For nearly two weeks, the Solana (SOL) price has been attempting to surpass the $200 mark but has yet to succeed in this endeavor.

This struggle has likely impacted the bullish sentiment among investors, potentially leading to a further decrease in price.

Solana Investors Lose Hope

At the time of writing, Solana’s price, standing at $189, has failed to break through the $200 resistance level. This failure is reflected in a decrease in investor optimism, as evidenced by the Open Interest (OI) experiencing a decline.

Over two days, the OI fell from $3.14 billion to $2.88 billion, marking a 15% drop. This suggests that traders are hesitant to place bets on SOL, given its current period of consolidation.

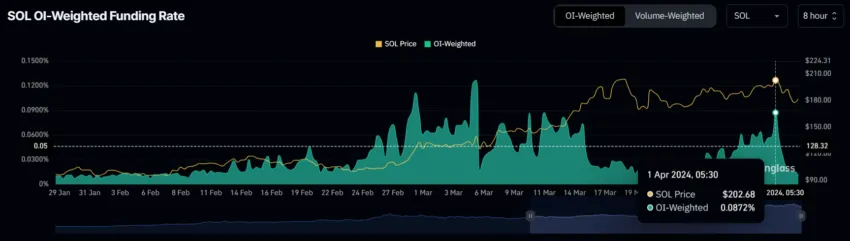

Moreover, traders are increasingly reluctant to make bullish bets, as indicated by the falling funding rate.

The funding rate is a crucial mechanism used in perpetual futures contracts, particularly in cryptocurrency and other financial markets. It is designed to ensure the price of the perpetual contract remains close to the underlying asset’s spot price.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

This metric has seen a significant decrease in the 48 hours following the unsuccessful attempt to breach the $200 resistance. With the funding rate at a nearly two-month low, edging closer to negative territory, it reflects the market’s bearish sentiment.

Therefore, without a resurgence in both the Open Interest and the funding rate, it is probable that Solana’s price will trend towards a bearish outcome.

SOL Price Prediction: Equilibrium

Currently, with Solana trading at $189 and holding above the support level of $181, it aims to reclaim the 50-day Exponential Moving Average (EMA) as support. However, even with another attempt to overcome the $200 barrier, it is probable that SOL will fall back to $168.

This indicates that SOL is caught in a consolidation phase between $168 and $200, where it is expected to continue moving sideways.

Despite these challenges, Solana benefits from being a favored asset among institutions. According to CoinShares’ institutional net flows report, Solana attracted approximately $25 million in the past month, outpacing all other altcoins, including Ethereum.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

This support from large investors may provide the necessary momentum for Solana’s price to attempt and possibly succeed in breaching the $200 mark, challenging the current bearish outlook and potentially reaching a 28-month high.