Solana’s (SOL) price is showing signs of bearish developments primarily owing to the broader market cues and declining interest of investors.

By the looks of it, the “Ethereum killer” will likely note a correction in the coming days that could drag SOL down to $100.

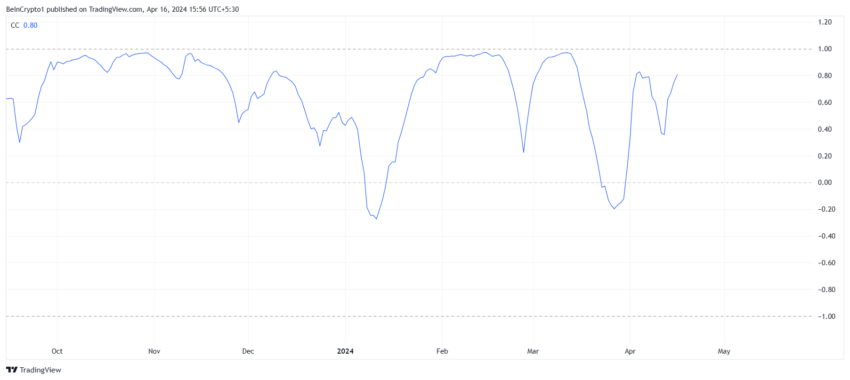

Bitcoin’s Influence on Solana

Solana’s price tends to mostly follow the broader market cues, be it the meme coin frenzy or the recent correction. As Bitcoin (BTC) crashed in the last few days, SOL did, too, and this could continue going forward.

This is due to the high correlation that the two cryptocurrencies share. After dissociation in March, the correlation between the two assets grew stronger, with the same currently standing at 0.8.

Thus, given Bitcoin is prone to further decline below the current trading price of $62,700, it could drag Solana’s price down.

Read More: 11 Best Solana Meme Coins to Watch in 2024

To make this worse, the investors aren’t optimistic about the asset. Their diminishing conviction is visible through the plunge in the Open Interest (OI). OI fell from $2.89 billion in the last four days to $1.84 billion.

This $1 billion outflow from the futures market indicates that investors are not only skeptical but also unwilling to make either a bullish or a bearish bet.

SOL Price Prediction: Decline to $100

Should the aforementioned bearish cues dictate the price action, Solana’s price could correct considerably. Trading at $132, the altcoin would extend the 34% correction noted since the beginning of the month by another 24% to bring SOL down to $100.

Since this is a critical support level, Solana’s price would likely find some support at this point, preventing further losses.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

A similarly strong support level is marked at $120, and if SOL manages to bounce off of it and engage in recovery, the bearish thesis would be invalidated. Consequently, Solana’s price could rally further towards $150.