Dogecoin (DOGE), despite noting almost 32%, is still due for further correction due to the lack of bullish cues.

Not only is the broader market opposing recovery, but even investors’ participation is signaling a downswing.

Dogecoin Holders Pull Back

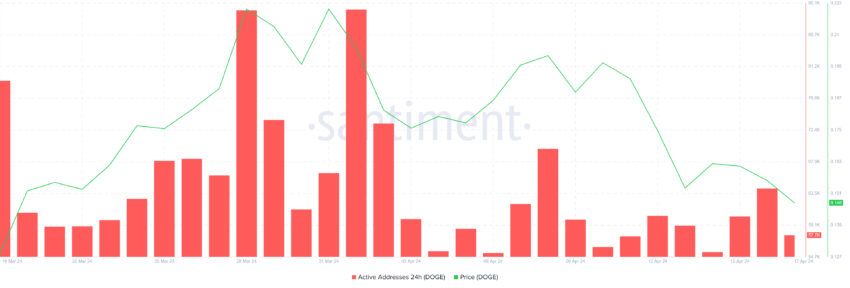

Dogecoin’s price notes the negative impact of the investors’ fading confidence, reflected in their network participation. Evinced by the daily active addresses, the average number of DOGE holders conducting transactions on the network has come down to 57,000.

This is also the lowest figure observed in the last six months, as towards the end of October 2023, only 41,900 active addresses were recorded in a single day.

Thus, the possibility of a decline is further amplified by the lack of confidence observed among DOGE holders.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

The same can be seen in the decline noted in the Relative Strength Index (RSI). This indicator assesses the magnitude of recent price changes to evaluate overbought or oversold conditions in a security or asset. It oscillates between 0 and 100, with readings above 70 indicating overbought conditions and below 30 indicating oversold conditions.

Presently, RSI is below the neutral line at 50.0 under the downtrend line, entering the bearish neutral zone. This is the farthest this indicator has fallen since the beginning of the year, indicating the bearishness is strong and could extend the corrections.

DOGE Price Prediction: Looking at Another Decline

Dogecoin’s price trading at $0.146 is presently under the $0.151 line, acting as a resistance level. Before the recent corrections, DOGE was stuck in a rising wedge, and a breakdown from it would have sent the meme coin toward the target of $0.127.

However, the breakdown arrived earlier than expected, and the correction was also less than predicted by the pattern. This leaves Dogecoin’s price vulnerable to further decline, i.e., another 13% drawdown to reach $0.127.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

But if the resistance of $0.151 is flipped into a support floor, the meme coin would have a shot at invalidating the bearish outcome. DOGE will likely bounce back to breach $0.160 to continue recovery.