to be discovered. Of course, the premise of innovation is to propose specific application scenarios of the corresponding paradigm to be valuable. Just recently, the introduction of new digital asset carriers such as Runes, which I think is a very good start;

* Value innovation : Through a certain economic model or application design, combined with the existing FT and NFT paradigms, carrying a new type of value is also a very meaningful innovation direction. Taking FT as an example, I think the value carried by the current FT can be roughly abstracted into the following types: practical value, growth value, dividend value and governance value. In the following article, I will analyze the differences between these four types of value in detail. Combined with the current development of the industry, I think credit value is likely to be the fifth dimension to supplement this.

* Business innovation : This type of innovation usually takes specific business as a breakthrough point, trying to solve old problems with new methods in the hope of achieving better results. I think there are two potential innovation paths here. The first is the transformation of traditional Internet business, using certain characteristics of digital assets to partially optimize or transform existing business models and form new competitiveness. The second is the optimization and transformation of existing usage models combined with digital assets, or it can also be called innovation in the token model. This type of innovation can usually act as a catalyst for industry development. Yield Farming, X-To-Earn, etc. all belong to this category;

In summary, I think that although Runes and other protocols seem to be a step backward from a technical perspective, as a new digital asset carrier, their value is still worthy of recognition. Let us wait and see what the future Web3 will look like.

This article is sourced from the internet: The popularity of Runes is a setback in the development of encryption technology, but it is also the best embodiment of the core value of Web3

Related: Mantle (MNT) Rebounds? Analyzing the Impact of a $36 Million Sale

In Brief Mantle price marked a new all-time high this week, reaching $1.31 before correcting slightly. Whales have sold about 30 million MNT in the span of three days, which was an expected outcome. Active addresses by profitability show that less than 12% of the participants are in profit, suggesting further selling is unlikely. Mantle (MNT) price continues to impress investors with its increases and rallies, which has resulted in the altcoin marking a new all-time high. The question now is whether MNT holders can sustain this rally or move to sell tokens. Mantle Investors Move Quick Mantle price reached a high of $1.31 this past week before correcting to trade at $1.22 at the time of writing. The altcoin still supports the 50-day Exponential Moving Average (EMA). However, as…