In approximately 10 days, the Bitcoin community will witness a significant event, i.e., the Bitcoin halving. This phenomenon will halve the reward for mining a Bitcoin block from 6.25 to 3.125 Bitcoins, putting pressure on miners’ profitability.

Miners are now in a race against time, requiring higher Bitcoin prices to maintain their earnings.

Why Bitcoin Miners Will Face Challenges

According to a CryptoQuant’s report shared with BeInCrypto, miner hashprice have dipped 30% since the last halving in May 2020. Currently valued at $0.11 per Terahash per second, this figure is poised to drop to $0.055 after the halving, assuming stable market conditions.

“The hashprice is the average revenue a miner gets each time it tries to find a valid Bitcoin block,” CryptoQuant explained.

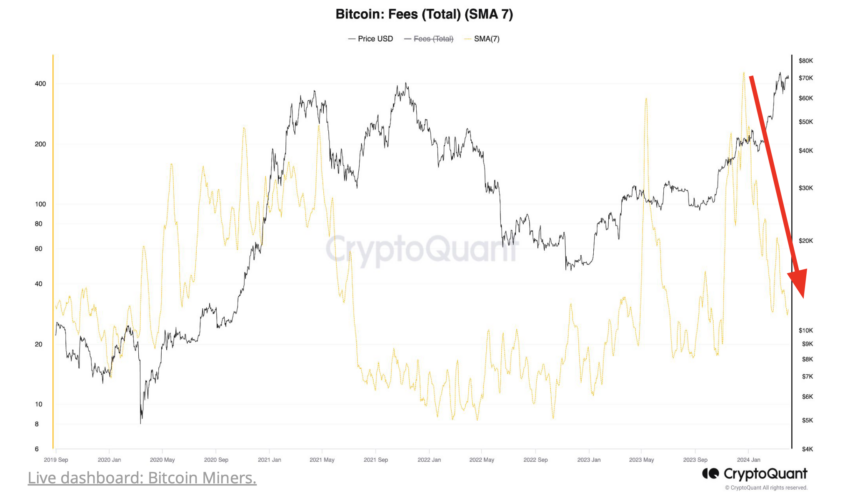

Furthermore, Bitcoin transaction fees have seen a dramatic decrease. They plummeted from 412 Bitcoin per day in mid-December 2023 to just 29 Bitcoin, marking a 90% reduction. Currently, transaction fees contribute just 3% to the total block reward, significantly down from 37% in mid-December 2023.

Read more: 7 Best Bitcoin Halving Promotions to Check Out in 2024

Moreover, the competition among miners has reached unprecedented levels. The Bitcoin network hashrate, indicating the total computational power, has soared to approximately 600 exahashes per second (EH/s), up from 116 EH/s since the last halving.

This surge means miners must exert significantly more effort and resources to mine the same amount of Bitcoin, with the cost of mining, or hashcoin, increasing tenfold since May 2020.

In response to these challenges, some miners have escalated their Bitcoin selling activities. For example, daily sales to over-the-counter (OTC) desks hit 1,600 Bitcoin in late March, the highest since August 2023. Simultaneously, the Bitcoin reserves held by miners have been on a consistent downward trajectory over the last year.

Significant selling from Bitcoin miners can indeed put pressure on Bitcoin’s price.

Despite these difficulties, not all mining companies are struggling. While major players like RIOT Platforms, Core Scientific, Bitfarms, and Marathon Digital have reported declines in Bitcoin production, CleanSpark has seen an increase. This variation highlights the differing impacts of market dynamics and operational issues on mining firms.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks Ahead of 2024 Halving

However, Sheraz Ahmed, the Managing Partner at Storm Partners, offers a different perspective. He argues that the mining industry doesn’t need special preparation for the halving, as market forces will eventually stabilize the situation.

“The miners are getting less Bitcoin for a similar amount of mining that they are doing, but the price should reflect that, or the hash rate can level itself out, almost becoming the perfect market. Any discrepancy can be rebalanced. It’s similar to gold, so I don’t think you need to prepare for it more than anything else,” Ahmed told BeInCrypto.

Past halving events support Ahmed’s view. The total daily revenue of the Bitcoin mining industry has hit new highs in 2024, with a record $79 million on March 6 and $67 million currently. This is 3.5 times higher than the revenue just before the May 2020 halving.

These figures suggest that despite the immediate challenges, the industry may find a new equilibrium after the halving.