Tron (TRX) price is on the verge of witnessing corrections owing to broader market cues and profit taking.

The likely outcome is an 18% drawdown, which can only be prevented if this support level is reclaimed.

Tron Sees Rising Bearishness

Tron’s price noted a successful rally from early January to February end which flipped into corrections starting March. The onslaught of red candlesticks resulted in TRX falling by 21%, with another bout of declines noted in the past week.

Based on the price action, TRX will likely endure further losses owing to the formation of Death Cross on the daily chart. A Death Cross occurs when a short-term 50-day Exponential Moving Average (EMA) crosses below a long-term 200-day EMA, signaling potential bearish sentiment in the market.

Should this Death Cross occur, it would mark the first such instance in over ten months, which could signal excessive declines.

Read More: 7 Best Tron Wallets for Storing TRX Tokens

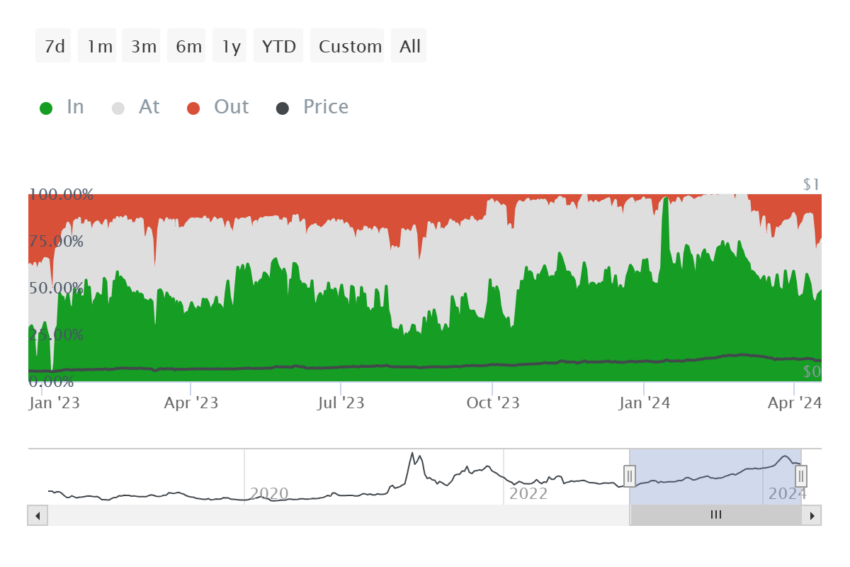

To make this worse, TRX holders are showing no signs of fighting this decline either. Most investors are potentially aiming at profit-taking by looking at the distribution of active addresses by profitability. This metric highlights that more than 48% of all participating investors are in profit, which means they are potentially looking to book profits.

Should this happen, TRX would witness a considerable drawdown.

TRX Price Prediction: Two Crucial Levels

Tron’s price trading at $0.109 has already lost the support of the 61.8% Fibonacci Retracement of $0.152 to $0.050. The altcoin is now hovering above the 50% Fib line marked at $0.101. Looking at the market and investor cues, this support will likely be broken, and TRX could fall to $0.089.

This price point coincides with the 38.2% Fibonacci Retracement, and a decline to it would result in an 18% correction.

Read More: TRON (TRX) Price Prediction 2024/2025/2030

This bearish outcome can be invalidated provided Tron’s price can reclaim the 61.8% Fib level at $0.113. This level is also known as the bull market support floor, making it possible for TRX to reclaim $0.120.