Bitcoin’s (BTC) price is reeling from the recent corrections, and to boost the recovery, a major development took place on Monday.

Will this event cause BTC’s climb back to $70,000 and potentially a new all-time high?

Bitcoin Finds Approval in Hong Kong

Bitcoin’s price showed signs of recovery as the biggest cryptocurrency in the world found acceptance in Hong Kong. The country approved the applications of spot Bitcoin and spot Ethereum ETFs on April 15, becoming the second region in the world after the United States.

Given the event’s magnitude, this approval will catalyze the potential recovery. Hong Kong is among the leading countries in adoption, making this a bullish event for Bitcoin.

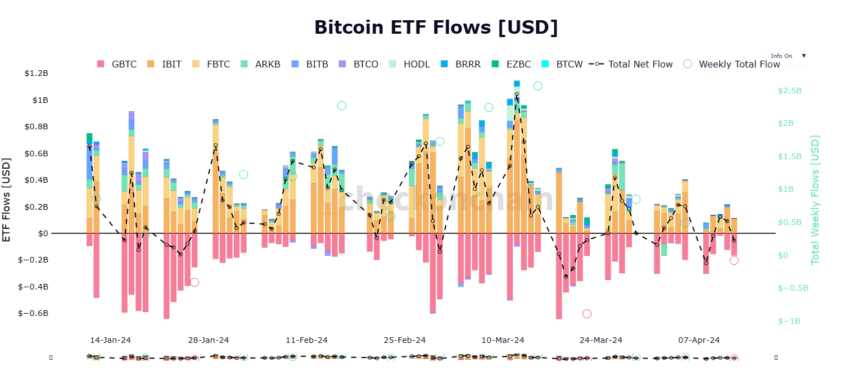

The Bitcoin ETFs entering the Hong Kong market will likely boost accumulation among investors. Institutions have been bullish towards BTC, as noted in the consistent inflows into ETFs over outflows.

Read More: What Happened at the Last Bitcoin Halving? Predictions for 2024

The potential of the same is also visible on the Reserve Risk metric. This indicator measures the confidence of long-term Bitcoin holders by assessing the price versus HODLer ratio, indicating potential selling or buying pressure based on past accumulation patterns.

Given that the indicator is in the green zone, investor confidence is high, making BTC an attractive asset in terms of risk/reward. Thus, accumulation could be the investor’s preferred move in the future.

This could translate into a quicker recovery for Bitcoin’s price.

BTC Price Prediction: Look out for New All-Time High

Bitcoin’s price has majorly witnessed consolidation within the $71,800 and $63,700 range. Testing them as resistance and support for the past month and a half has cemented them as barriers.

This makes breaching them challenging, although BTC might have gained the necessary boost to break through with the Hong Kong ETF approval news and the upcoming halving.

Consequently, Bitcoin’s price would mark an 8.29% rally, enabling BTC to form a new all-time high.

Read More: 7 Best Bitcoin Halving Promotions to Check Out in 2024

Nevertheless, if the consolidation regains strength and the eventual test of the $63,700 support level fails, Bitcoin’s price could fall to test the support floor of $61,800. Losing this level would invalidate the bullish thesis and cause further price decline.