Bitcoin (BTC) price is currently stuck in the sub $70,000 range after marking an all-time.

However, looking at the on-chain metrics, it appears that BTC could be heading back up.

Bitcoin Flashes Buy Signals

Bitcoin price, trading at $67,760 at the time of writing, is noting a red candlestick today, but the metrics are suggesting a long-term bullish outlook for the cryptocurrency. The Reserve Risk indicator is currently in the green zone, making its way out of it.

This indicator measures the confidence of long-term Bitcoin holders by comparing the current price to its long-term HODLer cost basis. A lower Reserve Risk suggests that long-term holders are likely going to accumulate, signaling a recovery in sight.

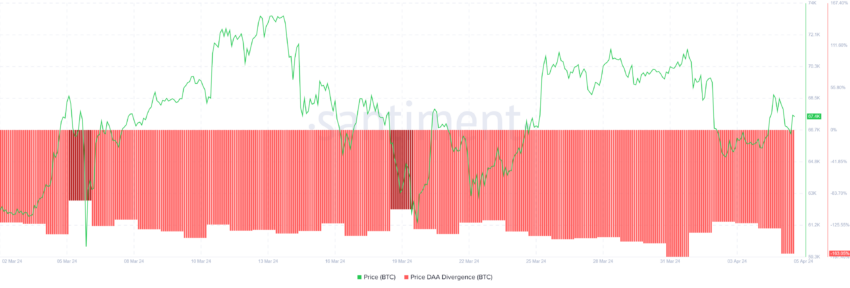

This potential is also visible in the Price Daily Average Addresses (DAA) Divergence. This Indicator measures the disparity between a cryptocurrency’s price and the number of active addresses interacting with it daily, helping identify potential price trends based on user activity.

During moments of price decline and active address incline, the indicator flashes a “buy” signal. Such is the case at the moment, making BTC ripe for accumulation.

If these factors drive investors to add BTC to their wallets, Bitcoin price could see a surge in the next few days.

BTC Price Prediction: Bounce

Bitcoin price over this weekend will likely note a rise to $70,000 and beyond. Since investors are likely going to accumulate owing to the bullish anticipation ahead of the halving, the price could go up too.

However, Bitcoin price will find some resistance at $71,370 as this barrier has been unbreached since mid-March and will likely remain that way until intense bullish cues are noted.

Read More: Bitcoin Price Prediction 2024/2025/2030

On the other hand, if BTC fails to breach the resistance level marked at $68,250, Bitcoin will fall back to $65,300. A drop below it, however, will invalidate the bullish thesis and lead to the cryptocurrency testing of $61,730.