Ethereum (ETH) price trades under two crucial support levels after noting consistent declines for the past week.

The bearishness, however, is expected to intensify in the coming days as ETH is witnessing a market top at the moment.

Ethereum Is Set to Lose $3,000 for This Reason

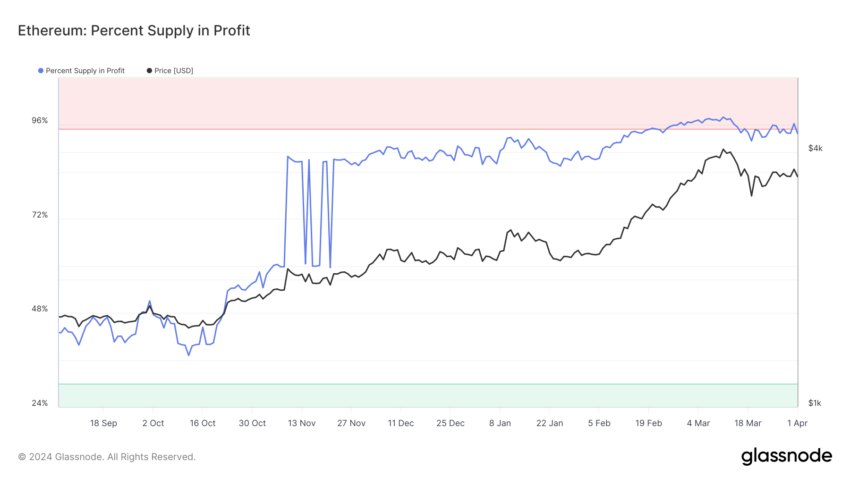

Despite the recent drawdown, Ethereum’s price nearly recovered $3,500 as a support floor before failing. This has resulted in cryptocurrency investors witnessing profits. At present, over 96% of the entire supply is in profits.

Such a situation validates a market top. A market top refers to the highest point reached by an asset’s price before a downward trend begins. It signifies a peak in investor optimism and often precedes a market correction or downturn. This is confirmed when more than 95% of the supply is in profit.

Thus, the potential of ETH witnessing further drawdown is very likely.

Read More: Ethereum ETF Explained: What It Is and How It Works

Furthermore, ETH has consistently been selling, with the supply on exchanges climbing for the past couple of months. Selling among investors has resulted in over 2.31 million ETH worth over $7.6 billion entering the exchanges.

So if the selling continues amidst bearish conditions, Ethereum price will find it difficult to engage in recovery, which would push ETH further downward.

ETH Price Prediction: $3,000 Here We Come?

Ethereum price trading at $3,308 has already lost the support of the 50 and 100-day Exponential Moving Averages (EMA) and is also below the $3,336 support line. This leaves ETH highly vulnerable to testing the next crucial price point as support, which is $3,031.

A fall to this level is likely, and if the aforementioned conditions persist, ETH could fall below $3,000 as well.

Read More: How to Invest in Ethereum ETFs?

However, if it manages to bounce back from $3,031, it could very well engage in recovery or slow down the decline. This would give the Ethereum price an opportunity to reclaim $3,336 and invalidate the bearish thesis.