Solana (SOL) price is currently under the microscope, with a mix of technical indicators and network activity trends fueling discussions about its future direction.

Amidst an increase in DEX trades and a challenging technical setup, SOL finds itself at a critical crossroads.

Challenges and Operational Capacity on Solana

The ascent as a favored blockchain for new Solana-based meme coins brought with it an uptick in network activity, but not without its drawbacks. Recent weeks saw a spike in failed transactions, a concern for users and developers alike.

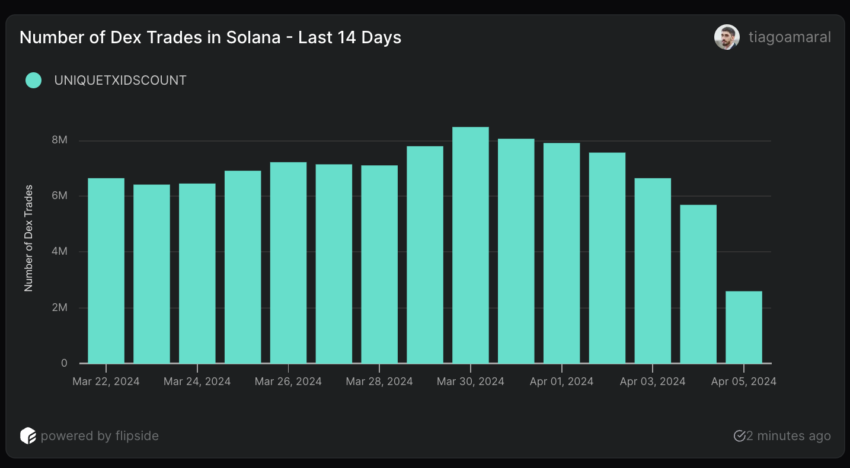

Despite reaching a peak of 8.5 million DEX transactions on March 30, activity has since tapered off to 5.6 million by April 4, indicating possible operational limits and growing user frustration.

Moreover, the Average Directional Index (ADX) on Solana presents a stark picture for its price. With a current reading of 36, it indicates a solid bearish trend.

This uptick from a reading of 9 to 36 in a short span underscores the growing strength of the downtrend, possibly setting the stage for further price drops.

Read More: 6 Best Platforms To Buy Solana (SOL) in 2024

SOL Price Prediction: Can It Get Back to $137?

Solana’s price is at a crucial juncture. The recent technical patterns, including a death cross, coupled with declining DEX trades and a robust ADX reading, paint a bearish picture.

If the trend continues, SOL could see it $167 support level tested, potentially dropping to as low as $137, especially if operational issues persist and shake investor confidence further.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

However, should Solana manage to effectively address these operational challenges, there is a chance for a reversal in fortunes. A successful resolution could pave the way for Solana price to challenge higher resistance levels. Therefore, it could potentially aim for $205 or even $210, as market sentiment improves.