The Render Network (RNDR) price trends are unfolding a nuanced narrative. On one hand, an increase in the average coin age signals bolstered confidence among holders, hinting at a bullish outlook. On the other hand, the halt in whale accumulation since late March suggests a more cautious stance, as some investors pause their investments.

At this juncture, RNDR is at a crossroads, with its future direction—a bullish surge or a bearish downturn—resting on the developing market trend strength.

Increased RNDR Holder Confidence

Over the past week, the Mean Coin Age (MCA) for Render, which measures the average duration that coins are held or remain unspent, has notably risen.

Indeed, there has been a discernible increase in MCA, climbing from 350 on March 27 to 356 by April 4. This shift suggests a prevailing inclination among investors to hold their assets longer, possibly forecasting price increases.

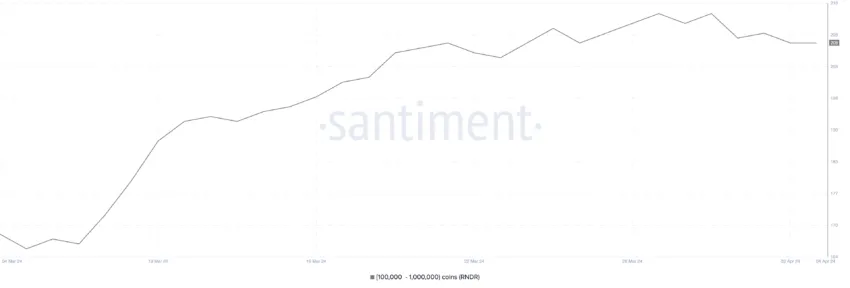

Despite the rising MCA, the expansion in the number of addresses holding substantial RNDR amounts has leveled off in the last week. This change in whale behavior may signal a consolidation phase for Render Network, where the market reaches a balance between buying and selling pressures.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

This pause in whale accumulation could be seen as a period of market assessment or possibly reflect a cautious or bearish sentiment regarding the near-term price trajectory.

RNDR Price Prediction: Crossroads

Currently, RNDR finds itself without clear support or resistance in its vicinity, according to the IOMAP chart. This tool highlights key investor activity zones, indicating potential support and resistance based on investment density.

The IOMAP points to significant support at $7.63, suggesting this as a fallback level in case of a downtrend. Conversely, for an uptrend, RNDR faces a notable resistance at $9.79, marking a potential target before encountering heavy selling pressure.

Given the mixed signals from RNDR’s on-chain metrics, staying informed and monitoring developments closely is crucial for understanding its potential market direction.