Polkadot (DOT) price is seemingly on the path to a massive increase that could help the altcoin recover from the recent losses.

One major entity has a huge hand In making this happen, and as long as it stays in place, the uptick will be possible.

Polkadot Gains This Cohort’s Favor

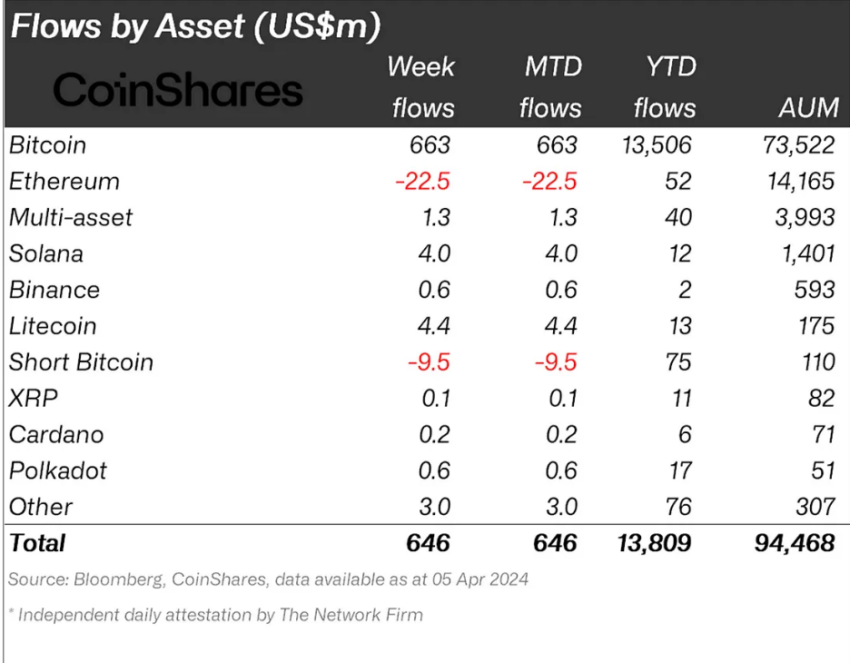

Institutions significantly influence Polkadot’s price, and the altcoin is positioned to make the most of this. Throughout Q1, DOT received significant inflows from institutional investors.

The year-to-date inflows amount to about $17 million, the highest for any altcoin after Ethereum. Even the likes of Solana, XRP, and Cardano are far lower than Polkadot. This shows that DOT has gained the favor of institutions and could immensely benefit from it.

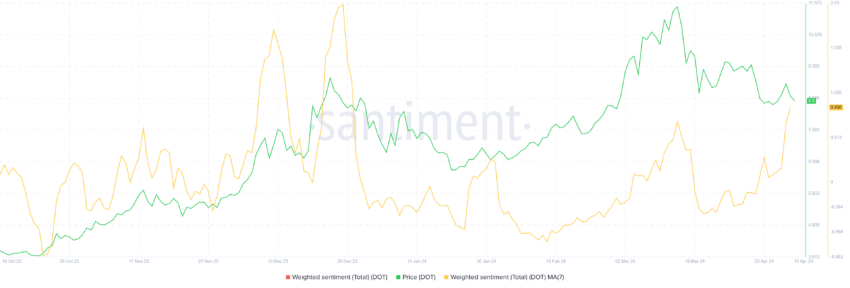

Furthermore, the cryptocurrency is noting a surge in investors’ optimism. Their overall sentiment, which has become increasingly positive, is a testament to the altcoin’s potential for a rally.

Read More: A Guide to ParaState: Enabling Ethereum DApps on Polkadot

Bullishness will persuade investors to hold on to their assets for longer while expecting a price rise. This will catalyze Polkadot’s price, eventually sending it to newer highs while recovering losses.

This seems to be the case with DOT at the moment as well.

DOT Price Prediction: A Rally in the Midst?

Polkadot’s price trading at $8.5 is currently stuck in a falling wedge pattern, holding the potential to break out in the coming days. A falling wedge pattern is characterized by converging trendlines sloping downward, signaling a potential bullish reversal. A breakout to the upside is often accompanied by increased volume.

According to the pattern, Polkadot’s price could see a 22.89% rally, which could send DOT to test the resistance level, which is $10.67. In doing so, the altcoin would also reclaim $10 as a support floor.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

But this depends on when DOT bounces off the lower trend line toward a breakout. This line coinciding with the $8 support is crucial, and falling through it would send Polkadot’s price to $7.5, invalidating the bullish thesis.