Fetch.ai (FET) price is reeling from the recent corrections that wiped out significant profits from the crypto market.

While recovery is on the cards, FET might stop short of regaining all the profits as it is destined for consolidation.

Fetch.ai Investors Sit Back

Fetch.ai’s price has witnessed considerable bearishness in the last few days, and this has naturally spooked investors. The overall decline in the market has also pushed many potential investors away.

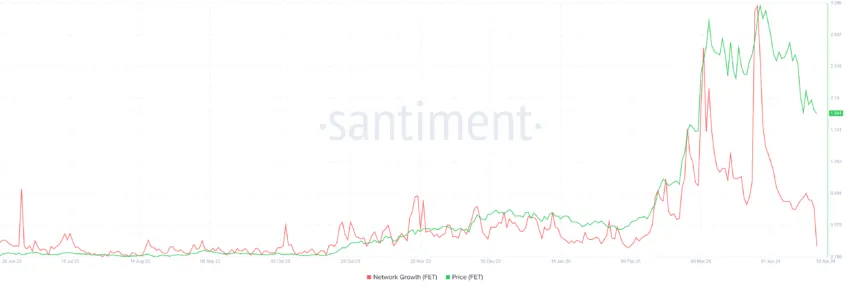

This is visible in the decline in network growth. The indicator has plunged to a multi-month low following the corrections. Network growth is calculated by the formation and participation of new addresses on the network.

A decline in the same is a hint of Fetch.ai losing traction within the market, creating bearish conditions.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Furthermore, some investors present on the network might not show resilience as the market is flashing a sell signal. Drawn from the price daily active addresses (DAA) divergence, this signal is flashed only when price and participation move in the opposite direction or both act bearish.

The case with FET is that former conditions are being observed, which might potentially trigger selling among investors.

FET Price Prediction: Sideways Is the Way

Fetch.ai’s price, trading at $1.93, just below the $2.00 mark, will likely witness consolidation going forward due to the mixed signals from the market. The upcoming halving event suggests a rise in Bitcoin price is due, which would inevitably impact the altcoins, too. However, a lack of support from investors could create bearish conditions.

Consequently, Fetch.ai’s price might end up moving sideways instead of sticking to either narrative. This consolidation will be within $2.26 and $1.71, which have proved to be solid resistance and support levels, respectively.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

A breakout or breakdown from these limits could cause a bullish or bearish reaction, invalidating the current bearish-neutral thesis.