Shiba Inu (SHIB) price is presenting a nuanced picture as it navigates through various market indicators.

On one hand, certain metrics suggest a stabilization in activity, hinting at a cautious optimism among investors. On the other, emerging technical patterns and fluctuating investor interest indicate the possibility of upcoming volatility.

Slow Shiba Inu Network Activity

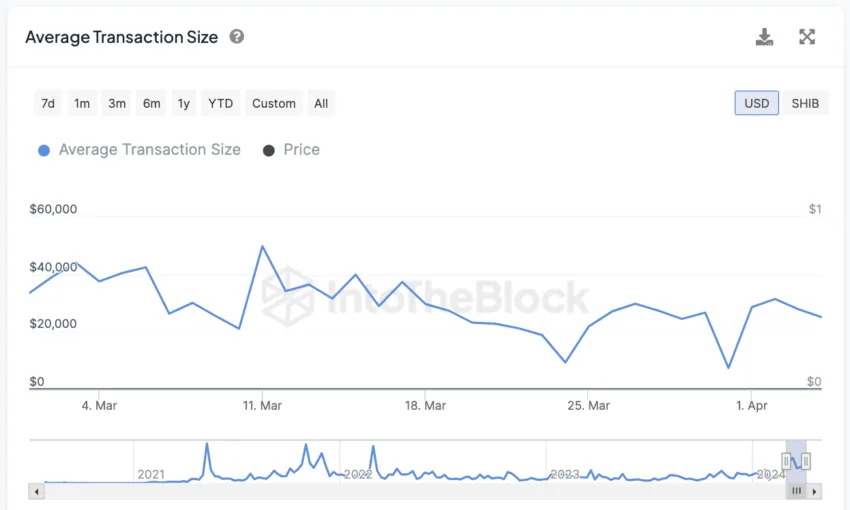

An analysis of Shiba Inu‘s average transaction size over the last month paints a narrative of rapid growth followed by stabilization.

Initially, there was a significant decrease in the average transaction size, dropping 81.23% in just under two weeks. However, following this drop, the transaction size began to stabilize, indicating a move towards a more stable phase for SHIB price.

The RSI has been trending in the overbought zone but has recently shown a decline from 90 to 78. This reduction in the RSI, while still indicating overbought conditions, suggests a slowdown in buying momentum behind Shiba Inu.

This trend may hint at a shift in investor sentiment, potentially leading to a price correction as the market adjusts to these changing dynamics.

SHIB Price Prediction: Another Dip

While some metrics suggest SHIB price may be entering a consolidation phase, the recent formation of a death cross raises concerns of a potential bearish turn.

This technical indicator, signaling a possible downtrend, could initiate new corrections for Shiba Inu. Depending on market response, SHIB could face a downturn toward $0.000019

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

However, if SHIB price manages to overcome current resistance at $0.000034, it could embark on an uptrend potentially reaching $0.000040. This represents a 50% bull rally from the current price levels.