Worldcoin (WLD) appears to be recovering after it bounced off a key support level, sparking conversations about its potential to reach $8 again.

Recent on-chain analysis offers a comprehensive perspective on WLD’s trajectory, underlining the coin’s resilience and the increasing optimism within the community.

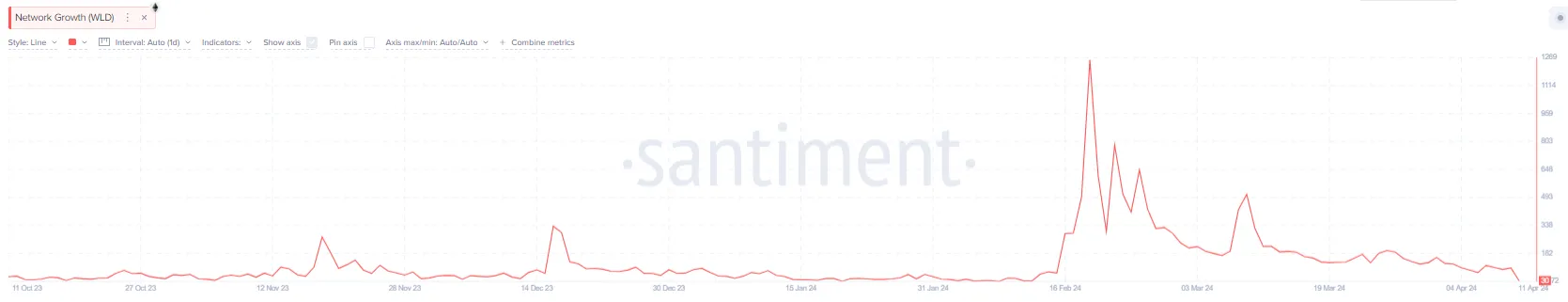

Worldcoin Network Growth Bottoms as Total Holders Increases

The coin’s network growth graph reveals periods of fluctuation, typical in the dynamic crypto market. Despite these variations, the underlying trend reflects steady growth over the longer timeline. While recently correcting as the price declined from its all-time high of $12 on March 11.

Network growth represents the number of new addresses being created on the network each day. Network growth sits at 103 and appears to be stabilizing at this range.

Significantly, the total number of WLD holders has seen a consistent rise. This gradual increase in holders indicates enduring trust in Worldcoin’s potential and a broadening user base committed to its long-term value. As of April 10, the total amount of holders had risen to 19,449. Up from 17,218 exactly one month prior.

The Global In/Out of the Money (GIOM) data for WLD presents an even more compelling narrative. Over half of the current holders are ‘In the Money,’ with a price point well above their average purchase price. Key resistance can be found by holders that are ‘out of the money,’ with 2,150 addresses holding 6.3 million WLD at an average purchase price of $7.23.

Read More: 5 Best Worldcoin (WLD) Wallets in 2024

Additionally, 996 addresses holding 12.38 million WLD at an average purchase price of $5.31 represent a formidable support zone for the price.

WLD Price Prediction: Pivotal Battle Between $7 Remains

The WLD navigates key support levels, with technical indicators depicting a struggle between bears and bulls. WLD is teetering below the 50-day (yellow) Exponential Moving Average (EMA) after slipping beneath the 20-day line (orange). EMAs give more weight to recent prices and are a tool to gauge the direction of the trend over different time frames.

Additionally, the Relative Strength Index (RSI) sits above 40, indicating bearish pressure without reaching oversold territory. Meanwhile, the Moving Average Convergence Divergence (MACD) echoes this sentiment with a bearish crossover.

Read More: Worldcoin (WLD) Price Prediction 2024/2025/2030

Currently, the price appears to be seeing some bullish strength as it pushes for $7. However, flipping the 20-day EMA will be vital for a bullish push towards $8. However, if WLD cannot maintain the buying pressure, bears could push the price back down to key support under $6, invalidating the bullish price action.