Ethereum (ETH) price is one of the strongest altcoins in terms of resilience, holding well above $3,000 for several days.

This would give ETH the necessary boost to initiate a recovery and push back to new local highs.

Ethereum Investors Pine for the Rise

Ethereum’s price witnessed considerable losses following broader market cues in the last couple of days. The altcoin has since been holding above the $3,000 mark, and investors seeing this are pushing for further increases in price.

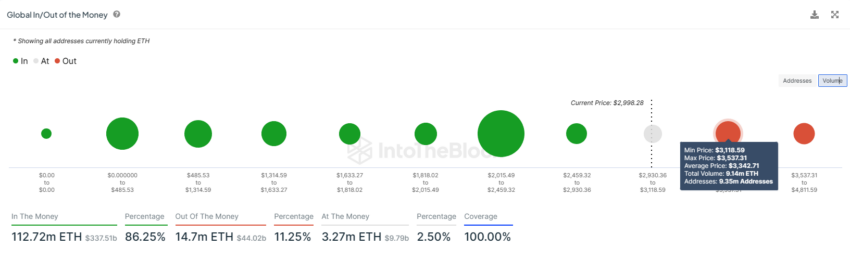

This is because a large chunk of the circulating supply is constrained within a 20% rally. According to the Global In/Out of the Money (GIOM), about 9.14 million ETH worth over $27.4 billion was bought under $3,537 and $3,118.

Given that this massive supply is sitting within a relatively smaller rally, ETH holders will certainly not give up until this supply bears profit.

Read More: Ethereum ETF Explained: What It Is and How It Works

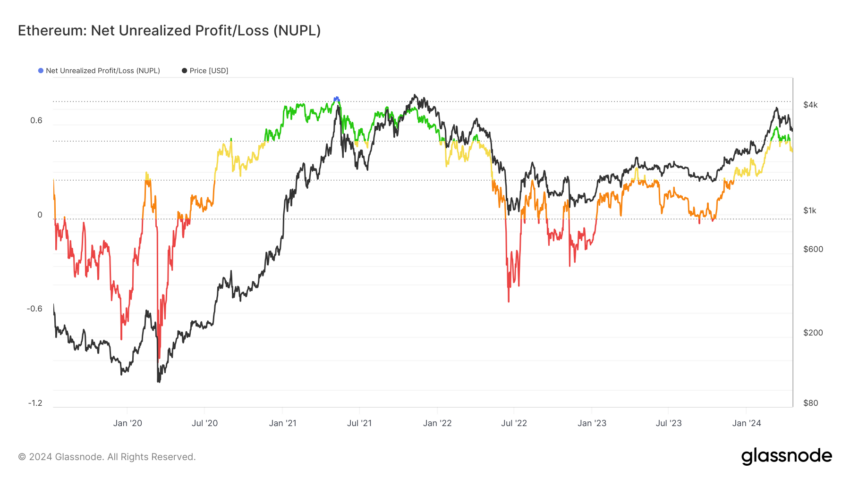

This sentiment is substantiated by the Net unrealized profit/loss (NUPL) indicator. This metric highlights the potential profits or losses the investors would obtain at market price should they move to sell.

When NUPL is high, investors are in profit, suggesting potential sell-offs; when low, it may signal accumulation or buying opportunities. In other moments, the metric is divided into zones to understand investors’ mindsets.

Currently, ETH is in the Optimism zone, which has historically been the trigger zone for price rallies.

Despite the correction, the NUPL in this zone is evidence that Ethereum’s price still has the potential to note a rally once again.

ETH Price Prediction: A Bounce Back From This Support Level

Ethereum’s price trading around $3,000 is fighting hard to ensure this price point is not lost as support. Given that the investors are currently heavily bullish, ETH has the opportunity to bounce back.

The most likely outcome is a potential 20% rally that would send the altcoin beyond $3,500. This would require ETH to first breach and flip the resistance of $3,376 into support. Completing the rally would also make the aforementioned supply profitable, driving investors toward the asset.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, Ethereum’s price will fall to test the crucial support of $2,736 if this support is lost. Losing this would invalidate the bullish thesis, causing a further decline in the asset price.