The Polkadot (DOT) price recently failed in its attempt at recovery, with the altcoin experiencing a correction of over 12% in the last two days.

This decline has brought DOT close to a potentially bearish event that could further impact its price.

Polkadot Seeks a Bullish Turnaround

Currently trading under $9, Polkadot is striving for a comeback, though the odds for recovery appear slim. The token’s value remains significantly lower than its October 2023 levels.

Despite a recent rally, DOT has not returned to the highs seen in the previous year, which may deter new investors from entering the market, limiting the asset’s recovery potential.

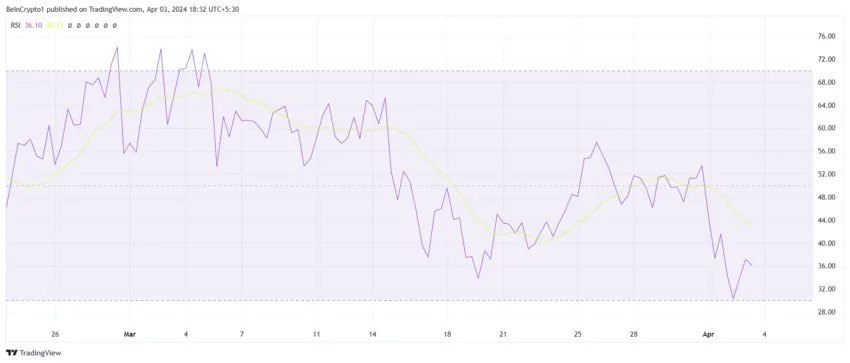

The current market dynamics show Polkadot facing more bearish than bullish influences. The Relative Strength Index (RSI)—a momentum oscillator that measures the speed and change of price movements—remains in the bearish zone, indicating that the asset is still below the neutral threshold of 50.

This suggests that DOT’s recovery could be sluggish unless there’s a shift in market sentiment or increased investor bullishness.

DOT Price Prediction: Likely Bearish

At the moment, with Polkadot trading at $8.63, it is encountering a death cross on the 4-hour chart. A death cross, characterized by the 50-day Exponential Moving Average (EMA) crossing below the 200-day EMA, signals potential bearish sentiment and the possibility of a trend reversal to the downside.

Given the lack of bearish indicators, this could mean Polkadot might fail in its recovery attempt and could also see its price retract to $8.10, potentially dropping to or below $8.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

However, should the market conditions shift favorably, avoiding a death cross, there is a chance for DOT to surpass $9. This shift would refute the bearish outlook, potentially enabling Polkadot to establish $9.63 as a new support level, offering a glimpse of hope for a bullish future.