Shiba Inu (SHIB) price was expected to note a 43% rally before the meme coin fell victim to broader market bearishness.

However, SHIB has the support of not just the market but also its investors in potentially initiating recovery.

Shiba Inu Investors Prepare for a Rally

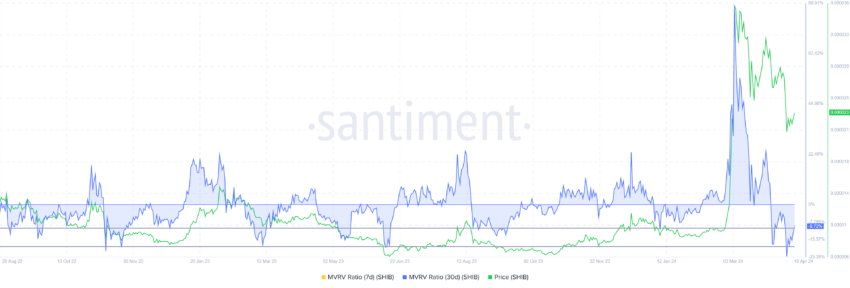

Shiba Inu’s price has seen the impact of its investor’s actions in the past. The meme coin tends to react positively to a bullish move from them, which is the anticipated outcome this time. According to the Market Value to Realized Value (MVRV) ratio, SHIB is in the opportunity zone.

The MVRV ratio monitors investor profits and losses. With Shiab Inu’s 30-day MVRV at -9.7%, indicating losses, accumulation may ensue. Historically, SHIB undergoes recovery at MVRV levels of -9% and -19%, marking it as an accumulation opportunity zone.

Thus, should investors stock up on SHIB at the current price, they could benefit from the eventual rally.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

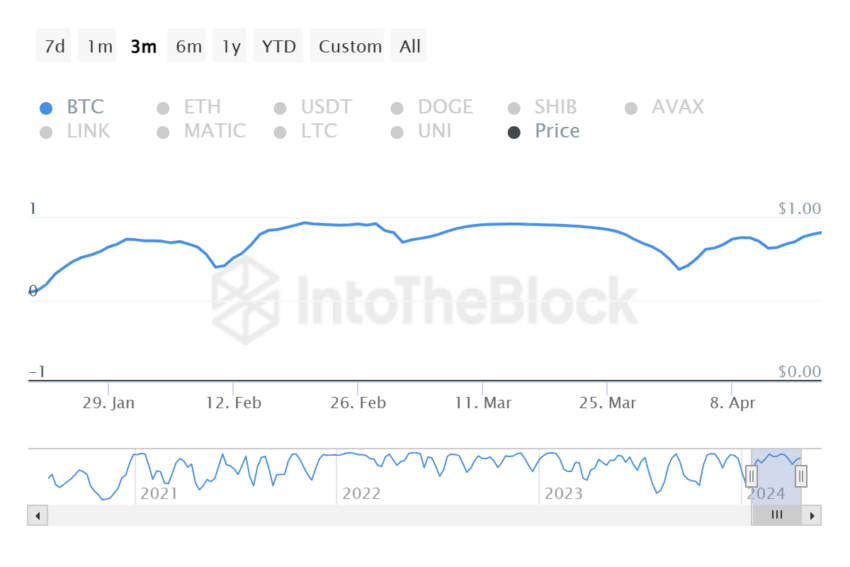

This price rise will likely occur in response to the broader market bullishness arising from the Bitcoin halving event. Set to take place in the next 12 hours, the halving will slash the Bitcoin mining reward by 50%, which historically has triggered a rally.

Given that SHIB and BTC share a high correlation of 0.83 at the moment, the meme coin will potentially ride this bullish wave.

Consequently, Shiba Inu’s price will also rise.

SHIB Price Prediction: Lookout for a Rise

Shiba Inu’s price, trading at $0.00002311 at the time of writing, is close to initiating a rally, which is expected to push the meme coin to $0.00002835. SHIB could rise by 23% with the bullish broader market cues, provided it can flip the $0.00002584 resistance into support.

This would also enable the meme coin to once again attempt to achieve the 43% rally target of the symmetrical triangle pattern.

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

However, if the support of $0.00002039 is lost, Shiba Inu’s price could decline considerably. The potential drawdown will bring the meme coin down to $0.00001473, invalidating the bullish cues.